[ad_1]

by Fintechnews Switzerland

January 25, 2024

Europe is present process a profound transformation in its immediate cost panorama because the bloc strives to develop into a frontrunner in cost innovation. Recognizing the necessity for enhanced adoption of real-time funds, regulatory our bodies are driving the push for higher immediate cost infrastructure and dealing in the direction of the unification of techniques and experiences throughout the Single Europe Funds Space (SEPA).

Final 12 months, the European Union (EU) moved nearer to creating immediate funds ubiquitous throughout the bloc by advancing immediate cost regulation. The regulatory proposal, which was first put ahead in 2022, amends and modernizes the SEPA regulation of 2012 by including particular provisions designed to expedite the adoption of immediate funds and the SEPA Prompt Credit score Switch scheme (SCT Inst).

The European Fee’s Prompt Funds Rules, Supply: Prompt Funds: a highlight on the European Fee for Regulation, PwC, Dec 2023

Launched in 2017, SCT Inst is a pan-European immediate cost scheme that enables home and cross-border funds in euro to be made to and acquired from collaborating PSPs. It gives tangible advantages for public administrations, with funds being made accessible instantly to the payee, and removes the constraints of conventional credit score transfers, that are sometimes sure to the enterprise hours of the dealing with cost service supplier, with credited funds taking extra time to seem in consequence.

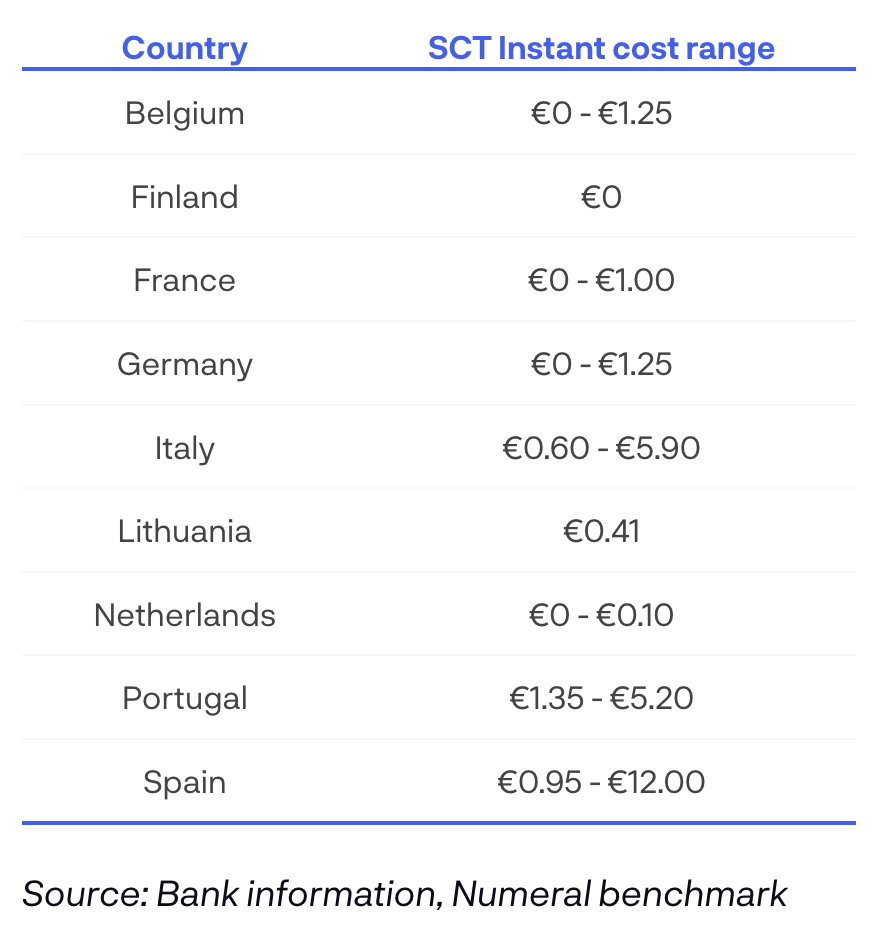

Although SCT Inst has been accessible for a while and regardless of the system’s clear benefits, adoption of immediate funds throughout the EU has been gradual, partly as a consequence of excessive financial institution pricing. The brand new regulation goals to deal with that by mandating cost service suppliers (PSPs) together with banks to supply the service of sending and receiving immediate funds in euro at no further price.

Revealed in November 2023, the ultimate regulation proposal requires banks to offer immediate funds to their prospects with out exceeding the prices of non-instant transfers.

To deal with elevated pace and potential dangers, the regulation instructs suppliers to confirm the match between the checking account quantity (IBAN) and the identify of the beneficiary supplied by the payer as a way to alert the payer of a attainable mistake or fraud earlier than the cost is made. This goals to cease scams like approved push cost fraud the place individuals are manipulated into sending massive sums to bogus accounts whereas believing they’re paying a reputable bill.

Talking to Fintech Futures, the EC stated {that a} mandate is crucial at this time limit to understand the excellent advantages of immediate funds for EU residents, companies, public authorities and society.

“5 years after the required know-how was put in place to course of euro funds immediately, it’s obvious that the efforts of the European funds trade or member states haven’t been ample to take away these obstacles all through the EU in a well timed trend,” the EC informed the media outlet.

“Legislative intervention is critical to unlock the full-scale community results by connecting all cost service suppliers to immediate cost know-how, tackling excessive costs and frictions, and mitigating the danger of fraud or errors.”

Sluggish uptake of immediate funds

Though policymakers are pushing for fast cost adoption, the present state of adoption assorted extensively throughout nations inside SEPA. Denmark, for instance, has embraced immediate funds by way of MobilePay, an app that allows low-cost immediate cost capabilities and which is claimed to have reached a 93% penetration fee quantity the nation’s grownup inhabitants, in accordance with knowledge from the Danish central financial institution.

France, alternatively, has seen decrease adoption because of the recognition of the nationwide debit scheme, Cartes Bancaires, and the excessive price related to utilizing real-time funds. In France, whereas customers sometimes obtain immediate funds totally free, immediate funds nonetheless incur a expensive premium price of as much as EUR 1 per transaction for senders, in accordance with Victor Mithouard, vp of development at UK paytech supplier Numeral.

Mithouard believes {that a} key problem to widespread adoption of immediate funds within the EU is the present excessive pricing by banks, estimating that immediate credit score transfers price on common 5 occasions greater than common credit score transfers.

Common price of SCT Inst transfers in Europe, Supply: Victor Mithouard, vp of development of Numeral, Dec 2022

Presently, solely 11% of the EU’s euro cash transfers are immediate, Carlos Cuerpo, secretary common of the treasury and worldwide financing of the federal government of Spain and minister for financial system, commerce and corporations, informed The Banker in November 2023.

The brand new EU mandate seeks to deal with these obstacles and profit customers by lowering operational delays and dear necessities related to credit score transfers. Nevertheless, the implementation might pose challenges for smaller PSPs.

Nadish Lad, managing director and world head of strategic enterprise at Volante Applied sciences, an American paytech agency, expects main banking gamers to adapt extra simply to the brand new necessities. “Some establishments are very tech savvy, and so would take a look at most likely doing one thing internally with their very own groups,” Lad informed Fintech Futures.

Nevertheless, smaller PSPs with restricted inner leverage might encounter some difficulties and will go for the outsourcing route.

“If [you are an experienced vendor with an established history of implementations] you will have carried out it in different nations, you already know the pitfalls, you already know what must be finished,” he stated. “And that’s the place we predict that lots of the desire goes to be extra on utilizing a vendor moderately than doing one thing internally.”

Interoperability with worldwide markets

Lad famous that whereas the mandate underlines SEPA-wide connectivity, it additionally encourages a worldwide view of interoperability with worldwide markets, such because the Center East and the US.

“If we take a look at the steps the place we’re heading now, it’s most likely essential to have a look at a extra world scale, as a result of the idea is that, on the finish of the day, we’re Europe right now, however inside a number of years, we absolutely count on some key corridors, for instance, USD to euro,” he informed the media outlet.

“All the important thing elements for a world world standardization strategy are there. If you need to do it, let’s take into consideration the place it’s heading and take into consideration the following steps.”

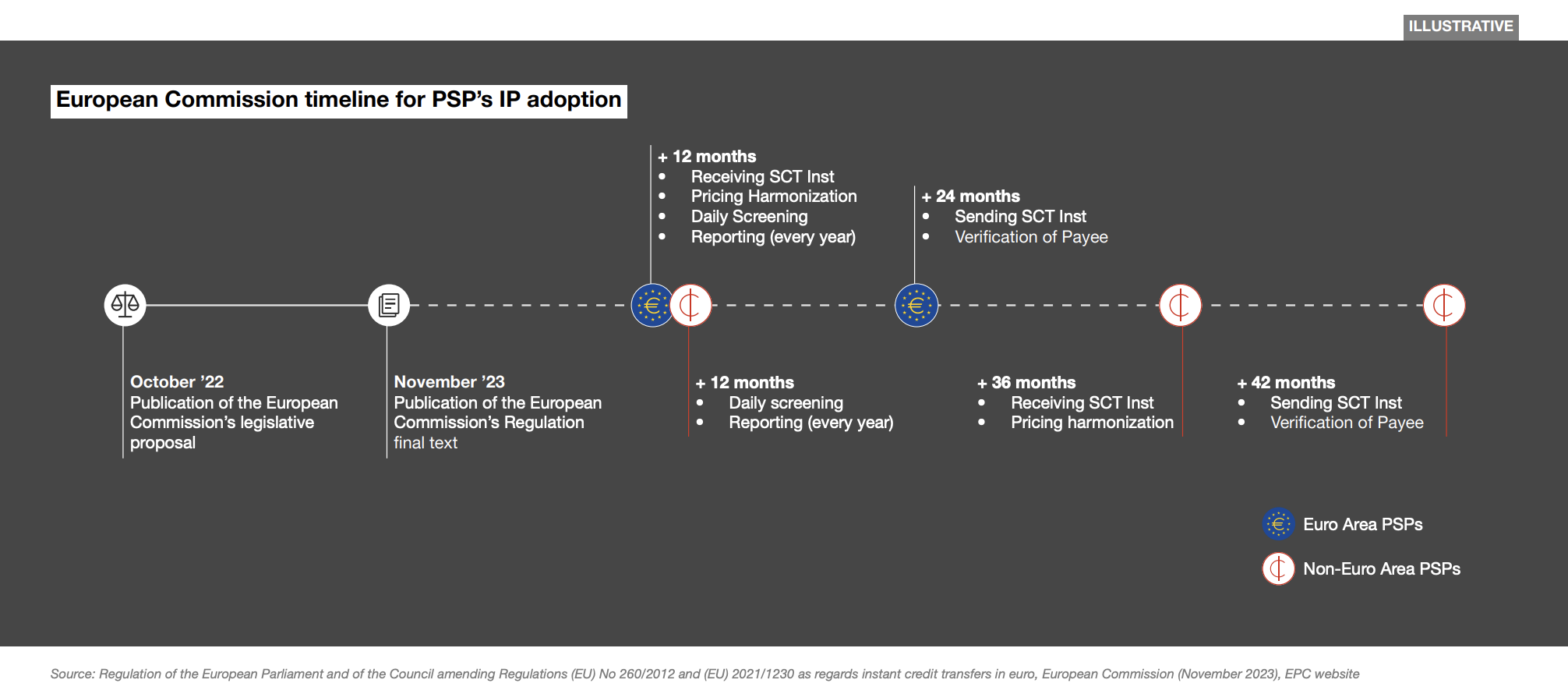

The primary provisions of the moment cost regulation had been agreed by representatives of the EU’s Council and Parliament in November 2023, however the legislation nonetheless nevertheless must be formally signed off by each these EU establishments.

The Parliament additionally voted in favor of implementation deadlines for the brand new regulation. The timeline, included within the textual content, requires all euro-area PSPs to assist receiving and sending SCT Inst funds together with fulfilling IBAN identify checking and entity screening necessities by the tip of 2025. From the tip of 2026 onwards, these obligations will likely be expanded to cost establishments and to banks positioned in non-euro space nations.

European Fee timeline for PSP’s immediate cost adoption, Supply: Prompt Funds: a highlight on the European Fee for Regulation, PwC, 2023

A webinar will likely be hosted by Bottomline on Feb 8, 2024 at 11am CET to debate about SIC Prompt Funds and its impression for Swiss banks and monetary establishments. Be a part of this webinar to be taught extra on preparing for SIC Prompt Funds by 2026, and new banking developments and initiatives.

Featured picture credit score: Edited from freepik

[ad_2]

Source link