[ad_1]

da-kuk

It is good to cowl ETFs that are inclined to not get a lot consideration which have fascinating methodologies. To that finish, let’s check out the HCM Defender 100 Index ETF (NYSEARCA:QQH), which I believe has an fascinating methodology which, though it hasn’t generated significant alpha during the last a number of years, is price maintaining a tally of.

QQH is an ETF that primarily invests in equities and Treasury Payments (T-Payments). It strives to supply funding outcomes that align with the efficiency of the HCM Defender 100 Index. The fund is designed to copy the returns of the Nasdaq when the market is trending upwards, and to transition to a extra conservative stance with a better money allocation when the proprietary quantitative alerts flip bearish.

The fund’s construction is pushed by energetic administration utilizing pattern evaluation. The fund mechanically switches to lower-risk devices when market alerts recommend a risk-off atmosphere. This alleviates the standard burden on a retail investor to individually resolve when to maneuver into decrease beta devices.

Understanding the HCM Defender 100 Index

The HCM Defender 100 Index types the inspiration of the ETF’s funding strategy. The index incorporates a proprietary quantitative program and pattern evaluation to decide on between a pure expertise fairness allocation, a mix of equities and T-Payments, or a pure money allocation.

The index is made up of securities from the Solactive US Know-how 100 Index, which incorporates the biggest and most liquid firms recognized within the Know-how sector. It additionally consists of securities from the Solactive 1-3 month US T-Invoice Index, which includes U.S. dollar-denominated T-Payments with a maturity interval of 1 to three months.

In essence, the HCM Defender 100 Index is a structured index that actively switches between 100% allocation to expertise shares and 100% allocation to money by way of T-Payments. The index operates on 4 levers: 100% shares, 70/30 stocks-cash, 40/60 stocks-cash, and 100% money.

Composition of the HCM Defender 100

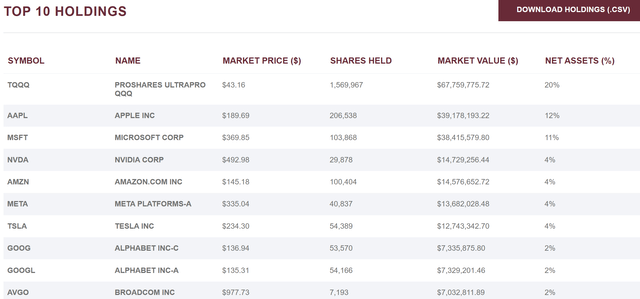

The fund consists of 100 positions, with a big weightage given to the biggest mega-cap tech shares and a leveraged Nasdaq fund. The highest 10 holdings make up over 60% of the fund’s portfolio, which considerably influences the fund’s efficiency.

The fund’s portfolio predominantly is comprised of Giant-Development allocations. Nonetheless, it is price noting that the present market atmosphere has led to valuations for Giant-Cap Development firms reaching stretched ranges, making this an overvalued portfolio impartial of tactical alerts (not less than for now).

howardcmetfs.com

Efficiency Evaluation of the HCM Defender 100

Traditionally, the fund’s efficiency has been carefully aligned with that of the Nasdaq, with notable outperformance through the 2021 interval. Though the fund underperformed through the vital market downtrend in 2022, it nonetheless had temporary intervals of outperformance as we are able to see from the worth ratio under.

stockcharts.com

Execs and Cons of Investing within the HCM Defender 100

One of many key benefits of investing within the HCM Defender 100 is its dynamic allocation technique. The fund’s construction permits it to adapt to adjustments in market situations, switching between equities and money or money equivalents primarily based on proprietary alerts. This will doubtlessly shield traders from substantial losses throughout market downturns.

Nonetheless, this strategy additionally has its drawbacks. The fund depends closely on its proprietary alerts to drive its funding selections. If these alerts are incorrect or fail to anticipate market adjustments, the fund’s efficiency may very well be adversely affected. Moreover, the fund’s concentrate on tech shares makes it prone to the inherent dangers of this sector.

Conclusion: Is the HCM Defender 100 a Good Funding?

The HCM Defender 100 affords a singular strategy to funding, offering an automatic, quant-driven algorithm that goals to mitigate dangers throughout market downturns. This may be notably useful for retail traders who usually wrestle with timing their funding selections. I believe it is an fascinating fund, and one to keep watch over ought to markets be in for a extra tumultuous journey.

[ad_2]

Source link

Add comment