[ad_1]

Monty Rakusen

Funding Thesis

Honeywell (NASDAQ:HON) reported outcomes on the first, February, lacking on revenues however beating on normalized EPS. The corporate sports activities a large moat with excessive ranges of return on capital pushed by their Aerospace, Constructing Applied sciences, and Efficiency Supplies and Applied sciences segments. Subsequent outcomes are due on the twenty fifth, April, and I’m initiating a Purchase on the corporate as a result of my valuation factors to extra upside.

Background

HON is a top quality diversified industrials firm with a large financial moat. The corporate operations lead to excessive ranges of intangible belongings aligned with the corporate benefitting from excessive switching prices. I consider one key facet to the corporate’s moat is their potential to leverage software program options throughout their vary of business product choices. This software program know-how is utilized in mission-critical operations, resembling cockpit management throughout business plane flights, and buyer operations, like warehouse automation.

The aerospace section is HON’s widest moat enterprise as a result of switching prices concerned. They boast a major put in base with over 35,000 auxiliary energy models, 20,000 flight administration programs, and over 10,000 models of satellite tv for pc communication {hardware}. This class varieties 37% of gross sales and produces EBIT Margins north of 20%. They function a razor-blade enterprise mannequin whereby they provide free components and providers with a purpose to drum up enterprise for larger margin merchandise. Their merchandise are sometimes properly built-in into the plane’s mission-critical capabilities, and the lengthy supply cycle of constructing the plane leads to excessive switching prices.

Within the efficiency supplies and know-how section, HON operates three enterprise strains, common oil merchandise, which sells catalysts and adsorbents to the oil and fuel {industry}, course of options, which sells industrial software program, and superior supplies, that sells fluorine merchandise, chemical substances, and polymers. The corporate has a collection of intangible belongings from this section that kind a large moat for the corporate. And one such product is the Solstice molecule, which is a chemical compound utilized in cleansing and aerosol purposes.

The constructing applied sciences section additionally has intangible belongings shaped over a big put in base. They’ve a robust popularity from over 100 years of operation and their merchandise embrace safety and fireplace monitoring in addition to vitality utilization and local weather management.

Lastly, the security and productiveness options enterprise additionally has a slender moat. Right here, HON is investing into new markets with unsure progress prospects, which embrace the corporate’s warehouse automation choices. In keeping with knowledge, solely about 5% of warehouses are automated within the US, leaving room for severe progress going ahead. The market remains to be fragmented however will consolidate, and I consider HON is properly positioned after the acquisition of Intelligrated, a prime robotics firm, in 2016.

Financials

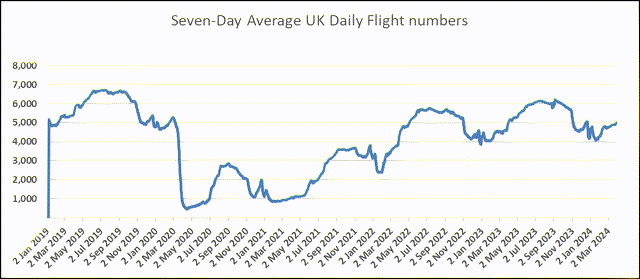

Being near 40% of revenues, the aerospace {industry} is an important class, and with the pandemic, exercise throughout this section fell considerably. This has affected the highest line 5-year CAGR, which is unfavorable, however the firm stands to profit because the {industry} recovers, and that is being factored into ahead progress charges. The corporate has a long-term goal of 4-7% progress, which I consider is achievable with a broad-based restoration in aviation and the thrilling prospects of warehouse automation, regardless of the difficult comparables on 2023. Beneath is a chart of every day flights out of UK airports, as you’ll be able to see, there was a broad-based restoration in UK flights knowledge, and the seasonally adjusted knowledge exhibits the trailing seven-day common is up on the place it was this time final yr, however stays under pre-COVID ranges.

Every day flight numbers (ONS)

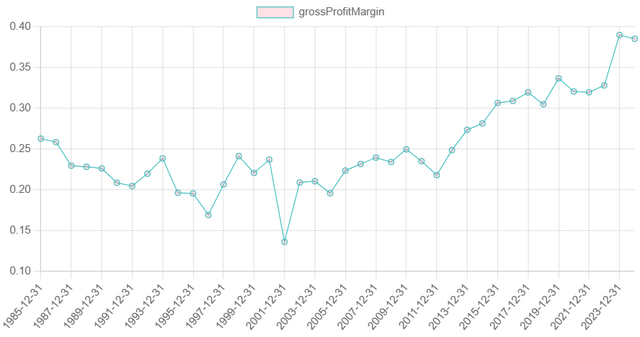

Gross Margins have expanded over 1000 foundation factors within the final decade pushed by pricing energy, and this, aligned with properly managed working overheads, has pushed up working margins to over 20%, they usually rank prime within the {industry}.

Supply: Creator’s Calculations

The corporate’s capital allocation technique entails distributing earnings to shareholders within the type of a dividend yield of two.1% and repurchasing inventory. For each greenback of gross sales, the corporate repurchases about 10 cents again, which is larger than 3M (MMM) and different friends. Additionally they spend money on R&D , which represents about 4%-5% of gross sales with a purpose to drive natural progress, and eventually, they make acquisitions.

The excessive working margins and it being a comparatively low capital intensive enterprise, leads to excessive returns on capital that exceed its value of capital. Web Debt to Gross sales sits at -1.5% which means they’ve adequate money to pay any impending debt principals.

Adjusted EPS got here in at $2.60, which represents a 3% improve on the prior yr’s quarter. Complete revenues climbed 3% on the yr, and a couple of% in fixed foreign money, as a result of progress throughout aviation and course of options. Aerospace elevated 15%, Constructing Applied sciences fell 1% as a result of decrease volumes of fireside and safety choices, Efficiency Applied sciences grew 6% pushed by progress throughout a spread of choices and Security and Productiveness decreased 24% on account of softness within the warehouse automation market.

Waiting for 2024, administration expects income progress of 4%-6% organically, 30-60 foundation factors of section margin enlargement and seven%-10% adjusted EPS progress.

Revisions

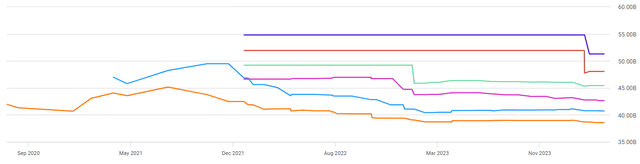

Income revisions are down roughly a p.c during the last 6-months, and have remained flat during the last month. The close to time period EPS forecasts additionally present an identical image, with revisions marginally down during the last 6-months and 1-month durations.

Income Revisions (Searching for Alpha)

On the eighth, December 2023 Honeywell introduced they’re buying Provider World Corp for $4.95 billion. The acquisition strengthens HON’s constructing automation capabilities and can permit them to grow to be a pacesetter in safety options. Moreover, in October 2023, HON received a contract to supply the T-55 engines to South Korea’s new fleet of helicopters. That is one among simply $10 billion value of contracts received by HON’s aviation section. And extra not too long ago, HON received a contract to supply hydrogen gas cells used to energy digital tools for the US military. I consider these contract wins are signal of a robust enterprise surroundings, and I can see income revisions transferring up from these ranges.

Valuation

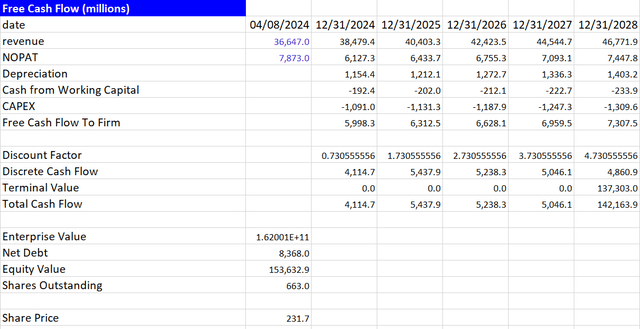

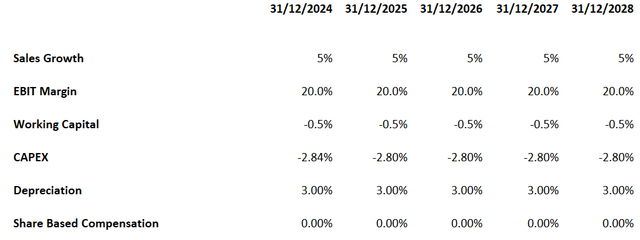

Supply: Creator’s Calculations

When valuing HON, I’ve used a P/FCF a number of of 28x (the 5-year median) for the terminal worth and a WACC of 9% to reach at a share worth goal of $230 and an upside of 17%. To attain this I’ve EBIT Margins fixed at 20%, working capital of -0.5% in relation to gross sales and CAPEX of -2.8%. I’ve stored EBIT Margins fixed to indicate the worth of the corporate, however there is perhaps room for an enlargement, as the corporate automates their provide chain going ahead.

Supply: Creator’s Calculations

Relative to the sector, HON is rated a D+ by Searching for Alpha, however there may be worth in GAAP earnings multiples and the Dividend Yield.

Dangers

The challenges to my thesis embrace, uncooked supplies prices pushing up the price of gross sales, and the corporate discovering it troublesome to push by means of the additional prices. Any downturn in flying exercise like we skilled throughout COVID-19. And the house and constructing know-how section faces danger from residential and development cycles.

Different challenges embrace, fast technological innovation, which may have an effect on a few of HON’s software program investments and lead to diminished returns on capital. Lastly, the worth of oil can be a danger, because the PMT segments promote oils and adsorbents to the oil & fuel {industry}.

Conclusion

HON is without doubt one of the strongest multi-industry companies in operation immediately. The corporate has efficiently pivoted to seize totally different ESG developments, and I consider the corporate’s choices will assist drive progress. Elevated demand for warehouse automations, safety options and the broader restoration within the aviation market will assist maintain long-term progress. This can be a high-quality firm that seems to be buying and selling at an inexpensive low cost, so I’m initiating a Purchase on the corporate with an upside of 17%.

[ad_2]

Source link