[ad_1]

Lemon_tm

Fundamentals:

Gold costs have lately surged to close all-time highs on account of a extra dovish stance from the Federal Reserve, which has attracted traders to gold.

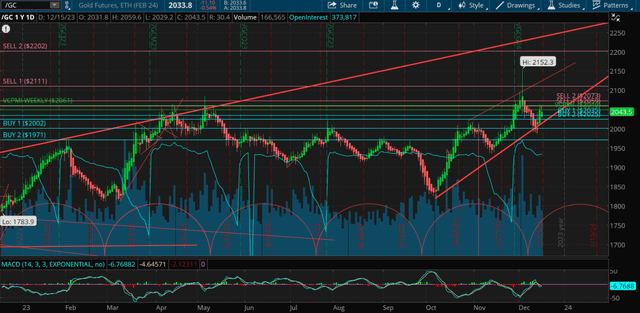

GOLD DAILY (TOS)

Client Worth Index (CPI) knowledge launched in the course of the week met expectations, ensuing in a subdued market response throughout numerous belongings, together with gold.

Gold initially dipped barely however shortly discovered assist after nearing $1990 per ounce earlier than the CPI launch.

The Federal Reserve’s unexpectedly dovish tone of their statements, financial projections, and Chair Jerome Powell’s press convention stunned the markets. Whereas no speedy rate of interest change was anticipated, the shift in inflation expectations and the potential for three fee cuts in 2024 had a major affect.

As anticipated, the market reacted with a falling U.S. greenback, rising Treasury costs, and a surge in U.S. shares, resulting in a powerful enhance in gold costs, breaking by means of the $2000 per ounce resistance degree.

Nonetheless, profit-taking within the gold market occurred in the course of the U.S. buying and selling session on Friday, resulting in a slight moderation in its post-Federal Reserve rally.

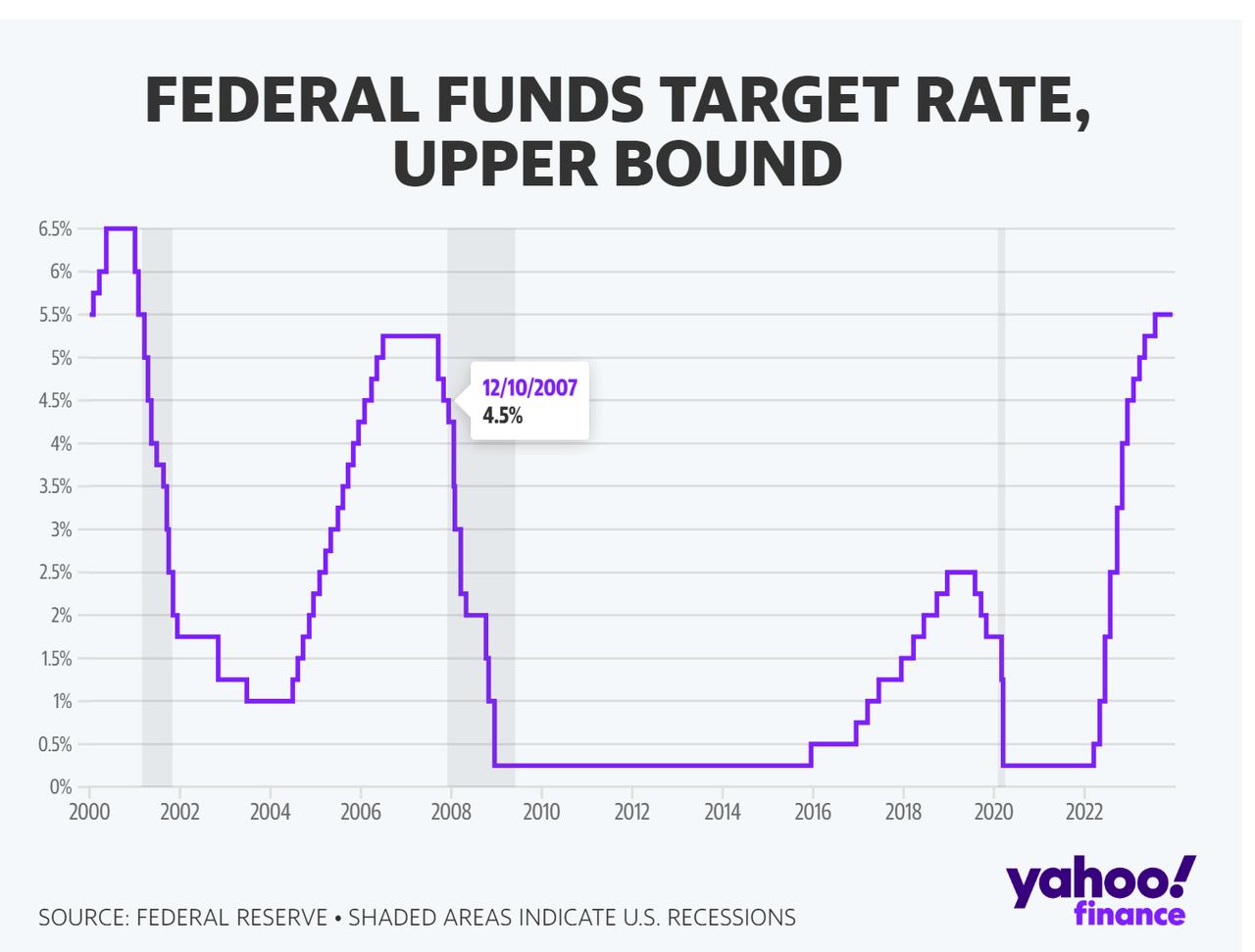

The Federal Reserve, in its current announcement, determined to take care of its benchmark rate of interest inside a spread of 5.25% to five.50%, which is the very best degree in 22 years. Nonetheless, it signaled its intention to doubtlessly minimize rates of interest by a complete of 75 foundation factors (0.75%) within the coming yr, a extra important discount than beforehand indicated in September when a 0.50% minimize was anticipated. Over the previous yr, the Fed has carried out fee will increase in 25-basis-point increments, however now it anticipates three fee cuts in 2024.

Fed Funds Charge (Yahoo)

These projections are influenced by the Fed’s expectation that inflation will lower to 2.4% within the subsequent yr, down from the two.5% forecast in September, and additional decline to 2.2% by 2025. The coverage assertion launched by the Fed included language suggesting a willingness to contemplate further fee hikes cautiously, indicating a shift away from additional will increase. This marks the third consecutive assembly the place the central financial institution has stored charges unchanged.

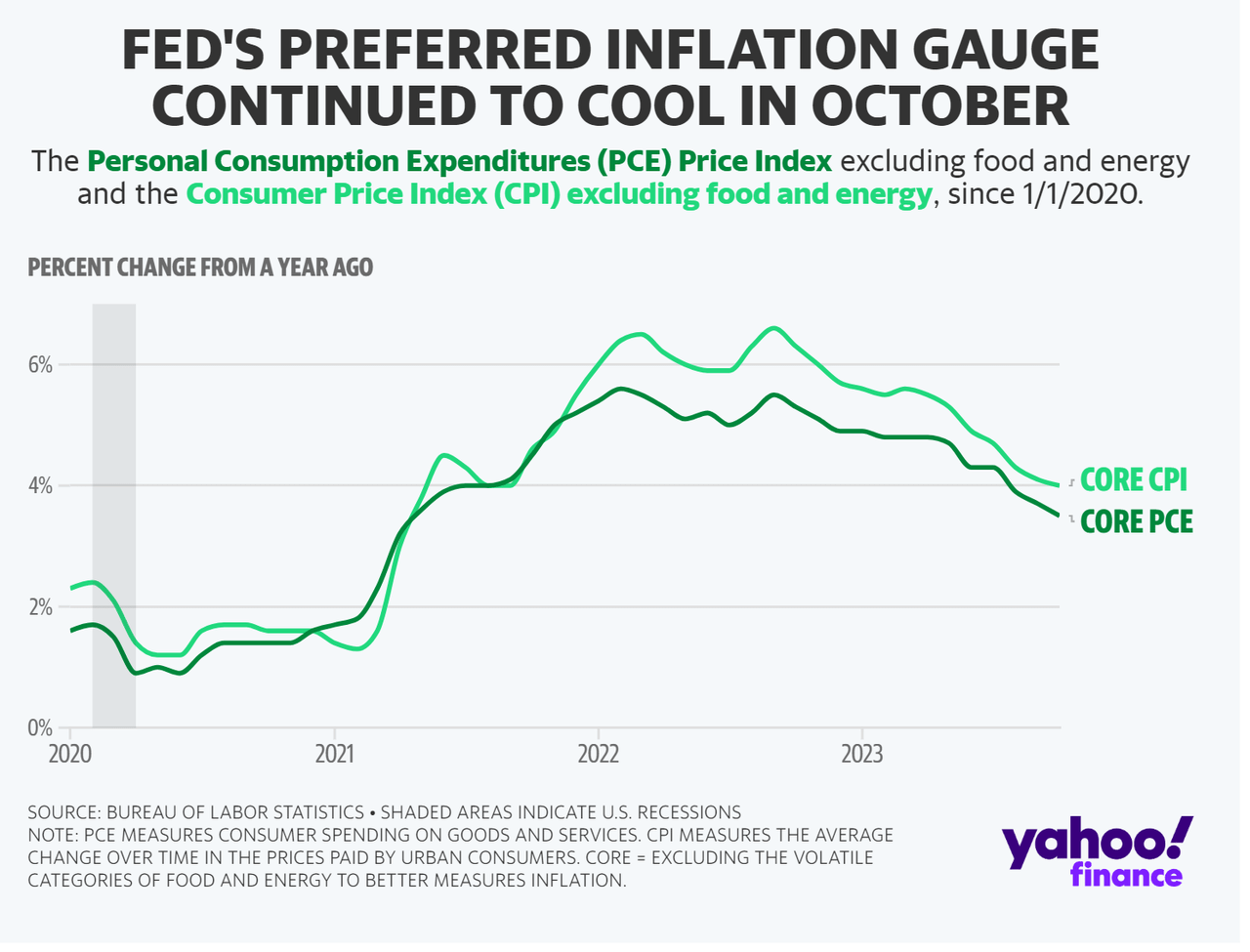

Inflation (TOS)

Throughout a press convention, Fed Chairman Jerome Powell defined that the inclusion of the phrase “any” within the coverage assertion acknowledged that they could have reached or approached the height fee for this financial cycle. Nonetheless, he emphasised that they didn’t need to rule out the potential for additional fee hikes completely, and the choice would rely upon financial and monetary developments.

Powell reiterated the necessity for extra proof that inflation is transferring towards their 2% goal, and acknowledged the potential for sudden financial developments within the coming yr. He emphasised that whereas there isn’t any present indication of a recession, there stays a major chance of 1 occurring.

Relating to the timing of fee cuts, Powell didn’t present particular steerage however indicated that the Fed is discussing when to ease coverage restraints. The objective could be to behave earlier than inflation reaches 2% to keep away from overshooting the goal.

The coverage assertion additionally acknowledged the progress made in inflation however famous that it “stays elevated.” Moreover, it acknowledged the financial slowdown for the reason that fast progress seen within the third quarter and revised the financial progress forecast for subsequent yr to 1.4%, down barely from the earlier estimate of 1.5% in September. Fed officers anticipate the unemployment fee rising to 4.1% subsequent yr.

Latest inflation readings present a lower, with the core Private Consumption Expenditures index, the Fed’s most popular inflation measure, dropping to three.5% in October from 3.7% in September and 4.3% in June. The Client Worth Index, excluding unstable meals and power costs, confirmed a 4% enhance in November, per October’s fee.

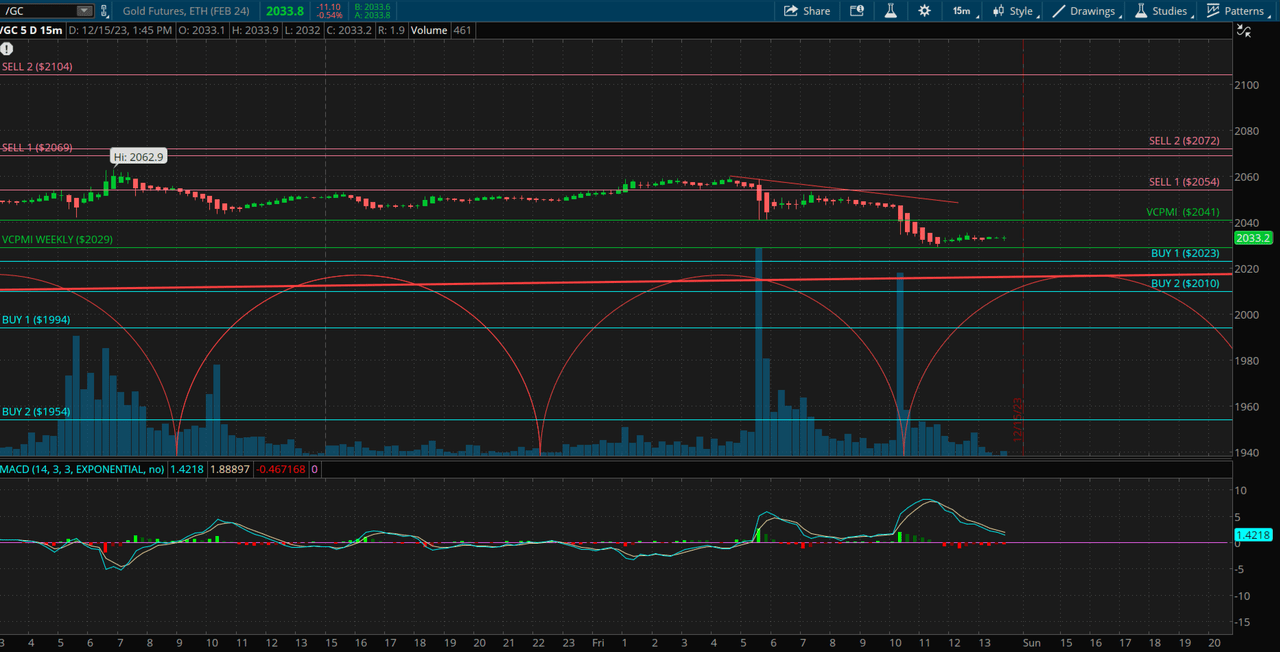

Let’s check out the weekly normal deviation report revealed within the Market Place part and see what brief time period buying and selling alternatives we are able to establish for subsequent week’s buying and selling.

GOLD: Weekly Customary Deviation Report

Dec. 16, 2023 11:21 AM ET

Abstract

Weekly development momentum is bullish so long as gold futures contract stays above 9-day SMA. Weekly worth momentum is bullish so long as market closes above VC Weekly Worth Momentum Indicator. Particular ranges for taking earnings and coming into trades talked about, with potential turning level on 12.30.23.

GOLD WEEKLY (TOS)

Weekly Development Momentum: The weekly development momentum is taken into account bullish so long as the gold futures contract stays above the 9-day Easy Transferring Common (SMA), which is at 2020. An in depth under the 9 SMA would change the short-term development to impartial.

Weekly Worth Momentum: The weekly worth momentum can be thought-about bullish so long as the market closes above the VC Weekly Worth Momentum Indicator at 2029. An in depth under this indicator would flip the short-term development to impartial.

Weekly Worth Indicator Ranges: Particular ranges for taking earnings and coming into trades. For brief positions, contemplate taking earnings at ranges between 1994 and 1953 throughout corrections. For lengthy positions, look to enter on a weekly reversal cease. If lengthy, use 1953 as a Month-to-month Cease Shut Solely and Good Until Cancelled order. Moreover, contemplate taking earnings when the value reaches the 2069–2103 ranges in the course of the month.

Cycle Date: The following cycle due date is talked about as 12.30.23, which could point out a possible turning level or occasion in your buying and selling technique.

Technique: If you’re at present in a protracted place, contemplate taking earnings when the value reaches the 2069–2103 ranges.

Please observe that buying and selling in monetary markets entails dangers, and it is important to have a well-defined buying and selling plan, threat administration technique, and keep up to date with the most recent market situations. It is also a superb follow to seek the advice of with a monetary advisor or conduct thorough analysis earlier than making any buying and selling choices.

[ad_2]

Source link