[ad_1]

peterschreiber.media

Funding Thesis

I final coated Franklin Electrical Co., Inc. (NASDAQ:FELE) in early October with a impartial score. Whereas the inventory is up in sync with the broader market since then, I proceed to want remaining on the sidelines. The corporate’s income progress faces near-term headwinds from a declining backlog and stock destocking at its clients. As well as, the corporate’s Water Methods and Fueling Methods companies are seeing initiatives deferral from shoppers resulting from excessive rates of interest which ought to proceed to influence income progress over the following few quarters. Whereas a possible reversal within the rate of interest cycle and simpler Y/Y comparisons are anticipated to assist the corporate’s income progress within the again half of subsequent 12 months and past, there are considerations in regards to the long-term decline within the firm’s conventional gasoline station gross sales within the Fuelling Methods phase gross sales resulting from EV adoption. The corporate is providing some EV-related merchandise however there’s not a lot readability on the extent to which the corporate’s new and comparatively small EV-related gross sales can offset the decline in its conventional fueling techniques product traces.

On the margin entrance, the advantages from the corporate’s cost-control efforts and declining commodity prices ought to assist the margins. Nonetheless, the unfavorable combine resulting from decrease gross sales within the high-margin Fueling Methods phase ought to proceed to negatively influence margin progress.

So, regardless of FELE inventory buying and selling at a reduction to its historic averages, the unfavorable progress prospects hold me on the sidelines and I’ve a impartial score.

Income Evaluation and Outlook

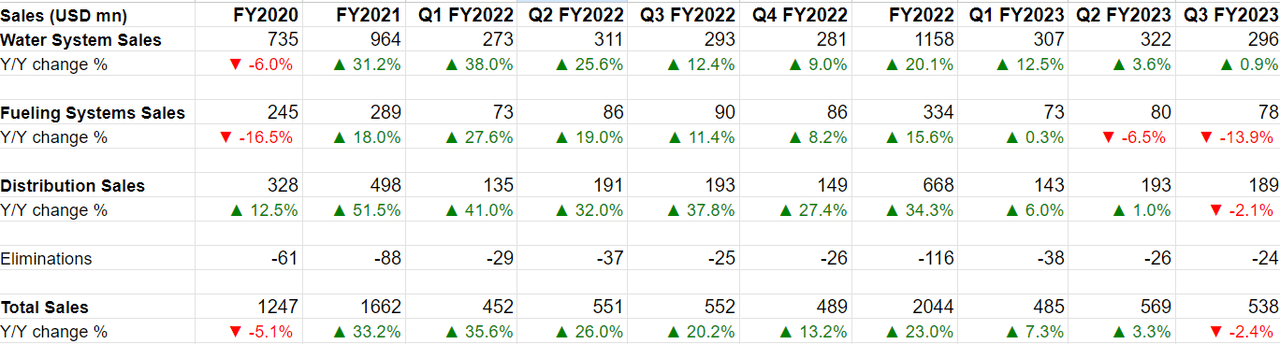

After experiencing double-digit progress in FY21 and FY22 benefitting from robust end-market demand, value will increase, and strategic acquisitions, FELE witnessed a slowdown in gross sales progress as FY23 progressed and the corporate’s gross sales turned detrimental within the final quarter.

Within the third quarter of 2023, the corporate’s gross sales declined 2.4% Y/Y to $538 million resulting from decrease volumes and a 2% influence from unfavorable FX translation which greater than offset the advantages from greater value realization. Within the Water Methods phase, gross sales grew 0.9% Y/Y led by continued robust end-market demand for big dewatering pumps, primarily within the U.S., and elevated gross sales within the Latin America and EMEA areas. This was partially offset by a decline in gross sales of groundwater gear introduced on by channel stock destocking and moist climate situations throughout the U.S.

Within the Fueling Methods phase, gross sales declined 13.9% Y/Y as a result of detrimental influence of continued channel stock destocking, market delays in new station construct initiatives, and divestiture of the above-ground storage tank enterprise in 2022. The Distribution phase’s gross sales declined 2.1% Y/Y attributable to decrease pricing on commodity-based merchandise offered via the enterprise and continued wetter-than-expected climate delaying contractor installations throughout a lot of the U.S.

FELE’s Historic Income Development (Firm Information, GS Analytics Analysis)

Wanting forward, I anticipate a difficult interval for the corporate within the subsequent few quarters.

Whereas the corporate has benefited from elevated backlog ranges in latest quarters, facilitating gross sales, the backlog is swiftly returning to normalized ranges. Sequentially, the corporate’s backlog was $44 million decrease on the finish of Q3 in comparison with Q2. I count on the corporate’s backlog to additional lower by the top of This fall, and the corporate getting into subsequent 12 months with a decrease backlog does not bode properly for gross sales.

The corporate’s gross sales grew 7.3% Y/Y in Q1 FY23 on high of 35.6% Y/Y progress in Q1 FY 22. I imagine excessive backlog ranges on the finish of the earlier 12 months performed a job in robust Q1 FY23 progress. The Y/Y progress then sequentially decreased because the 12 months progressed with backlog ranges persevering with to say no. As the corporate laps the advantages from greater backlog conversion within the final 12 months, I count on progress to be detrimental no less than within the first half of the following 12 months.

The tip market situations are additionally difficult with the corporate persevering with to see stock destocking within the close to time period and its venture enterprise, each within the water in addition to fueling facet, seeing deferral from shoppers resulting from excessive rates of interest. The Grid Answer enterprise on the Fueling facet is seeing an excellent demand as EV adoption tailwinds proceed to profit it. Nonetheless, this can be a comparatively new and smaller portion of the corporate’s enterprise and a lot of the Fueling phase is tied to conventional gasoline stations the place there’s a long-term menace from secular decline.

There are some positives although. With a possible reversal within the rate of interest cycle by mid-2024, a few of the deferred initiatives could get began because the return on funding turns into extra enticing. The comparisons are additionally getting simpler within the again half of FY24.

So, the expansion outlook of the corporate is combined with the primary half of FY24 anticipated to be difficult and a few enchancment anticipated within the again half.

Margin Evaluation and Outlook

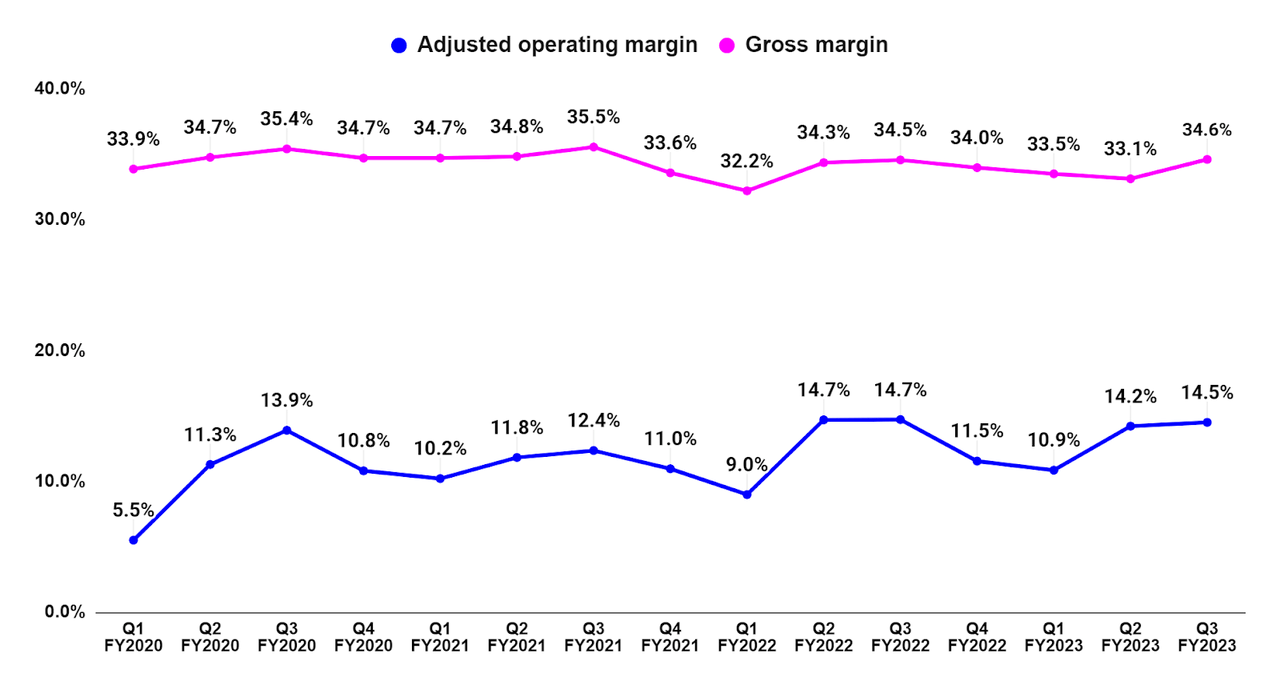

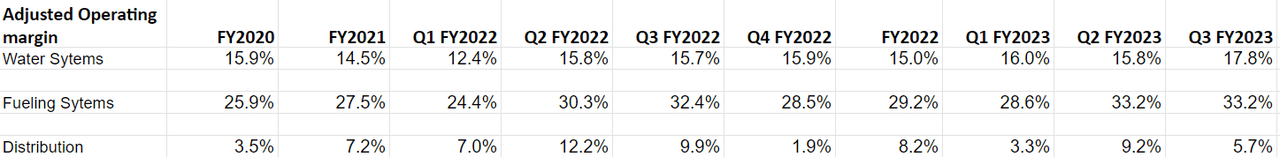

In Q3 2023, the corporate’s gross margin benefitted from greater value realization, favorable product combine, and decrease freight prices within the Water Methods and Fueling Methods segments which offset the influence of margin compression from unfavorable pricing of commodity-based merchandise offered via the Distribution phase. This resulted in a ten bps Y/Y improve in gross margin to 34.6%. Nonetheless, the adjusted working margin declined 20 bps Y/Y to 14.5% because the decline within the high-margin Fueling Methods phase revenues negatively impacted the combo.

On a phase foundation, the Water Methods and the Fueling Methods segments adjusted working margin improved by 210 bps Y/Y and 80 bps Y/Y, respectively. However, the Distribution phase’s adjusted working margin contracted by 420 bps Y/Y resulting from decrease gross sales and unfavorable pricing of commodity-based merchandise offered via the enterprise.

FELE’s Adjusted Working margin and Gross margin (Firm Information, GS Analytics Analysis) FELE’s Phase Smart Adjusted Working Margin (Firm Information, GS Analytics Analysis)

Wanting ahead, the corporate’s margin outlook is combined. The corporate is executing properly when it comes to price management and a few of the commodity prices are declining, serving to margins. Nonetheless, the outlook for progress in Fueling Methods (which is a high-margin enterprise) stays difficult resulting from near-term venture deferrals and long-term headwinds to conventional gasoline stations (the place nearly all of this enterprise is) from rising EV adoption.

The Fueling Methods phase’s working margins are nearly double that of the Water Methods phase and 4 occasions that of the Distribution enterprise. So, the difficult progress outlook for Fueling Methods will proceed to negatively influence the margin combine.

Valuation and Conclusion

FELE is at present buying and selling at a 22.09x FY24 consensus EPS estimate of $4.38, which is at a reduction versus the Firm’s 5-year common ahead P/E of 24.81x.

Whereas the valuation is decrease than historic, I imagine the decrease valuation is justified given the near-term challenges with headwinds from the declining backlog, stock destocking, and venture deferrals impacting the near-term income progress and the long-term progress challenges within the high-margin Fueling Methods phase with rising EV adoption. So, I imagine it might be higher to attend on the sidelines until the backlog/order developments begin bottoming and there’s some visibility on the extent to which the corporate’s EV-related enterprise can offset the secular decline in legacy gas techniques enterprise in the long run. For now, I’ve a impartial score on the FELE inventory.

[ad_2]

Source link