[ad_1]

Gold got here below stress, owing to the US greenback’s strengthening and sustained Treasury Yields, which led to losses right down to a one-month low of $2,001.72 per ounce. The latest surge within the worth of the greenback, triggered by hawkish statements from the Federal Reserve, lowered expectations of upcoming rate of interest cuts, which boosted Treasury yields and the greenback.

The greenback index, which is close to its highest degree in a month, was additional supported by Fed Chairman Christopher Waller’s warning in opposition to speedy charge cuts to maintain inflation low. The yield on 10-year Treasury bonds elevated concurrently. The market is kind of pessimistic about the potential for a well timed charge minimize, which can stress gold costs. The affect of this minimize is delayed as a result of sturdy greenback, making it tough for gold to proceed rising.

In an announcement on Thursday, Federal Reserve Financial institution of Atlanta President Raphael Bostic mentioned, as a result of surprising rise in inflation, he anticipates a charge minimize by the central financial institution within the third quarter of 2024 and never within the fourth quarter.

“As a result of I’m data-dependent, I’ve included surprising advances in inflation and financial exercise into my forecast and thus elevated my projected timing to start normalizing the federal funds charge to the third quarter of this 12 months from the fourth quarter,” Bostic famous on the Atlanta Enterprise Chronicle’s Financial Outlook 2024 occasion.

Nonetheless, Bostic additional cautioned in opposition to adopting a “decisive strategy” to financial coverage amid an “unpredictable setting…I consider we must always let occasions proceed to unfold earlier than starting the method of coverage normalization,” he added.

Regardless of these difficulties, geopolitical issues preserve gold costs above the $2,000 mark as a counterweight. The valuable steel has a robust future forward, regardless of continued tensions all over the world and commodity purchases by banks reaching report highs. International geopolitical tensions are rising, but banks are nonetheless accumulating unprecedented quantities of gold.

Market reactions to greenback energy and the Fed’s cautious stance in direction of charge cuts spotlight the advanced dynamics at play, though the present local weather offers headwinds for gold. The setting by which buyers function is one by which the outcomes of financial choices take time to materialize. Gold’s endurance is demonstrated by its capability to carry its worth within the face of sturdy currencies and a unstable market environment.

Briefly, the dynamic setting for gold is created by the interplay of a number of elements, akin to greenback energy, geopolitical tensions and central financial institution operations. Traders hoping to benefit from the dear steel’s potential in an ever-changing market setting want to concentrate to vital resistance ranges and perceive the delicate responses to financial cues as these difficulties are labored by means of.

XAUUSD on Thursday’s buying and selling closed +0.75%, supported by geopolitical dangers within the Center East, as Houthi rebels proceed to assault ships within the Pink Sea off the coast of Yemen. Moreover, rising inflation expectations boosted demand for gold as an inflation hedge after the 10-year breakeven inflation charge rose to a 2-month excessive of two.348% on Thursday. Gold’s good points have been capped by a stronger greenback and better international bond yields. As well as, the December 13-14 ECB assembly report launched on Thursday was bearish for gold, because it confirmed ECB officers rejected market expectations of an ECB charge minimize.

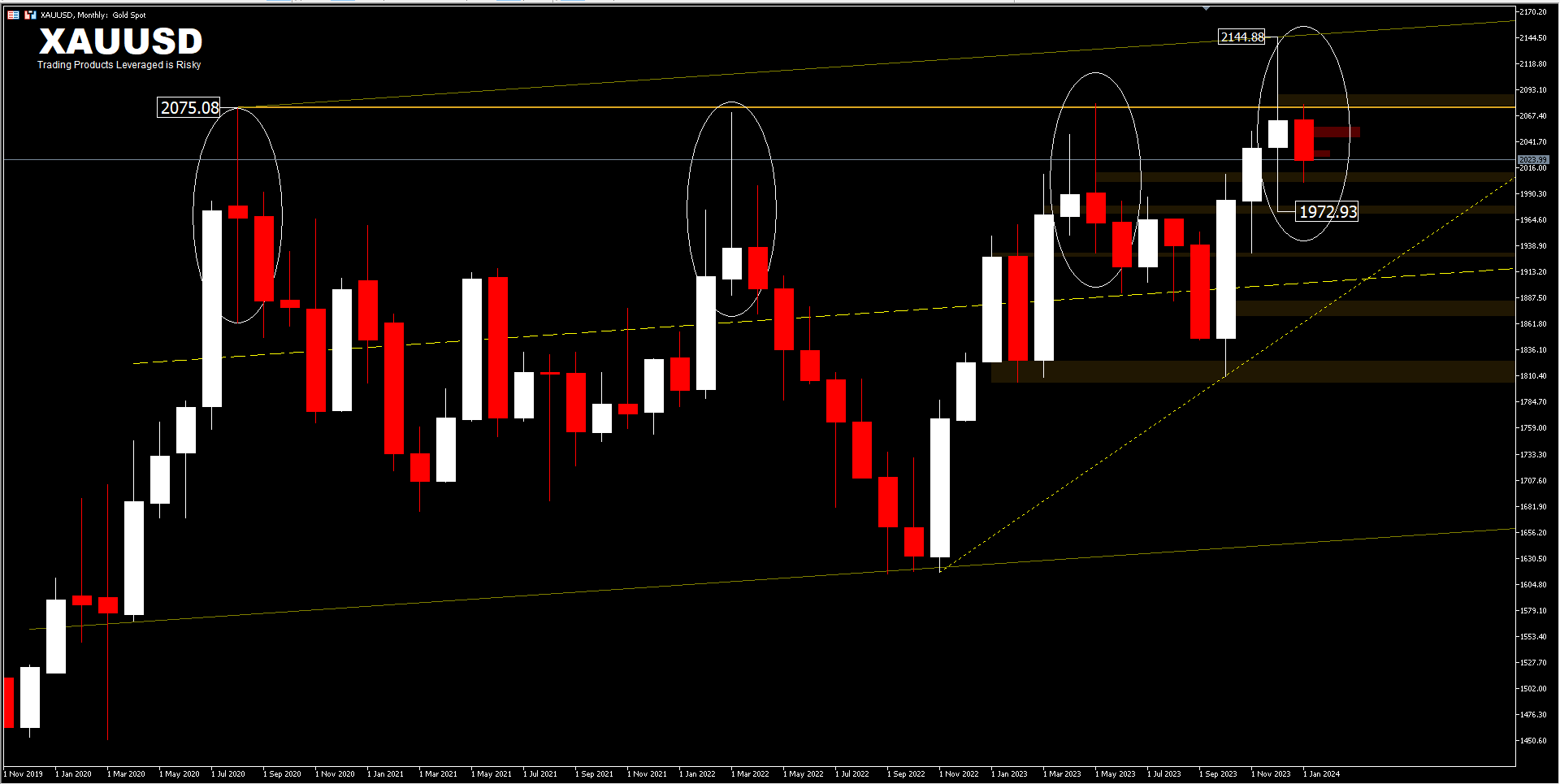

GOLD, MN

From a technical perspective, on the month-to-month chart, the common peak value is at a value vary of $2075.00. Ignoring the ATH of $2144.88, the yearly value degree could be a bear stronghold that will problem the bulls to create new defenses above it. Of the a number of month-to-month peak value patterns, the August 2020 high-wave candle, the March 2022 capturing star candle and the April-Might 2023 exterior pin bar gave delivery to a value decline. The presence of the December 2023 high-wave candle (1972.93-2144.88) briefly overshadows the January 2024 drop.

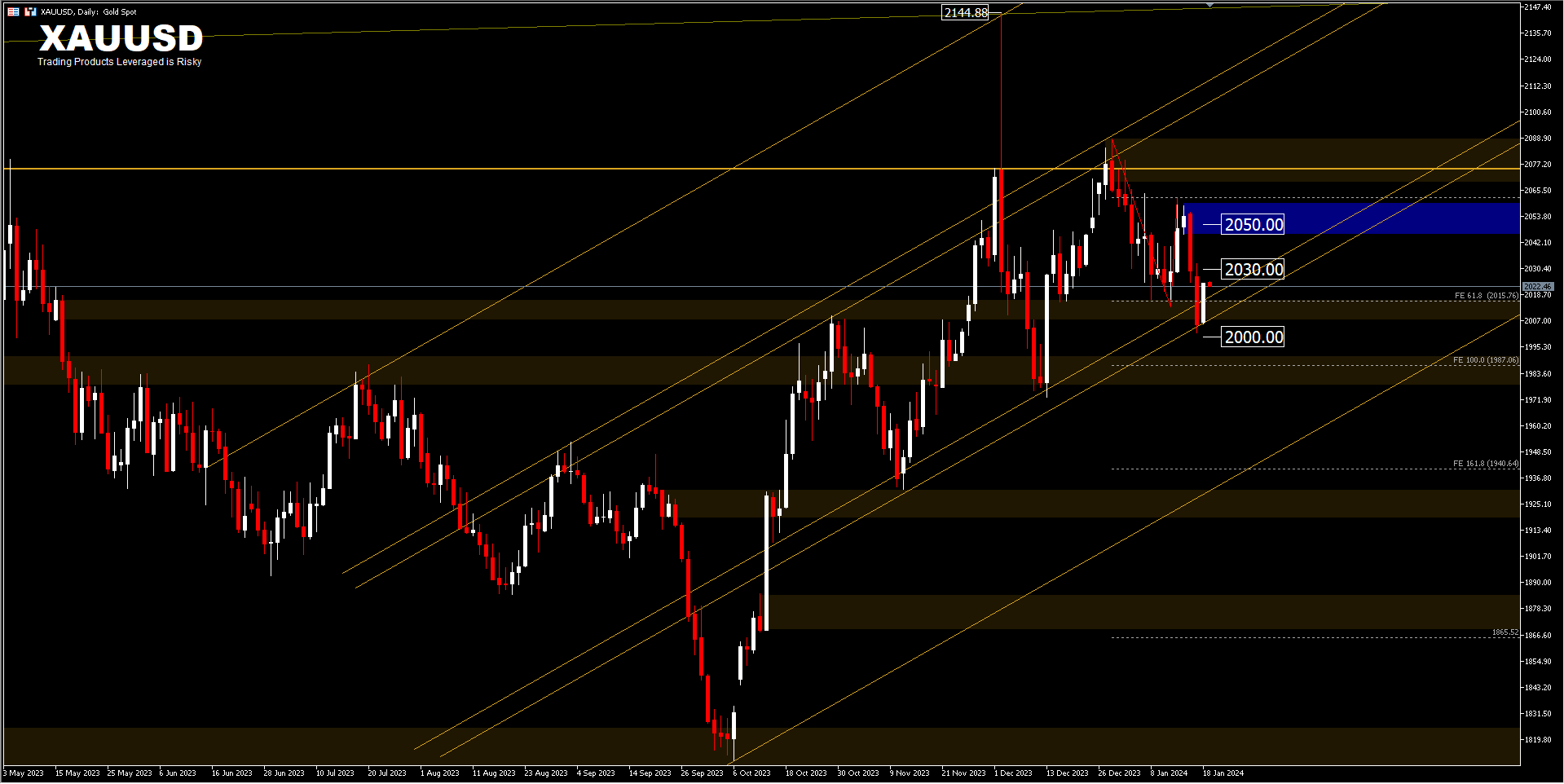

XAUUSD, D1

Gold value dynamics relies on the American rate of interest market, however geopolitical elements even have an important affect. On the upside, a transfer above the extent of $2032.83 directs consideration to $2,050. Going past this degree may create a unique section for merchants to chase the common excessive of $2075.00.

However, a break under $2000.00 as a considerable assist provides good prospects for the bulls to cost decrease with projections for FE100% at 1987.08 [from 2088.34-2013.22 and 2062.18 pullback]. Nonetheless, so long as the value is above $2000.00, it could sign the potential for the market to oscillate in a spread between $2,000-$2,050 first. The present value is characterised by a each day inside bar sample.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link