[ad_1]

fcafotodigital

Funding thesis

Our present funding thesis is:

FDP is a reasonably enticing funding, even when we’re hesitant to advocate foodservice companies because of their gentle progress. The corporate has a extremely aggressive worth proposition, underpinned by its scale and model. The hot button is that the inventory is sort of significantly undervalued, notably towards its historic common stage. Its near-term outcomes and relative efficiency depart some trigger for concern, however that is compensated for in its valuation.

Firm description

Recent Del Monte Produce (NYSE:FDP) is a world producer, marketer, and distributor of high-quality, contemporary, and value-added meals merchandise. The corporate primarily focuses on contemporary fruits, greens, and ready meals. With operations spanning North America, Europe, Asia, and the Center East, Recent Del Monte is a outstanding participant within the international contemporary produce business.

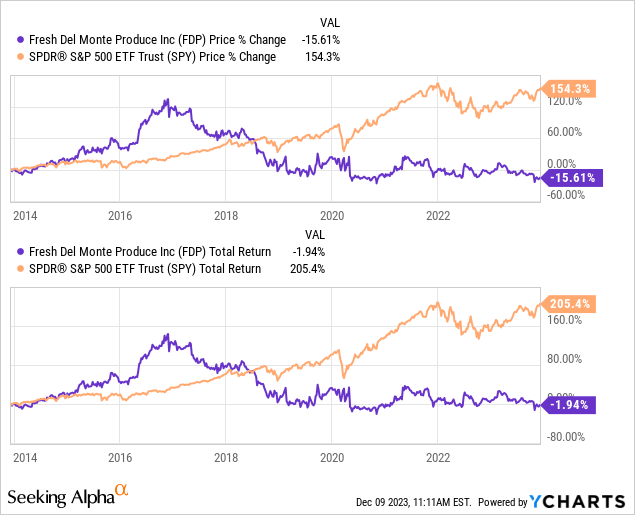

Share value

FDP’s share value efficiency has been poor, dropping over 15% of its worth over the past decade and broadly heading in a downward trajectory. It is a reflection of the difficulties working inside this business and its valuation evolution.

Monetary evaluation

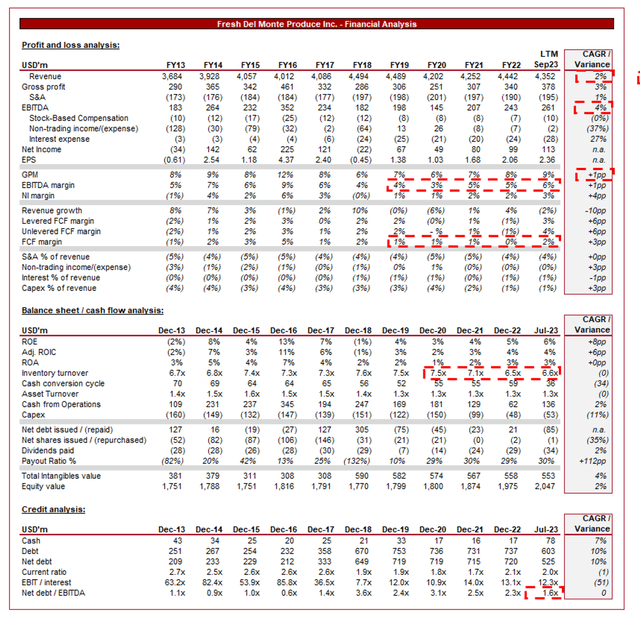

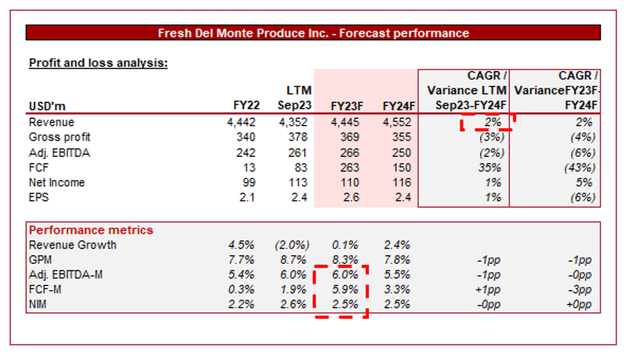

FDP financials (Capital IQ)

Offered above are FDP’s monetary outcomes.

Income & Industrial Elements

FDP’s income has grown mildly over the past decade, with a CAGR of +2% into the LTM interval. Development has been constantly low, with solely a single interval of double-digit positive factors and three fiscal years of adverse progress.

Enterprise Mannequin

FDP controls each step of the manufacturing course of, from farming and processing to packaging and distribution. This vertical integration permits it to keep up high quality requirements and reply to altering ranges of demand globally.

The corporate presents a variety of merchandise, together with contemporary fruits (pineapples, bananas, melons, and so forth.), greens, ready meals, and drinks. Diversification helps mitigate dangers related to fluctuations in particular product markets and provide. The character of those merchandise limits FDP’s scope for important worth enhancement, impacting profitability (EBITDA-M of ~6% and restricted enchancment) and progress (+2% CAGR). This mentioned the enterprise sells client meals staples, permitting for constant demand for items consistent with inhabitants progress and financial growth.

FDP is branching out the place doable, reminiscent of with its partnership with Kraft Heinz (KHC), however such actions don’t transfer the needle in comparison with its core contemporary produce providing.

Kraft partnership (FDP)

FDP’s key promoting level is its well-known and trusted model. Its means to ship contemporary and high-quality merchandise at scale has constructed sturdy model recognition. Customers know they’re getting high-quality merchandise and companies can belief FDP to supply flexibly. This has allowed the corporate to broadly keep its upward progress trajectory regardless of scale.

The contemporary meals market, particularly vegatables and fruits, is saturated. With many rivals providing comparable merchandise, that are “commoditized” in nature, differentiation turns into difficult, main to cost wars and decreased revenue margins. This basically makes the business fairly unattractive and is a major cause why we’ve been important of foodservice companies prior to now as investments.

Margins

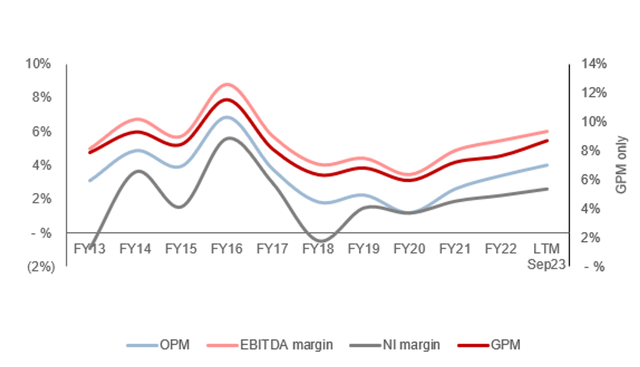

Margins (Capital IQ)

FDP’s margins have seen some volatility during the last decade, pushed by business growth from globalization and elevated competitors (EBITDA-M peaked at 9% and had a low of three%). Execution of operational enhancements has been minimal, which is comparatively disappointing given the technological developments we’ve seen in provide chains throughout various industries. It’s doubtless a lot of that is offset by competitors.

The corporate has seen an upward trajectory in recent times by means of pricing energy, which we suspect will start to subside (mentioned additional subsequent). This mentioned, we do imagine the enterprise can normalize at its current stage, which is barely forward of its historic common.

Quarterly outcomes

FDP’s current efficiency has materially slowed relative to its 3Y stage, with top-line income progress of +2.2%, (0.7)%, (2.6)%, and (4.8)% in its final 4 quarters (Supply: Capital IQ). Along side this, margins have barely stepped up, though look like normalizing.

The corporate’s declining progress is a mirrored image of the broader macroeconomic atmosphere. With elevated inflation and rates of interest, companies have initiated constant value will increase to offset provide chain points, permitting for an accelerated top-line trajectory. That is unsustainable, nonetheless. With customers considerably squeezed from a cost-of-living perspective, demand is starting to waver. This has initially impacted discretionary industries however will not be spreading to areas of inelastic demand, with quantity starting to wholly offset value positive factors.

Trying forward, we imagine there may be extra ache coming. Inflation is remaining cussed and so a return to expansionary coverage continues to be pushed again. It was at all times going to be extraordinarily troublesome to steadiness financial progress and disinflation. Offsetting advantages will come from easing inflationary pressures permitting for near-term margin enhancements.

Key takeaways from its most up-to-date quarter (Q3) are:

The web gross sales decline was primarily pushed by the contemporary and value-added merchandise phase, specifically decrease unit pricing on avocados because of market circumstances and decrease gross sales quantity of non-tropical fruit. This displays a cooling within the business. This was partially offset by larger internet gross sales in its banana phase, pushed by each per-unit pricing and quantity. The corporate has benefited from decrease product and distribution prices within the contemporary and value-added merchandise phase, owing to easing inflationary pressures.

Stability sheet & Money Flows

FDP is conservatively financed, with a ND/EBITDA ratio of 1.6x. Curiosity solely includes 1% of income but Administration appears dedicated to deleveraging. This cautious method has meant underwhelming distributions, with restricted dividend progress and sporadic buybacks. We want to see money flows redirected to distributions, with a dedication to develop dividends.

FCF era has been traditionally restricted, though restricted by its profitability profile along side its Capex necessities. Administration has considerably decreased Capex spending in current quarters, doubtlessly because of softening demand and the will to guard FCF. The priority right here is that FDP is underinvesting its capabilities.

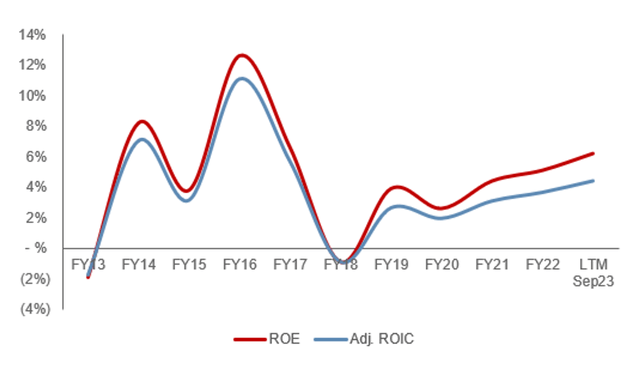

FDP’s ROE has been broadly gentle, usually fluctuating between 3-8%. It is a reflection of the business and its commoditized nature, limiting the scope for producing substantial returns. Excluding FY13 and FY18 (because of massive below-EBITDA non-recurring accounting costs), FDP’s common is ~6%.

Returns (Capital IQ)

Outlook

Outlook (Capital IQ)

Offered above is Wall Avenue’s consensus view on the approaching years.

Analysts are forecasting a continuation of its gentle progress, with a CAGR of +2% into FY24F. Along side this, margins are anticipated to broadly flatline on the present stage.

These assumptions seem cheap in our view. We suspect FDP has restricted scope to outperform on progress given the business, as it’s extremely mature and commoditized in nature. The important thing query for us is whether or not FDP can sufficiently shield its place and incrementally enhance with small positive factors, which seems to be the case. Offsetting demand will soften the scope for margin enchancment.

Business evaluation

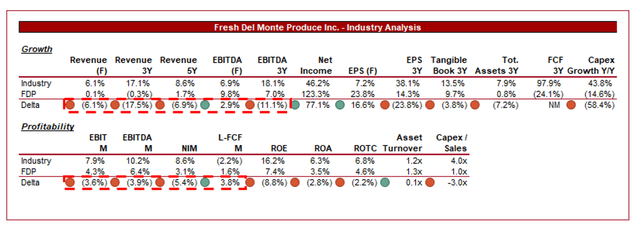

Recent produce (In search of Alpha)

Offered above is a comparability of FDP’s progress and profitability to the common of its business, as outlined by In search of Alpha (6 corporations).

FDP’s efficiency is disappointing relative to its friends, a lot of which is straight attributable to the particular phase it serves. Its commoditized nature and restricted scope for value-add past scale and distribution capabilities have restricted its means to enhance margins.

Additional, its decrease profitability limits FDP’s means to conduct inorganic progress by means of acquisitions, one other key issue that makes its total progress potential restricted.

Valuation

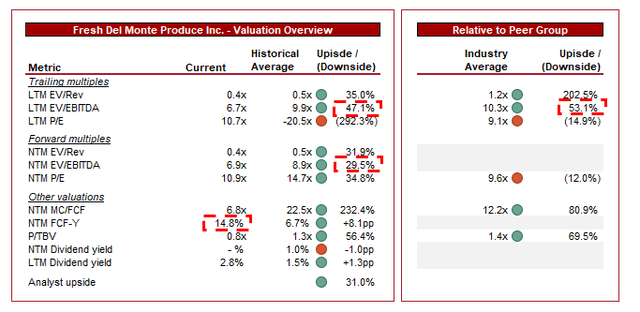

Valuation (Capital IQ)

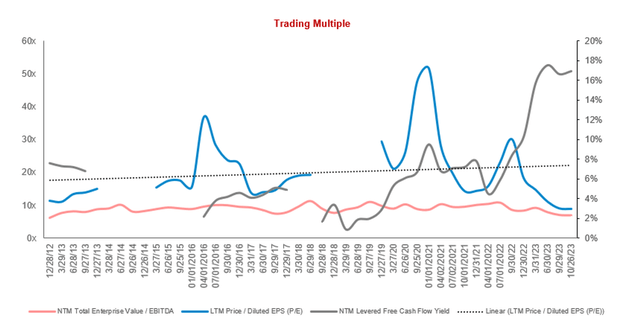

FDP is presently buying and selling at 7x LTM EBITDA and 7x NTM EBITDA. It is a low cost to its historic common.

A reduction to its historic common is warranted in our view, though to not a considerable extent. The corporate has seen margin erosion and faces near-term dangers because of market uncertainty. This mentioned, as a meals enterprise, inelasticity will work in its favor and restrict its draw back danger. At a 30-47% low cost on an LTM EV/EBITDA foundation, we think about the inventory undervalued (Valuation sources: Capital IQ).

Additional, FDP is buying and selling at a 53% low cost to its friends on an LTM EV/EBITDA foundation. A reduction once more seems cheap, owing to its decrease progress and profitability. The dimensions of the low cost seems barely bigger than we’d counsel (~35%), which once more implies upside.

Primarily based on this, FDP is undervalued. Our goal upside at this valuation is ~18%, reflecting its relative valuation to its friends and a conservative low cost of 35%.

In search of Alpha’s Quant concurs with this, ranking the inventory a “STRONG BUY”. Its monetary profile along side its valuation is pretty compelling. That is illustrated in its NTM FCF yield, which is ~16%.

Valuation evolution (Capital IQ)

Key dangers with our thesis

The dangers to our present thesis are:

[UPSIDE] Enlargement into rising markets. [UPSIDE] Product diversification to enhance scale. [DOWNSIDE] Market saturation contributes to additional competitors and pricing stress. [DOWNSIDE] Local weather-related disruptions. by. [DOWNSIDE] Provide chain challenges with yield.

Closing ideas

FDP is a strong enterprise. The corporate is positioned to develop at its gentle price in the long run, pushed by financial growth and inhabitants progress. past this stage, we battle to see any scope for outperformance. The enterprise doesn’t generate sufficient money to revolutionize itself, and so is ring-fenced inside its present sphere.

We’re extremely important of foodservice companies for that reason, they supply restricted scope to outperforming the market. This mentioned, FDP is in a singular place. The corporate seems extremely low cost and is buying and selling at a formidable FCF yield.

For extra risk-conscious traders trying to exploit the dip in valuations, FDP may very well be a pretty alternative.

[ad_2]

Source link