[ad_1]

Previous rate of interest hikes have already begun to impression company and family spending and the financial system is basically standing nonetheless from mid-2023 to mid-2024, with gentle recessions in particular person nations. The Financial institution of Canada is inching nearer in direction of a financial coverage pivot, after welcoming the current decline in inflation and stating the financial system has reached a steadiness in provide and demand.

Yesterday, the BOC maintained its in a single day rate of interest goal at 5.00% in step with market expectations. The central financial institution emphasised lingering considerations about inflation dangers in its coverage assertion, noting that it “stands prepared to boost the coverage charge additional if wanted.” Nevertheless, the BOC cited current statistics exhibiting that the Canadian financial system is “not in extreme demand.” This development is anticipated to contribute to decrease inflationary pressures throughout a variety of products and companies costs. These findings point out a small however vital change within the financial surroundings, which may sign a change within the central financial institution’s future coverage actions. Nevertheless, the market assesses that the turning level is approaching, and a charge reduce is now anticipated to happen in March or April 2024.

In the meantime, the BOE is anticipated to chop charges earlier (round Might), than the Fed and ECB (round June), in accordance with Canada’s worldwide funding and capital markets financial institution. In response to them, 2024 will largely decide the period and severity of the decline in development, in addition to central financial institution easing. Financial development in 2024 is anticipated to be effectively beneath 1.0% for the US, Eurozone and UK, guaranteeing inflation stabilises again in direction of goal. And the tempo of central financial institution charge cuts over the course of this yr is prone to be a lot sooner than present market expectations. The UK financial system is anticipated to develop by 0.3%, as is the Eurozone financial system; each are seen rising by 1.1% by 2025.

Within the UK, client demand is anticipated to return below strain because the labour market continues to weaken and previous rate of interest hikes additional weigh on households. As such, development is prone to gradual in 2024, which in flip will assist spur a decline in inflation. If the BOE leads the speed reduce cycle, UK bond yields will fall sooner in comparison with bonds within the Eurozone and america, placing strain on Sterling.

Technical Overview

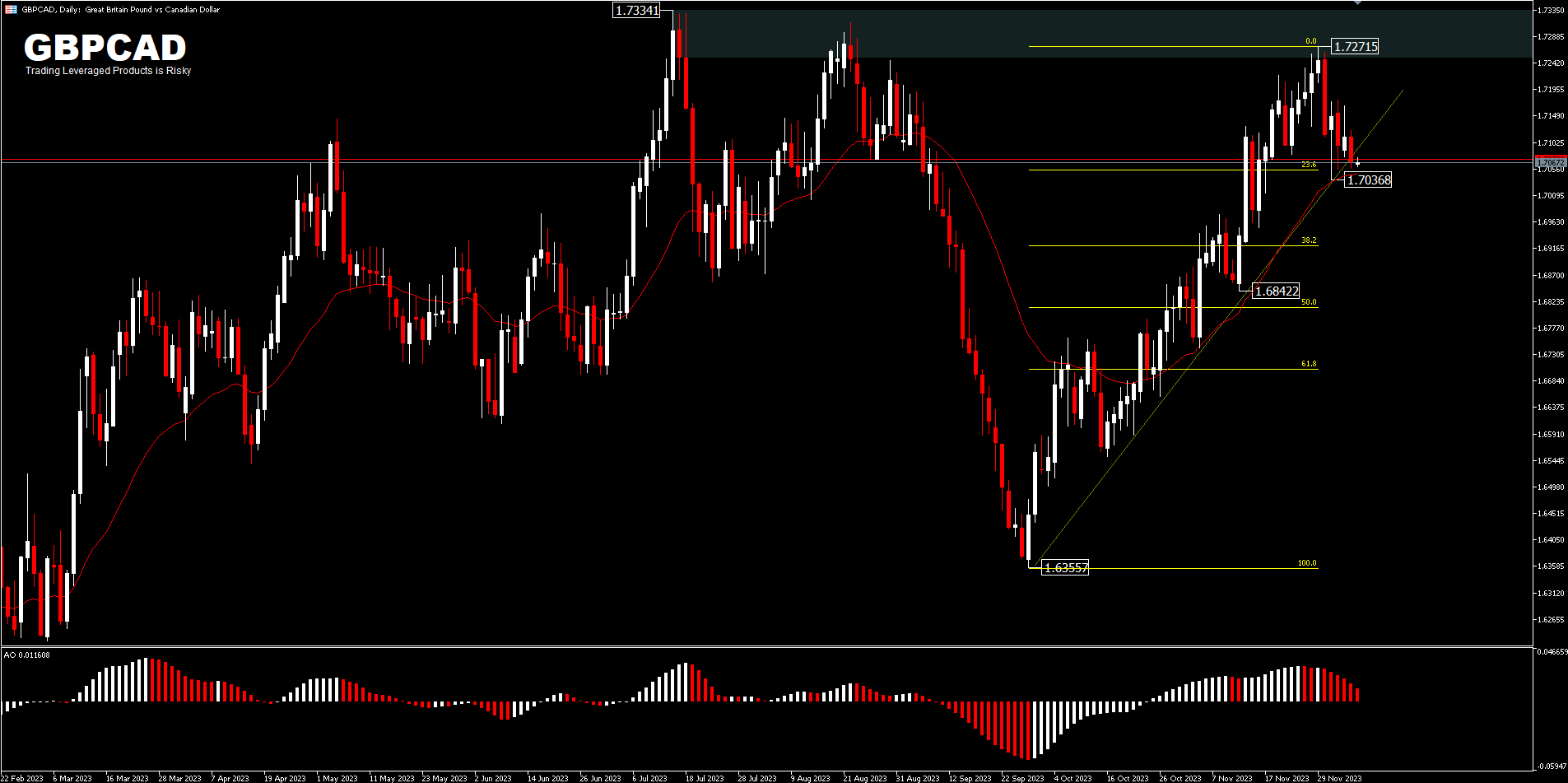

The GBPCAD cross pair rallied over 4% all through 2023, recording a low of 1.6076 in February and a excessive of 1.7334 in July and has since fallen till September with a better low recorded at 1.6355 and a rebound till November at 1.7271.

Technically, the cross pair has skilled a decline in upside momentum, having didn’t equalise the July excessive. The drop on 30 November was the most important every day decline since 14 September. Now, the value is seen consolidating above the 26-day EMA, however is slowly beginning to shift curiosity by breaking the up_trendline. A transfer beneath the 26-day EMA and 1.7036 help may take a look at the 38.2percentFR [of 1.6355 – 1.7271 retracement] and slightly additional to 1.6842 help. So long as 1.7036 minor help holds, it’s going to create some consolidation earlier than figuring out the precise development.

Intraday bias is quickly impartial. A transfer beneath 1.7036 help will affirm a short-term topping of 1.7271 and worth is projected for FE100% [1.6942]. So long as, the help holds, the vary of motion shall be restricted between 1.7036 – 1.7177. (R1: 1.7129; R2: 1.7177; S1: 1.7036; S2: 1.6953)

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link