[ad_1]

Delmaine Donson

Reaffirming The Funding Thesis

In my earlier and first article about Franklin Covey (NYSE:FC), I mentioned why I used to be bullish on the corporate. Since then the inventory has underperformed the S&P 500 by roughly 8% and the corporate reported earnings twice. Earlier than we dive into the quarterly outcomes, let me first reaffirm my purchase thesis.

FC’s new service AAP, has reworked the enterprise from a transactions base to SaaS. This has considerably improved margins and enabled predictable money circulate. The agency has additionally considerably deleveraged its stability sheet and began returning money to shareholders. Moreover, I am inspired by the improved money circulate technology and AAP’s subscription development within the current quarter.

Latest Quarterly earnings

Since my final article, FC has reported earnings twice, on November 1, 2023, and January 4, 2024. At this time, I can be discussing the latest quarterly outcomes. The primary quarter of fiscal yr 2024. Let’s dive in.

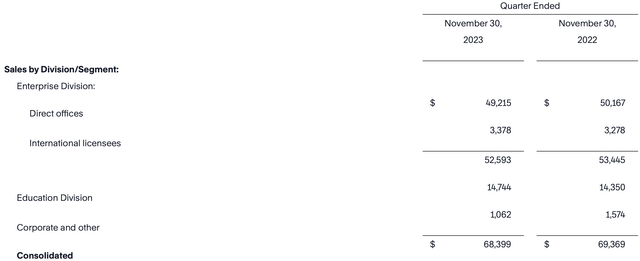

FC reported a comparatively modest lower in internet gross sales, with a 1.40% change from the prior yr, which could frustrate some traders, however not essentially as a result of the corporate’s flagship service gross sales (“AAP”) elevated by 13% year-over-year; the one purpose there was a decline within the direct workplace section regardless of development in AAP gross sales is as a result of lower in add-on providers income.

Q1-FY24 Press launch

In relation to SaaS firms, one has to take a look at deferred income to get an concept of future development. On the finish of November thirtieth, FC’s deferred income totaled $103.3 million, up by $12.9 million from the earlier yr. The corporate additionally famous in its convention name that bill subscription income is rising. A big portion of the corporate’s income is derived from subscriptions. That is what the CEO (Paul Walker) needed to say:

Second is that our bill subscription income is rising. After flattish All Entry Move invoiced subscription development within the second and third quarters final yr

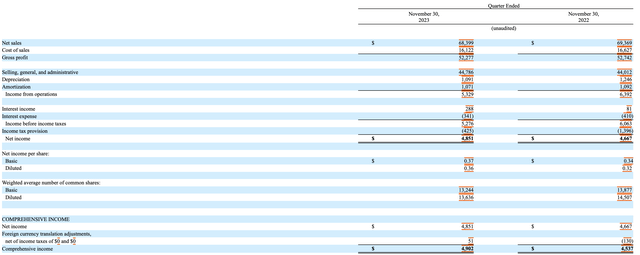

Gross margin improved by 40 bps resulting from decrease gross sales and the price of items bought. Regardless of this working margin diminishing year-over-year resulting from a rise in SG&A, the rise was resulting from $0.6 million of severance prices associated to restructuring exercise and $0.2 million of elevated non-cash stock-based compensation expense.

10Q

Money circulate from working skilled an enormous increase of $14.4 million from the earlier yr resulting from favorable modifications in working capital, equivalent to a lower in accounts receivables (money collected) and accounts payables. The corporate bought 408,596 shares for $16.3 million and repaid $2.1 million of debt. The shopper retention price additionally remained excessive, above 90%. FC guided for an adjusted EBITDA of $54.5 million and $58.0 million, in contrast with the $48.1 million of adjusted EBITDA achieved in fiscal 2023.

All in all, I consider the agency began its fiscal yr sturdy with a stable first quarter efficiency, beating high and backside line estimates, and allocating capital in a means from which shareholders can profit, equivalent to by means of buybacks, debt discount, and tuck-in M&A. Mr. Walker talked about present initiatives with clients that sounded promising; that is what he needed to say:

The primary is we’re working with the CEO of a big and quickly rising manufacturing firm to develop their high 500 international leaders…The second instance is the place we’re partnering with the Chief Human Useful resource Officer of a big 100,000-person agency to deploy a number of Franklin Covey options throughout your complete group…

To me, this, mixed with a rise in deferred income, emphasizes that there’s nonetheless demand for FC’s merchandise within the company world regardless of the extraordinary competitors and harsh financial circumstances.

Valuation

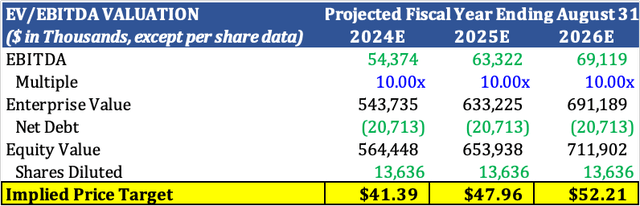

For this evaluation, I made a decision to worth FC utilizing a unique method, the EV/EBITDA technique. I utilized at a 10x a number of, which is in keeping with the FWD a number of, however at a reduction to TTM. For 2025, I estimate an ADJ EBITDA of $63 million, which is beneath administration’s steering of $66 million.

created by the creator

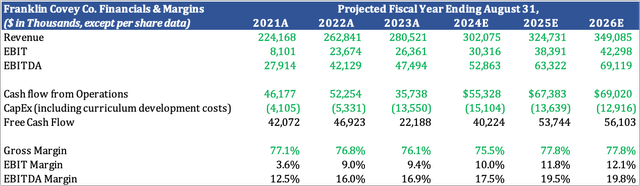

I arrived at an implied value goal of $47.96, which interprets right into a 17% return from the worth of this writing ($40.35). I mannequin a 22.2% margin for COGS and 62.8% for SG&A. I anticipate the corporate to proceed benefiting from economies of scale, which signifies that as income will increase, prices as a share of income will lower.

As you’ll be able to see beneath, I anticipate free money circulate to virtually double in 2024 as a result of favorable change in working capital the corporate skilled within the current quarter. FC spent roughly $9 million on curriculum improvement prices in 2023 and is guiding for $6–$8 million in 2024. These investments, mixed with market development and penetration, are my largest top-line contributors.

Created by the creator

Funding Dangers

As I discussed in my final article, I consider the largest threat going through FC is competitors. The business through which FC operates is extremely fragmented; this will function a double-edged supply. On one hand, it leaves FC (a big participant) with a whole lot of room for enlargement, however however, it might make it laborious for FC to draw future shoppers. The opposite draw back is that companies are slicing spending and never enrolling as many staff in coaching applications. This may be resulting from excessive rates of interest or recessionary environments.

Conclusion

To sum all of it up, Regardless of the inventory underperforming the market since my preliminary protection, the basics and financials of the corporate stay sturdy, underpinned by stable subscription development, money circulate technology, and debt discount. In the latest quarterly outcomes, the agency beat bottom-line estimates by double digits regardless of gradual income development, which led to a small rally within the inventory.

Until subsequent time.

[ad_2]

Source link