[ad_1]

Euro (EUR/USD) Evaluation

ECB Governing Council explicitly addresses the potential of a fee cutRobust US knowledge more likely to maintain the Ate up maintain for longerEUR/USD plummets – on monitor for largest drop in 18 monthsImprove your buying and selling edge by getting your arms on the Euro Q2 outlook at present for unique insights into key market catalysts that must be on each dealer’s radar:

Advisable by Richard Snow

Get Your Free EUR Forecast

ECB Governing Council Explicitly Addresses the Risk of a Price Lower

Whereas the ECB said that there will probably be no pre-commitment concerning the timing of the primary rate of interest minimize, there was an indication that rate of interest cuts may materialise quickly. The ECB assertion learn as follows, ‘if the Governing Council’s up to date evaluation of the inflation outlook, the dynamics of underlying inflation and the power of financial coverage transmission have been to additional enhance its confidence that inflation is converging to the goal in a sustained method, it will be acceptable to cut back the present degree of financial coverage restriction”.

As well as, a number of ECB members have said a choice for June with the most recent assertion offering some type of insurance coverage towards what seems like a miniscule likelihood of a reacceleration in costs. The ECB has been holding onto comparatively sizzling wage progress knowledge as justification of maintaining rates of interest so excessive for thus lengthy. General, stagnant financial progress and inspiring inflation knowledge has introduced the prospect of fee cuts nearer, whereas the other may be stated for the Fed.

Sturdy US Knowledge Prone to Maintain the Ate up Maintain for Longer

The Atlanta Fed’s GDPNow forecast sees US GDP for the primary quarter coming in at 2.4%, a notable method off the 4.9% determine in Q3 2023 and three.4% in This fall but it surely continues to point out a resilience all through the world’s largest financial system.

Moreover, the March NFP knowledge posted an enormous shock with 303k jobs being added versus estimates of simply 200k, proving that the labour market is not only sturdy however sturdy. US CPI earlier this week beat estimates throughout the board as inflationary pressures look like making a comeback. Markets trimmed expectations of Fed fee cuts this yr to simply underneath two – an enormous change from six, even seven cuts initially anticipated on the finish of 2023. US yields and the greenback have shot up at a time when the euro is more likely to come underneath strain because the ECB prepares to step in and decrease rates of interest.

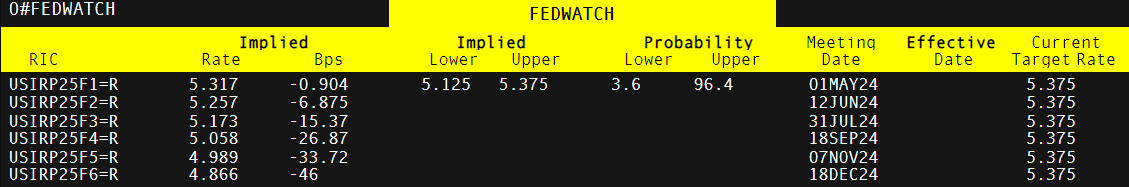

Market-Implied Foundation Level Cuts Derived from Fed Funds Futures

Supply: Refinitiv ready by Richard Snow

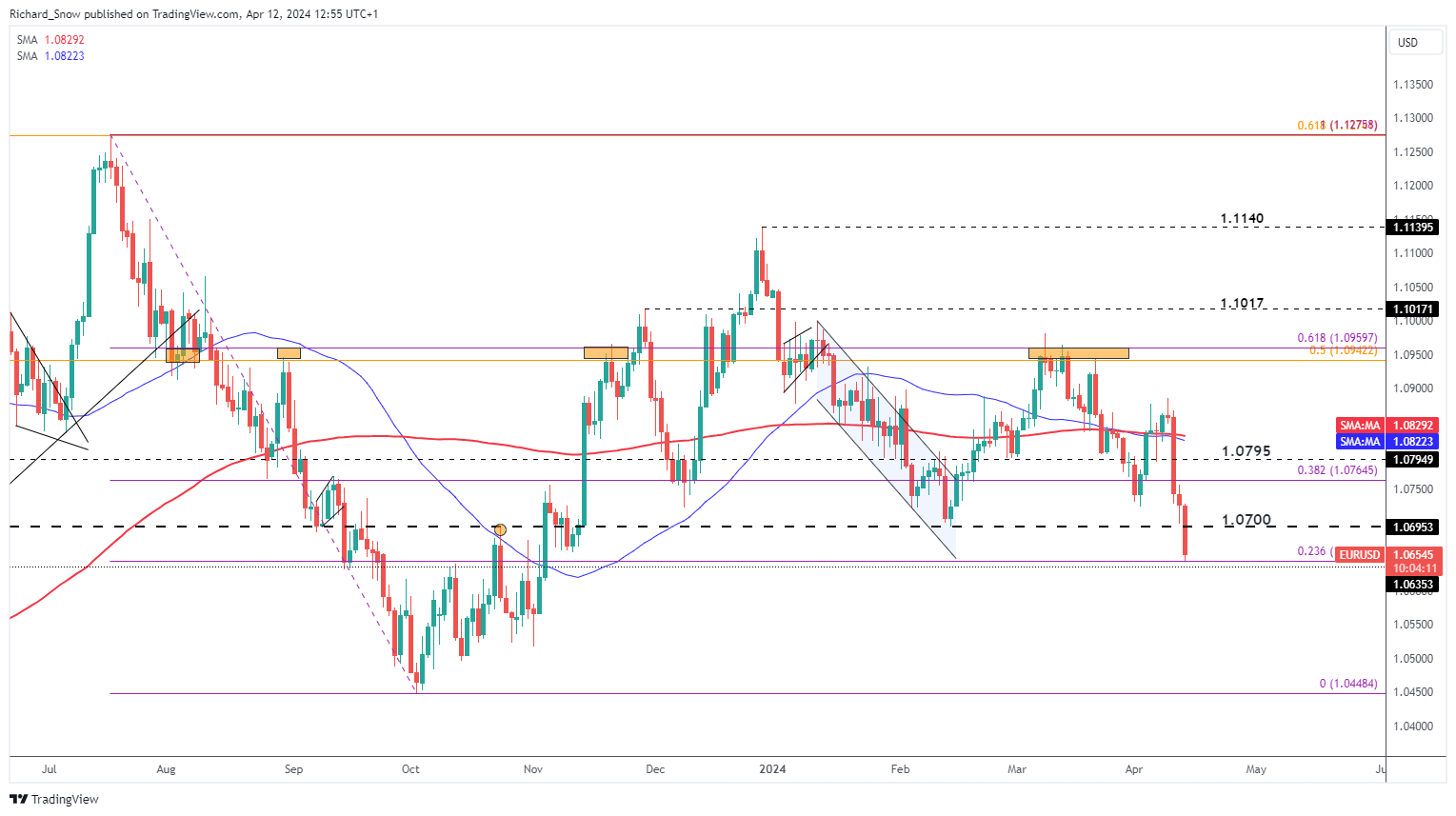

EUR/USD Plummets, On Observe for its Largest Weekly Drop in 18 Months

EUR/USD dropped massively on Wednesday when US CPI knowledge confirmed hotter, extra cussed inflation pressures. The shorter-term measures of inflation just like the month-on-month comparisons revealed what seems to be hotter worth pressures with added momentum.

As such, the pair continues to plummet, gaining acceleration on Friday because the pair traded via 1.0700 with ease, now testing the 28.6% retracement of the 2023 decline at 1.0644. At this fee, there doesn’t look like a lot that would maintain up the latest decline however the 1.0644 gives an imminent check earlier than eying a possible full retracement of that broader 2023 decline.

EUR/USD Every day Chart

Supply: TradingView, ready by Richard Snow

Searching for actionable buying and selling concepts? Obtain our high buying and selling alternatives information full of insightful suggestions for the second quarter!

Advisable by Richard Snow

Get Your Free Prime Buying and selling Alternatives Forecast

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

aspect contained in the aspect. That is in all probability not what you meant to do!

Load your software’s JavaScript bundle contained in the aspect as a substitute.

[ad_2]

Source link