[ad_1]

Most Learn: Euro’s Outlook Turns Bearish After ECB Determination, Setups on EUR/USD, EUR/GBP

The euro suffered a serious setback this week, primarily in opposition to the U.S. greenback, although it additionally misplaced some floor in opposition to the British pound. The European Central Financial institution’s dovish stance throughout its April assembly laid the groundwork for the widespread forex’s downturn, which was additional exacerbated by heightened geopolitical tensions within the Center East main into the weekend.

ECB Turns Dovish

At its newest coverage assembly, the ECB opted to go away rates of interest unchanged however left little question about its intention to transition in the direction of a looser place imminently amid elevated confidence within the inflation outlook. This steerage prompted merchants to ramp up wagers that the establishment led by Christine Lagarde would launch its easing marketing campaign at its subsequent financial coverage assembly in June.

Annoyed by buying and selling setbacks? Take cost and elevate your technique with our information, “Traits of Profitable Merchants.” Unlock important insights to avoid frequent pitfalls and dear missteps.

Really helpful by Diego Colman

Traits of Profitable Merchants

Financial Coverage Divergence

The prospect of the ECB shifting forward of the Fed by way of easing is poised to be detrimental to EUR/USD within the brief run. Only a few weeks in the past, there have been indications that the FOMC may additionally act in June, however a sequence of hotter-than-expected U.S. CPI readings and labor market information have derailed this state of affairs, triggering a hawkish repricing of fee expectations that has been a boon for the U.S. greenback.

Financial coverage divergence may current challenges for the euro in opposition to the British pound as properly. Though the Financial institution of England can also be seen eradicating coverage restraint in 2024, market pricing means that the primary minimize could not materialize till August. Furthermore, merchants are solely discounting 50 foundation factors easing from the BoE, whereas they anticipate about 75 foundation factors in cumulative cuts from the ECB this 12 months.

Geopolitical Tensions on the Rise

Geopolitical tensions within the Center East are set to maintain the euro on tenterhooks within the brief time period, although any destructive affect needs to be extra seen in opposition to the U.S. greenback, historically thought of a safe-haven asset. Considerations about potential retaliatory actions from Iran following an assault on its Syrian embassy by Israel may escalate tensions within the area, unsettling markets and weighing on high-beta currencies.

For a complete evaluation of the euro’s medium-term prospects, be sure that to obtain our complimentary Q2 buying and selling forecast right now.

Really helpful by Diego Colman

Get Your Free EUR Forecast

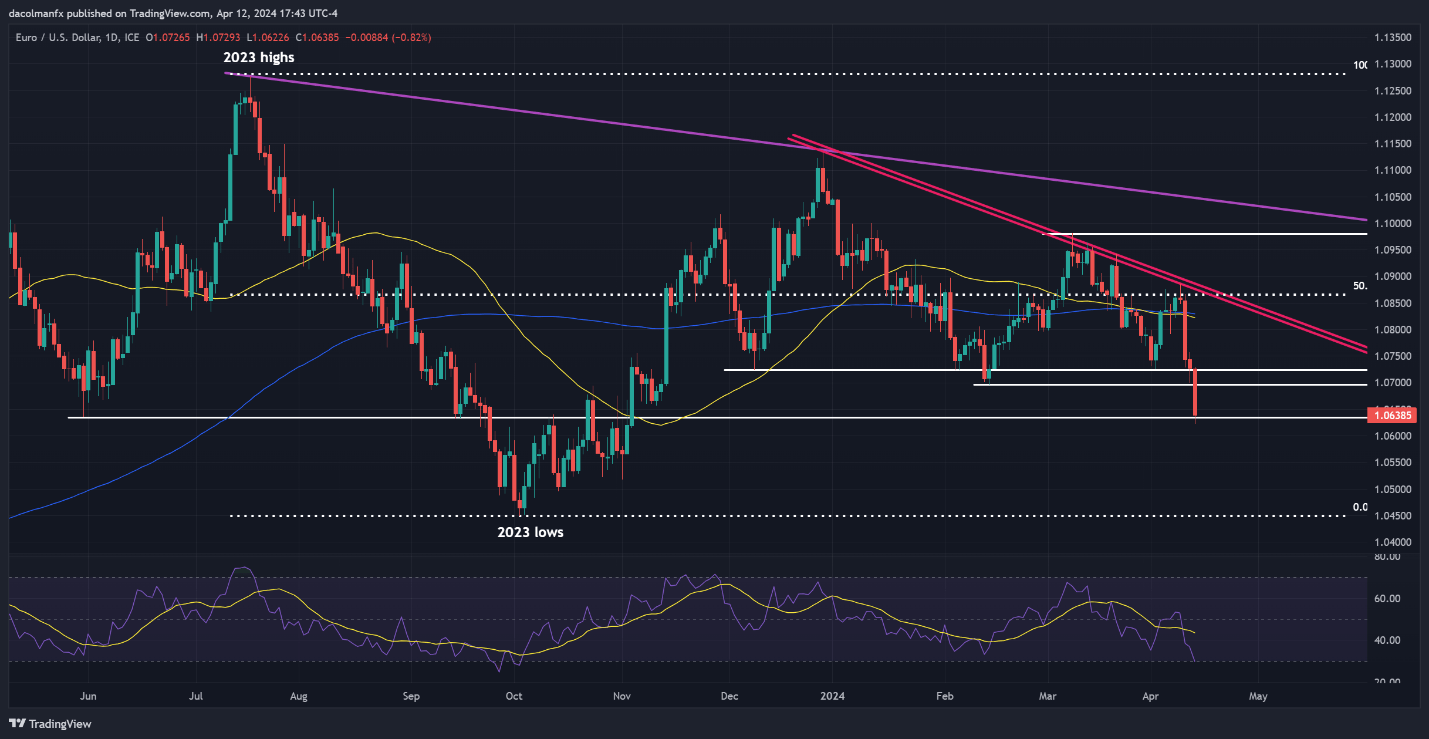

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD has dropped sharply in latest days, breaching a number of technical flooring within the course of. The most recent leg decrease has introduced the pair to its lowest level since early November of the earlier 12 months, nearing an important assist at 1.0635. To stop a deeper downturn, euro bulls might want to staunchly defend this zone; failure to take action could immediate a retreat in the direction of the 2023 lows.

Alternatively, ought to promoting stress ease and costs start to rebound from their present place, preliminary resistance emerges at 1.0695 and 1.0725 subsequently. Past these two thresholds, consideration shifts to the 50-day and 200-day easy shifting averages within the neighborhood of 1.0825. On additional power, the main target will probably be on 1.0865, the 50% Fib retracement of the 2023 stoop.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Utilizing TradingView

Concerned about studying how retail positioning can provide clues about EUR/GBP’s directional bias? Our sentiment information incorporates beneficial insights into market psychology as a development indicator. Get it now!

Change in

Longs

Shorts

OI

Day by day

4%

-24%

-6%

Weekly

17%

-42%

-9%

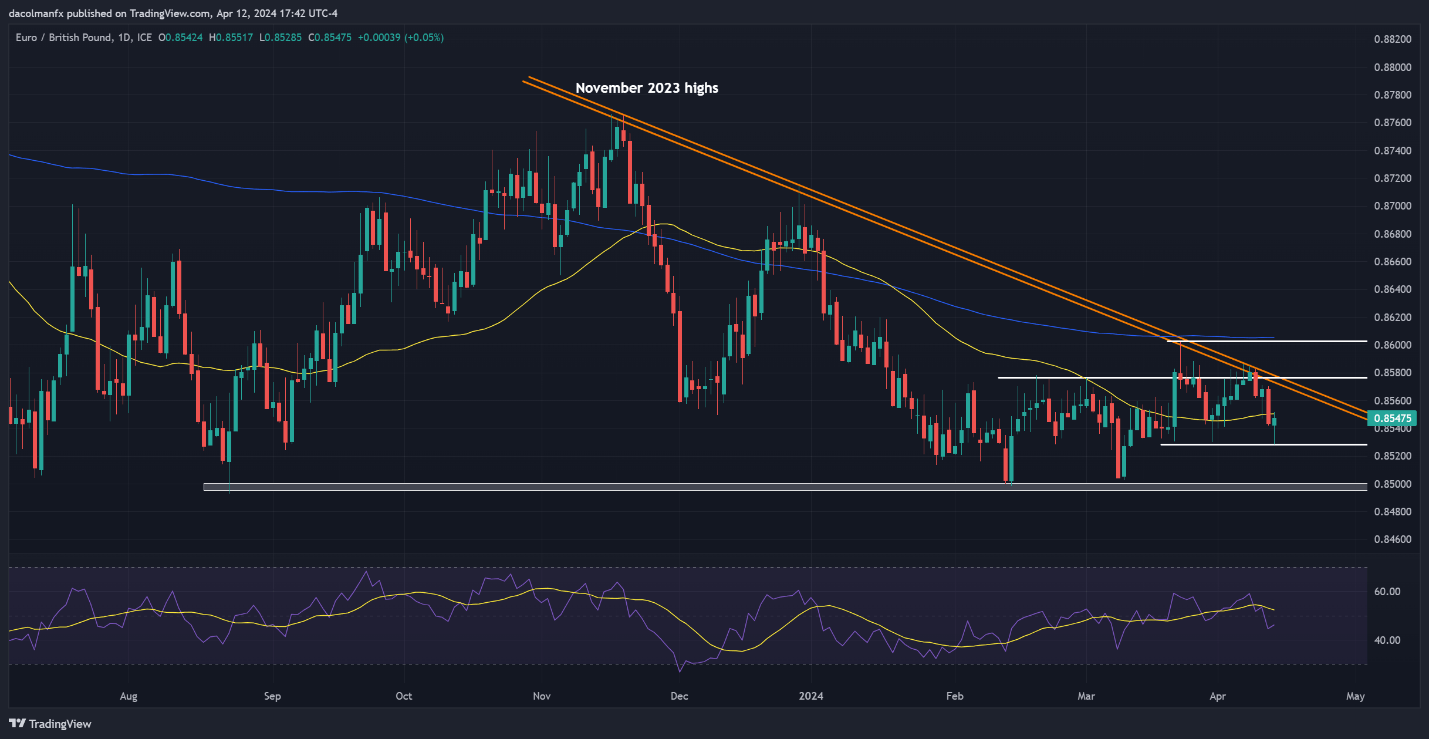

EUR/GBP FORECAST – TECHNICAL ANALYSIS

EUR/GBP dropped reasonably this week, however draw back momentum pale heading into the weekend because the pair discovered assist at 0.8525 and commenced to maneuver increased off its weekly lows. If the nascent restoration continues over the following few days, resistance seems at 0.8550 close to the 50-day easy shifting common. Wanting increased, the highlight will probably be on trendline resistance at 0.8575, adopted by 0.8600.

Alternatively, if bears mount a comeback and EUR/GBP resumes its downward journey, assist looms at 0.8525, which represents the late March swing lows. Bulls should try to take care of costs above this technical space to forestall a breakdown; in any other case, sellers may seize the chance to launch a bearish assault on the 2023 lows.

EUR/GBP PRICE ACTION CHART

EUR/GBP Char Creating Utilizing TradingView

factor contained in the factor. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the factor as a substitute.

[ad_2]

Source link