[ad_1]

A month in the past the remained bullish regardless of the fallout from a correction that began mid-summer, primarily based on a number of units of ETF pairs. Following yesterday’s upbeat Federal Reserve information, nonetheless, the upbeat outlook has strengthened.

The central financial institution left its coverage charge unchanged for a 3rd time whereas suggesting {that a} spherical of charges cuts is on the desk for 2024.

“Whereas the climate remains to be chilly exterior, the Fed has steered a possible thawing of frozen excessive rates of interest over the following few months,” says Rick Rieder, chief funding officer of worldwide fastened earnings at BlackRock.

Markets cheered as costs for each US shares and bonds surged on Wednesday, Dec. 13. In reality, a bullish pattern has been seen all alongside through a number of ETF pairs that monitor varied sides of worldwide markets.

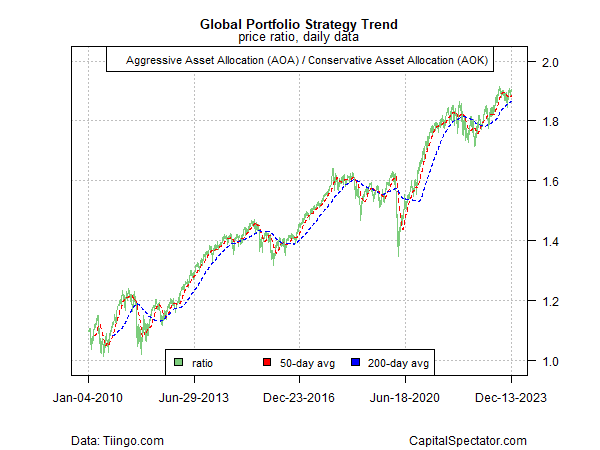

For a top-down perspective, contemplate the ratio for an aggressive international portfolio () vs. its conservative counterpart (). Though the pattern wavered resulting from turbulence in 2023 and this 12 months’s summer season/fall correction, the upside bias has endured, suggesting {that a} risk-on sign stays intact for international asset allocation methods.

World Portfolio Technique Pattern

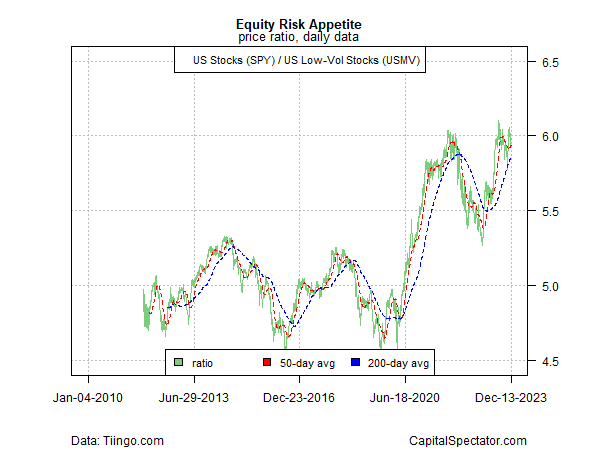

Specializing in US shares displays extra volatility, however the current rebound within the ratio of the broad market () vs. a low-volatility portfolio of equities () continues to skew constructive.

Fairness Danger Urge for food

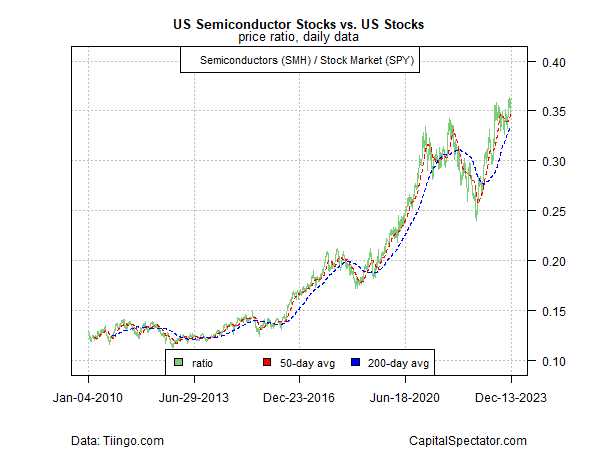

Utilizing the relative efficiency of semi-conductor shares (), a business-cycle proxy, vs. US shares total (SPY) additionally paints a bullish pattern.

US Semiconductor Shares vs US Shares

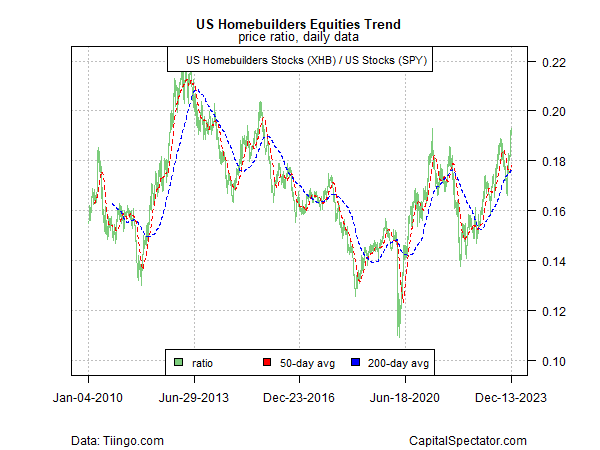

In the meantime, one of many hardest hit industries in current historical past — homebuilders () — are rebounding relative to the US inventory market (SPY). The essential issue: expectations that rates of interest will fall suggests aid is coming for dwelling shopping for and residential building.

XHB vs SPY Chart

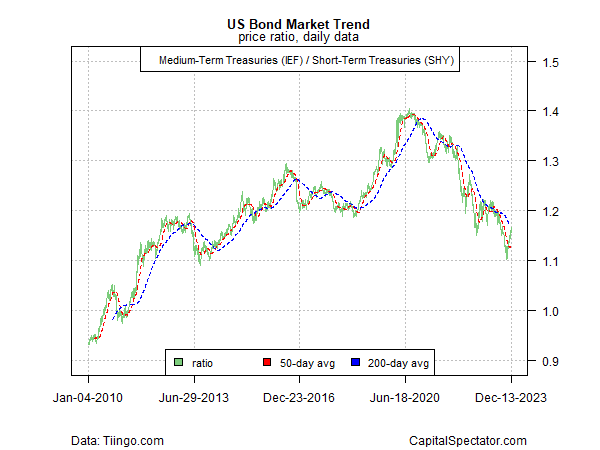

The danger-on occasion in bonds remains to be combined, in accordance with the ratio of medium-term Treasuries () vs. their short-term counterparts (). However the sharp rebound in current days means that this key market sign is on monitor to revive after a future of bearish trending. If this ratio turns decisively constructive within the weeks forward, the shift would mark one of many final market elements to go all-in on risk-on.

IEF vs SHY Chart

Markets may be unsuitable, in fact, and so the evaluation above shouldn’t be confused with an infallible all-clear indicator. However, betting towards the pattern isn’t riskless both. What is evident, not less than in relative phrases, is that market traits are nonetheless leaning right into a constructive bias. In consequence, the percentages favor a risk-on positioning.

[ad_2]

Source link