[ad_1]

Euro (EUR/USD, EUR/GBP) Evaluation

ZEW financial sentiment inches larger however confidence stays lowEUR/USD descending channel heads decrease after testing resistanceEUR/GBP testing essential assist zone – comply with by means of wantedThe evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra info go to our complete training library

Advisable by Richard Snow

Learn how to Commerce EUR/USD

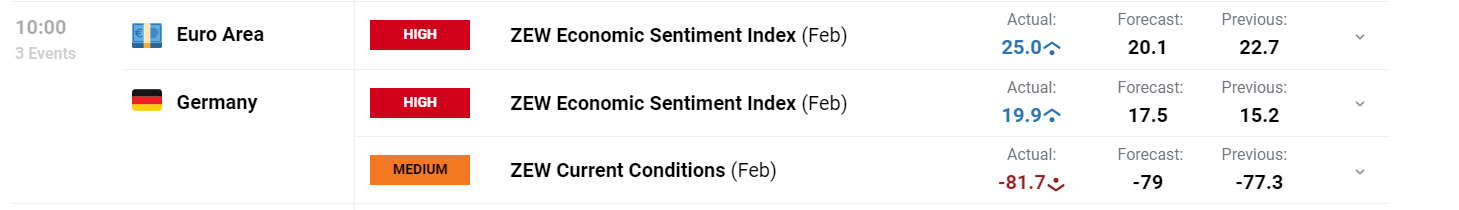

ZEW Financial Sentiment Inches Increased however Confidence Stays Low

Sentiment within the EU and in Germany proceed to climb larger however nonetheless has a protracted option to go. Analysts are persevering with to realize extra confidence within the financial outlook in 6 months’ time, however extra worrying is the notion of present circumstances which proceed to deteriorate.

Customise and filter dwell financial knowledge through our DailyFX financial calendar

The financial outlook for Europe stays pessimistic because the stagnant economic system has barely dodged a technical recession all through 2023 with little to no reprieve on the horizon in 2024. As such, markets nonetheless anticipate over 100 foundation factors (bpd) of cuts this 12 months whereas the new US CPI print for January reeled in Fed fee lower bets which now see a larger probability of the primary fee lower in June or July – beforehand March. Due to this fact, type a elementary angle, the euro may undergo additional setbacks in opposition to the greenback.

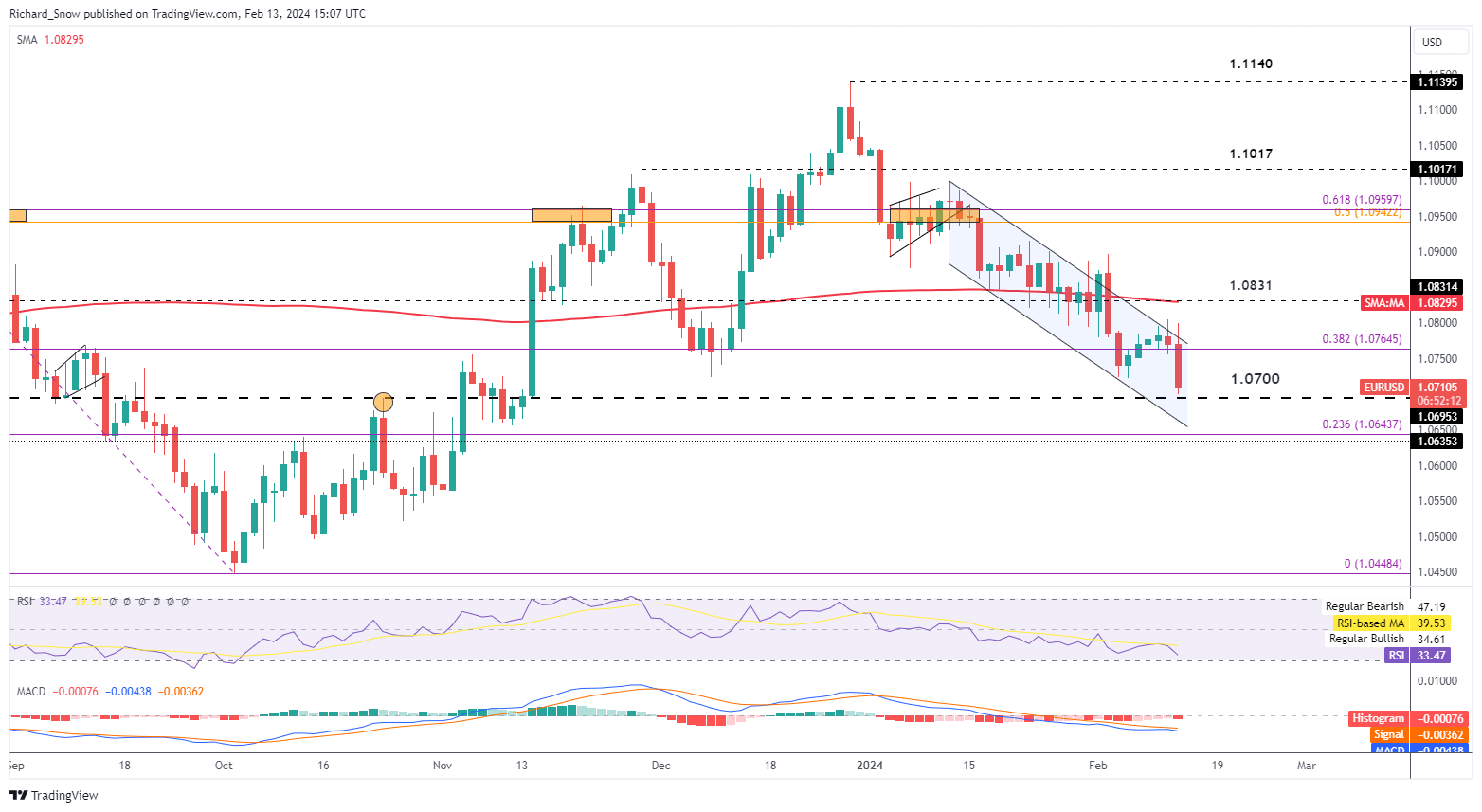

EUR/USD Descending Channel Heads Decrease After Testing Resistance

On the weekly EUR/USD chart a double backside appeared across the December and February lows (1.0724), which steered a bearish continuation could wrestle, requiring a catalyst to push additional. US CPI seems to have offered that catalyst seeing the pair head decrease, in direction of assist at 1.0700 flat. The following stage of assist seems within the type of channel assist, adopted by the 23.6% Fibonacci retracement of the 2023 main decline. Resistance is again at channel resistance and the 38.2% Fib stage.

EUR/USD Each day Chart

Supply: TradingView, ready by Richard Snow

In case you’re puzzled by buying and selling losses, why not take a step in the suitable course? Obtain our information, “Traits of Profitable Merchants,” and acquire invaluable insights to keep away from widespread pitfalls that may result in expensive errors:

Advisable by Richard Snow

Traits of Profitable Merchants

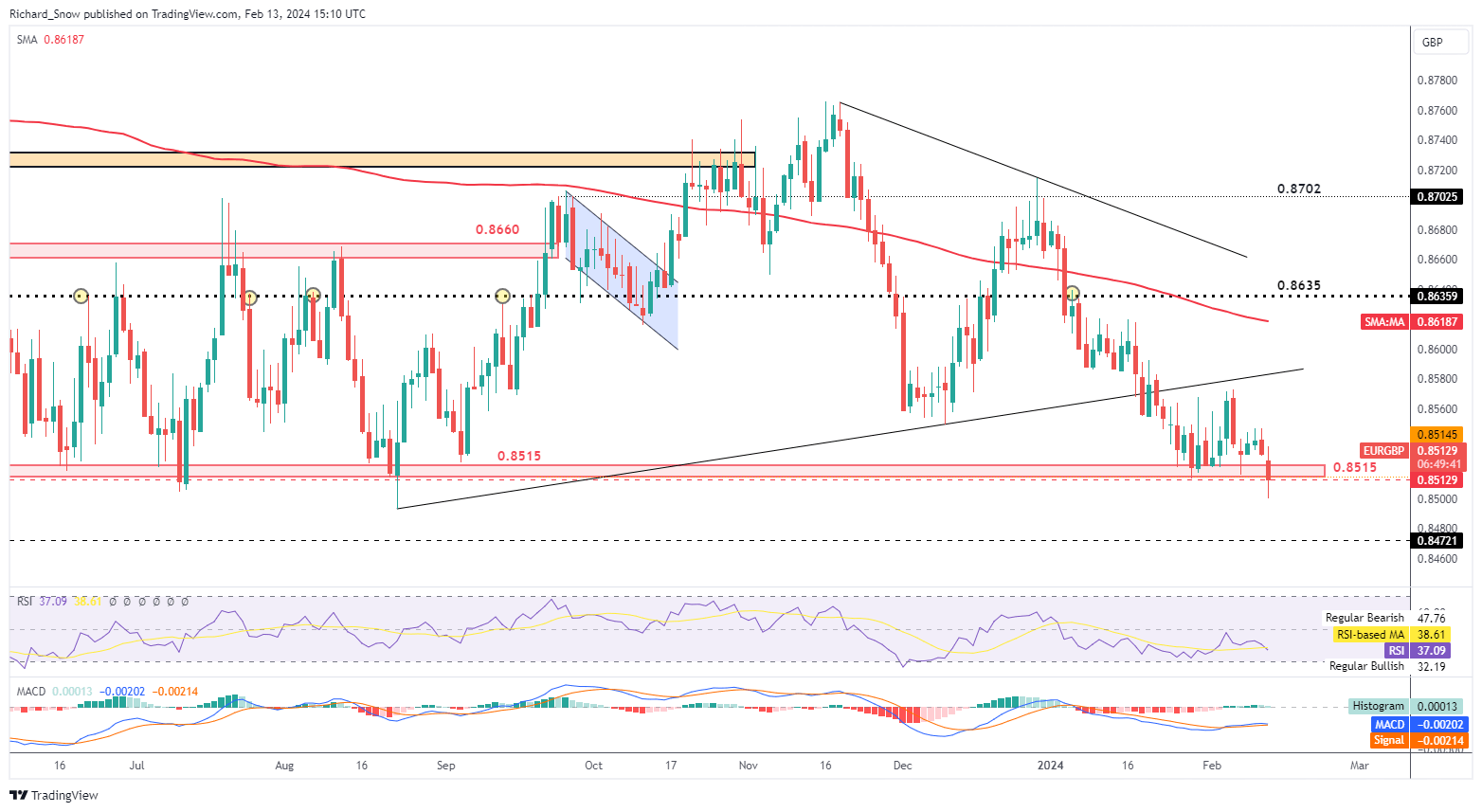

EUR/GBP Testing Essential Help Zone – Comply with By Wanted

EUR/GBP has moved decrease on the again of constructive surprises in each UK employment knowledge and common earnings. Markets now value in lower than 65 foundation factors value of cuts from the Financial institution of England, a notable decline after printing above 100 bps not too way back.

EUR/GBP must be monitored for a possible shut beneath the essential zone of assist at 0.8515. Momentum factors to the draw back with the RSI nonetheless a good distance away from oversold territory and with extra excessive significance UK knowledge nonetheless to come back, bears can have extra knowledge available. UK CPI is anticipated to print larger than the December print, doubtlessly strengthening the pound and sending EUR/GBP even decrease. Nevertheless, the pound could also be introduced again in line of quarter-on-quarter GDP reveals a technical recession for the UK.

EUR/GBP Each day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX

component contained in the component. That is in all probability not what you meant to do!

Load your utility’s JavaScript bundle contained in the component as an alternative.

[ad_2]

Source link