[ad_1]

However that’s the reverse of what a smart investor ought to do, in line with the nice Benjamin Graham

In the end, having a ‘margin of security’ whereas shopping for shares is vital and InvestingPro’s screener could be of nice assist in that respect

Safe your Black Friday good points with InvestingPro’s as much as 55% low cost!

When the inventory market is on the rise, the sensible transfer is to withstand the urge to time the market. It may appear tempting, however as Benjamin Graham properly put it: a stable funding is one which, after a deep evaluation, guarantees not only a good return but in addition security in your invested capital. Something much less falls into the speculative class.

Now, that is the place the idea of ‘margin of security’ is available in. Think about: you purchase a inventory for $70s, however your evaluation tells you it is truly price $100. That additional $30? That is your security internet, guaranteeing you continue to make a revenue even when your evaluation is not spot on. The core of this technique is intrinsic worth, or honest worth, which is principally what we expect a inventory is basically price, primarily based on digging into the info and predicting the long run.

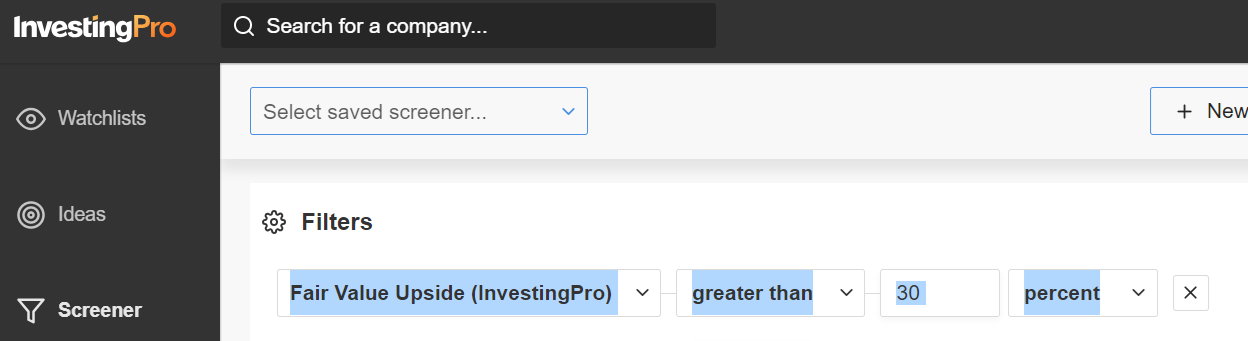

Personally, I am all about money movement estimates. This is the deal: the worth of an organization at the moment is just about the overall of its anticipated future money flows. So, if I make investments 100 {dollars}, I am anticipating a gradual movement of money yearly. For this, InvestingPro is my go-to software. I take advantage of the “elevate Truthful Worth” filter to identify shares which might be an excellent 30% or extra off from what I feel they’re actually price.

In a nutshell, it is about making use of these worth investing methods in real-world eventualities to make sensible funding strikes.

Supply: InvestingPro

Figuring out the honest worth of a safety includes a mixture of mathematical fashions like DDM, DCF, multiples, and the like. However here is the factor: having an excellent buy is not nearly getting the value proper. It is a two-part sport. We want to verify we’re not solely shopping for at an excellent value but in addition getting our fingers on shares which have a historical past of high quality and future potential. That is if you’ve obtained the successful combo for a stable funding.

Investor conduct issues most. Neglect the concept that a inventory’s value will magically align with its honest worth in a day or per week. Nope, it typically takes appreciable time, perhaps even months or years. That is the place endurance, conserving an everyday eye on issues, and coping with the ups and downs develop into essential in your journey as an investor.

Conclusion

Investing is an easy idea, nevertheless it’s removed from simple. As Warren Buffett rightly places it, “It is easy, however not simple.” It is a mix of numbers, high quality checks, and an excellent dose of endurance that makes for profitable investing.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable choices are the keys to maximizing revenue potential. This Black Friday, make the neatest funding determination out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this supply is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to speculate as such it’s not supposed to incentivize the acquisition of property in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link