[ad_1]

The prospect that the Fed’s pivot may are available in Could has stored gold underneath stress and strengthened the greenback.

Nonetheless, forecasts level to continued secure demand for gold in 2024

$1940 per ounce is a key demand zone and will current a shopping for alternative for traders.

In 2024, make investments like the large funds from the consolation of your house with our AI-powered ProPicks inventory choice software. Study extra right here>>

At the beginning of December final yr, costs reached a brand new all-time excessive of $2,135 per ounce.

Since then, nevertheless, the yellow steel struggled to keep up this stage amid a rebounding , principally boosted by strong US financial knowledge that might delay the pivot from March to Could.

However regardless of the correction, bullion nonetheless hovers across the $2,000 line, indicating that the optimistic outlook for the medium and long run persists.

Essentially, the yellow steel is poised to proceed attracting strong demand from central banks, retail traders eager on each bodily gold and ETFs, and the burgeoning jewellery trade.

In opposition to this backdrop, shopping for into gold’s dip could also be a sensible, secure play for long-term traders. However at which stage?

Let’s take a deeper take a look at all of the elements to raised reply that query.

US Greenback Energy Short-term?

Though the has exhibited short-term energy this month as seen within the pair dropping from 1.11 to almost 1.08, it’s nonetheless an area uptrend.

The stronger-than-expected knowledge helps the Fed’s hawkish stance, however it’s seemingly a brief strengthening, with the pivot anticipated later within the first half of the yr.

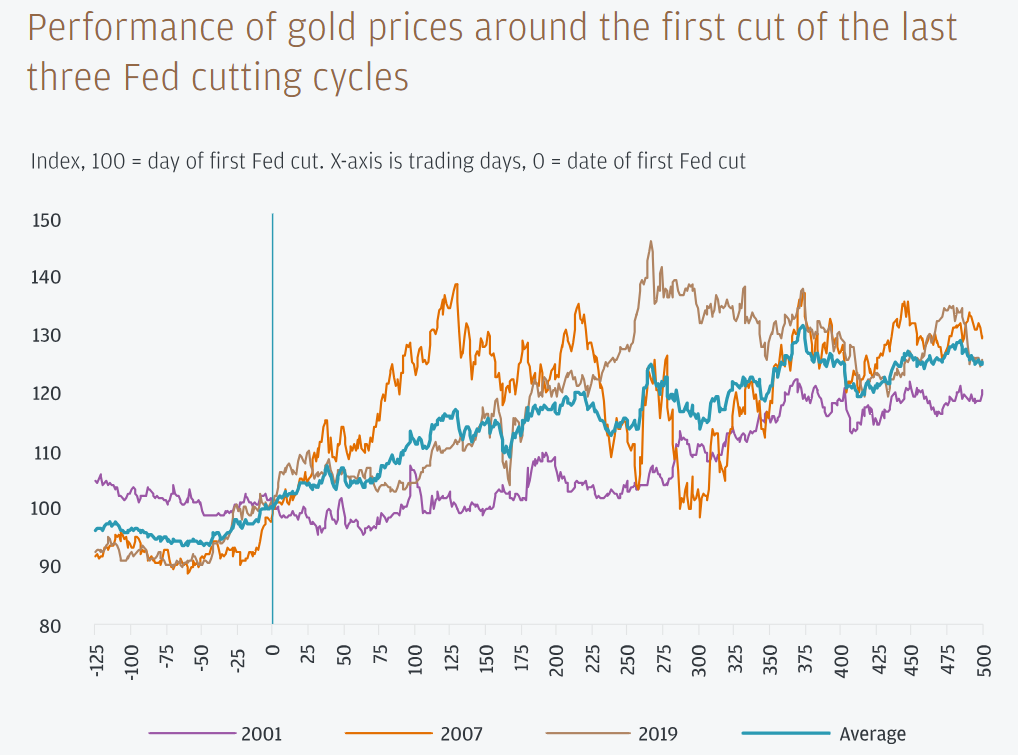

Earlier situations of Fed pivots have proven an upward trajectory in gold costs within the subsequent months.

Supply: jpmorgan.com

There isn’t a indication that this state of affairs shall be completely different this time.

Gold seems poised to maintain its upward trajectory, bolstered by escalating conflicts, notably within the Center East, which tends to drive traders towards safe-haven property.

The demand outlook for the valuable steel stays optimistic.

Will Central Banks Proceed to Have an Urge for food for Gold in 2024?

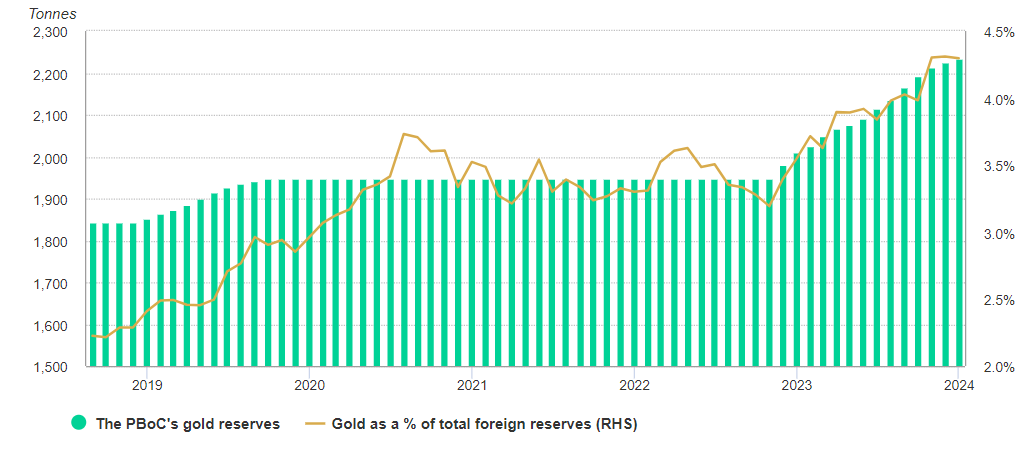

A key issue contributing to gold’s optimistic outlook is the continued urge for food of Central Banks for the steel.

In 2023, Central Banks have been energetic in gold purchases, accumulating round 800 tons. China emerged as a frontrunner, buying 287 tons in 14 months and concluding the yr with a reserve stage of 2235 tons.

JP Morgan Analysis forecasts that world demand from Central Banks in 2024 may additional improve to 950 tons.

Supply: gold.org/worldgoldcouncil

Over the previous few years, nevertheless, it’s demand from the jewellery trade that has accounted for the biggest share in the case of the demand aspect globally.

In response to knowledge for the primary half of 2023, the trade accounted for just below 50% of complete demand for the commodity.

Gold Technical View: Correction to Deepen – Purchase Zone Round $1940 Is Key

Given not less than the short-term energy of the US greenback presently, there’s a excessive chance of a deepening of the correction in gold.

The energy of the availability aspect will face a vital check in its try and breach the psychological barrier of $2,000 per ounce.

A profitable break beneath this stage may pave the best way for a continuation of the downward motion.

The important thing goal space for the bears would be the demand zone situated within the value area of $1940 per ounce.

The energy of this area is as a result of it initiated a powerful upward impulse taking the value to a brand new all-time excessive.

The negation of the bearish state of affairs shall be when the value breaks the important thing provide zone round $2050 per ounce.

***

Take your investing recreation to the subsequent stage in 2024 with ProPicks

Establishments and billionaire traders worldwide are already properly forward of the sport in the case of AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 952% during the last decade, traders have the perfect choice of shares out there on the tip of their fingers each month.

Subscribe right here for as much as 50% off as a part of our year-end sale and by no means miss a bull market once more!

Declare Your Low cost In the present day!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of property in any approach. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding determination and the related danger stays with the investor

[ad_2]

Source link