[ad_1]

Gold is about to finish 2023 on a bullish word.

Present technical setup is pointing towards one other cost towards all-time highs.

Elementary elements, such because the macro setting and rising geopolitical dangers are additionally favoring the gold bulls.

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Be taught Extra »

The 12 months 2023 will be marked as notably profitable for , boasting a return charge of simply over 14%.

The surge in demand will be attributed to geopolitical tensions within the Center East and the anticipation of the Federal Reserve shifting away from its restrictive financial coverage within the upcoming 12 months.

This shift signifies the initiation of an rate of interest reduce cycle, anticipated to weaken the and result in a decline in U.S. Treasury bond yields.

Technically talking, the present state of affairs signifies an try to interrupt out from the long-term consolidation that has persevered since roughly the primary half of 2020.

The most definitely state of affairs within the present context factors in direction of a continued upward trajectory, with the preliminary goal within the neighborhood of $2100 per ounce.

Will the bullish pattern proceed in 2024?

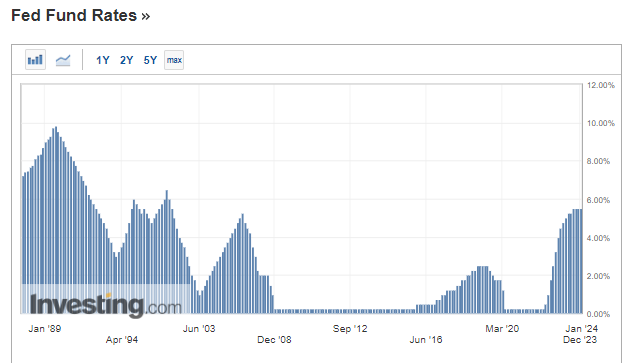

Within the first quarter of 2022, the Federal Reserve initiated some of the sturdy cycles of rate of interest hikes in many years, elevating the vary from zero to five.25-5.50% by July.

This trajectory was already factored in earlier in 2021, appearing as a big obstacle to gold’s dynamic bull market and ushering in a part of an prolonged sideways pattern.

Not even the battle in Ukraine supplied substantial assist, triggering solely a weak upward impulse. The overarching determinant stays the insurance policies of main central banks, led by the Federal Reserve.

Fed Fund Charges

At the moment, the macroeconomic setting coupled with the rising geopolitical tensions appear to be creating a mixture conducive to a free-flowing bull market.

The Federal Reserve’s newest assembly confirms the state of affairs of the tip of the hike cycle and the execution of a pivot with 4 reductions subsequent 12 months.

The scenario within the Center East stays tense, which appears to be underscored by Benjamin Netanyahu’s phrases ruling out a fast finish to the battle.

Stability within the area can be definitely not improved by assaults by the Houthi rebels (a Yemeni armed group) on service provider ships within the Pink Sea basin and the demise of an Iranian basic who was killed in Israeli Air Pressure air strikes in Syria.

Gold bulls goal $2100 subsequent

The latest robust demand shot established a brand new historic excessive within the $2150 per ounce value space, however these had been shortly negated.

Patrons will not be wanting gas, nevertheless, and all indications are that they’ll have the ability to completely overcome the important thing resistance space examined a number of occasions over the previous few years positioned close to the spherical barrier of $2100.

The pure goal for demand is the world round $2150 and the subsequent spherical barrier of $2200.

Attainable corrective actions needs to be restricted by the native upward pattern line and demand zones close to $2000 and $1950 per ounce.

As we strategy an election 12 months, we stand on the threshold of a interval marked by numerous declarations that would affect the trajectory of fiscal spending, posing a possible danger of sustaining inflation above the goal.

Alternative ways to achieve publicity to gold

Within the upcoming 12 months, buyers looking for to allocate their funds particularly to gold may have a various array of choices, together with:

ETFs (Trade Traded Funds): These funds are designed to reflect the value of gold and are traded on exchanges. One notable benefit is that these funds are backed by bodily gold, enhancing their credibility.

Bodily Gold: The commonest methodology of buying bodily gold entails buying bars and cash, with the selection relying on the scale of your portfolio. Given the mint’s fee, this selection is extra suited to long-term investments, requiring a number of p.c revenue to offset prices.

***

In 2024, let arduous selections develop into simple with our AI-powered stock-picking device.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not understanding which shares to purchase!

Declare Your Low cost At this time!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation.

[ad_2]

Source link

Add comment