[ad_1]

Within the dynamic world of markets, entry to the most effective info is paramount for knowledgeable funding selections.

InvestingPro, the skilled device from Investing.com, supplies a various vary of value-added info essential for successfully managing our portfolios.

Among the many choices supplied by InvestingPro, the ‘Information Explorer’ part stands out, which shows monetary info on firms in response to all kinds of metrics.

InvestingPro Information Explorer

Supply: InvestingPro

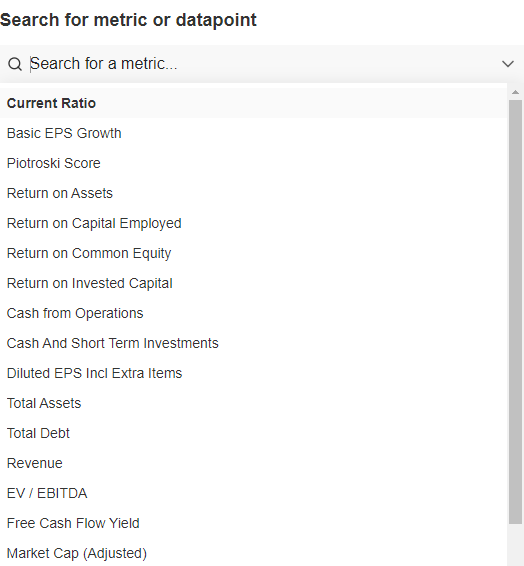

It presents a search engine with a number of choices. These embody solvency ratio, primary EPS (earnings per share) progress, Piotroski rating, return on property, return on capital employed, return on frequent fairness, income, and so forth.

Seek for Information Level

Supply: InvestingPro

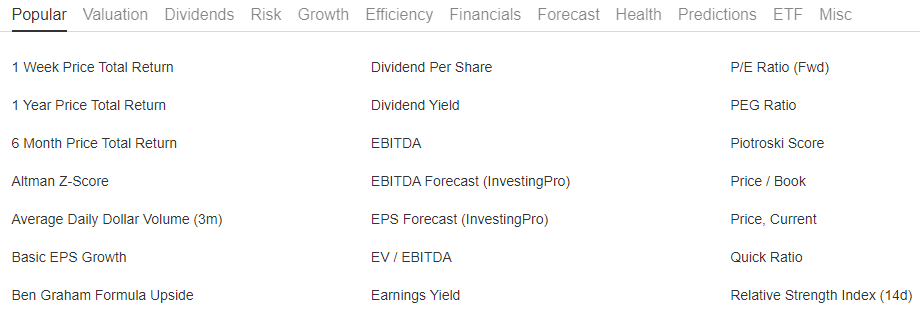

The information explorer additionally presents info in response to the choices that could be most helpful to the investor: Most Standard, Valuation, Dividend, Threat, Development, Effectivity, Elementary, Forecast, Standing, Predictions, or ETF, amongst others.

Supply: InvestingPro

In every class, InvestingPro presents metrics sorted in alphabetical order.

The ‘hottest’ monetary metrics are:

1-week complete value return: complete value change (adjusted for dividends and splits the place relevant) during the last 1 week.

1-year complete value return: Complete value change (adjusted for dividends and splits the place relevant) during the last 1 yr.

6-month complete value return: Complete value change (adjusted for dividends and splits the place relevant) during the last 6 months.

Altman Z-Rating: Method used to foretell the chance of an organization going out of enterprise inside 2 years.

Common every day greenback quantity (3m): Three-month common of shares traded every day multiplied by the share value.

Fundamental EPS progress: Development in primary EPS for 1 / 4 versus the earlier quarter.

Ben Graham Method Increment: Share upside (if optimistic) or draw back (if destructive) an investor can count on relative to the present inventory value based mostly on the Ben Graham system worth. The Ben Graham system worth estimates the intrinsic worth of a inventory based mostly on a system impressed by investor and professor Benjamin Graham.

Supply: InvestingPro

Below the ‘Valuation’ tab, yow will discover greater than 170 metrics. Amongst them, the next stand out:

Age of quoted value: Signifies the size of time because the final quote. The worth is without doubt one of the following: delayed, real-time, end-of-day, or unavailable.

EV/EBITDA ratio: Approach used to measure the extent of EBITDA progress in relation to the EV/EBITDA a number of.

Share turnover ratio: This merchandise represents the three-month common quantity divided by an organization’s excellent shares.

Supply: InvestingPro

On this evaluation, now we have mentioned all of the metrics out there in 2 tabs, however there are nonetheless 10 different tabs that provide complete details about the inventory in query.

In a unstable market the place strategic selections can considerably impression our portfolio, possessing probably the most correct market info turns into indispensable.

Using InvestingPro’s knowledge explorer ensures direct entry to market knowledge that may improve your portfolio’s efficiency.

Learn additionally:

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Worth This Black Friday!

Well timed insights and knowledgeable selections are the keys to maximizing revenue potential. This Black Friday, make the neatest funding choice out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this provide is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation or advice to take a position as such and is by no means supposed to encourage the acquisition of property. I wish to remind you that any asset class is evaluated from a number of factors of view and is very dangerous. Due to this fact, any funding choice and the related threat stays with the investor.

[ad_2]

Source link