[ad_1]

BITCOIN, CRYPTO KEY POINTS:

Bitcoin Stays Above the 40k Mark Which Stays Key for Additional Draw back.Crypto Trade Resilience on Show with Newest Analysis Piece Reveals 83% of Crypto Mentions are Optimistic.Over $300 Million in Lengthy Positions Liquidated Following Todays Hunch in Costs.To Be taught Extra AboutWorth Motion,Chart Patterns and Shifting Averages,Take a look at the DailyFX Training Sequence.

READ MORE: EURO Weekly Forecast: ECB Anticipated to Maintain Charges however How Will Projections Differ from Market Expectations?

Advisable by Zain Vawda

Get Your Free Introduction To Cryptocurrency Buying and selling

Bitcoin (BTC/USD) Sank as a lot as 7.5% in a single day to a low of round $40520, which is only a whisker away from the psychological $40000 degree. I had mentioned the potential of this potential pullback final week in my article (to learn click on right here). There doesn’t look like any singular driving power behind the transfer besides maybe the marginally stronger US Greenback. I nonetheless suppose that that is partly right down to revenue taking forward of the Threat Occasions this week and the top of 12 months holidays.

Supply: TradingView

WILL THE $40K LEVEL SUPPORT HOLD?

The $40 okay mark may maintain the important thing heading into the festive break. A break under this degree may open up the potential of a deeper retracement down towards the $31k-$32k space. As talked about above I imagine that a part of the transfer is probably going right down to revenue taking as we do have a bunch of threat occasions forward. The transfer down could also be welcomed by many, notably establishments who could need to become involved earlier than the Spot ETF choices early in 2024. The query is how deep a retracement will we get and can the FOMC assembly play a component?

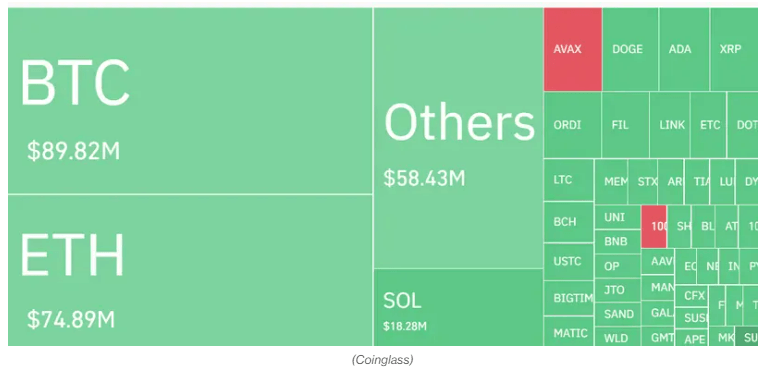

In response to CoinGlass information reveals that there was an approximate liquidation of round $335 million of lengthy positions during the last 12 hours. The quantity of liquidations are represented under with Bitcoin main the best way adopted by Ether.

Supply: CoinGlass/CoinDesk

CRYPTO RESILIENCE

A pullback shouldn’t be considered in a unfavourable gentle as the general cloud which many although would hover over the Crypto sector cleared way back. That is one thing I’ve beforehand mentioned however has truly been identified in analysis of late as nicely. In response to analysis launched just lately by Coinwire.com, 83% of Crypto mentions in op publications have been constructive in 2023. This may clarify the resilience of the business in a time when it has confronted plenty of challenges.

Different key takeaways from the CoinWire examine revealed that over 65% of worldwide crypt associated Tweets have a constructive sentiment. The UK takes the lead on this international cheer, with extra than72percentof crypto-related tweets from this area being constructive. The US as nicely is a pacesetter right here with roughly 2 out of three Individuals have a constructive view of Crypto in 2023. That is one I admit shocked me given the FTX scandal, however I used to be as soon as once more compelled to recollect the Banking disaster earlier within the 12 months.

I suppose the purpose m attempting to make here’s a selloff shouldn’t be accompanied by doom and gloom and don’t get caught up within the FOMO of all of it with the festive season forward. The outlook for 2024 seems promising and I’d hold that in thoughts if we do have a deep and aggressive pullback.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

CATHY WOOD’S ARK INVEST SELLS COINBASE SHARES

ARK has been constantly promoting Coinbase (COIN) shares over the previous couple of weeks. ARK upped the ante in July promoting 480,000 shares at a price of $50.5 million on the time till this previous Friday when ARK offloaded an extra 335,860 shares which might have been valued at $49.2 million at Coinbase’s closing worth. A shock to me given the constructive outlook I’ve concerning Coinbase in 2024, however that’s a subject for one more time.

ARK nonetheless did the sale as a result of goal weighting it applies to its ETFs. The current rally within the Coinbase share worth has seen the load of the shares exceed the restrict of 10% imposed by ARK. The sale nonetheless failed to perform this, as issues stand COIN accounts for some 13% of the Fintech Innovation ETF and +-11% of the Subsequent Technology ETF. An additional appreciation within the Coinbase worth may see ARK impact additional gross sales within the coming days and weeks and could possibly be value monitoring.

READ MORE: HOW TO USE TWITTER FOR TRADERS

BITCOIN PRICE OUTLOOK AND FINAL THOUGHTS

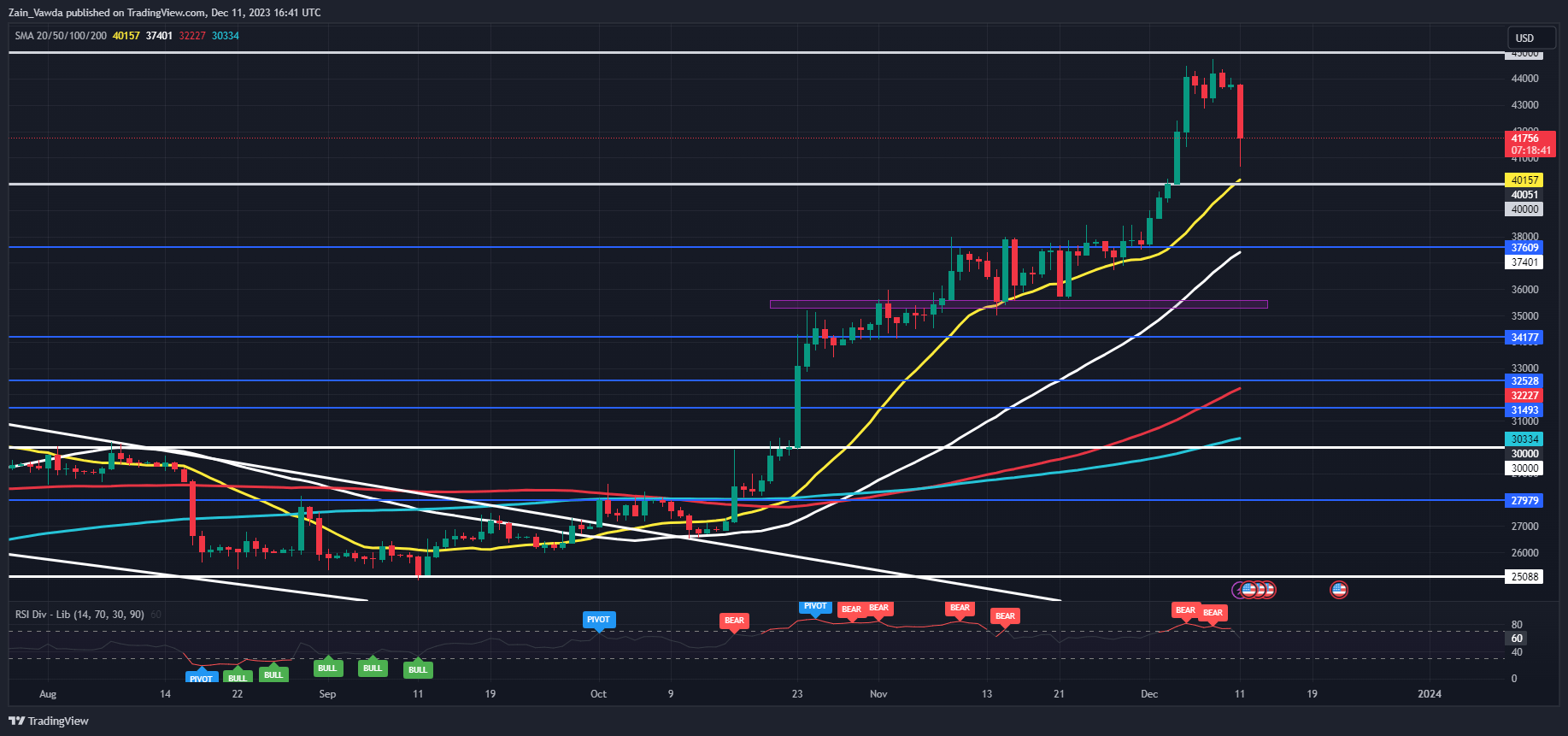

From a technical standpoint BTCUSD failure to seek out acceptance above $45k was an indication that retest of the $40k degree was inevitable. We have now simply fallen in need of this degree right now however may nonetheless go on to faucet that degree, the place the 20-day MA additionally rests simply above the $40k mark.

The assist degree on the $40k mark with a break decrease brings assist on the $37600 into focus with the 50-day MA resting on the $37400 mark. Any additional drop will carry the assist areas at 35600 and 35000 into play.

A transfer greater from right here will face quick resistance on the $43000 deal with earlier than the psychological $45000 mark comes again into focus. The main resistance degree on the $50000 mark seems tasty and achievable however there’s a rising likelihood of a deeper retracement earlier than a check of this degree involves fruition.

Supply: Kobeissi Letter

Resistance ranges:

Help ranges:

BTCUSD Each day Chart, December 11, 2023.

Supply: TradingView, chart ready by Zain Vawda

Advisable by Zain Vawda

The Fundamentals of Pattern Buying and selling

— Written by Zain Vawda for DailyFX.com

Contact and observe Zain on Twitter: @zvawda

factor contained in the factor. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the factor as a substitute.

[ad_2]

Source link