[ad_1]

tadamichi

By Christian Correa, CFA, Chief Funding Officer, Franklin Mutual Sequence

Worth shares are poised to ship stable returns in what might show to be a extra unsettled 12 months forward, in accordance with Mutual Sequence CIO Christian Correa.

Worth shares are magnificently odd. Not solely are they in much less flashy sectors like client staples, industrials and well being care, however in addition they are buying and selling at traditionally affordable valuations.

That is likely to be advantageous to buyers in what may very well be an unsure 2024 when buyers might face larger volatility amongst costly development shares, normalizing rates of interest and the additional unwinding of pandemic-era stimulus.

Such an atmosphere might make these odd worth firms look extraordinary.

Worth’s valuations matter

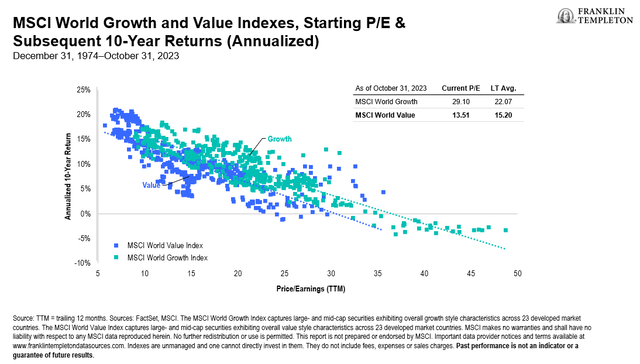

Though worth shares have lagged their development counterparts over a lot of 2023, we imagine the set-up for 2024 and past seems to be promising. Traditionally, beginning valuations have been a powerful indicator of long-term future returns.

At the moment, the MSCI World Worth Index’s price-earnings (P/E) a number of is buying and selling at a reduction to its historic common, whereas the P/E a number of for the MSCI World Development Index is at a premium.

As seen in Exhibit 1, evaluating the trailing P/E multiples for world development and worth shares with their return over the following 10 years reveals that decrease P/E shares achieved larger future returns over the following decade, primarily based on information from FactSet and MSCI.

As such, with development shares’ stretched valuations, we see many alternatives to seek out compelling worth alternatives with vital future return potential.

Exhibit 1: Valuations Matter for Lengthy-Time period Returns

Moreover, we imagine that discovering firms with compelling catalysts that may unlock worth and generate stable long-term returns will stay essential for separating interesting worth shares from potential worth traps, significantly in an atmosphere of accelerating uncertainty.

We additionally assume the market ought to reward secure money move technology and monetary returns. We imagine it’s essential to concentrate on money flows and monetary returns to grasp how an organization is run and whether or not it could produce sturdy share value appreciation for buyers over time.

Diversification over focus

With 2023 world market returns concentrated in a handful of US shares, searching for out worth shares may give buyers extra diversified world publicity and probably extra constant returns over time, in our view.

We are inclined to assume the world outdoors the US has extra alternatives. Whereas we do see some US prospects, after we take a look at Europe, for instance, we will discover massive globally aggressive firms which might be buying and selling at compelling valuations and supply the potential alternative for enticing future returns.

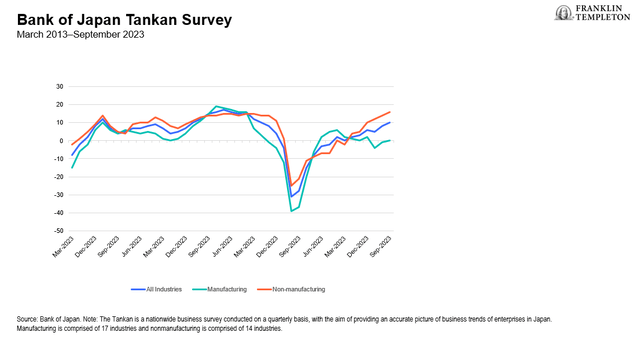

Japan can also be an more and more dynamic market value buyers’ consideration, in our view. Increasingly more Japanese firms are centered on bettering returns on capital, elevating costs amid larger inflation and are keen to take extra dangers to pursue quicker development – a marked change from the previous few many years.

The Tokyo Inventory Change can also be pushing reforms to get firms to lift their e-book values.

Regardless of a powerful efficiency this 12 months, Japanese inventory valuations (primarily based on FactSet information) stay enticing to us, because the nation exits an extended interval of unfavorable rates of interest and general enterprise sentiment continues to enhance (Exhibit 2).

Exhibit 2: Financial institution of Japan Tankan Judgment Survey Reveals Rising Company Optimism

Financial coverage normalization in lots of nations ought to additional positively affect sure value-oriented sectors. Increased rates of interest have lured capital away from dividend-paying industries towards fastened revenue over the previous 12 months.

For worth buyers, the drop in valuations within the client staples, utilities and actual property sectors, as an illustration, can create better prospects of discovering shares unfairly buying and selling under their elementary worth.

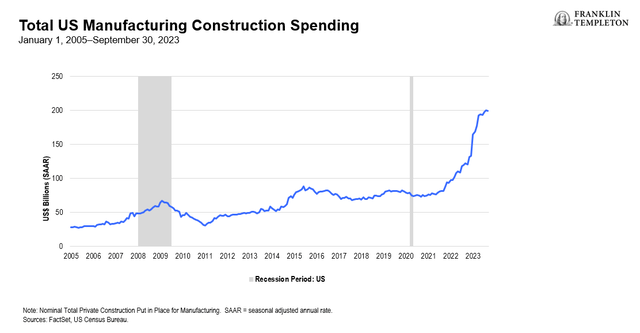

Authorities infrastructure spending and the long-term vitality transition can also be geared towards sectors that commerce at “worth” multiples, comparable to firms within the vitality, industrials and supplies sectors.

US authorities spending on constructing new semiconductor and electrical automobile battery crops, for one, ought to result in better spending on the metals, cement and industrial gear used to construct them.

US spending on manufacturing services has risen sharply since current laws was handed in Congress. (See Exhibit 3.)

Exhibit 3: US Stimulus Infrastructure Spending Booms

Momentum behind the vitality transition additionally continues to push vitality firms and utilities towards embracing cleaner vitality.

Whereas we don’t assume oil goes away, world utilities are closing coal crops and rolling out renewable initiatives, incentivized by a slew of current laws in the US and in Europe.

Pandemic’s finish

Client spending is an space of concern. Whereas development has slowed as Individuals spend the final of their pandemic-era financial savings, scholar mortgage repayments are restarting and low-end shoppers are coping with larger vitality prices. We imagine what is going on is just a spending slowdown, not a shutdown.

The labor market has up to now remained resilient with elevated participation, rising wages and persistently low unemployment supported by continued enterprise and authorities infrastructure spending.

Nevertheless, ought to wages, employment or the promised infrastructure spending falter, we’d not be shocked to see an financial slowdown.

Regardless, after a 12 months when worth underperformed development shares globally, we anticipate a brighter 12 months forward as world inventory valuations recommend to us constructive long-term return potential.

Extra money must also move to value-oriented components of the market and financial system by ongoing client spending and up to date authorities packages, whereas normalized financial coverage could make curiosity rate-sensitive and dividend-paying teams extra interesting. Extraordinary worth. Extraordinary potential.

What are the dangers?

All investments contain dangers, together with doable lack of principal.

Fairness securities are topic to cost fluctuation and doable lack of principal.

To the extent a technique invests in firms in a selected nation or area, it might expertise better volatility than a technique that’s extra broadly diversified geographically.

Worldwide investments are topic to particular dangers, together with forex fluctuations and social, financial and political uncertainties, which might improve volatility. These dangers are magnified in rising markets.

Worth securities might not improve in value as anticipated or might decline additional in worth. The funding type might change into out of favor, which can have a unfavorable affect on efficiency.

Energetic administration doesn’t guarantee positive factors or defend in opposition to market declines.

Authentic Submit

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.

[ad_2]

Source link