[ad_1]

This week kicks off with a number of points weighing on investor sentiment:

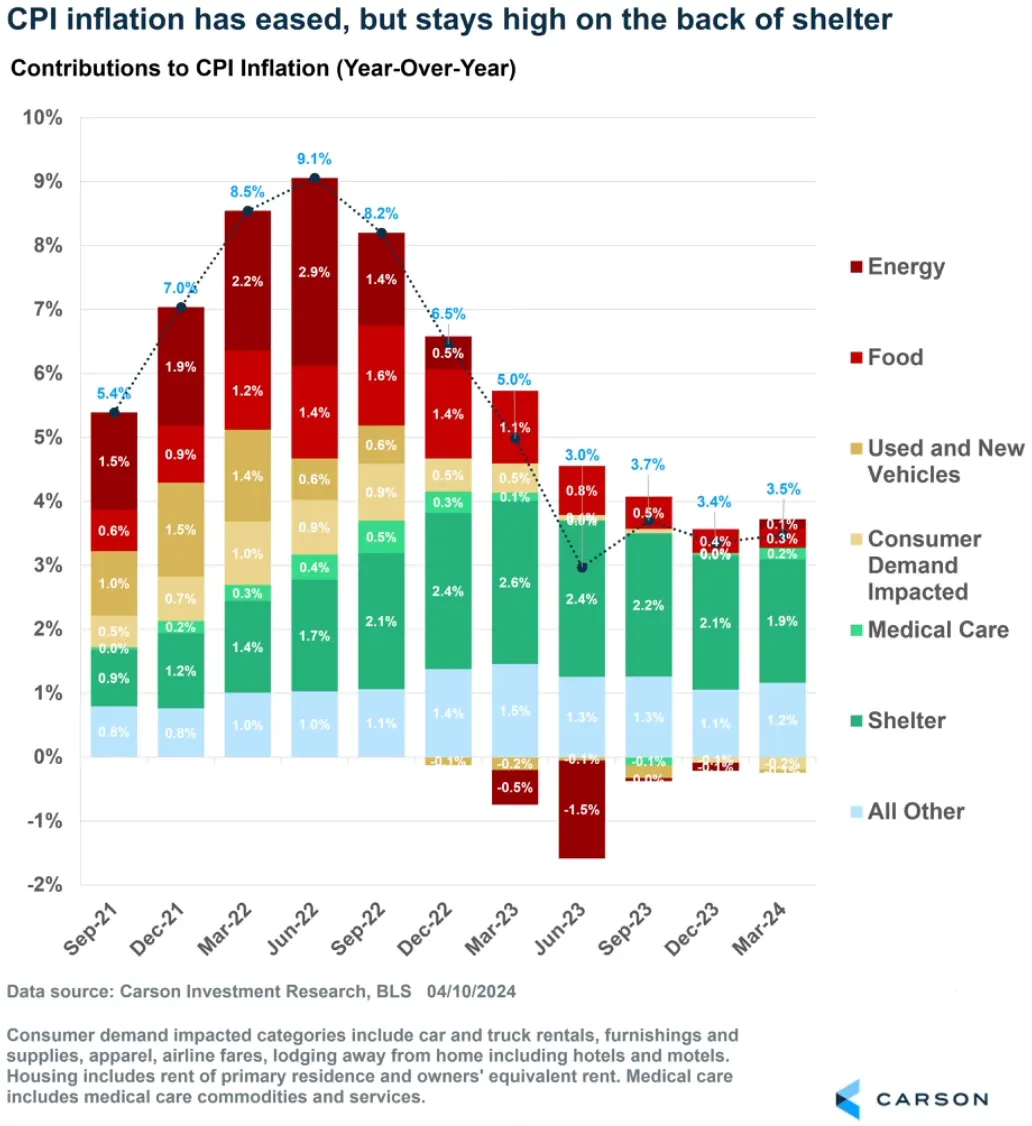

The inflation report got here in larger than anticipated, displaying a fluctuation in March.

Excluding shelter providers, rose to +4.77 p.c year-on-year in March from +3.94 p.c in February. This marks the fifth month out of the final six the place it has accelerated on a year-on-year foundation, now reaching its quickest tempo since April 2023.

Though the year-over-year improve in CPI ex-energy appears modest for now, it reached +3.57 p.c year-on-year in March, in comparison with +3.54 p.c within the earlier month.

The skilled its largest unfavorable weekly shut in six months, final week.

Volatility has elevated for the primary time in 2024, with the closing above October 2023 ranges.

At present, the info signifies that inflation is staying at a gentle degree, and the speed of disinflation is reducing. Power and commodity costs have been driving this development, with oil costs rising by 26% since December.

Rising Inflation Good for Shares?

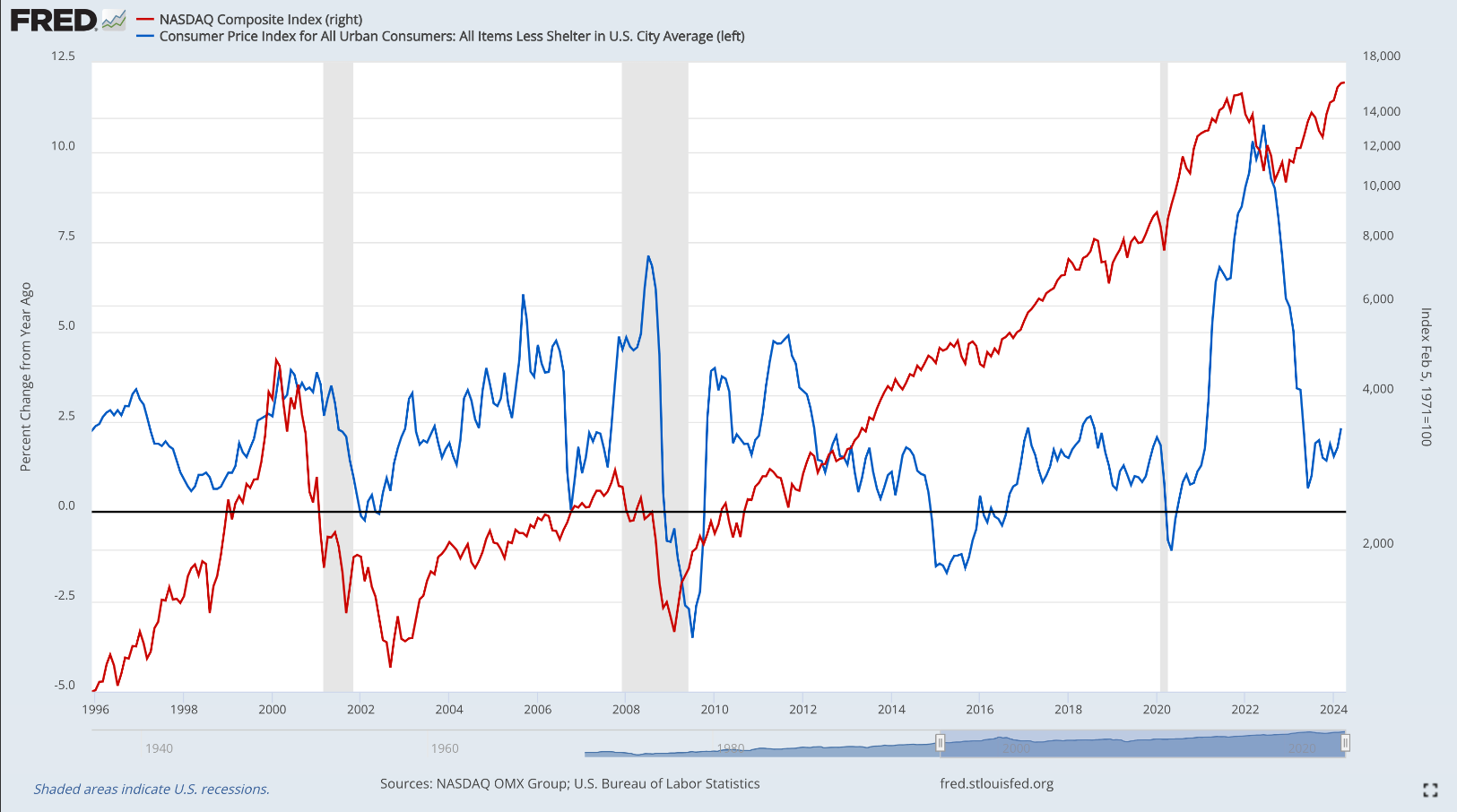

Nonetheless, growing inflation would not all the time imply unhealthy information for shares. Once we have a look at inflation exterior of housing prices and examine it with the index, we see that in instances of inflation acceleration, the inventory market tends to carry out properly.

The report exhibits us that when inflation will increase reasonably alongside financial progress, it is truly good for shares. So, there’s an opportunity that inflation and the Nasdaq will each rise collectively, with out inflation getting too excessive. Taking a look at information from 1995 to 2024, when inflation stayed under 5% yearly, shares usually saved going up.

Final Week’s Decline: Pullback or Begin of a Bear Market?

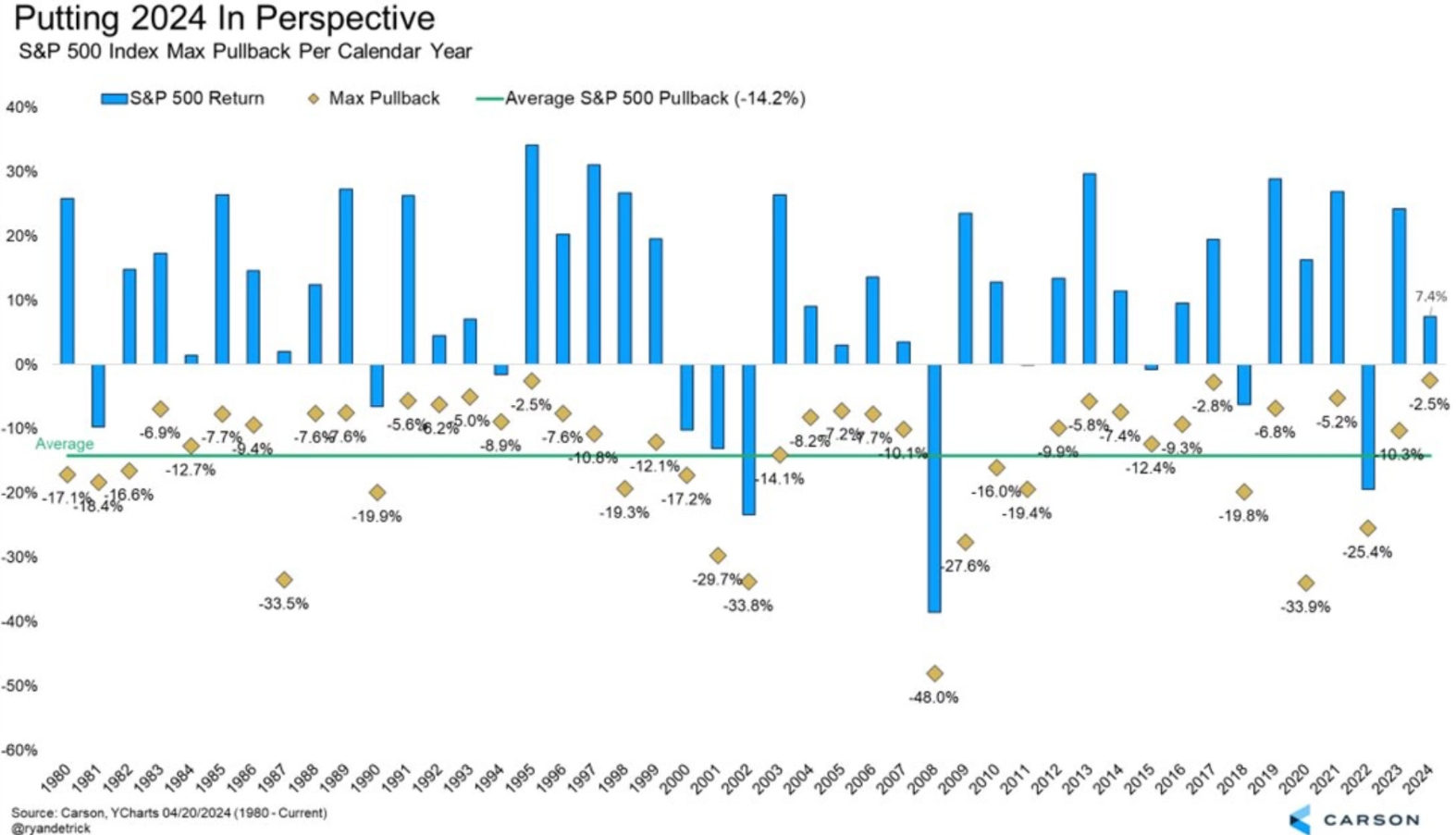

Contemplating the current volatility, it is vital to keep in mind that pullbacks are a standard a part of the market.

The chart shows the most important yearly decline within the S&P 500 and its common decline, standing at 14.2 p.c. This yr, in 2024, it is merely 2.5 p.c, marking one of many lowest drops ever, akin to the droop noticed in 1995. Comparatively, final yr, regardless of a strong rally, shares underwent a ten.2% correction.

Discussions usually revolve round our place on this bullish cycle, with some suggesting it is too late and anticipating an imminent bubble burst. The tech-driven inventory market rally is corresponding to the catastrophic dotcom crash of 2000, which stays the one substantial bubble burst within the U.S. inventory market post-World Struggle II period.

This was attributed to hovering valuations that finally collapsed on account of dismal income or earnings progress. Nonetheless, right now’s tech sector is way from being as overpriced and is witnessing real progress in underlying earnings.

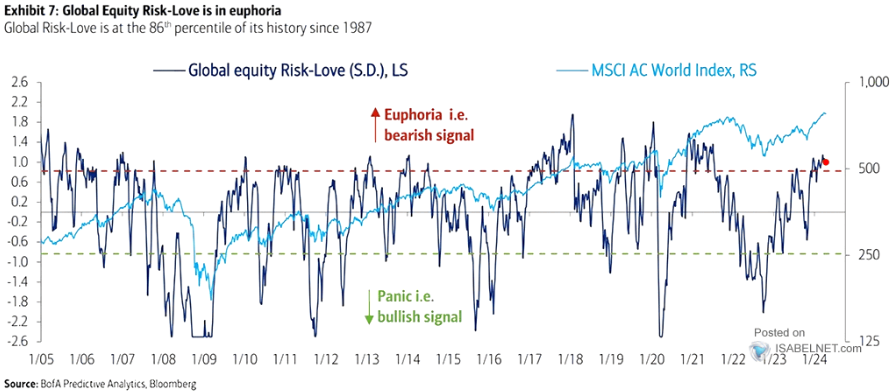

Concurrently, the World Fairness Danger-Love index, at the moment on the 86th percentile, suggests {that a} short-term pause in fairness markets would not be stunning.

The chart shows the utmost yearly pullback of the S&P 500 and its common pullback. The indicator displays numerous components like supervisor positioning, put-call ratios, investor surveys, costs, volatility, unfold, and correlations.

When the worth reaches round 0.8 or larger, it signifies a state of “euphoria” within the international inventory market. Conversely, if it fluctuates round -0.8 or under, it alerts “panic” because the prevailing sentiment.

Contemplating a number of indicators, valuations, fundamentals, and sentiment, there may be assist for a possible short-term pullback. At present, the ratio ranges are at excessive factors of optimism, suggesting elevated short-term threat.

Nonetheless, this does not rule out potential future upside, given the historic development of persistently medium-high ranges resulting in continued optimistic traits within the following months.

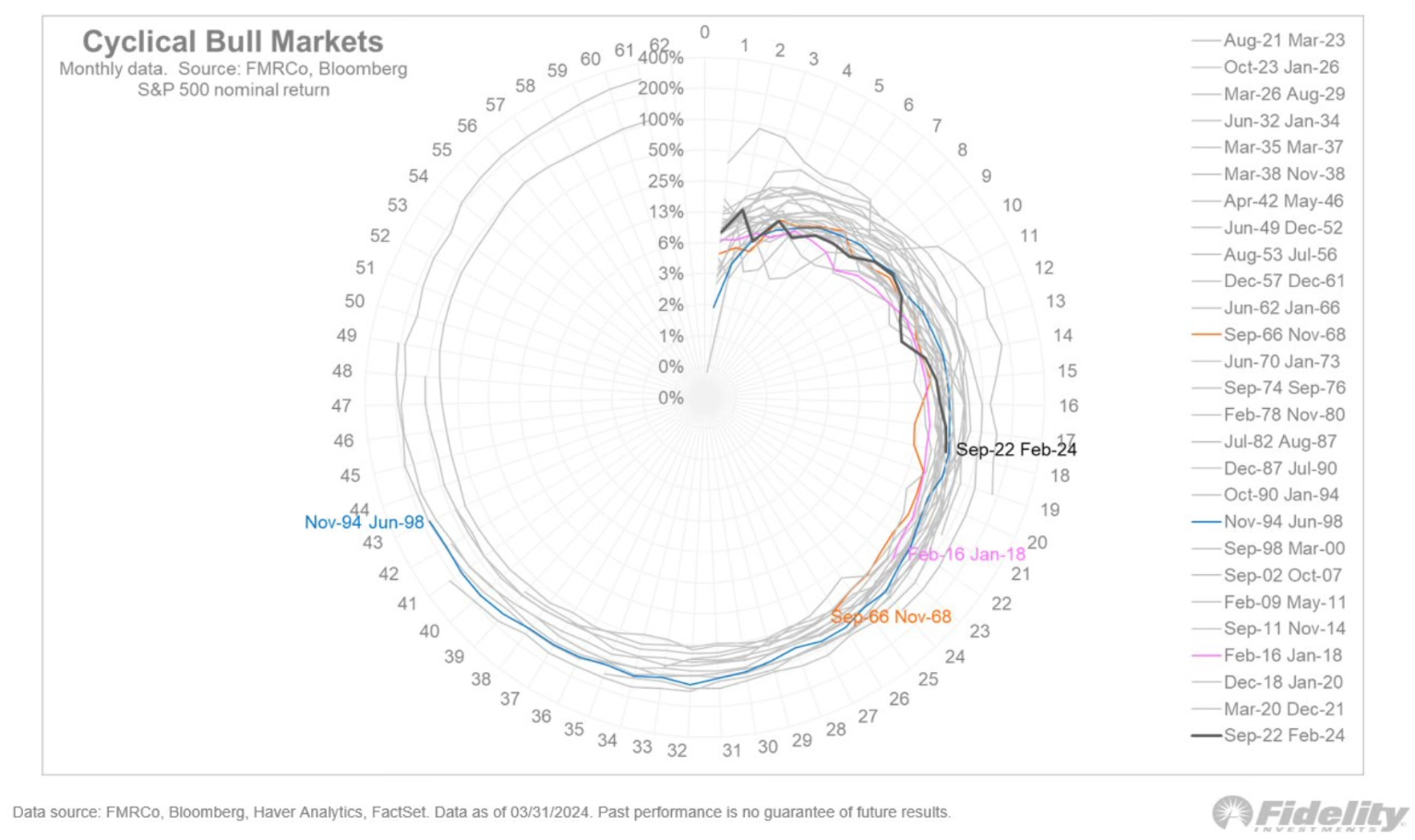

The next chart signifies that we’re at the moment within the center section of the bullish market cycle.

Constancy’s chart presents one other perspective: the cycle is depicted as a clock. At present, the clock reads 15:00 in comparison with the longest cycles in historical past. For the common cycle, it is at 18:00. In each eventualities, time at the moment favors the bulls.

***

Wish to know the Honest Worth of different shares? Strive InvestingPro+ and discover out! Subscribe HERE and recover from 40% off your annual plan for a restricted time!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any means. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding choice and the related threat stays with the investor.

[ad_2]

Source link