[ad_1]

by Fintechnews Switzerland

November 27, 2023

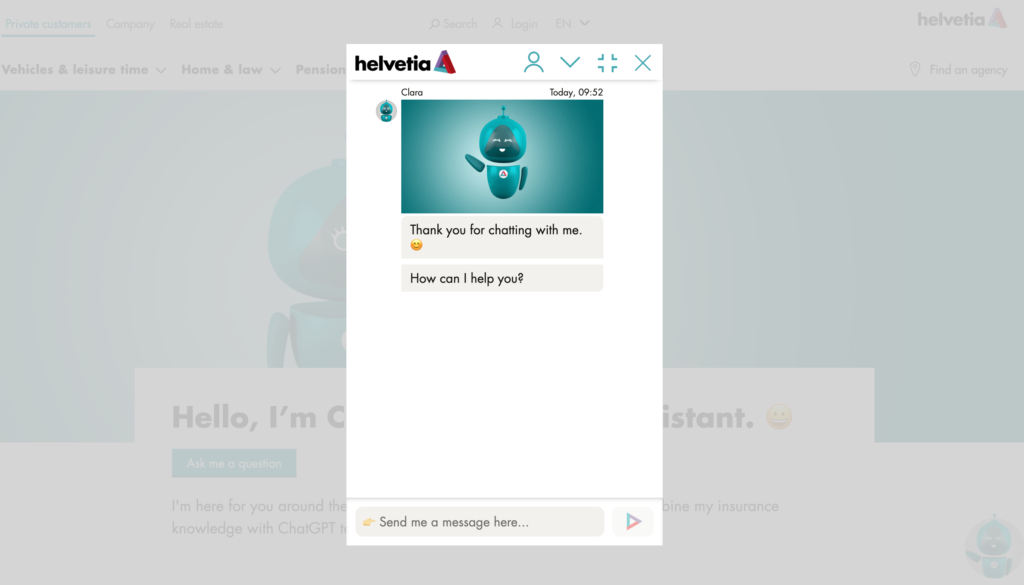

Helvetia insurance coverage enhances its digital assistant Clara. The pilot venture was launched in spring 2023 and gives a simple approach for purchasers to ask questions and describe points by way of the Helvetia web site.

Now that the trial interval is over, Clara goes reside with fast impact as a typical service powered by the newest generative AI know-how.

Jan Kundert

Jan Kundert, Head Buyer and Market Administration and Member of the Government Administration of Helvetia Switzerland:

“We’re delighted that our ChatGPT venture has been properly obtained by our clients. Our focus shifting ahead can be on tailoring what’s now Helvetia’s key self-service channel even higher to person necessities.”

Worldwide pioneering function

Following the profitable completion of the take a look at section, Clara is now going reside as a typical service incorporating the newest generative AI know-how, additional optimizing response high quality in comparison with the earlier model. Helvetia thus affords its clients in Switzerland a service that’s distinctive within the insurance coverage sector, offering easy and uncomplicated solutions to questions on insurance coverage and pensions across the clock, thereby additionally taking part in a pioneering function internationally. It stays exploratory in nature, with customers contributing to the training course of. Because of person suggestions, Clara is continually being developed additional. Customer support might be accessed in German, French, Italian, English and varied different languages.

Clients can simply ask a query or describe a problem by way of the digital assistant Clara. The service is designed to be low-threshold and might be accessed with out registration. Consumer numbers because the launch of the trial in spring 2023 present it has been properly obtained. Helvetia predicts it is going to have dealt with over 150,000 chats by the tip of this yr – virtually double the determine for final yr. In only a quick time period, Clara has thus turn out to be Helvetia’s key self-service channel. The chatbot is the right addition to the prevailing customer support providing.

Belief is important

Belief performs a key function within the relationship between insurers and their clients. That is true whether or not buyer companies are supplied by way of standard or digital channels. Though there are at the moment nonetheless no binding laws for the business, Helvetia has determined to go reside with its chatbot powered by the newest GPT know-how.

Helvetia is conscious of the ensuing duty and solely makes use of synthetic intelligence inside a managed framework. The info is managed and processed in accordance with the best safety requirements and the brand new Swiss Knowledge Safety Act (DSG), which got here into power on 1 September 2023. For instance, customers are knowledgeable that Clara can also present incorrect solutions as a result of these are generated by synthetic intelligence. As Clara solely makes use of verified sources when answering buyer questions, the chance of incorrect data is low, however Helvetia recommends contacting the client advisory service or utilizing various contact choices if something is unclear. Customers may also fee Clara’s solutions and thus assist enhance the service.

Helvetia has been utilizing synthetic intelligence for a number of years already in areas reminiscent of claims processing, identification of fraud, underwriting and advertising. The corporate actively includes its workers in AI-adoption; for instance within the improvement of self-learning fashions. Helvetia believes that utilizing synthetic intelligence expertly and transparently is essential within the improvement of present and future insurance coverage fashions.

Featured picture credit score: Helvetia

[ad_2]

Source link