[ad_1]

Justin Sullivan

As 2023 slowly attracts to an in depth and the S&P 500 (SP500) as soon as once more trades close to all-time highs, the 12 months can also be more likely to be one of many worst for shopper staples on a relative foundation.

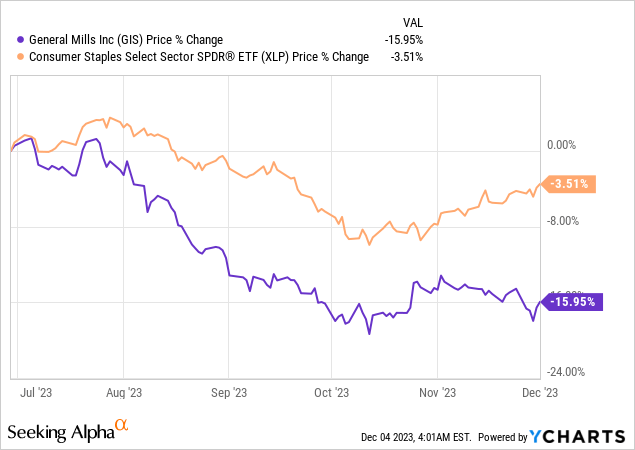

On prime of broader market pressures, Basic Mills, Inc. (NYSE:GIS) additionally skilled increased realized idiosyncratic dangers over the calendar 12 months and has now fallen greater than 15% since I downgraded it to Maintain earlier in June.

As short-term traders, merchants and speculators are more likely to chase momentum and run for the exit, the sharp fall of GIS shouldn’t come as a shock to long-term traders. That’s the reason, only a few months in the past, I wrote that from a market-timing viewpoint GIS shareholders needs to be ready for such a situation and will benefit from any significant drop (emphasis added):

It’s extremely seemingly that the following 12-month interval shall be tougher for GIS shareholders as topline development slows down and the uncertainty round profitability will increase. Whereas this dynamic would make short-term traders nervous, long-term traders may benefit from any main drop within the firm’s share worth because the administration takes the mandatory steps to create shareholder worth within the long-run and stays centered on the dividend.

Supply: Looking for Alpha.

Though attempting to time the market by both shopping for or promoting a inventory is one thing that I keep away from, there are actually durations of time when it’s extra enticing for long-term traders to extend holdings. Such durations are often not onerous to identify relating to steady enterprise fashions like that of Basic Mills.

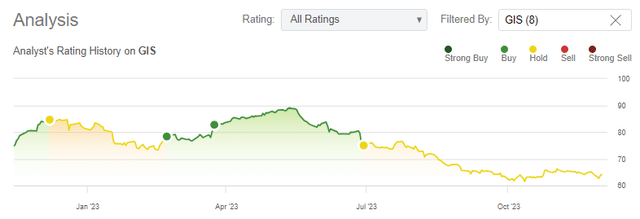

Looking for Alpha

With that in thoughts, at current Basic Mills’ share worth is as soon as once more buying and selling at enticing ranges relative to its enterprise fundamentals.

The Huge Image

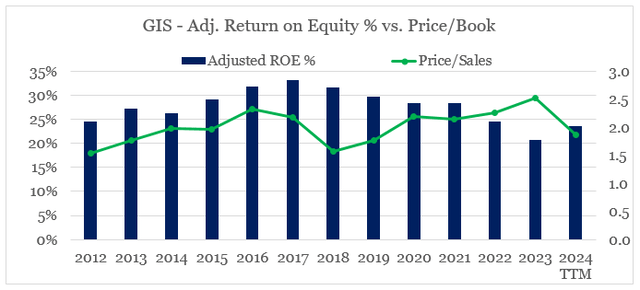

Over the long run, Basic Mills’ adjusted return on fairness (adjusted for asset impairments and tax bills in FY 2018) is a key driver of shareholder returns. Given the annual fluctuations and modifications in traders’ sentiment and expectations, nonetheless, the inventory’s gross sales a number of may overshoot in both route.

After the worth/gross sales a number of was just lately working method forward of the ROE, it has now fallen sharply to one among its lowest ranges for the reason that FY 2018-19 interval.

ready by the creator, utilizing knowledge from SEC Filings

On the similar time, the adjusted ROE has barely recovered throughout the previous 12-month interval and would proceed to profit from ongoing tailwinds (extra on that later). If this occurs, we may as soon as once more have a large hole between adjusted return on fairness and worth/gross sales a number of in a similar way to FY 2018 on the graph above.

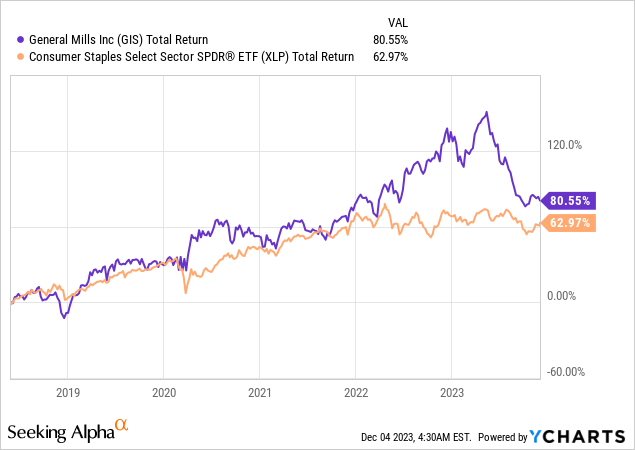

This conservative pricing creates a big margin of security for traders and as we may see on the graph beneath, following FY 2018 GIS has been outperforming the Shopper Staples Choose Sector SPDR® Fund ETF (XLP) although ROE has been regularly declining within the following years.

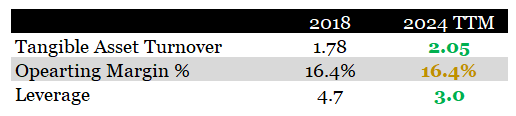

Though ROE is considerably decrease now, GIS is in a significantly better place operationally than it was again in FY 2018. Tangible asset turnover is notably increased and working margin has stayed flat. The important thing driver of decrease GIS ROE is an enormous drop in leverage prior to now couple of years.

ready by the creator, utilizing knowledge from SEC Filings

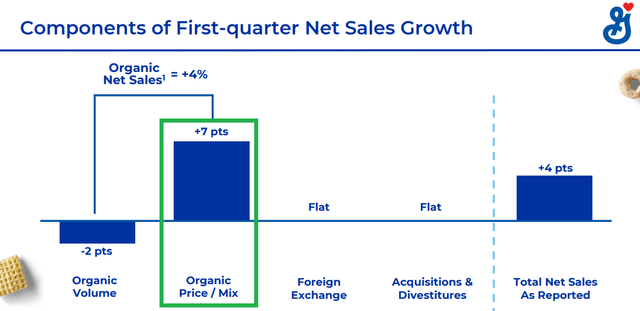

The model portfolio has additionally been optimized since then, and this allowed vital worth will increase over the previous 12 months, with out sacrificing quantity development and market share.

Basic Mills Investor Presentation

As I famous in my earlier evaluation on GIS, there was a danger that the corporate may face worse than anticipated drops in volumes, however this has not materialized.

Basic Mills Investor Presentation

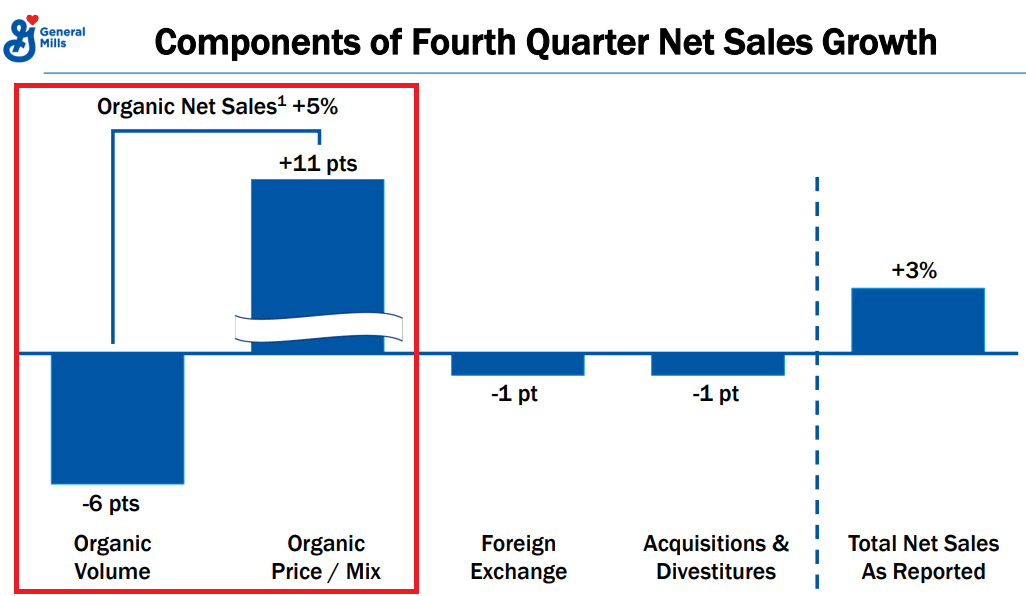

In an effort to keep away from a significant drop in volumes, GIS needed to taper down its pricing initiatives, which as we noticed above has not occurred both (emphasis added):

All that might seemingly trigger volumes to get well within the coming quarters, however on the similar time the worth/combine profit ought to fall sharply over the approaching quarters as properly.

Supply: Looking for Alpha

All that clearly illustrates the energy of the GIS model portfolio, and though it is cheap for worth/combine influence on natural web gross sales to fade away throughout the present fiscal 12 months, margins ought to proceed to profit within the close to time period.

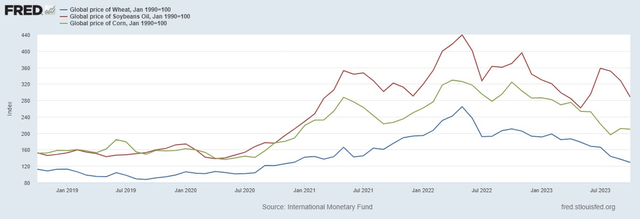

Lastly, GIS margins would additionally proceed to profit from falling commodity costs. Wheat, corn, and soybean oil are three of the primary inputs into Basic Mills’ merchandise, and costs of all three at the moment are properly beneath their current highs.

FRED

Shareholder Distributions

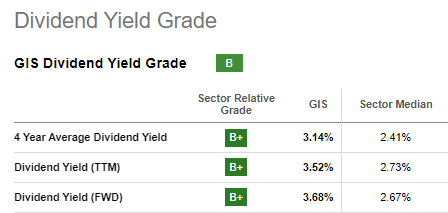

The current fall in GIS share worth together with the dividend improve introduced in June have additionally made the corporate a really enticing dividend play.

Looking for Alpha

With a ahead yield of three.7%, GIS gives one of the crucial enticing yields throughout the sector.

Looking for Alpha

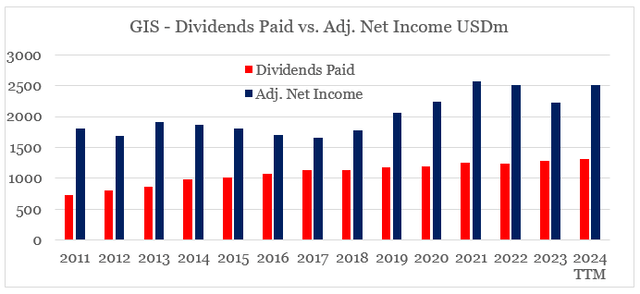

The dividend shouldn’t be solely protected, however given the margin alternative outlined within the earlier part and the elevated prime line development, GIS is in a very good place to proceed rising its dividend on an annual foundation. The explanation for that’s the comparatively low payout ratio, which presently stands at 55% on a GAAP foundation.

ready by the creator, utilizing knowledge from SEC Filings

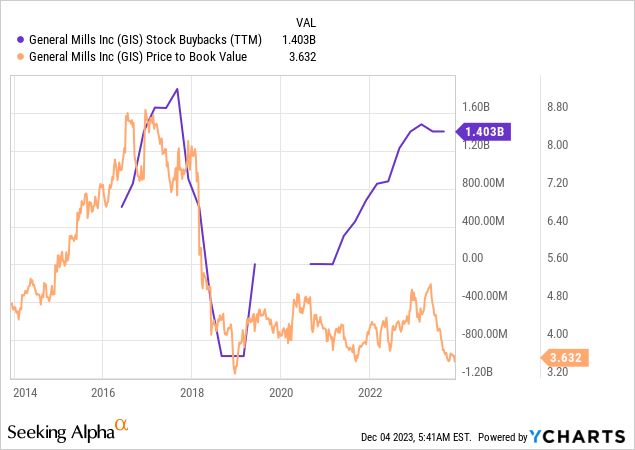

In terms of shareholder distributions, we also needs to point out the report excessive share buyback program of GIS which presently stands at $1.4bn on an annual foundation. That is finished at a time when the corporate trades at multi-year low multiples, which might be extremely accretive for future shareholder returns.

Conclusion

Basic Mills, Inc. has fallen roughly 15% since I downgraded the inventory to a Maintain again in June of this 12 months. Brief-term headwinds, nonetheless, at the moment are slowly disappearing, whereas the corporate trades at very enticing ranges relative to its enterprise fundamentals. The inventory additionally gives a extremely enticing dividend yield, and up to date capital allocation choices bode properly for future shareholder returns.

[ad_2]

Source link