[ad_1]

Article by IG Chief Market Analyst Chris Beauchamp

FTSE 100, DAX 40, S&P 500 Evaluation and Charts

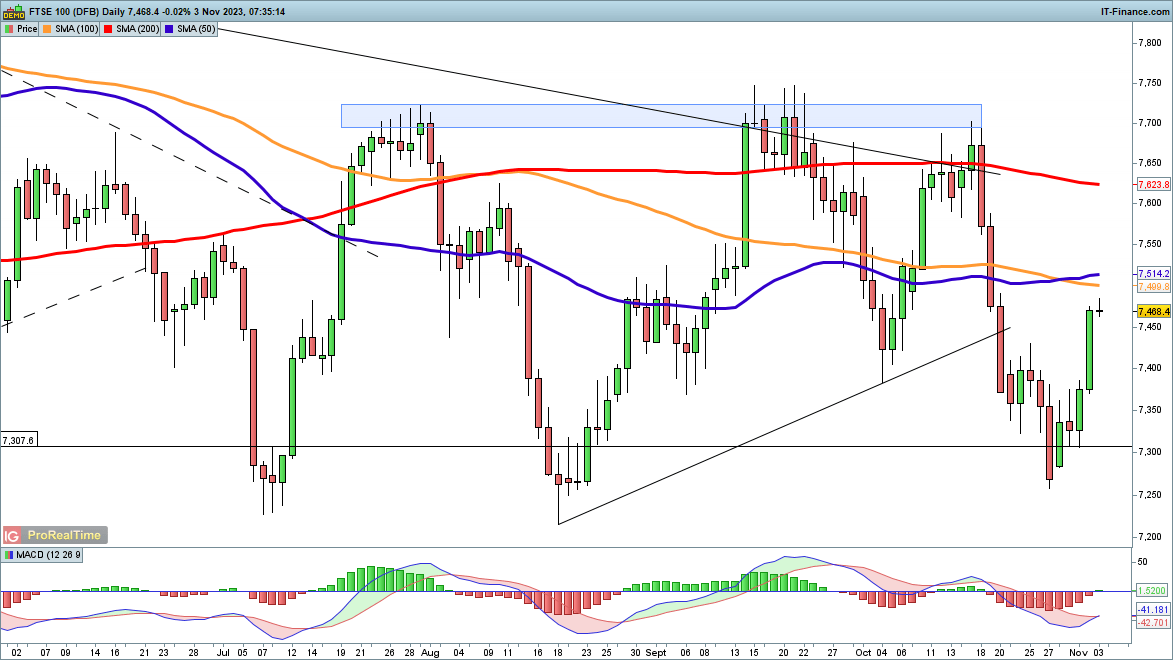

FTSE 100 in bullish short-term type

The rally off the 7300 continued on Thursday, with spectacular features for the index which have resulted in a transfer again by means of 7400. This now leaves the index on the cusp of a bullish MACD crossover, and will now see the value on the right track to check the 200-day SMA, after which on to 7700.

A reversal again under 7320 would negate this view.

FTSE 100 Day by day Chart

Change in

Longs

Shorts

OI

Day by day

13%

-25%

0%

Weekly

-9%

19%

-3%

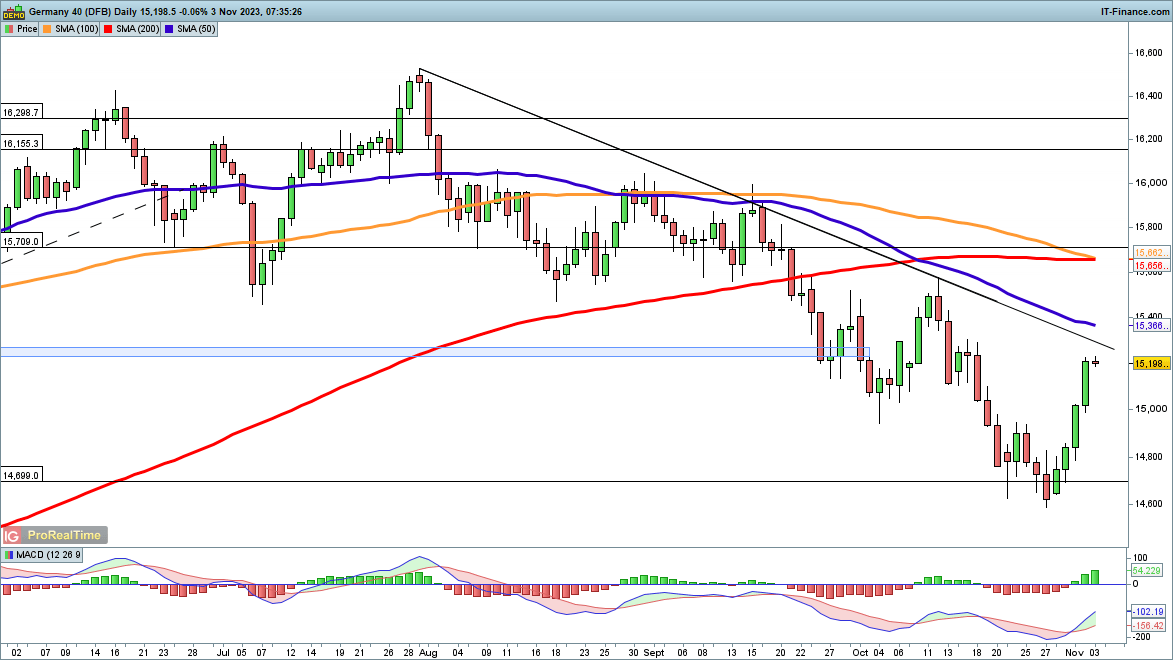

Dax 40 at two-week excessive

The index made large features for a second consecutive day, and with a contemporary bullish MACD crossover the consumers look like firmly in cost.The subsequent cease is trendline resistance from the August file excessive, after which on the declining 50-day SMA, which the index has not challenged since early September.

A failure to interrupt trendline resistance would possibly dent the bullish view, although an in depth under 15,000 could be wanted to offer a firmer bearish outlook. This could then put the lows of October again into view.

DAX 40 Day by day Chart

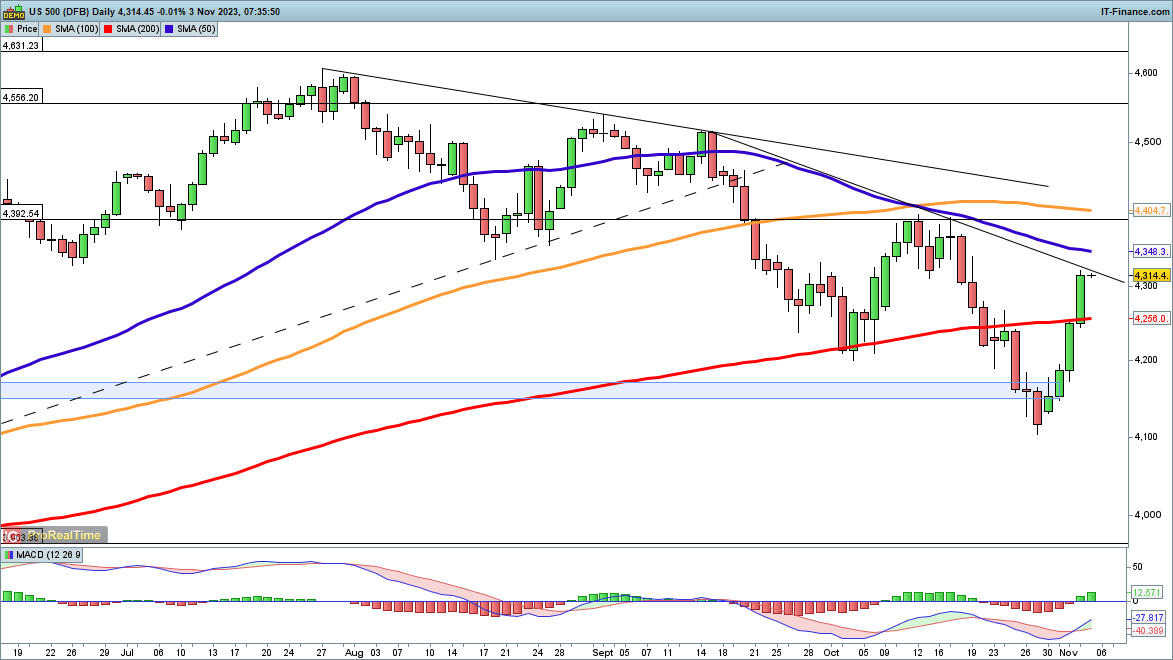

S&P 500 in robust type forward of non-farm payrolls

The index has recouped a big quantity of the losses suffered in October, and just like the Dax is now barrelling in the direction of trendline resistance after which the 50-day SMA.Past these lies the 4392 peak from early October, and an in depth above right here would solidify the bullish view.

A reversal again under the 200-day SMA would sign that the sellers have reasserted management and {that a} transfer again in the direction of 4100 could possibly be underway.

S&P 500 Day by day Chart

Really helpful by IG

Get Your Free Equities Forecast

component contained in the component. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the component as an alternative.

[ad_2]

Source link