[ad_1]

Following the ECB’s determination to take care of rates of interest, consideration shifts to the Federal Reserve’s upcoming determination.

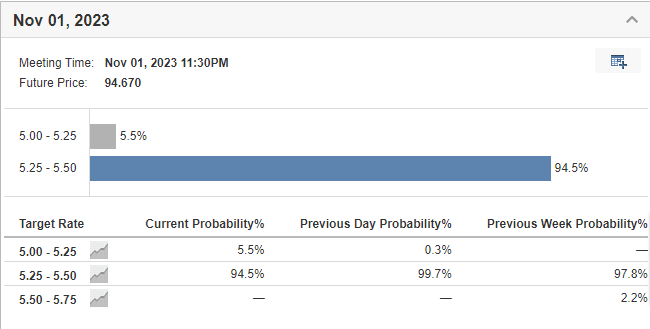

The Fed Charge Monitor Software signifies a robust consensus for the Fed to maintain charges regular, with a chance of 94.5%.

The main focus will probably be on Jerome Powell’s speech, however expectations are for typical statements with out main revelations.

Following the European Central Financial institution (ECB)’s to conclude its string of consecutive rate of interest hikes and keep its charges on the present degree, the monetary world’s consideration has shifted to the Federal Reserve.

In alignment with the ECB’s current stance, the Federal Reserve is extensively anticipated to maintain its charges regular within the upcoming .

This expectation is substantiated by the robust consensus mirrored within the , which now signifies an amazing chance of 94.5%, marking a slight lower from the earlier week’s 97.8% studying.

Fed Charge Monitor Software

Nonetheless, what holds probably the most significance on this state of affairs isn’t just the prospect of a second consecutive pause but additionally the content material of Jerome Powell’s forthcoming . So, what ought to we anticipate from his deal with?

Realistically, I do not foresee any groundbreaking revelations, and I remorse to disappoint those that could also be hoping for any dramatic or abrupt modifications.

We will usually anticipate a standard Powell, the place he reiterates the next key factors:

The Federal Reserve’s major goal is to steer inflation again in the direction of its 2 p.c goal.

Coverage choices will proceed to be made on a meeting-by-meeting foundation, making an allowance for probably the most present information and financial circumstances.

The current state of the financial system stays resilient, with ongoing changes within the labor market.

The potential penalties of financial coverage on the financial system are a big consideration.

Past these factors, there may be unlikely to be any substantial deviation from the standard rhetoric.

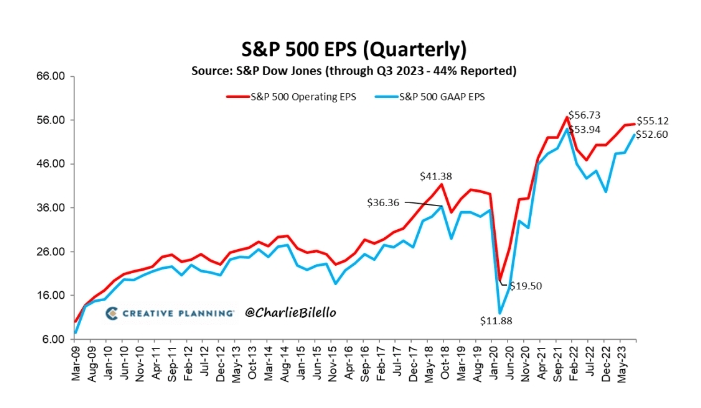

S&P 500 EPS Development Stays Optimistic

In the meantime, round 44% of the businesses listed on the have launched their earnings experiences.

It seems that the development is affirming a optimistic route and that the previous quarter marked the low level, indicating that, to this point, U.S. corporations are sustaining their resilience successfully.

Supply: Charlie Bilello

As for Treasury yields, after reaching new highs, they look like retracing, with the yield properly under 5 p.c and the yield barely above, however solely marginally so.

All eyes will stay on Powell’s phrases, making immediately an intriguing day for the markets.

***

Apple Earnings: What to Count on?

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counseling or advice to speculate as such it isn’t meant to incentivize the acquisition of property in any approach. I wish to remind you that any kind of property, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related threat stays with the investor.”

[ad_2]

Source link