[ad_1]

monsitj

Funding Thesis

Fortune Manufacturers Improvements, Inc.’s (NYSE:FBIN) inventory is up barely since my earlier purchase score in September. The top-market outlook has meaningfully improved since then and, with lower-than-expected inflation, analysts have began betting on a fee minimize as quickly as the center of subsequent yr. The enhancing end-market demand given moderating inflation and potential restoration in single-family housing ought to profit the corporate’s income in 2024. Additional, the corporate’s gross sales must also profit from retail stock destocking coming to an finish, energy within the Related product enterprise, new product improvements, and market share positive factors.

On the margin entrance, the corporate ought to be capable of develop margins with the assistance of working leverage from gross sales development, a good value setting, and cost-saving initiatives. The valuation can also be cheap. Therefore, I proceed to have a purchase score on the inventory.

Income Evaluation and Outlook

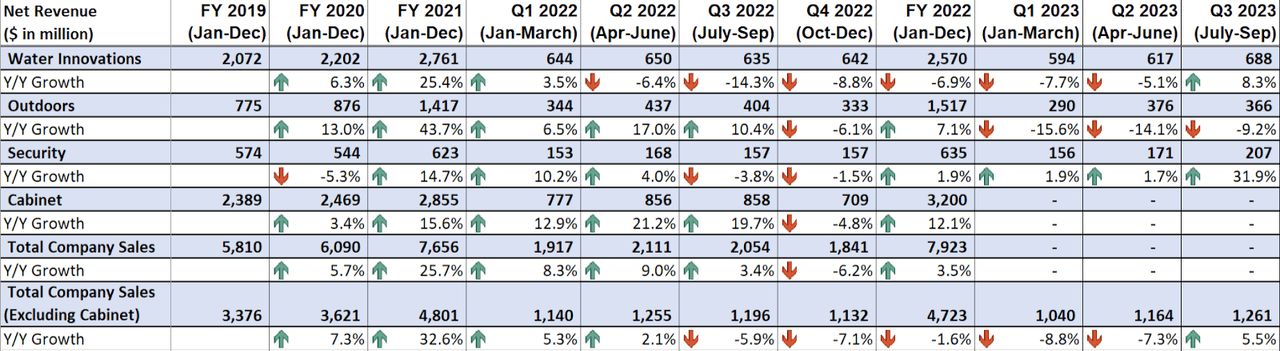

After going through challenges from stock destocking over the previous yr, Fortune Manufacturers’ income development has began to see sequential enchancment in its gross sales development within the final couple of quarters due to the normalization of stock destocking and simpler comps. Within the third quarter of 2023, along with the normalization of retail stock destocking, good contributions from the corporate’s current acquisition of Emtek and Schaub Enterprise, Yale and August Enterprise, and Aqualisa Holdings additionally benefited the income development within the quarter. Furthermore, value will increase additionally helped the corporate in partially offsetting quantity decline because of softness in end-markets given the inflationary setting. This resulted in a 5% YoY improve in gross sales to $1.26 billion. Excluding the good thing about $119.3 million or ~9% from acquisitions, natural income declined 4% YoY. The natural income declines mirror a mid-single-digit quantity decline which greater than offset the low single-digit profit from value will increase.

FBIN Revenues (Firm Knowledge, GS Analytics Analysis)

Wanting ahead, I’m optimistic in regards to the firm’s income development prospects.

With inflation trending in the best path and the talks of a possible reversal within the rate of interest cycle in mid-2024, I count on 2024 to be a significantly better yr for the corporate.

On the restore and rework (R&R) aspect, the corporate started experiencing stock destocking within the latter half of 2022, a pattern that persevered till mid-2023. This resulted within the firm witnessing decrease income in comparison with the precise point-of-sales (POS) demand throughout this era. With stock destocking now full, the corporate’s gross sales ought to see enchancment. Even within the absence of a considerable enchancment in POS demand, simply the corporate’s gross sales aligning with POS demand ought to contribute to year-over-year (YoY) development.

Additionally, I count on the broader macroeconomic setting to enhance transferring ahead with inflationary headwinds diminishing which ought to assist enhance client confidence and improve POS demand. Additional, after the divestiture of its Cupboards enterprise, FBIN’s present R&R portfolio consists of principally smaller ticket gadgets, and normally, spending on smaller ticket gadgets sees a a lot faster restoration in comparison with the big ticket gadgets when the economic system improves. So, the corporate is well-positioned going into 2024.

The long-term underlying demand drivers within the R&R market are additionally stable with excessive residence fairness ranges because of appreciation in housing costs post-COVID and the rising median age of properties within the U.S. which ought to assist the R&R market within the medium to long run.

The basics of the single-family housing market are additionally stable and this market has held up higher than anticipated regardless of mortgage charges at multiyear highs. This may be attributed to the numerous underbuilding of latest properties after the nice housing recession of 2008 which has resulted in a decent demand-supply scenario out there. Due to pent-up demand on this market, I count on it to submit a fast restoration as soon as the rate of interest cycle begins reversing. The corporate additionally faces simpler comparisons on this market subsequent yr which ought to assist Y/Y development.

Along with end-market enchancment, the corporate ought to profit from good execution and concentrate on product improvements which helps it acquire market share and outperform the end-markets. instance of it’s the firm’s related product choices the place it noticed gross sales tripping from FY20 to FY22 regardless of the disruptions within the chip provide which restricted the corporate to succeed in its full gross sales potential. Together with current Yale and August acquisitions, the corporate’s related merchandise gross sales have reached ~$250 million with 4.5 million activations for its related merchandise. The corporate expects related merchandise to be a major development driver within the coming years and is specializing in scaling and introducing new merchandise in classes like Sensible residential locks, Grasp Lock related entry for enterprise, and Moen’s Sensible Water Community. On its final earnings name, speaking in regards to the potential alternative within the sensible water enterprise, the corporate’s CEO Nicholas Fink stated:

I imply whenever you have a look at the Sensible Water alternative from a variety of completely different lenses, it’s fairly staggering, proper? Simply to start out with simply the pure — how a lot preventable water harm is there in the present day. We predict that is $15 billion of claims a yr. It is better than Fireplace and Housebreaking mixed, proper, so $15 billion of preventable water harm. I truly consider we’ll develop that addressable market as a result of we’ll provide you with extra merchandise that may tackle extra varieties of preventable water harm. We will take that just about to zero. I imply we did a research with LexisNexis in 10,000 properties. We decreased 96% of the claims to zero, and the opposite 4% of claims, I consider, we decreased by over 70%. So just about going to zero.

There’s an ESG lens to it, proper? Along with saving, we expect probably trillions of gallons of water, there’s an enormous vitality part to processing and cleansing water. And so you’re taking Mission Moen, which is absolutely based mostly on what we’ve out there in the present day, our dedication to save lots of 1 trillion gallons by 2030, that in response to the mathematics obtainable on the EPA web site, so equal to us taking a million vehicles off the street for a yr, proper? And so you can begin to see (inaudible) municipalities, proper? It has an enormous greenback worth impression. And so the chance is big”

I consider a restoration in the long run market coupled with the corporate’s above-market development alternative via innovating and scaling related merchandise ought to assist it ship good development within the coming years.

Margin Evaluation and Outlook

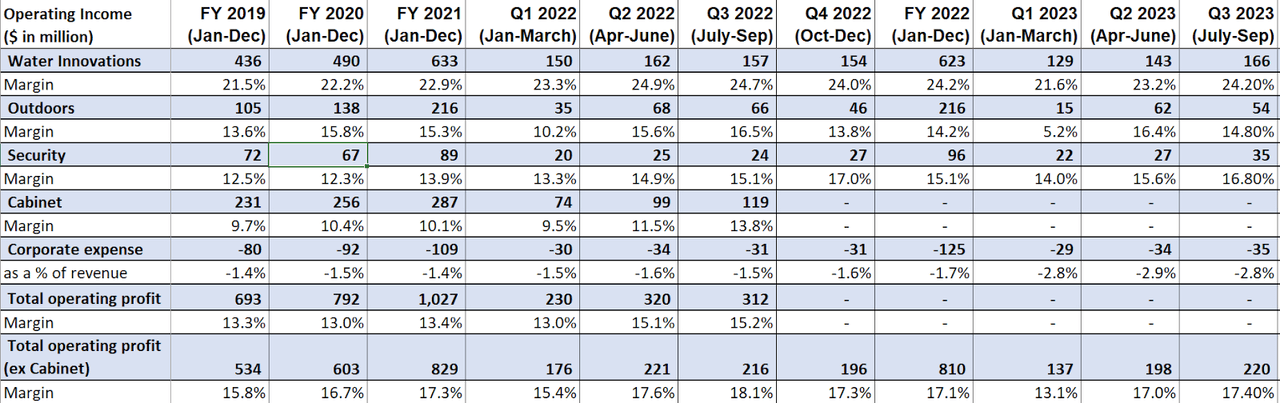

Within the third quarter of 2023, the corporate’s margins continued to face headwinds from gross sales deleveraging because of quantity decline. The corporate was capable of partially offset it via value will increase, cost-saving initiatives, and deflation in enter prices. This resulted in a 70 bps YoY decline in adjusted working margin to 17.4%.

On a phase foundation, the Water improvements phase adjusted working margin declined 50 bps YoY because of quantity deleveraging partially offset by cost-saving measures. The outside phase’s working margin declined by 170 bps YoY because of decrease volumes leading to gross sales deleveraging. Nevertheless, the Safety phase was capable of improve its working margin by 170 bps YoY because of value will increase, high-margin product combine, and working leverage from larger gross sales.

FBIN Working Margins (Firm Knowledge, GS Analytics Analysis)

Wanting ahead, the corporate’s margins ought to profit from working leverage from gross sales restoration as finish markets enhance. On its earnings name in October, administration talked about seeing a path to margin enchancment even when the tip market is right down to low single digits in 2024. The top-market scenario has improved since then as inflation information reported in November was higher than anticipated and this led to an elevated likelihood of fee cuts subsequent yr. With my expectations of end-market development subsequent yr, I consider the corporate can submit good margin enchancment subsequent yr. The medium to long-term outlook can also be good with administration focusing on 300-500 bps working margin enchancment via initiatives like productiveness enchancment, near-shoring, website consolidation, and many others. So, I’m optimistic in regards to the firm’s close to to medium-term margin development prospects.

Valuation and Conclusion

Fortune Manufacturers is at the moment buying and selling at ~17.54x FY24 consensus EPS estimate of $4.19 and 15.06x FY25 consensus EPS estimate of $4.87. During the last 5 years, the inventory has traded at a mean ahead P/E of 15.89x. Nevertheless, one wants to notice that the corporate spun off its low-margin and extra cyclical Cupboard phase late final yr, and the remaining firm has higher-margin and extra steady companies. Therefore, I consider FBIN’s valuation multiples deserve a re-rating in comparison with its 5-year common. I consider the inventory can proceed to commerce at a ahead P/E within the excessive teen vary. If we apply a 18x P/E a number of to the FY25 consensus EPS estimate of $4.87, we get a one-year ahead goal value of ~$87 which means ~19% upside over the subsequent yr.

I consider the corporate has good development potential over the approaching years. The income outlook appears favorable due to the completion of stock destocking and a extra aligned gross sales development with POS demand, enhancing finish markets, energy within the related merchandise enterprise, and product improvements and market share positive factors. As well as, margins must also develop with the assistance of working leverage from gross sales restoration. Therefore, given the great development prospects and cheap valuation, I fee the inventory a purchase.

[ad_2]

Source link