[ad_1]

hatman12

Co-authored with “Hidden Alternatives.”

In center college physics, we realized about easy machines, these primary mechanical gadgets for making use of pressure and getting work carried out. Take into consideration the wheel and axle, one of the crucial vital innovations within the historical past of humankind. As easy as it’s, we wouldn’t survive with out it – cars, trains, and practically all manufacturing unit tools wouldn’t exist. We might be shifting masses by carrying them or by utilizing sleds or the backs of animals.

Pulleys, wedges, and inclined planes are all examples of straightforward machines instrumental in our every day lives, simplifying duties that will in any other case be exhausting to finish. The engineer in me can’t cease appreciating and speaking about easy instruments and applied sciences that make our lives extra comfy. Allow us to get again on observe to debate easy methods to brighten your retirement.

Dividends are the easy machines within the monetary world, simplifying an in any other case difficult retirement by supplying an everyday money infusion into our accounts. It doesn’t matter what the market does every day, I do know a sure set of dividends can be credited into my account – this sense is priceless.

They are saying the primary million is the toughest. It’s because as soon as a sure stage of wealth is attained, the facility of compound curiosity performs a major function. As investments pay dividends, and when these dividends are reinvested, we speed up wealth accumulation, making subsequent hundreds of thousands simpler (and extra automated) to achieve.

“Compound curiosity is the eighth marvel of the world. He who understands it, earns it … he who does not … pays it.” – Albert Einstein.

Like easy machines powering advanced equipment, easy dividends coupled with the facility of compounding is the key to my wholesome retirement. So, that’s sufficient physics for as we speak; let’s take a look at two picks to make some cash.

Decide #1: RVT – Yield 7.5%

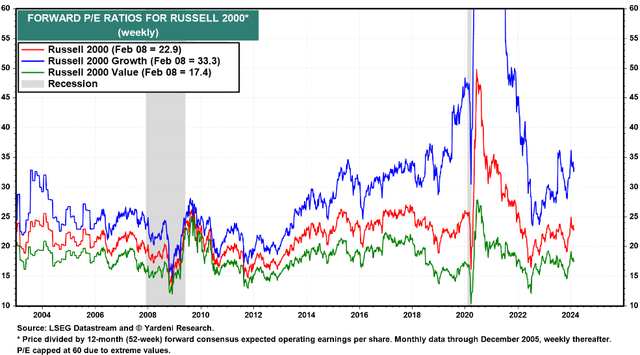

The monetary markets ended FY 2023 with worth shares being traditionally cheaper than every other class of securities. The small-cap worth class carried a mean worth / honest worth ratio of 0.84%, implying a 16% discounted pricing, whereas massive hole development shares traded at a whopping 15% premium. The divergent restoration from the 2022 bear market is clearly seen within the chart under, with buyers overpaying for development names at a time when our financial system is grinding right into a recession. Supply.

Yardeni Analysis

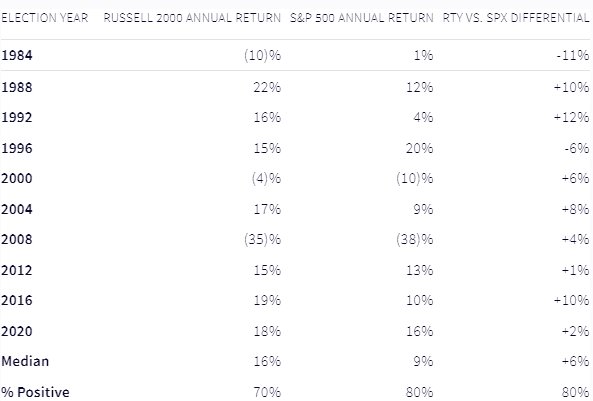

In keeping with a examine by Goldman Sachs, in 80% of the election years since 1984, the Russell 2000 has outperformed the S&P 500. Supply.

Nasdaq

Along with being an election yr, in 2024, we anticipate to see a major change within the Fed’s rate of interest coverage, and normalizing charges will set off a valuation reset, fueling small-cap restoration in 2024.

Royce Worth Belief (RVT) is a small-cap closed-end fund, or CEF, managed since its inception in 1986 by the identical portfolio supervisor – Chuck Royce. Though Mr. Royce has taken a step again from lead portfolio supervisor duties since 2022, the Royce funds proceed to learn from his oversight and expertise.

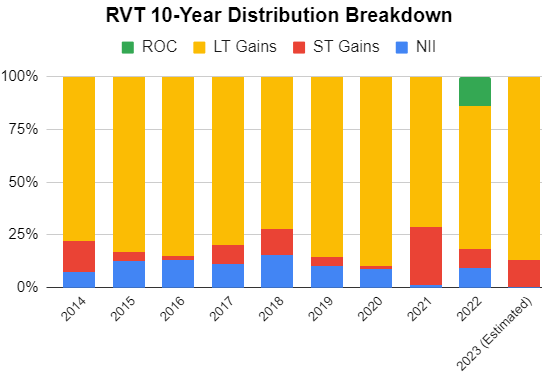

RVT is massively diversified throughout 486 holdings, a much-needed requirement as small caps are typically a riskier funding class. The CEF is actively managed, with a 2022 portfolio turnover price of 60%. This implies a holding stays within the portfolio for about 20 months. As such, it doesn’t come as a shock that a good portion of RVT’s distributions over the previous ten years have been from long-term capital positive factors.

Writer’s Calculations

Industrials and manufacturing firms stand to learn considerably from authorities incentives and initiatives to boost home manufacturing capabilities. This section is the biggest holding for RVT, representing ~24% of the CEF’s property. The subsequent largest sector is financials (~19%), which continues to be deeply discounted following a number of financial institution failures from 2024 and stands to exhibit sturdy restoration with rate of interest normalization.

RVT doesn’t make the most of leverage in its funding technique and maintains a variable distribution that’s adjusted quarterly based mostly on NAV on the finish of the trailing 4 quarters. Which means that the distribution rises and falls with RVT’s NAV, however for the reason that calculation makes use of a mean of the previous 4 quarters, the cost modifications are gradual.

RVT’s administration payment construction reveals a uncommon characteristic amongst CEFs, indicating a major incentive for administration alignment with shareholder pursuits:

Advisor charges can improve or lower based mostly on the fund’s efficiency relative to the S&P 600 SmallCap Index benchmark.

The fund managers will forfeit charges for any month when the fund’s efficiency over a trailing 36-month interval is adverse.

At a ~11% low cost to NAV, RVT presents a wonderful cut price to journey the restoration of the small-cap sector. Small caps are well-positioned for a powerful restoration in 2024, and RVT is among the finest income-oriented funds to journey this restoration. Pushed by a time-tested energetic administration technique and a administration crew that eats its personal cooking, this CEF pays 7.5% to attend for the massive valuation reset.

Decide #2: BTO – Yield 9.1%

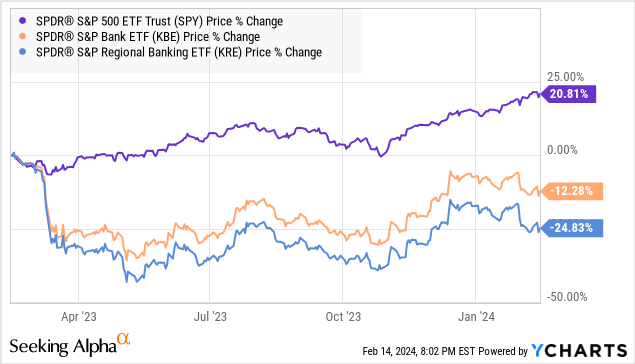

It has been ten and a half months for the reason that FDIC shut down Silicon Valley Financial institution, making it the third-largest financial institution failure in the US. Mr. Market feared banking names, and regional banks bought the worst of his emotional spree.

Banks virtually grew to become the pariah of the inventory market, with analysts of various reputations and backgrounds trying to foretell the following “shoe that may drop.” However the actuality is that the Feds moved rapidly and aggressively, and there was no “contagion,” so to talk, within the sector. Whereas banks recovered since their darkest days of 2023, they nonetheless stay considerably undervalued.

The terminal rate of interest is sort of right here, and historic market efficiency reveals that banks outperform when charges peak and head downward. It’s because as rates of interest fall, bond market valuations rise, easing strain on banks and permitting them to spice up their earnings and regulatory capital ratios.

RBC analysts level out two particular eventualities the place price peaks fueled banking sector rallies:

1994-95 price cycle: The Federal Reserve engineered a comfortable touchdown after elevating rates of interest from 3% to six%. Charge hikes led to Feb 1995, however shares bottomed months earlier than and demonstrated a 55% rally in 1995-96.

2004-06 price cycle: The Federal Reserve beneath Chair Alan Greenspan saved rates of interest elevated from mid-2006 to late 2007. Shares rallied by 2007 however plummeted as a result of International Monetary Disaster, primarily as a result of credit score issues.

Credit score high quality wasn’t a problem in 1994 however grew to become a deadly drawback for the monetary sector in 2006, leading to extremely contrasting market outcomes.

Credit score high quality is carefully monitored and wholesome in as we speak’s market. Banks have been working cautiously amidst QT, and their loss-absorbing capability stays traditionally sturdy, demonstrating readiness to handle an unsure macroeconomic and regulatory atmosphere. Common reserve protection elevated for the seventh consecutive quarter to 2.2%, evaluating favorably with pre-pandemic ranges (1.6% in This fall 2019). Equally, financial institution CET1 ratios have been increased vs. historic ranges, averaging 11.4% in contrast with 10.9% on the finish of FY 2022 and 10.8% on the finish of FY 2019. Credit score company Fitch expects banks to proceed to protect capital given regulatory uncertainty pending the finalization of proposed capital guidelines. RBC Capital Administration estimates that U.S. banks have set provisions sufficient to deal with credit score losses and defaults for a situation the place the unemployment price is 5% (We’re at 3.8% per the December 2023 report).

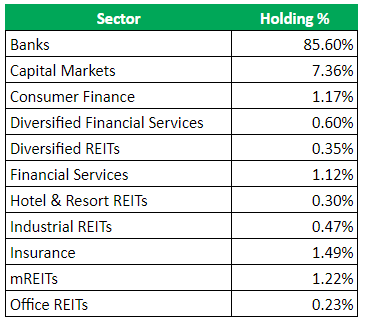

Banks proceed to get better from the March 2023 scare, sentimentally and essentially. We need to receives a commission to journey the restoration with the John Hancock Monetary Alternatives Fund (BTO) – a CEF with ~95% of its allocations to banks, capital markets, and different monetary providers firms.

Writer’s Calculations

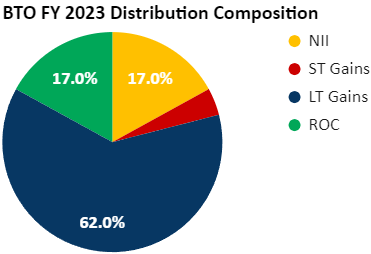

BTO’s distributions in 2023 comprised 62% Lengthy-term Good points, 4% Quick-term Good points, 17% web funding earnings, and 17% return of capital. We anticipate continued era of capital positive factors in 2024 as financial institution valuations enhance.

Writer’s Calculations

BTO operates with a ~18% leverage at a modest curiosity expense of 0.47%. This units the fund up for boosted returns with the banking sector restoration.

BTO distributes $0.65/share each quarter, reflecting a 9.1% annualized yield. Given the fund’s tenure available in the market and demonstrated shareholder returns since inception, the CEF has at all times traded at wholesome premiums (typically double-digit) to its Web Asset Worth. BTO is now a cut price, buying and selling at par.

In as we speak’s report, we mentioned two previous price peaks (adopted by cuts), and present banking sector parameters resemble one. But, market speculators are inclined to assume the worst in each situation and draw parallels to solely the problematic instances of the previous. As earnings buyers, time available in the market is cash by wholesome distributions. BTO’s 9.1% yield supplies an effective way to journey the banking sector’s restoration.

Conclusion

Little drops of water make the mighty ocean. Retirement is that massive ocean that everybody worries and stresses about, however this may be simplified with a number of sources of earnings. Our Investing Group maintains a mannequin portfolio of +45 securities, focusing on an total yield of +9%. We satisfaction ourselves on this diversification – no single supply constitutes greater than a single-digit proportion of our portfolio earnings.

We take into account dividends because the constructing blocks for monetary progress and success. Along with the facility of compounding, these may also help snowball your retirement earnings, one greenback at a time. Starting early, investing usually, reinvesting persistently, and remaining rational in decision-making are the secrets and techniques to long-term wealth accumulation.

BTO and RVT are two time-tested CEFs with profitable navigation by quite a few bear markets and recessions. Their allocation to crucial but undervalued sectors, present yield ranges, and discounted valuation makes them engaging picks to spice up our portfolio earnings. Each advanced piece of kit round us is constructed with less complicated instruments. I’m simplifying my advanced retirement planning with easy and dependable dividends. In illness and in well being, I get my share with none effort. That’s the great thing about my Revenue Technique and the unbeatable energy of earnings investing.

[ad_2]

Source link