[ad_1]

by Rebecca Oi

January 19, 2024

The digital banking panorama in Asia is a vibrant and numerous ecosystem, contrasting considerably with its Western counterparts.

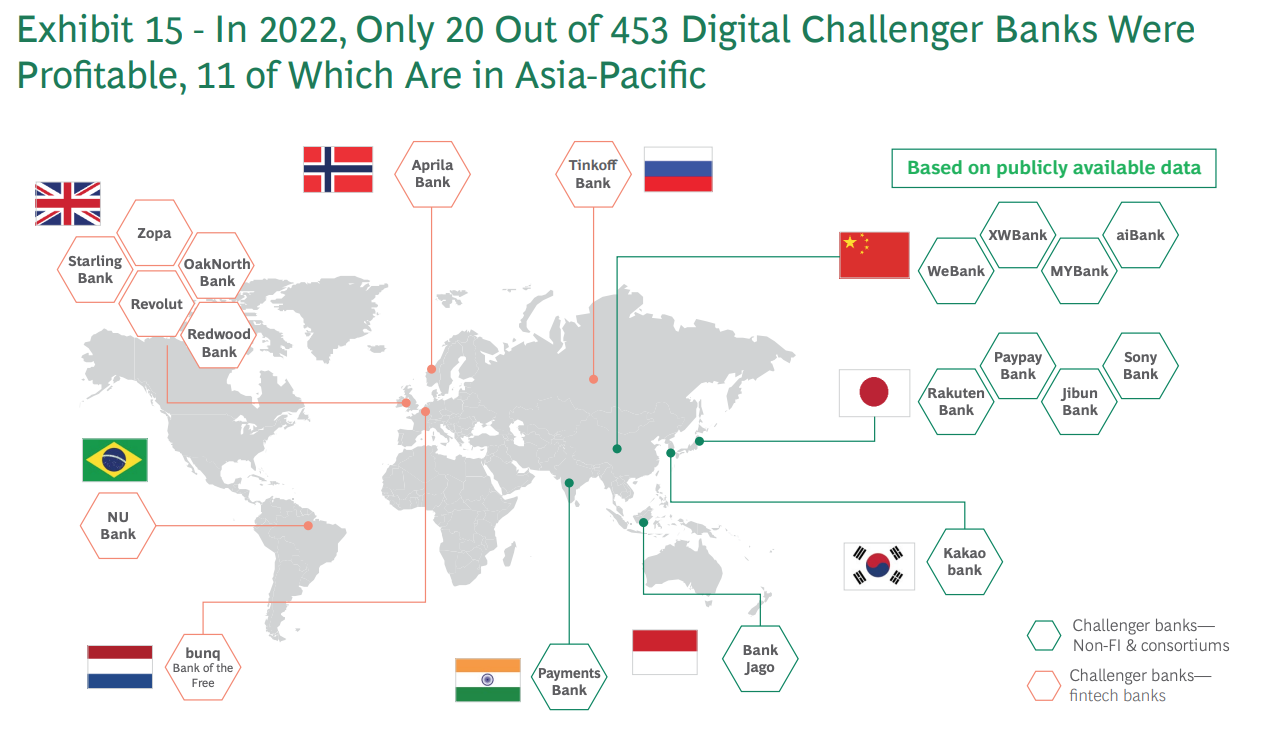

Within the Asia-Pacific (APAC) area, 11 out of the 13 worthwhile digital banks, together with South Korea’s Kakao Financial institution, India’s Paytm Financial institution, and China’s AIBank, WeBank, XW Financial institution, and MyBank, are redefining banking paradigms.

These banks are flourishing amidst present ecosystems, a buyer base inclined in direction of digital adoption, and enterprise fashions tailor-made to the distinctive calls for of their markets.

Ecosystem-driven digital banks

In contrast to many Western digital banks that function as standalone apps focusing totally on consumer expertise, APAC’s digital banks usually leverage present, complete ecosystems.

These ecosystems vary from e-commerce platforms to social media apps, offering a built-in buyer base with a excessive propensity for digital adoption.

For example, entities like Jibun Financial institution, Sony Financial institution, PayPay Financial institution, and Rakuten Financial institution have efficiently capitalised on their related ecosystems in Japan.

Many digital banks in Southeast Asia, comparable to Singapore, Hong Kong, and Malaysia, undertake a consortium mannequin relatively than working as single entities. This collaborative method leverages the strengths and assets of a number of companions, offering a extra sturdy basis for development and innovation.

Enterprise fashions and worth propositions of Asian digital banks

To achieve deeper insights into the intriguing enterprise fashions and worth propositions of Asian digital banks, let’s discover a variety of compelling instances and key gamers within the area.

Kakao Financial institution: A South Korean phenomenon South Korea Kakao Financial institution is without doubt one of the most profitable examples within the Asia-Pacific area. Based in 2019, Kakao Financial institution shortly gained traction and achieved profitability inside two years. It boasts 13.35 million customers and belongings price US$25 billion (SG$33 billion), making it the most important digital financial institution in South Korea by customers and belongings.

South Korea Kakao Financial institution is without doubt one of the most profitable examples within the Asia-Pacific area. Based in 2019, Kakao Financial institution shortly gained traction and achieved profitability inside two years. It boasts 13.35 million customers and belongings price US$25 billion (SG$33 billion), making it the most important digital financial institution in South Korea by customers and belongings.

Kakao Financial institution’s main power lies in its capability to leverage an ultra-sticky ecosystem. The financial institution’s free messaging app, Kakao Discuss, is utilized by practically 90 p.c of South Korea’s inhabitants, making it a ubiquitous platform. South Korea’s quick and dependable web connection speeds additional contributed to Kakao Financial institution’s success.

As soon as customers are throughout the Kakao ecosystem, it turns into difficult to go away. Apart from Kakao Discuss and Kakao Financial institution, customers can entry many providers, together with Kakao Pay, Kakao Video games, Kakao Web page for monetised content material, and Kakao Mobility for ride-hailing. Kakao’s strategic partnerships with tech giants like Ant Group (Kakao Pay) and Tencent (Kakao Video games and Kakao Financial institution) have performed a pivotal position in its development.

MYBank: Revolutionising SME financing in China

China’s MYBank, related to Ant Group, serves small and micro enterprises (SMEs). It has pioneered the “310 lending mannequin,” which permits SME house owners to acquire collateral-free enterprise loans inside minutes by a cell app.

The applying course of is accomplished inside three minutes, accredited inside one second, and requires zero human interplay.

The success of MYBank is rooted in its method to SME financing. It has harnessed superior applied sciences comparable to graph computing, multimodal recognition, blockchain, and privacy-preserving computation to supply provide chain financing options. These options assist blue-chip manufacturers by offering extra financing choices for SMEs of their provide chains.

In 2021, over 500 main manufacturers, together with China Cellular, Haier, and Mengniu Dairy, applied MYBank’s provide chain financing options. This not solely boosted the accessibility of SME loans but in addition contributed to the financial institution’s development.

MYBank’s deal with rural areas is one other notable facet of its enterprise mannequin. Utilizing distant sensing applied sciences on farmland, the financial institution assesses credit score danger based mostly on crop development and numerous components. This method ensures that even farmers in distant areas can entry credit score.

Belief Financial institution: Fast buyer acquisition and distinctive merchandise

Belief Financial institution, backed by Normal Chartered Financial institution and FairPrice Group, launched in Singapore in 2022. Inside a brief interval, it shortly gained over 500,000 prospects, with a deal with serving to prospects save on on a regular basis spending.

Belief Financial institution’s success will be attributed to its customer-centric method, merchandise, and strategic partnerships. The financial institution’s buyer referral programme, providing on a regular basis vouchers as rewards, performed a major position in its fast buyer acquisition.

Moreover, Belief Financial institution’s integration into the FairPrice Group ecosystem showcases the potential for synergy between digital banks and established companies.

By aligning with a well-established retailer, Belief Financial institution was in a position to faucet into an unlimited buyer base and supply added worth to its customers.

Paytm Financial institution: India’s pioneer in digital funds

Paytm Financial institution, a family title in India, began as a digital pockets providing straightforward digital funds. It shortly grew to become synonymous with digital funds in India, even earlier than introducing the Unified Funds Interface (UPI). Many small companies benefited from its expertise, software program, and monetary providers.

Paytm Financial institution’s monetary providers, cost providers, and commerce and cloud providers contribute considerably to its income, with the monetary and funds sectors alone accounting for 75 per cent of its revenues.

By 2015, PayTM expanded its providers to incorporate cell recharges, gasoline, electrical energy, and water invoice funds. It additionally ventured into journey ticket amenities, with 20 lakh month-to-month ticket bookings.

Strategic investments from firms like Alibaba and Berkshire Hathaway propelled PayTM’s development and solidified its place as a pacesetter within the Indian digital banking area.

Paytm Financial institution is India’s largest digital ecosystem for retailers and shoppers. As of March 2021, it had one of many largest India-based funds platforms when it comes to the variety of transactions, shoppers, retailers, and income, in keeping with RedSeer.

ZA Financial institution: Excessive rates of interest and complete merchandise Hong Kong’s ZA Financial institution, backed by ZhongAn Insurance coverage, has carved a distinct segment within the digital banking sector. By the tip of 2020, the financial institution had amassed over HK$6 billion in deposits and attracted 300,000 prospects, surpassing different digital banks in Hong Kong.

Hong Kong’s ZA Financial institution, backed by ZhongAn Insurance coverage, has carved a distinct segment within the digital banking sector. By the tip of 2020, the financial institution had amassed over HK$6 billion in deposits and attracted 300,000 prospects, surpassing different digital banks in Hong Kong.

Additionally it is the primary digital financial institution in Hong Kong to obtain a Sort 1 license from the Securities and Futures Fee for dealing in securities in January 2022.

One of many methods contributing to ZA Financial institution’s success is its aggressive deposit charges. The financial institution provided a beautiful two per cent rate of interest for three-month Hong Kong greenback deposits capped at HK$200,000. Some purchasers had been even provided as much as 4 p.c extra curiosity, totalling six p.c, setting it aside from its rivals.

Moreover, ZA Financial institution holds an insurance coverage company license because of its affiliation with ZhongAn Insurance coverage. This license permits the financial institution to supply a extra complete suite of services and products than its rivals.

ANEXT Financial institution: Empowering SMEs in Singapore

ANEXT Financial institution, a completely owned subsidiary of Ant Group, has established its presence in Singapore’s digital banking panorama since its inception in 2022. The financial institution’s mission includes monetary inclusion and empowering micro, small, and medium-sized enterprises (MSMEs).

ANEXT Financial institution addresses the monetary challenges MSMEs face, recognising that regardless of Singapore’s excessive banking penetration, MSMEs stay underbanked.

To cater to their wants, the financial institution launched the ANEXT Enterprise Mortgage, providing unsecured financing options with a minimal mortgage quantity ranging from SG$5,000 and a streamlined utility course of requiring no paperwork for loans beneath SG$30,000.

Moreover, ANEXT Financial institution collaborates with business companions, together with fintech firms and digital options suppliers, by its ANEXT Programme for Trade Specialists. This B2B answer empowers MSMEs by granting them entry to financing options and assist for cross-border operations.

The financial institution’s easy and streamlined onboarding course of and user-friendly digital providers have helped companies throughout numerous industries, together with these not historically digital. ANEXT Financial institution additionally emphasises safety, incorporating options like three-factor authentication and facial recognition to make sure protected transactions.

Shaping the way forward for finance

Digital banks within the Asia can reshape the monetary panorama by their progressive enterprise fashions and customer-centric worth propositions.

These banks will not be simply competing with their Western counterparts by successfully leveraging present ecosystems, specializing in underserved market segments, and utilising technology-driven options.

Nonetheless, they’re setting new requirements for achievement within the world banking business. As they proceed to evolve and adapt to the dynamic market wants, digital banks in Asia are poised to play a pivotal position in the way forward for finance regionally and globally.

Featured picture credit score: Edited from Unsplash

[ad_2]

Source link