[ad_1]

An worker places gold bullions right into a secure deposit field at Degussa store in Singapore

Edgar Su | Reuters

Gold costs hit one other file excessive this week after a roaring 2023, and a mixture of geopolitical tensions and continued central financial institution shopping for ought to see demand stay resilient subsequent yr, in keeping with the World Gold Council.

The yellow metallic broke by way of $2,100 per ounce on Monday earlier than moderating barely, and spot costs have been hovering at round $2,030 per ounce early Friday.

In its Gold Outlook 2024 report revealed Thursday, the World Gold Council famous that many economists now anticipate a “delicate touchdown” within the U.S. — the Federal Reserve bringing inflation again to focus on with out triggering a recession — which might be constructive for the worldwide financial system.

The trade physique (which represents gold mining corporations) famous that traditionally, delicate touchdown environments have “not been notably enticing for gold, leading to flat to barely damaging common returns.”

“That stated, each cycle is completely different. This time round, heightened geopolitical tensions in a key election yr for a lot of main economies, mixed with continued central financial institution shopping for might present extra help for gold,” the WGC added.

Its strategists additionally famous that the chance of a delicate touchdown is “in no way sure,” whereas a world recession remains to be not off the desk.

“This could encourage many traders to carry efficient hedges, comparable to gold, of their portfolios,” the WGC added.

The 2 most important occasions for gold demand in 2023 have been the collapse of Silicon Valley Financial institution and the Hamas assault on Israel, the WGC stated, estimating that geopolitical occasions added between 3% and 6% to gold’s worth over the yr.

“And in a yr with main elections going down globally, together with within the U.S., the EU, India, and Taiwan, traders’ want for portfolio hedges will probably be greater than regular,” the report stated, waiting for 2024.

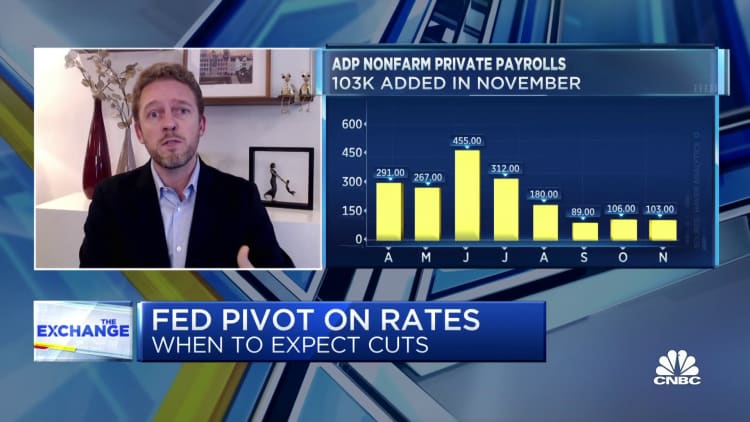

All eyes on the Fed

WGC Chief Market Strategist John Reade informed CNBC on Thursday that gold costs would probably stay range-bound however uneven subsequent yr. He expects them to react to particular person financial knowledge factors that inform the probably trajectory of Fed coverage till the primary rate of interest reduce is within the bag.

Markets are at present pricing the primary 25-basis-point reduce to the Fed funds charge as early as March subsequent yr, in keeping with CME Group’s FedWatch software.

Nevertheless, though charge cuts are often seen as excellent news for gold (as money returns fall and savers look elsewhere for high-yielding investments), Reade highlighted that two elements might imply that “anticipated coverage charge easing could also be much less sanguine for gold than it seems on the floor.”

Firstly, if inflation cools extra rapidly than charges — as it’s largely anticipated to do — then actual rates of interest stay elevated. And secondly, lower-than-expected progress might hit gold shopper demand.

“I am not saying rates of interest have to return to 0 to reignite the demand, however that mixture I consider the primary reduce within the States and cuts elsewhere in different necessary economies, will I feel change a little bit of the sentiment in direction of gold,” Reade stated.

Central financial institution shopping for to proceed

One different supporting issue for the yellow metallic wanting forward is additional central-bank shopping for, in keeping with the World Gold Council.

Central banks have been a serious supply of demand within the international gold market during the last couple of years and 2023 is more likely to be a file yr. The WGC expects this to proceed in 2024.

Reade stated the group was shocked by the numerous improve in central financial institution purchases in 2022 and that the tempo of shopping for continued this yr.

In its report, the WGC estimated that central financial institution demand added 10% or extra to gold’s efficiency in 2023, and famous that even when 2024 doesn’t attain the identical heights, above-trend shopping for ought to nonetheless supply an additional increase to gold costs.

“Our expectations are that central financial institution purchases will proceed subsequent yr on a internet foundation, and that is just about the case for the reason that international monetary disaster,” Reade stated.

“My very own expectation is that central banks are very a lot going to be once more, the kind of distinguished story within the gold market in 2024, however I feel that it could be optimistic of us to say that it’ll be one other file yr or a record-matching yr.”

[ad_2]

Source link