[ad_1]

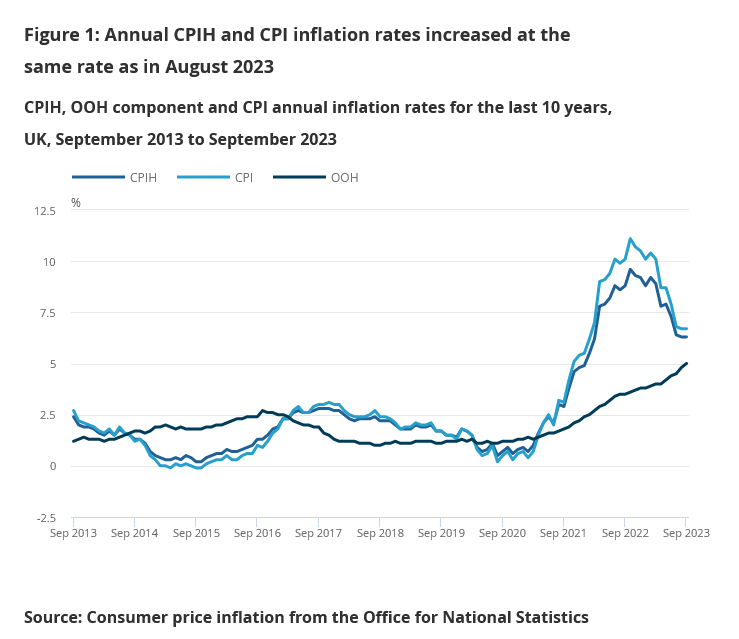

The Pound strengthened barely to $1.2210 following studies of inflation remaining excessive in September, regardless of the BOE making a sequence of fee hikes over the previous few months. GBPUSD good points had been short-lived, as a stronger US Greenback grew to become a stumbling block for the Pound. UK annual client value inflation held at an 18-month low of 6.7%, opposite to market expectations which forecast a slight decline to six.6%, whereas the core fee fell lower than anticipated to six.1%.

In the meantime, labour knowledge launched earlier this week confirmed that total payroll progress within the UK slowed from 8.5% to eight.1%, falling in need of the projected 8.3%. As well as, the variety of job vacancies fell to a two-year low in August. On Saturday, BOE Governor Andrew Bailey expressed his confusion over the persistent energy of payroll progress within the UK, whereas Chief Economist Huw Tablet emphasised on Monday that the central financial institution shouldn’t assume too early that the struggle in opposition to excessive inflation has been gained.

In the meantime, Eurozone CPI settled at 4.3% y/y in September, down from 5.2% y/y in August. Core CPI was 4.5% y/y, down from the earlier month’s 5.3% y/y. The best contribution to the Eurozone’s annual inflation fee got here from providers (+2.05 proportion factors, pp), adopted by meals, alcohol & tobacco (+1.78 pp), non-energy industrial items (+1.06 pp) and vitality (-0.55 pp).

EU CPI was 4.9% y/y, down from 5.9% y/y in August. The bottom annual charges had been recorded within the Netherlands (-0.3%), Denmark (0.6%) and Belgium (0.7%). The best annualised charges had been recorded in Hungary (12.2%), Romania (9.2%) and Slovakia (9.0%). In comparison with August, annual inflation fell in twenty-one Member States, remained secure in a single and elevated in 5.

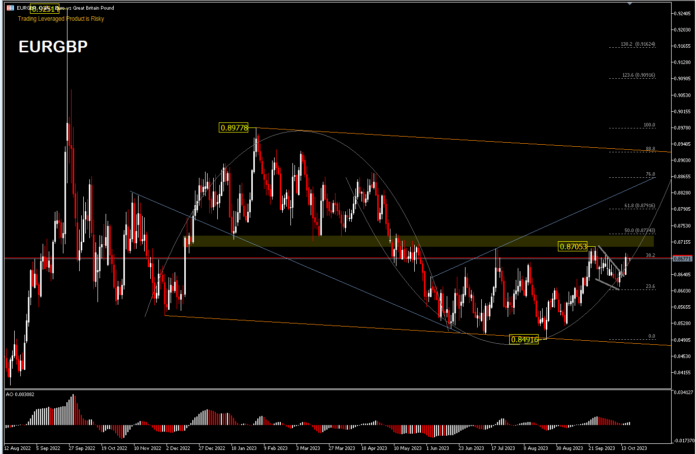

The EURGBP pair is buying and selling in a slender vary on the 38.2% FR stage of the 0.8977-0.8491 drawdown. The downtrend from the 2022 peak [0.9251] is seen as a part of a long-term ranging sample from the 2020 peak [0.9498]. A break of the 0.8705 resistance would verify that this decline has been accomplished. An increase from 0.8491 may then resume the stalled rally with projections to focus on the 50.0% FR and 61.8% FR ranges, at 0.8734 and 0.8791 respectively. Nonetheless, rejection from 0.8705 would hold the downtrend alive for a drop again to the 0.8491 backside value.

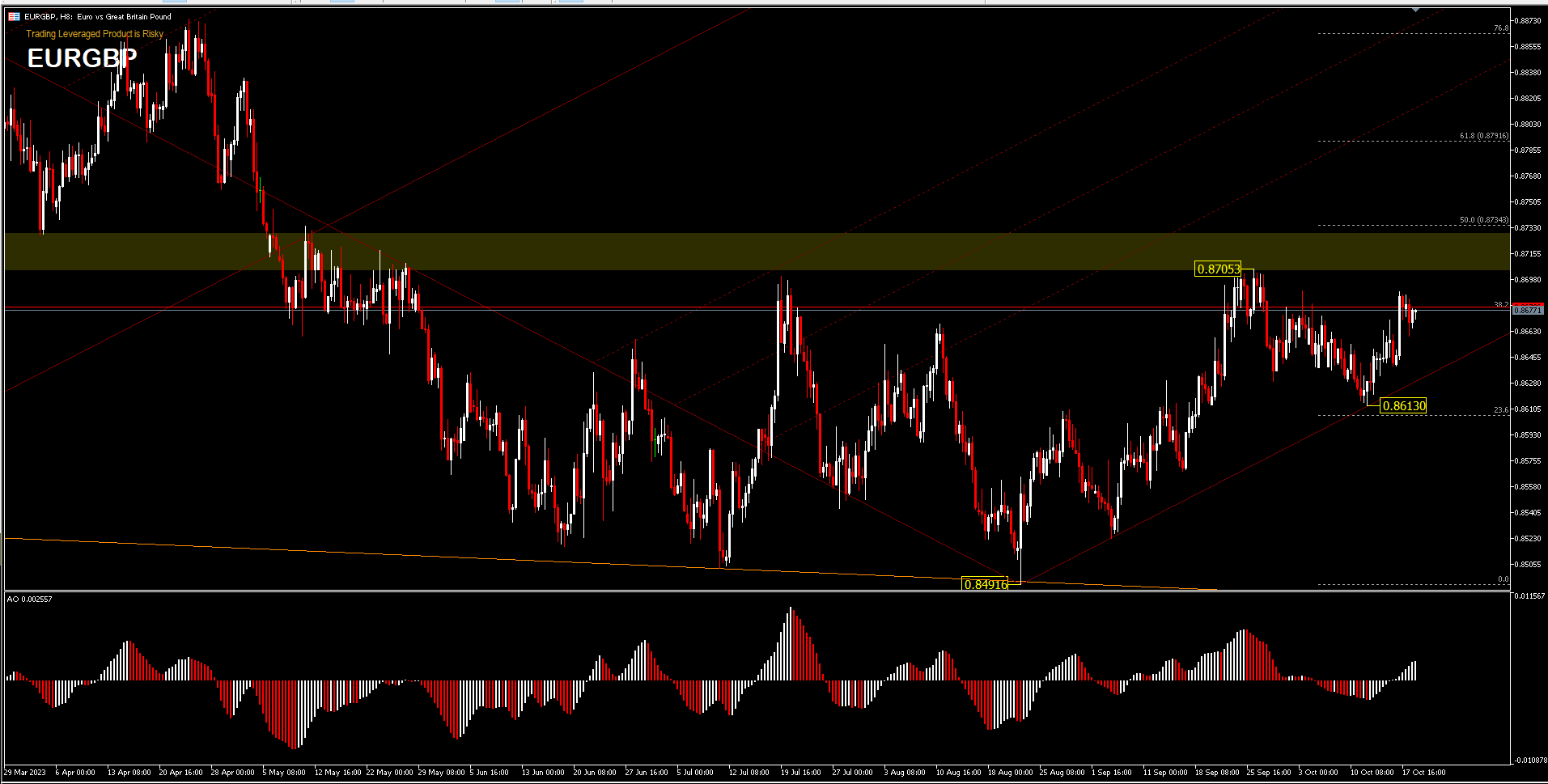

Intraday bias [H8] on EURGBP appears impartial. A break of the 0.8705 resistance would resume the 0.8491 rebound and convey extra bullish implications. Nonetheless, a break of 0.8613 would flip the bias to the draw back and resume the decline from 0.8705.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link