[ad_1]

Bitcoin’s surge above $52,000 has contributed to the broader crypto market’s renewed bullish momentum.

Ethereum has lately gained bullish momentum, breaking out from a sideways section and approaching a important resistance degree at $2,850.

In the meantime, Solana has re-entered the short-term peak zone, going through resistance at $125.

In 2024, make investments like the massive funds from the consolation of your property with our AI-powered ProPicks inventory choice instrument. Study extra right here>>

This week, surged above $52,000 despite the hotter-than-expected report, triggering an identical response within the altcoin market.

Because of this, gained some upward momentum, shadowing a few of Bitcoin’s beneficial properties. Concurrently, , which skilled a modest correction final month, re-entered the short-term peak zone this week.

This has led to some attention-grabbing technical alternatives within the crypto market. Listed here are two high-potential breakout setups merchants ought to be careful for within the coming days:

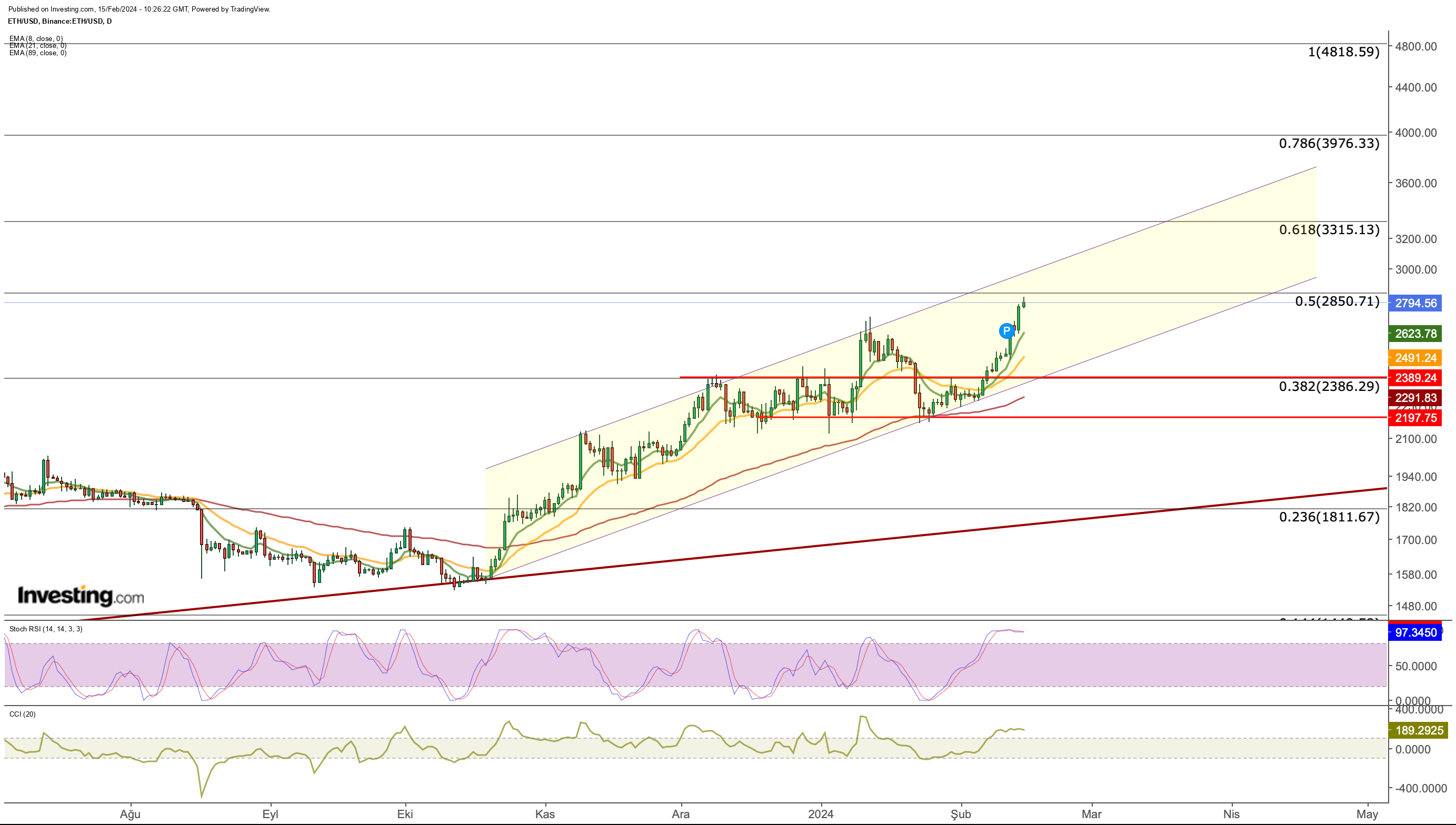

1. Ethereum’s Bullish Momentum Features Traction

Persevering with its uptrend which began in October, Ethereum gained momentum in February. This adopted a interval of sideways motion within the $2,200 to $2,400 vary all through December and January

With the introduction of spot ETFs set to spice up Ethereum’s buying and selling quantity, the cryptocurrency initially surged in January however later retraced together with the broader market.

Nevertheless, current developments within the sector and upgrades to Ethereum’s community have reignited optimism, propelling its worth upwards as soon as once more.

Anticipation for spot ETF approval in the summertime and a brand new community replace are driving optimistic sentiment, alongside the milestone of 1 / 4 of the full Ether provide being staked.

At present, ETH is approaching its subsequent resistance degree of $2,850, primarily based on long-term Fibonacci ranges, after struggling to breach the Fib 0.382 resistance round $2,400.

Breaking by way of $2,850 marks a vital step for ETH in the direction of reaching $3,000. If every day closes above $2,850 are sustained, the Fib 0.618 degree at $3,300 turns into the subsequent short-term goal, with additional potential to rally towards $4,000 upon ETF approval.

Within the occasion of short-term pullbacks, the 8- and 21-day exponential transferring averages are anticipated to offer dynamic assist, with the closest assist vary at present at $2,500 to $2,600.

Historic information means that these averages have served as dependable assist traces throughout earlier uptrends, notably evident within the January 20 breakout the place ETH bounced again from the 3-month EMA.

Moreover, on the weekly Ethereum chart, the Stochastic RSI is exhibiting indicators of turning upwards once more. A sustained flooring above $2,850 might set off a bullish sign from the Stoch RSI, indicating a continuation of the uptrend in ETH costs.

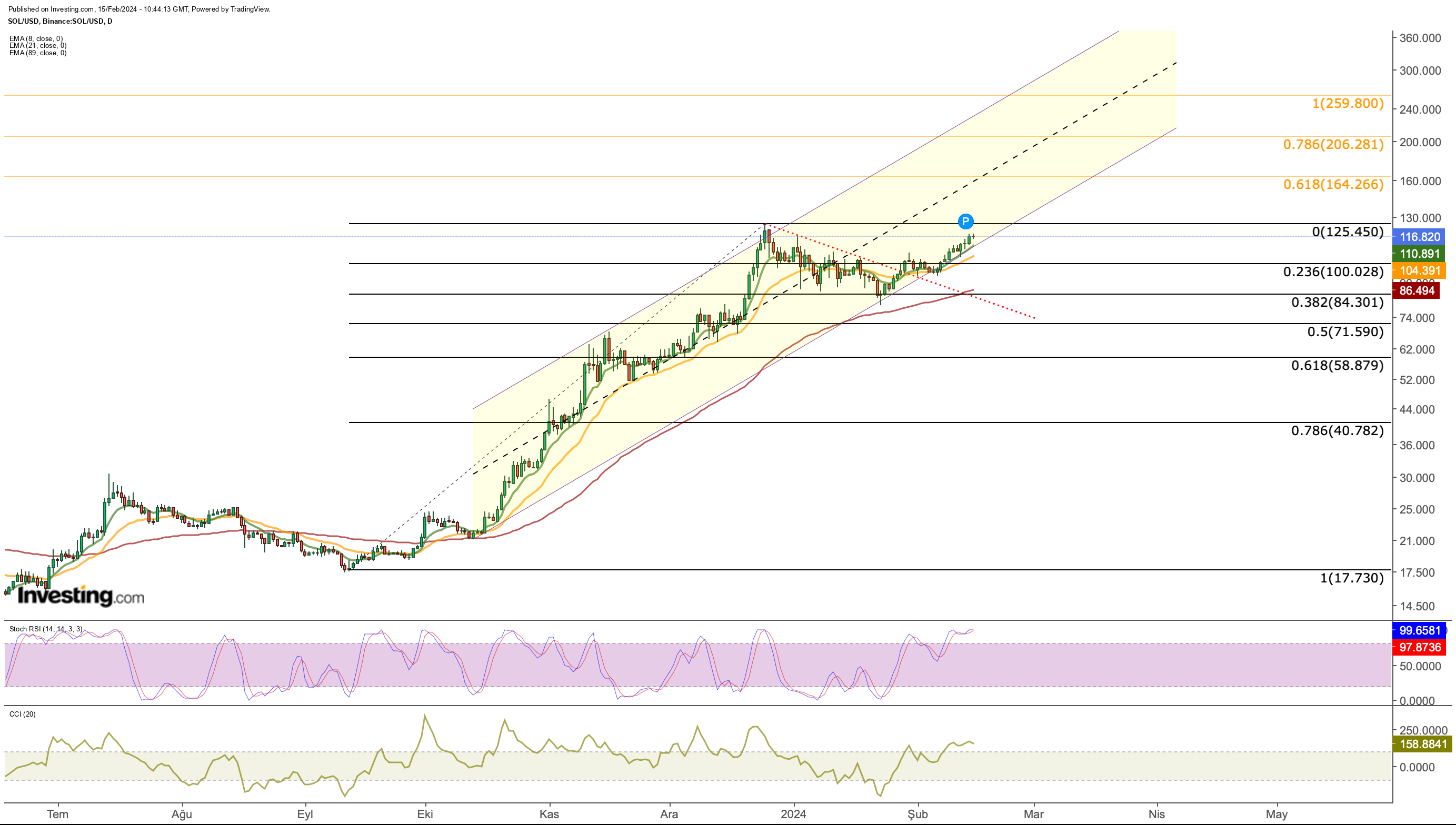

2. Solana: Does the Rebound Have Legs?

Throughout January, the correction of the September – December uptrend came about. This correction was restricted at Fib 0.382, equal to a median of $85 in line with Fibonacci measurement.

After SOL reclaimed the $100 threshold, the present bullish momentum faces the primary resistance level on the current excessive worth of $125.

Wanting again at historic peak and backside ranges, potential resistance zones lie between the $130 to $140 vary.

Past this vary, $160, akin to Fib 0.618 within the long-term outlook, emerges as a vital level for sustaining the development.

On the draw back, whereas $110 at present serves as SOL’s nearest assist degree, the $100 mark stays a focus in a possible retreat.

A breach of the $100 threshold might immediate sellers to push SOL in the direction of the 3-month EMA degree at $85.

In conclusion, the momentum SOL can collect inside the $125 – $130 vary holds important significance for the development’s continuation.

***

Take your investing recreation to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already effectively forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and reduce losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking instrument: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,427.8% during the last decade, traders have the very best collection of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe Right this moment!

Do not forget your free present! Use coupon code INVPROGA24 at checkout for a ten% low cost on all InvestingPro plans.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it’s not meant to incentivize the acquisition of belongings in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding determination and the related danger stays with the investor.

[ad_2]

Source link