[ad_1]

Investor sentiment stays bullish (44.3%) and stays above its historic common (37.5%) for one more week.

Whereas Nvidia is hovering, different shares might register greater features this 12 months.

On this piece, we’ll check out these shares and in addition how one can put money into the magnificent 7 by way of varied funds.

Investing within the inventory market? Make the most of our InvestingPro reductions. Extra info on the finish of this text.

The expertise sector has been a key driver of the ‘s power, led by the Magnificent 7.

Nvidia (NASDAQ:) has stood out among the many Magnificent 7, not simply as the most important gainer, but in addition by way of the extensive margin by which it beat different main shares’ efficiency.

In spite of everything seven corporations offered outcomes, the comparability is placing.

The opposite six shares noticed a median income enhance of +15% (Apple (NASDAQ:) +2%, Meta (NASDAQ:) +25%), whereas Nvidia boasted a powerful +265%.

Will the chipmaker proceed to submit staggering features? Solely time will inform. Nevertheless, as buyers, we should always maintain a watch out for various shares that might carry out even higher this 12 months.

Whereas Nvidia has stolen all of the headlines, over the previous 4 years, some shares have outperformed even Nvidia’s +963% development since February 19, 2020.

Examples embrace Celsius (NASDAQ:) (+3,030%), Antero Sources (NYSE:) (+1,232%), Vary Sources (NYSE:) (+871%), Builders FirstSource (NYSE:) (+557%), Shockwave Medical (NASDAQ:) (+514%), and EQT (NYSE:) (+509%).

Moreover, Superior Micro Gadgets (NASDAQ:), not a part of the Magnificent 7 however noteworthy, has climbed to the twenty fifth place within the S&P 500 and the tenth spot on the .

Wanting on the earnings development expectations for 2024, solely a choose group of corporations is projected to outpace Nvidia:

Allstate (NYSE:): An insurance coverage firm with an anticipated EPS enhance of +1211%.

Merck & Firm (NYSE:): A pharmaceutical and chemical large forecasting a +466% development, pushed by medication like Keytruda.

Stanley Black & Decker (NYSE:) (+184.6%)

Estee Lauder (NYSE:) (+125.9%)

Tyson Meals (NYSE:) (+125.1%)

Paramount World (NASDAQ:) (+115.3%)

Eli Lilly and Firm (NYSE:) (+98%)

Targa Sources (NYSE:) (+82.3%).

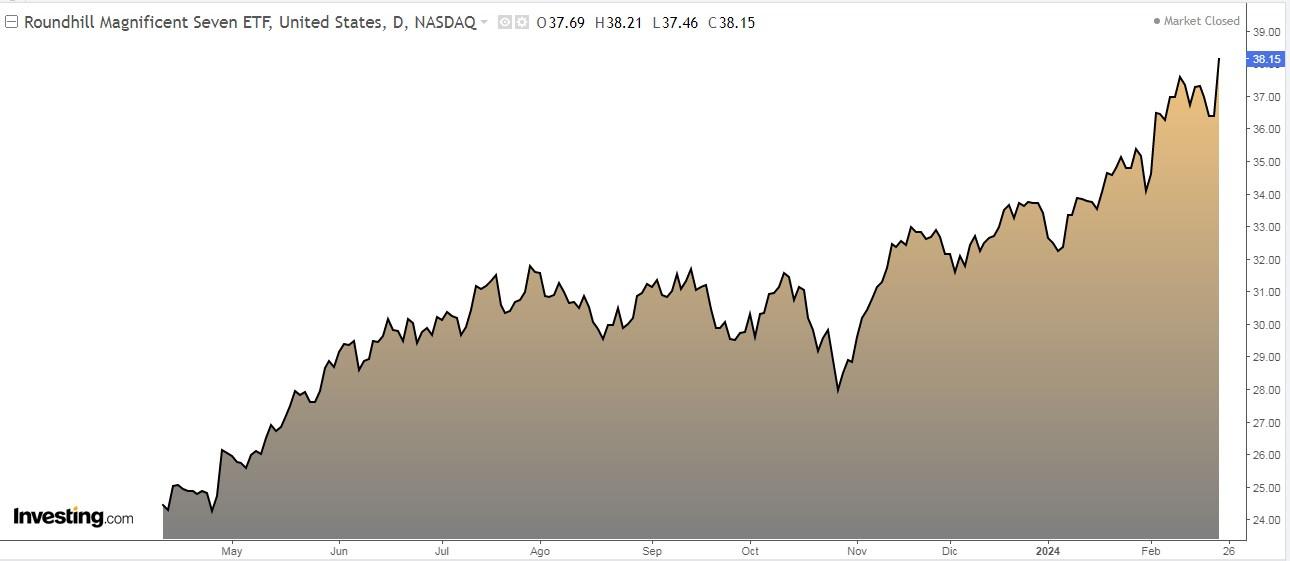

Ought to You Take into account Investing in This ETF to Acquire Publicity to the Magnificent 7?

The Roundhill Magnificent Seven ETF (NASDAQ:) supplies publicity to the Magnificent Seven shares.

It began buying and selling on April 11, 2023, underneath the title Roundhill BIG Tech (BIGT) and was later renamed Roundhill Magnificent Seven on November 9, 2023.

It has 4 benefits:

Accuracy: it lets you be invested in these shares and benefit from their actions.

Simplicity: it’s a lot simpler to take a position on this ETF than having to purchase shares of the 7 corporations.

Prices: it’s cheaper with its 0.29% annual fee than having to pay the acquisition commissions of all of the shares.

Adaptation: it’s rebalanced to have the identical weight each quarter, which ensures fixed publicity to the Magnificent 7.

The publicity as of immediately is as follows:

Nvidia 20.03%.

Goal 17.12%.

Amazon (NASDAQ:) 14.35

Microsoft (NASDAQ:) 13.87% Alphabet (NASDAQ:) 12.93

Alphabet 12.93

Apple 12.03% Tesla (NASDAQ:)

Tesla 9.52

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that inventory costs will rise over the subsequent six months, elevated 2.1 share factors to 44.3% and stays above its historic common of 37.5%.

Bearish sentiment, i.e., expectations that inventory costs will fall over the subsequent six months is at 26.2%, beneath its historic common of 31%.

Rating of the principle inventory exchanges in 2024

Japanese +17.24%.

+7,77%

Italian +7.74%

+6.87%

+6.74%

+5.61%

+4.03%

+3.99%

Spanish +0.28%

British -0.35%

Chinese language -1.89

***

Do you put money into the inventory market? Arrange your most worthwhile portfolio HERE with InvestingPro!

Apply low cost code INVESTINGPRO1 and you will get an instantaneous 10% low cost whenever you subscribe to the Professional or Professional+ annual or two-year plan. Together with it, you’ll get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: Digestible info to simplify a variety of complicated monetary information into a couple of phrases.

Superior Inventory Finder: Seek for one of the best shares primarily based in your expectations, considering lots of of economic metrics.

Historic monetary information for hundreds of shares: In order that basic evaluation professionals can delve into all the small print themselves.

And lots of different companies we plan so as to add quickly.

Subscribe At present!

Act quick and be part of the funding revolution – get your supply HERE!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link