[ad_1]

By Rodrigo Zepeda, CEO, Storm-7 Consulting

INTRODUCTION

In 2023, the Monetary Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) (Financial institution of England (BoE)) (collectively the “regulators”) sought to have interaction with monetary corporations and different stakeholders, to debate new

proposed measures to spice up “range and inclusion” (D&I) in monetary companies (FS) in the UK (UK).

In PART I of this

four-part weblog sequence, we outlined and mentioned key D&I ideas comparable to

demographic traits, range, groupthink, inclusion,

non-financial misconduct (NFM), and psychological security. In PART

II we supplied an summary of the D&I proposals, and we recognized the tiered requirements to be launched below the proposed FCA/PRA framework.

In PART III, we analysed how new NFM obligations match into the D&I

framework, what they are going to entail, and the way this can have an effect on and influence crypto and monetary expertise (FinTech) corporations. In

PART IV, we are going to analyse what the D&I guidelines and obligations include, to which varieties of corporations they are going to apply, and the way they are going to have an effect on and influence crypto and FinTech corporations.

REGULATORY FRAMEWORKS

The regulatory frameworks related to this evaluation embody:

PROPOSED FCA NFM AND D&I MINIMUM FRAMEWORK

The tiered measures differentiate between “Small” corporations, that are all corporations with

250 or much less staff, and “Massive” corporations, that are all corporations with

251 or extra staff (i.e., Massive FCA corporations, Massive PRA corporations). The proposed FCA NFM and D&I Minimal Framework consists of:

(1) NFM Guidelines; and

(2) D&I knowledge reporting (minimal obligations).

We all know that the NFM Guidelines apply to all Half 4A FSMA corporations. The D&I knowledge reporting (minimal obligations) additionally apply to all Half 4A FSMA corporations,

excluding all LS SMCR corporations. Consequently, all the next varieties of corporations which are crypto and FinTech corporations are

excluded from the D&I knowledge reporting (minimal obligations):

E-Cash corporations and Fee Companies corporations; LS SMCR corporations; registered CRAs; and Small PRA-regulated corporations.

Nonetheless, as quickly as current FinTech corporations (e.g., E-Cash and Fee Companies corporations) apply to increase FCA authorisation in any means (e.g., to supply new varieties of services or products), then they are going to seemingly fall inside scope of the D&I knowledge reporting (minimal

obligations) (i.e., Half 4A FSMA authorisation required). For crypto corporations, these searching for to make and market “monetary promotions” regarding “qualifying cryptoassets” within the UK, will probably be required to both change into FCA authorised, or talk them by way of FCA/PRA

authorised individuals. In the event that they change into authorised, they are going to be topic to D&I knowledge reporting.

In follow, all crypto and FinTech corporations that change into Half 4A FSMA authorised will probably be required to:

(1) full registration and arrange with the FCA’s

RegData system;

(2) word the full variety of staff within the agency on a specified date (supplied within the D&I measures) in every of the agency’s three (3) most up-to-date years;

(3) full Half 1 of the FCA D&I return (REPxxx Variety and Inclusion)

by way of the FCA’s RegData system;

(4) report the common variety of staff predominantly finishing up actions from an institution within the UK (primarily based on final three years) inside a 3-month reporting window (FCA

CP23/20, 26, paras. [4.31]-[4.32]; 65, Annex 4).

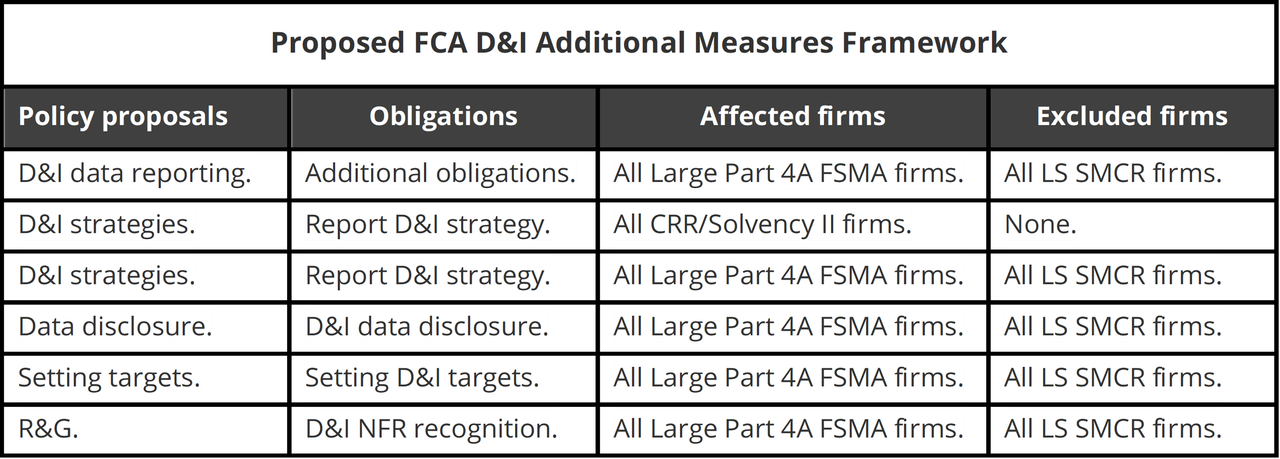

PROPOSED FCA D&I ADDITIONAL MEASURES FRAMEWORK

A abstract of the FCA D&I Extra Measures framework is ready out beneath.

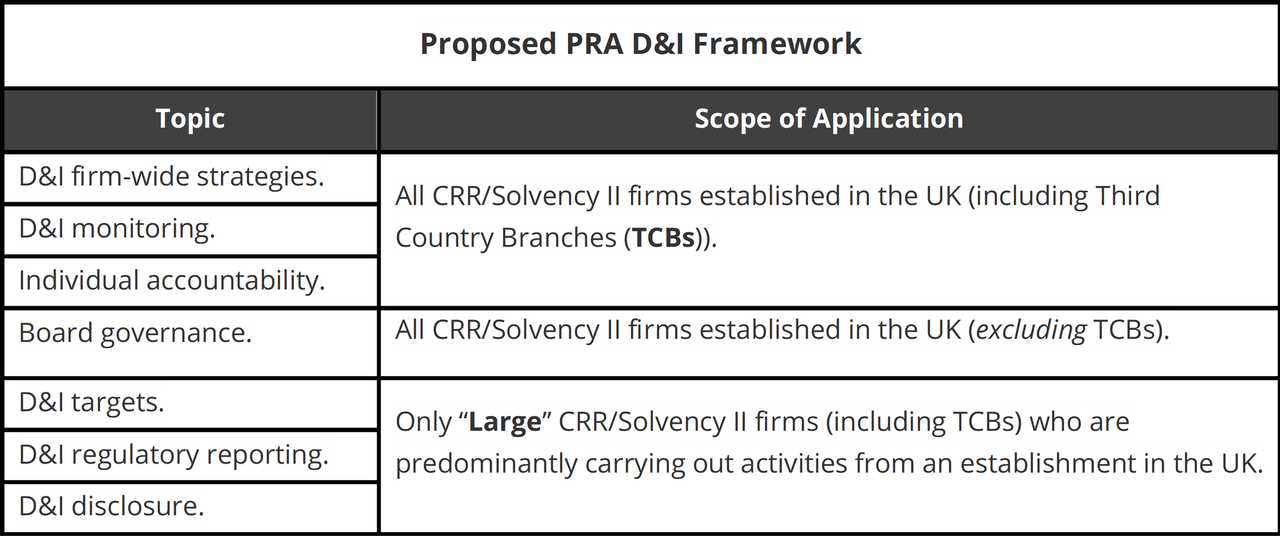

For comparative functions, a abstract of the PRA D&I framework is ready out beneath (albeit we are going to restrict commentary to the FCA D&I necessities) for corporations.

All crypto and FinTech corporations excluded from the D&I knowledge reporting (minimal obligations), can even be

excluded from the Extra Measures framework (i.e., E-Cash corporations and Fee Companies corporations, LS SMCR corporations, registered CRAs),

EXCEPT for sure Small PRA-regulated corporations. If a Small PRA-regulated agency can be a dual-regulated CRR/Solvency II agency, it should report its D&I technique.

In PART II, we recognized the totally different parts and necessities

for every particular space regarding the totally different coverage proposals. Right here, we are going to set out commentary regarding how every particular space could have an effect on and influence crypto and FinTech corporations that qualify as Massive Half 4A FSMA corporations.

D&I DATA REPORTING (ADDITIONAL OBLIGATIONS)

Common D&I Information Reporting

There are 4 factors to notice for crypto and FinTech corporations close to common D&I knowledge reporting necessities.

First, as a result of corporations are Massive, they are going to have at the very least 251 staff that they should report knowledge on. Subsequently D&I knowledge assortment would require some work. Even when corporations can get hold of among the knowledge required from current knowledge sources, it’s extremely

seemingly that they are going to nonetheless must implement new techniques and procedures to acquire among the new varieties of D&I knowledge required (e.g., D&I Inclusion Metrics).

As well as, D&I knowledge reporting is just not merely about knowledge assortment. Crypto and FinTech corporations should work with the D&I knowledge to develop D&I methods and justify these primarily based on proof they’ve obtained. Subsequently, preliminary D&I knowledge assortment and

reporting could not all the time go as easily as anticipated. D&I knowledge reporting timelines ought to incorporate built-in time buffers to deal with potential delays.

Second, as soon as reporting deadlines are set, corporations should put in place detailed D&I knowledge administration and reporting challenge timeline streams to make sure they report on time. The issue for corporations is that it isn’t merely a case of rapidly gathering knowledge

after which reworking it into the right format required by the FCA. Some areas would require extra tasks to be carried out to gather the suitable D&I knowledge.

Amassing such a knowledge could require corporations to amend their current worker and knowledge safety and privateness insurance policies, in addition to to create new varieties of knowledge assortment knowledgeable consent types. Companies additionally want to consider how they are going to inform and have interaction

their staff concerning D&I knowledge assortment, as a substitute of simply thrusting D&I knowledge assortment on them with out warning.

Third, even with advance planning, some corporations should run into D&I knowledge supply and reporting delays and issues. Within the first 12 months, the FCA will probably be offering corporations with a “comply or clarify” strategy which can enable them to elucidate and

justify knowledge gaps, and to elucidate how and when such gaps will probably be remedied. Fourth, D&I reporting is topic to a £250 administrative advantageous for non-timely submission of studies.

D&I Demographic Traits Information Reporting

Obligatory D&I demographic traits of staff to be reported are: (1) incapacity or long-term well being situations; (2) ethnicity; (3) faith; (4) intercourse or gender; and (5) sexual orientation (FCA

CP23/20, 33, para. [5.40]).

Voluntary D&I demographic traits to be reported are: (1) carer duties; (2) gender identification; (3) socio-economic background; (4) gender identification; and (5) parental duties (FCA

CP23/20, 33, para. [5.40]).

Crypto and FinTech corporations have to be cautious of their understanding of those necessities.

Obligatory right here signifies that the agency should submit related D&I knowledge to the FCA. It

does NOT imply that the agency should get hold of the information from staff. Voluntary right here means the agency could select whether or not or to not submit this D&I knowledge to the FCA.

Crypto and FinTech corporations will not be obliged to gather this knowledge, nevertheless, they’d be free to gather this knowledge after which select to not report this knowledge. Both means, crypto and FinTech corporations should make it completely crystal clear to staff that they’re

free to decide on NOT to answer questions, or to point if they like to not say (FCA CP23/20,

34, paras. [5.45]-[5.46]). Strictly talking, pressuring staff to forcibly disclose such private knowledge could possibly be seen as endangering the psychological security of such staff.

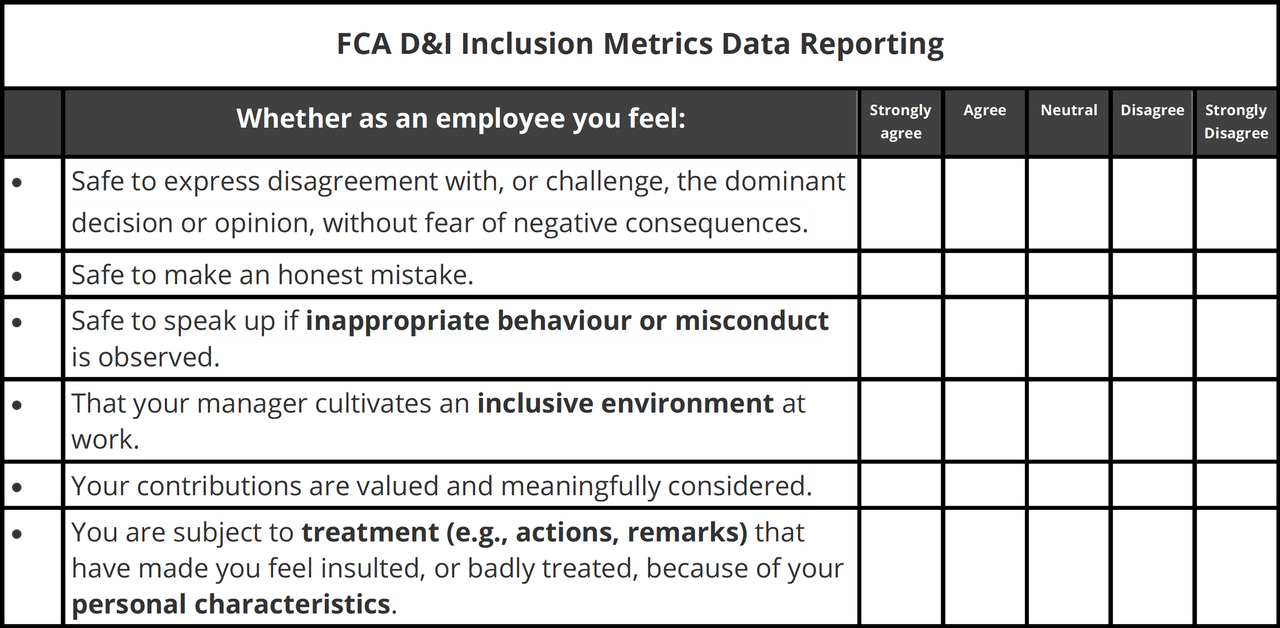

D&I Inclusion Metrics Information Reporting

Crypto and FinTech corporations should report on “inclusion metrics”. These are measures of inclusion knowledge reported on a 5-point scale (strongly conform to

strongly disagree) (FCA CP23/20, 36, para. [5.64]). The measures should determine the diploma to which

staff agree or disagree with sure statements (beneath). The D&I inclusion metrics knowledge is very problematic.

First, all of the descriptions highlighted in daring present that the statements are topic to particular person subjective interpretation. What’s inappropriate behaviour or misconduct, or what’s an inclusive setting. As a result of the statements generate intensive

subjectivity, the responses lose worth by way of their accuracy. As well as, say a Small FinTech agency has excessive ranges of inappropriate behaviour, harassment, and verbal bullying. On the identical time, while all staff are paid excessive salaries there are excessive

ranges of worker turnover.

In this type of tradition and setting, though the agency says that surveys are confidential, staff actually don’t know who may have entry to the survey knowledge, and whether or not the responses given

will probably be saved confidential. Offering unfavourable responses dangers “marking” the worker as being tough, a unfavourable affect, delicate, topic to over-reacting, or not being a workforce participant.

If there are excessive turnover ranges within the agency, mixed with poisonous cultures, staff don’t really feel secure, as a result of they could really feel they could possibly be fired at any time, for any purpose, or for a made-up purpose. In that sort of state of affairs, staff are extremely disincentivised

to inform the reality, and can extra seemingly interact in groupthink to play together with everybody else. The D&I Inclusion Metrics knowledge system fails to account for unfavourable and poisonous work environments. It presumes it is going to be utilized in an trustworthy and truthful means, which

could also be false.

D&I Goal Setting Information Reporting

Crypto and FinTech corporations should report on D&I goal setting (FCA CP23/20, 37, para. [5.67]). This covers

the progress corporations have made in the direction of attaining set D&I targets. Reportable D&I goal setting knowledge contains:

demographic traits for which corporations have set targets, and inclusion targets (if any);

percentages for every goal set; the rationale behind the targets set; the 12 months every goal was set; the 12 months the agency is aiming to fulfill the goal; and every other info the agency wish to be thought of concerning the targets set.

The target is for corporations to set acceptable range targets to deal with

under-representation of demographic traits throughout the agency (FCA CP23/20, 68, Half 2). Subsequently,

to set D&I targets, corporations really want to have already obtained D&I knowledge to determine current demographic traits throughout the agency. It makes little sense setting arbitrary targets primarily based on no knowledge (the goal could be fully unrealistic, or it could

have already been met). Companies should then outline what under-representation truly means throughout the agency. This illustrates why setting out D&I knowledge assortment and reporting timelines is so vital.

D&I STRATEGIES

Crypto and FinTech corporations should develop an “evidence-based” D&I technique that takes account of the agency’s progress on D&I. This may increasingly require senior administration to have interaction extra deeply with the D&I knowledge the agency has obtained, and to hunt extra enter from

all related inside stakeholders. Clearly, the bigger the agency (and the extra advanced that D&I points change into in that agency), the extra time and work that setting the agency’s D&I technique could take.

As well as, corporations should tie this D&I technique to the FCA’s three Operational Aims

and its Secondary Goal (FCA CP23/20, 28, para. [5.7];

Weblog PART I). Subsequent, corporations report their D&I technique by setting out:

the agency’s D&I goals and objectives (O&G); a plan for attaining D&I O&G and measuring progress; a abstract of preparations to determine and handle obstacles to attaining O&G; and

methods to make sure enough data of D&I technique amongst employees (FCA CP23/20, 28, para. [5.8]).

A agency’s D&I technique is subsequently dynamic in nature, as a result of it’ll should be monitored ultimately to determine how progress is measured, how obstacles are frequently recognized and monitored, and to what extent the agency has progressed in the direction of

its D&I O&G. It will require crypto and FinTech corporations to develop new techniques to watch and hold monitor of a agency’s D&I methods, key duty holders, and key personnel.

D&I DATA DISCLOSURE AND D&I TARGET SETTING

Companies will probably be required to publicly disclose their D&I targets and their progress in the direction of them yearly (FCA

CP23/20, 39-40). The D&I knowledge disclosed by corporations will probably be reported on an aggregated foundation in percentages (FCA

CP23/20, 39-40). Crypto and FinTech corporations can even be required to set at the very least 1 goal to deal with under-representation for:

(1) senior management;

(2) the board; and

(3) the agency’s worker inhabitants as an entire (FCA CP23/20, 30, para. [5.21]).

Goal setting should take into consideration a agency’s range profile and D&I technique (FCA CP23/20, 30, para.

[5.24]). The thought is that by requiring corporations to publicly disclose D&I targets and progress made in the direction of targets on an annual foundation, D&I transparency is elevated.

For instance, folks can externally monitor a agency which has made little, or no progress on D&I targets, after which analyse the agency to evaluate whether or not the agency views D&I compliance as a “tick field train”. D&I goal setting can even have the ability to act as an business

benchmark, as a result of folks will have the ability to examine D&I targets set by comparable corporations to match D&I achievements and progress.

As an instance the potential impact this may increasingly have, we are going to examine three FinTech corporations at present available on the market: (1) “Monese”; (2) “Revolut”; and (3) “Monzo”.

Monese at present has NO info on D&I accessible on its

web site – you can not even seek for D&I. Revolut has snippets of knowledge on D&I on its

web site, however that is superficial and there’s no knowledge or statistics accessible. Monzo has D&I knowledge, blogs exhibiting D&I knowledge and graphics,

and it has revealed a D&I report (2022) on its web site.

Whenever you examine web sites, the distinct impression you get hold of is that Monzo appears to be dedicated to D&I to a a lot larger diploma than Monese and Revolut. Nonetheless, the purpose is that there isn’t any technique to simply examine D&I knowledge and statistics for these corporations

at current. We can not benchmark the D&I efficiency of those corporations. One other takeaway is that crypto and FinTech corporations can use D&I knowledge disclosure and goal setting to leverage their D&I credentials with a view to securing strategic market benefit. Crypto

and FinTech corporations may incorporate D&I knowledge into strategic advertising channels and campaigns.

D&I R&G

Crypto and FinTech corporations should recognise an absence of D&I as a “Non-Monetary Danger” (NFR). In concept, which means they have to take into account issues regarding D&I as an NFR, after which deal with them “appropriately” throughout the agency’s governance constructions

(FCA CP23/20, 24, para [5.89]).

In PART II, we famous how this strategy will basically go away corporations

to report on their very own inside unhealthy behaviour and poor decision-making. This strategy creates a battle of curiosity (COI). If corporations develop extremely subtle instruments and applied sciences to seize knowledge to determine elevated groupthink and poor decision-making

in corporations, this knowledge could then doubtlessly should be disclosed to the FCA. It’s

unfavourable knowledge as a result of it might hurt the agency.

Companies will face a COI between, serving to the FCA to attain its D&I goals, and defending the agency and its repute. Given this potential COI, and in addition on condition that realistically D&I for a lot of corporations could also be seen as low precedence, corporations could undertake a superficial

and low precedence strategy to D&I NFR recognition throughout the agency’s governance constructions. Particularly because the agency faces no attendant prices or repercussions for doing so.

CONCLUSION

So, what do you suppose, do the brand new proposed D&I measures look clear and easy, or do they have an inclination in the direction of being described alongside the strains of “Sophisticated as hell”? By enterprise such a fundamental evaluation we now have been in a position to determine an enormous vary of points

and issues that come up with the proposed new D&I measures, D&I knowledge reporting, and particularly the NFM Guidelines. This sort of evaluation and danger evaluation actually ought to have been carried out by the FCA and the PRA, along with the usual Price Profit

Evaluation undertaken.

The report by the UK Treasury Committee (UKTC) into “Sexism

within the Metropolis” revealed right now discovered that there had been a disappointing lack of progress on sexual harassment and bullying (together with severe sexual misconduct), and that most of the obstacles initially recognized in 2018, nonetheless remained stubbornly

in place (Treasury Committee, 2024, 3). The UKTC acknowledged that they’d

heard many corporations nonetheless deal with D&I as a “tick-box” train, as a substitute of a core enterprise precedence, regardless of clear proof that numerous corporations obtain higher outcomes (Treasury

Committee, 2024, 3). The UKTC added:

“It’s surprising to listen to how prevalent sexual harassment and bullying, as much as and together with severe sexual assault and rape, nonetheless are in monetary companies, and the way poorly corporations deal with allegations of such behaviours. We have been notably involved

to listen to of the widespread misuse of non-disclosure agreements (NDAs), which have the impact of silencing the sufferer of harassment and forcing them out of an organisation, whereas defending perpetrators and leaving them free to proceed their careers and go

on to abuse others” (Treasury Committee, 2024, 3).

Sadly, the best way the present proposed NFM Guidelines are drafted to function, it’s unlikely that they are going to make any severe influence on NFM throughout FS within the UK. There are merely far, far, too many exceptions and exclusions and issues recognized. These

embody issues with totally different authorized frameworks with respect to EA 2010 protected traits, and 1000’s and 1000’s of corporations, and tens of 1000’s of staff being excluded from the appliance of the NFM Guidelines inside FS.

[ad_2]

Source link

Add comment