[ad_1]

Klaus Vedfelt

That is my third Exelixis (NASDAQ:EXEL) article after downgrading it from “BUY” to “HOLD” in 08/2023’s “Exelixis: Predominantly Single Molecule Most cancers Franchise”. On this article, I overview its funding prospects following its 01/08/2024 presentation (the “Presentation”) at the forty second Annual J.P. Morgan Healthcare Convention and its 2024 steering.

Stable however not stellar, greatest characterizes Exelixis 2023 outcomes

On 01/07/2024 upfront of its 01/08/2024 Presentation on the J.P. Morgan Healthcare Convention, Exelixis reported:

preliminary 2023 monetary outcomes and 2024 monetary steering; and a top level view of key priorities and milestones for 2024.

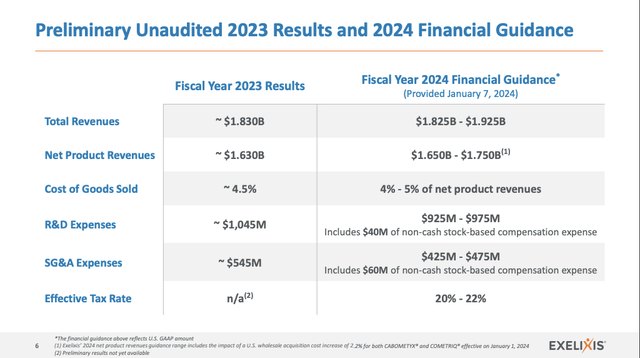

Presentation slide 6 assembles and stories Exelixis’ 2023 outcomes and 2024 steering as follows:

Searching for Alpha

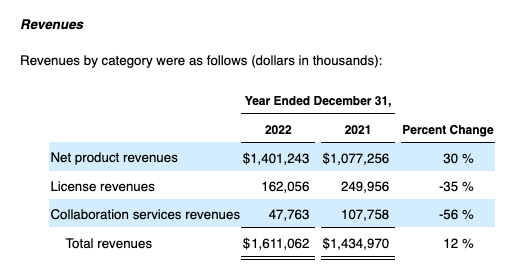

A overview of the product income excerpts under from Exelixis’ newest 10-Okay places the above figures in context:

Searching for Alpha

Complete revenues grew 12% from 2021 to 2022. They’re preliminarily pegged for a comparable ~12.7% leap from ~$1,611 billion to $1,830 billion as 2022 strikes to 2023. The proportion enhance from preliminary 2023 revenues of $1,830 billion to the $1,875 midpoint of the guided revenues for 2024 is ~2.5%.

This slowdown in guided complete income progress is discouraging. On a optimistic observe, administration is guiding for good reductions in each SG&A and R&D bills. The midpoint of mixed R&D and SG&A-guided 2024 bills are $1.4 billion in comparison with $1.59 billion mixed in 2023 for a financial savings of $0.19 billion.

Key priorities and milestones for 2024 are restricted by way of near-term catalysts

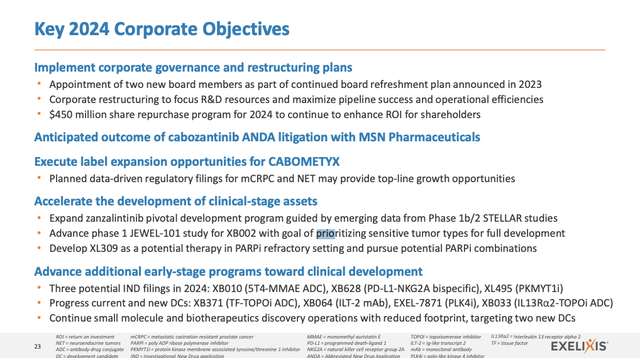

Presentation slide 23 under units out Exelixis’ key 2024 company aims:

Searching for Alpha

These embrace 5 separate areas as highlighted in blue above.

The primary of those 5 has two gadgets of near-term curiosity — company restructuring and share buyback. The company restructuring explains the R&D and SG&A expense reductions referenced above. The $450 million share buyback follows a $550 million program which was accomplished as of YE 2023 per slide 7 of the Presentation.

Throughout Q3 it repurchased $280 million of Exelixis shares at a median worth of $20.35 as said within the Name. As I write on 01/16/2024 its shares are buying and selling at $22.48. The Name supplies the newest intel on Exelixis’ liquidity which it listed at $1.9 billion. It characterised this as ample to:

spend money on inside discovery actions; pursue exterior enterprise growth alternatives; develop its pipeline, and permit it to return capital to shareholders by the $550 million repurchase and presumably its new $450 million program for 2024.

The second merchandise of the 5 in blue refers to its ongoing litigation with MSN Prescribed drugs. This difficult litigation addresses MSN’s proposed generic cabozantinib product (Abbreviated New Drug Software [ANDA] No. 213878) alleged as infringing Exelixis’ patent property.

The main points and sure anticipated end result of this dispute are past my experience. Within the Name, CEO Morrissey suggested that the trial had been just lately accomplished. He declined to remark past this recommendation. I’d observe that MSN will not be the one one to hunt an ANDA.

In 07/2023 Exelixis filed a settlement with Teva (TEVA) in decision of its ANDA to market a generic model of CABOMETYX tablets. The settlement gave Teva a license to market its generic model of CABOMETYX in the USA starting on January 1, 2031.

Again to the record of 5 key aims in blue above, merchandise 3 addresses label growth alternatives for CABOMETYX. That is clearly one thing of main significance for anybody, equivalent to myself, looking out for near-term catalysts. It goes on to level out deliberate data-driven regulatory filings for mCRPC and NET as doubtlessly offering top-line progress alternatives.

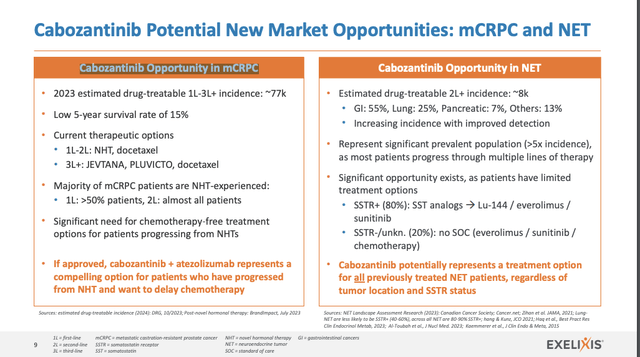

No dates are included right here. Presentation slide 24 implies that it’s directed to 2023. After all, as I write in 01/2024, 2023 has come and gone with no submitting. Presentation slide 9 under is concentrated instantly on Cabozantinib alternatives in mCRPC and NET:

Searching for Alpha

It gives nothing of substance by way of a submitting timetable. The Name is extra useful however missing in specifics. It referenced these two as Exelixis’ most mature prospects. CMO Peterson suggested:

… In late August, we introduced optimistic top-line knowledge from not one, however two part 3 CONTACT-02 which evaluated Cabozantinib plus atezolizumab in sufferers with Metastatic Castration-Resistant Prostate Most cancers, or mCRPC, and CABINET, which evaluated Cabo in sufferers with pancreatic or additional pancreatic neuroendocrine tumors. I will start briefly with CONTACT-02. This can be a randomized open-label examine of Cabozantinib plus atezolizumab versus second novel hormonal remedy, or NHT, in sufferers with mCRPC. This examine has a number of major endpoints of each PFS and OS. PFS is set by blinded unbiased central radiology overview and per-resist 1.1 So, for instance, development by PSA solely was not thought of a PFS occasion to greatest knowledgeable an endpoint. Eligibility was restricted to sufferers with measurable illness. That’s, bone-only, non-measurable illness was not allowed.

She went on to state that when the OS outcomes grow to be extra mature it should contemplate a regulatory submission because it consults with the FDA. When will such a submission truly happen? Not quickly sufficient for traders to contemplate them in any manner imminent. I anticipate administration might be extra forthcoming in future quarters when it may well set its bead on a selected date. Till then I measure them of minor near-term significance.

Conclusion

With its most mature pipeline asset in an unsure place timewise, I anticipate that Exelixis is in for a number of years of tepid progress. Its shares might nicely face important disruption because the MSN litigation outcomes are available in. Equally, if it has excellent news on the submitting entrance for NET or mCRPC, shares might get a bump.

In any other case, I anticipate Exelixis in 2024 to maneuver with the market. I price it as a “Maintain”.

[ad_2]

Source link