[ad_1]

Euro (EUR/USD, EUR/GBP) Evaluation

US CPI forces markets to recalibrate charge lower expectationsUS CPI beat sends EUR/USD decrease – subsequent degree of help at 1.0700EUR/GBP trades inside acquainted varyGet your arms on the EURO Q2 outlook as we speak for unique insights into key market catalysts that ought to be on each dealer’s radar:

Really useful by Richard Snow

Get Your Free EUR Forecast

US CPI Forces Markets to Recalibrate Charge Minimize Expectations

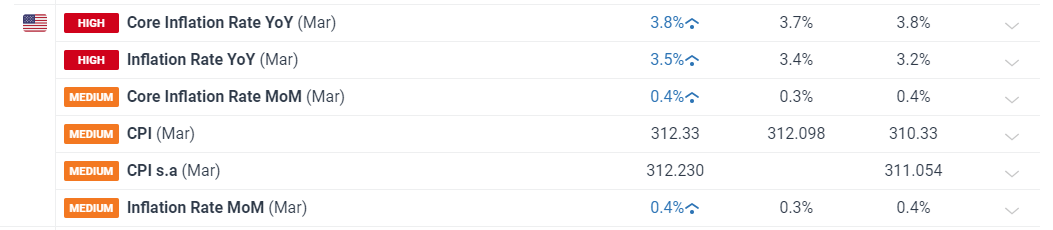

US CPI beat estimates throughout all main measures in March. Headline inflation rose from 3.2% to three.5% with the month-on-month measure beating estimates to come back in at 0.4%. Core inflation remained at 3.8% however beat estimates of three.7%, additionally rising 0.4% on the month.

Successive month-on-month rises in inflation makes it troublesome for the Fed to level to seasonality within the knowledge as the rationale for the rise now that we’ve acquired three months’ price of information already.

Customise and filter reside financial knowledge by way of our DailyFX financial calendar

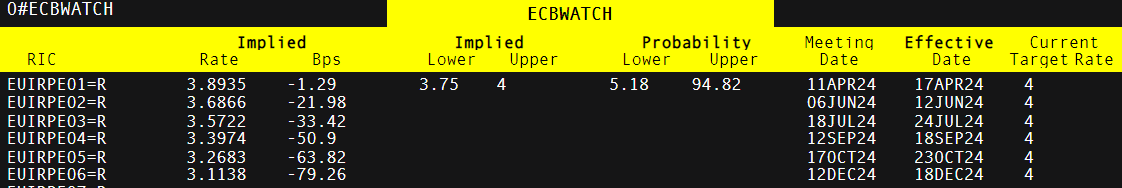

The ECB is essentially anticipated to make use of the platform of the April assembly to level in the direction of the beginning of the speed reducing course of in June. Notable ECB officers have already communicated this timeline and subsequently tomorrow’s announcement carries the chance that it might not be an enormous market mover.

Market Implied Possibilities of charge cuts (proven in foundation factors, bps)

Supply: Refinitiv

As a substitute, markets could search for refined clues on future coverage by way of questions fielded to Christine Lagarde within the press convention following the announcement.

The June assembly may even include up to date workers projections which is probably going to supply better confidence to the governing council concerning the charge lower. Current progress on inflation aligns with the notion of coverage normalization and serves to encourage the committee to chop charges prior to later.

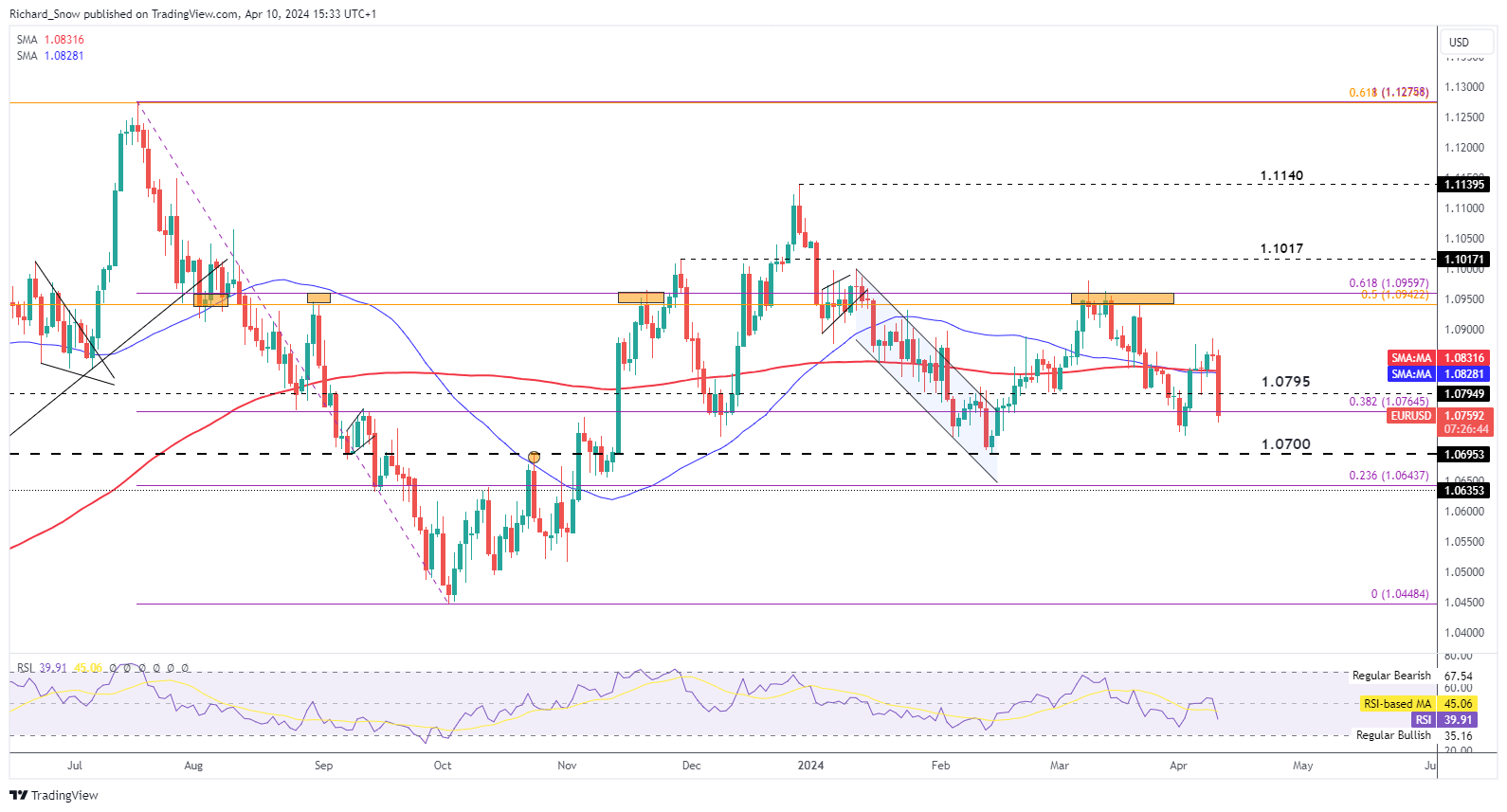

US CPI Beat Sends EUR/USD Decrease – Subsequent Stage of Assist at 1.0700

EUR/USD sank instantly after the new CPI print as markets reigned in Fed lower odds, strengthening the greenback and weighing on EUR/USD. The euro has traded in a reasonably strong method regardless of current drops in EU inflation – including strain on the ECB to chop charges.

EUR/USD assessments the 38.2% Fibonacci retracement of the 2023 decline at 1.0765, with a possible to move in the direction of the psychological 1.0700 degree. The bearish impulse follows the extra medium-term transfer that started when the pair discovered resistance round 1.0950.

EUR/USD Each day Chart

Supply: TradingView, ready by Richard Snow

EUR/USD is the chief amongst the highest three most liquid FX pairs on this planet, Discover out why these pairs are so fashionable and the way you must method them:

Really useful by Richard Snow

Really useful by Richard Snow

How To Commerce The Prime Three Most Liquid Foreign exchange Pairs

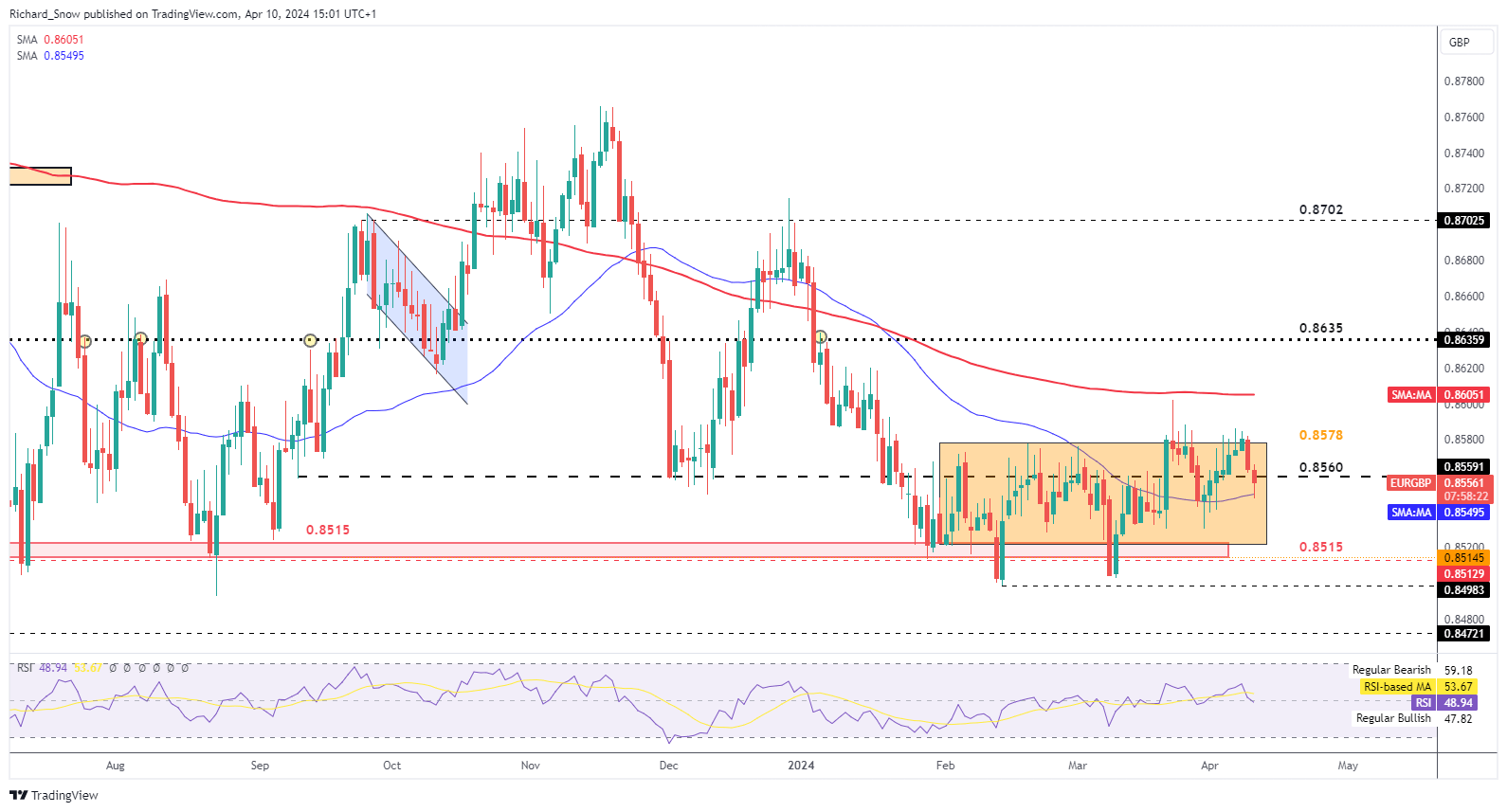

EUR/GBP Trades Inside Acquainted Vary

EUR/GBP pushed decrease after making an attempt to interrupt above the buying and selling vary (orange rectangle). FX volatility has been missing in 2024, that means breakout makes an attempt have did not obtain the mandatory comply with via to make a transfer stick.

Nevertheless, current inflation dynamics and nearing rate of interest cuts could change that. Divergence is showing in financial knowledge between the US and Europe but additionally the UK. With the EU and the UK anticipating comparable paths of decrease inflation, the 2 are more likely to proceed to oscillate and not using a clear directional transfer for now.

Speedy help seems at 0.8560 adopted by 0.8515. Resistance lies again at 0.8578 – the higher sure of the vary.

EUR/GBP Each day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

aspect contained in the aspect. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the aspect as an alternative.

[ad_2]

Source link