[ad_1]

On March 19, 2024, Seize made waves within the digital cost realm by introducing a brand-new characteristic: cryptocurrency top-up capabilities inside its digital pockets. This transfer marks a big milestone within the area’s tremendous app panorama. As I’ve been monitoring blockchain and crypto since 2016, I couldn’t resist delving into this innovation to evaluate its potential influence on the funds business. Right here’s a quick rundown of my observations:

1. Enhancing the Client Expertise:Curiosity piqued, I launched into a trial run of this new characteristic, desperate to uncover its worth proposition for shoppers. Does it provide a smoother cost expertise, price financial savings, or heightened safety in comparison with present digital cost strategies? Properly, there’s room for enchancment. First, it’s not cheaper however dearer for shoppers. In contrast to financial institution transfers, card funds, or PayNow, that are sometimes fee-free, crypto top-ups incur gasoline charges (the charge to validating transactions on a blockchain community) and fiat-to-crypto conversion prices.

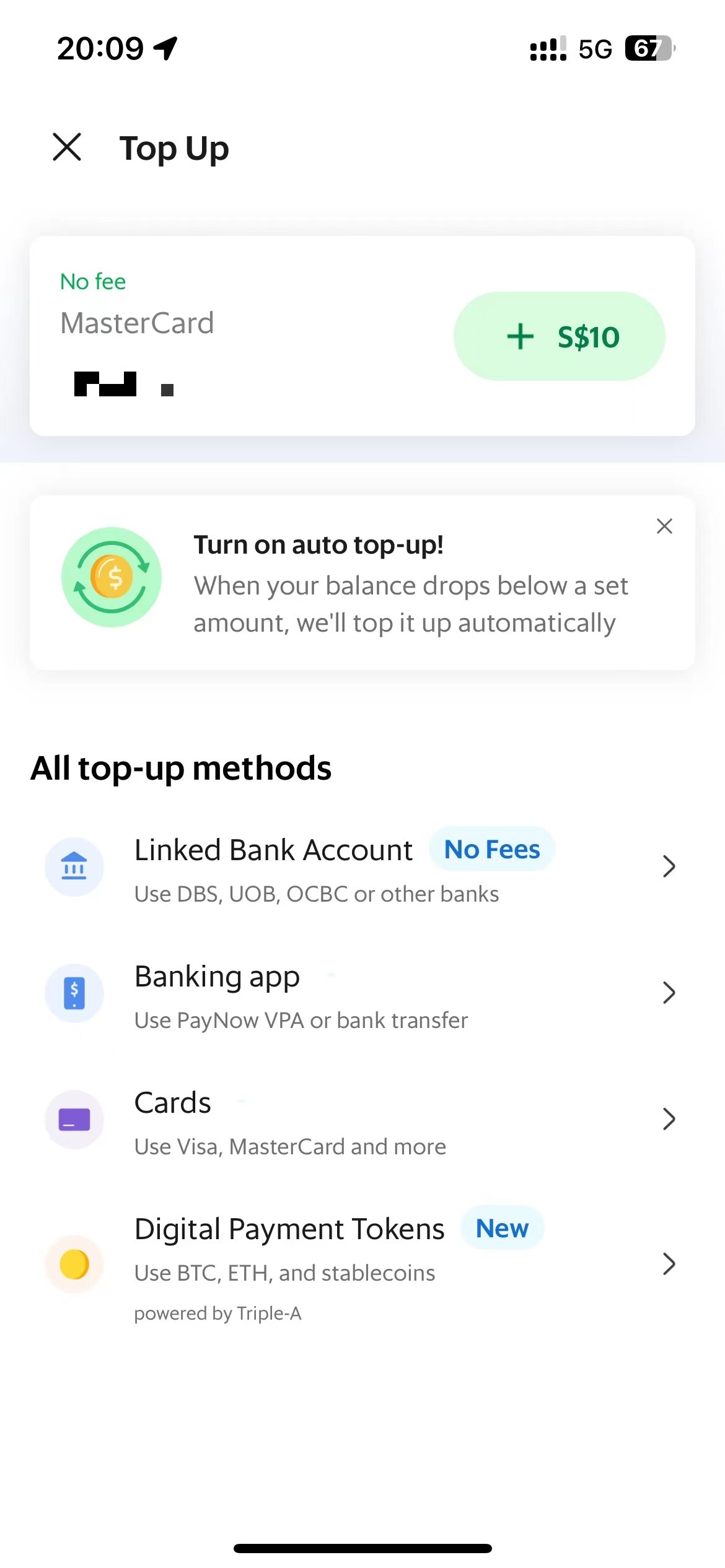

(Hyperlink with checking account, playing cards and banking app are charge free whereas cryptocurrency high up will incur gasoline charge and fiat and cryptocurrency unfold prices)

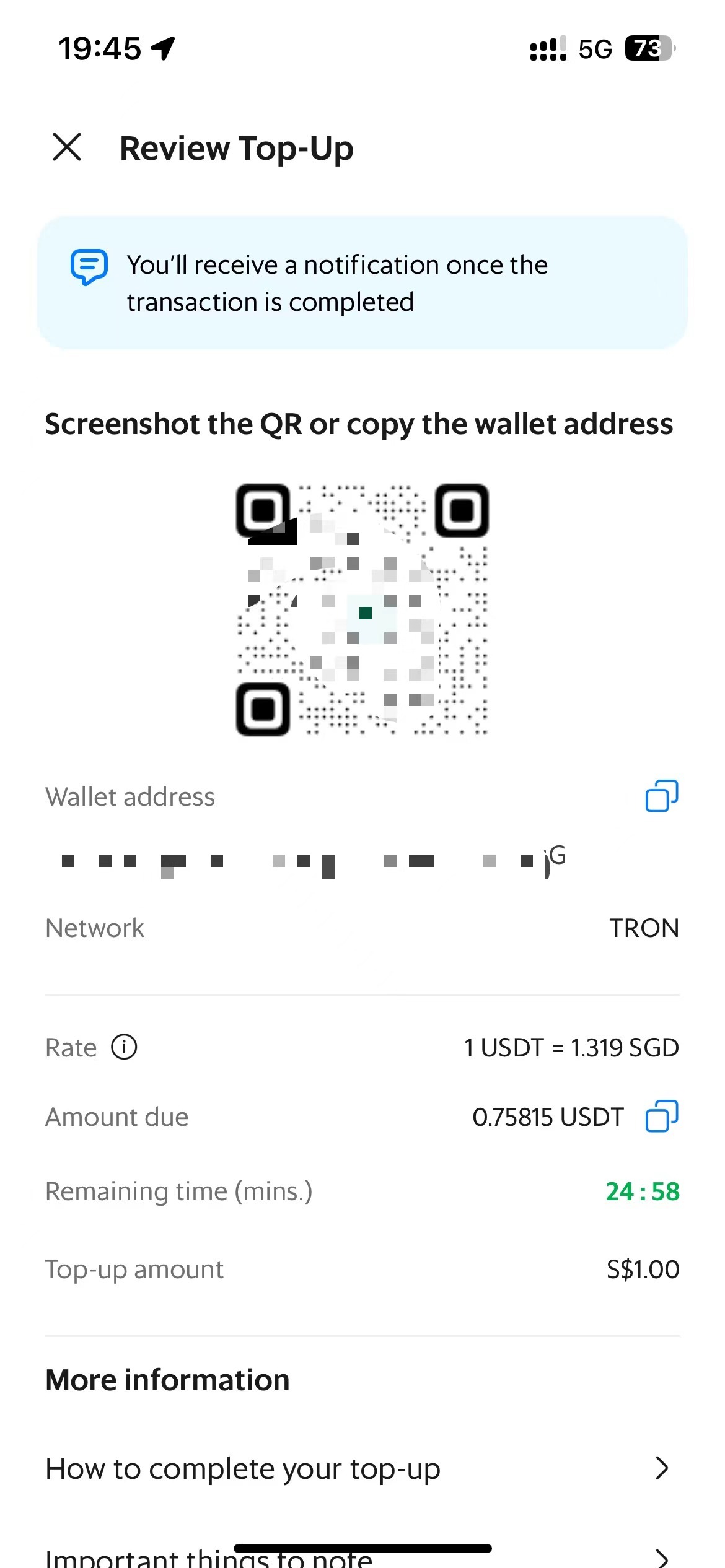

Second, I can’t inform that crypto switch between crypto wallets is extra handy than financial institution switch between totally different accounts utilizing PayNow or FAST. It’s truly extra difficult particularly for crypto learners. It consists of switching between at the least two crypto wallets, copying and pasting pockets addresses, checking all data is right and going by multifactor authentication processes.

(Switching between totally different crypto wallets and copying and checking pockets tackle are usually not straightforward duties for crypto learners)

Moreover, the “high up” course of itself resembles an ATM deposit within the digital realm, missing the seamless integration with direct hyperlinks to checking account and credit score/debit card with out the necessity for high up seen in tremendous apps in different areas like Alipay and WeChat Pay. By way of safety, the disparity between crypto and conventional digital funds is negligible. Nonetheless, for ardent crypto fanatics and merchants, this characteristic presents an attractive avenue to make the most of their property in on a regular basis transactions.

2. Empowering Retailers:Delving deeper, I explored the worth proposition for retailers. Whereas the attract of decreased prices and commissions related to crypto funds is simple, it’s not the complete image. On this situation, Seize assumes the position of the “service provider,” with Triple A appearing because the “acquirer” in a parallel to the standard card-based retail cost mannequin. By accepting crypto funds, retailers can circumvent the 2-3% interchange charges sometimes paid to card issuing banks (a small share additionally goes towards acquirers and card networks). Nevertheless, it’s important to notice that this doesn’t equate to fee-free transactions. The emergence of latest “middlemen” within the crypto cost worth chain introduces fiat-to-crypto conversion spreads akin to conventional overseas change (FX) charges. Retailers should weigh the comparative prices and, if the crypto route proves cheaper, think about passing on the financial savings to shoppers by rewards, reductions, and progressive loyalty applications tailor-made to crypto funds.

Lastly, although Seize’s new cryptocurrency cost characteristic is just not excellent and nonetheless have house for enchancment, as a regional tremendous app and the second most used digital cost app in Singapore based on Forrester’s shopper technographic information, Seize holds the robust potential to additional construct and develop their cryptocurrency funds choices to broader ecosystems reminiscent of introducing new loyalty applications, advancing digital cost expertise and integrating with future Central Financial institution Digital Currencies within the area. This can set off extra attention-grabbing improvements and different cost strategies in APAC.

To be taught extra particulars about digital funds improvements in APAC and crypto and digital forex improvements, Forrester purchasers can learn reviews The State Of Digital Retail Funds In Asia Pacific In 2023, The State Of Central Financial institution Digital Currencies In Asia Pacific and Digital Asset Custody: A Primer and schedule a steering session or inquiry with me.

[ad_2]

Source link

Add comment