[ad_1]

The funding world is present process a big transformation, with Change-Traded Funds (ETFs) on the forefront of this modification. The Trackinsight World ETF 2024 Survey outcomes present a window into the present state of ETF investments and the way traders are positioning themselves for future alternatives. This deep dive explores the enchantment of ETFs throughout completely different classes, together with fastened revenue, energetic, and thematic ETFs, and unveils the expectations and methods of contemporary traders.

The Rising Attraction of ETFs: A Portfolio Staple

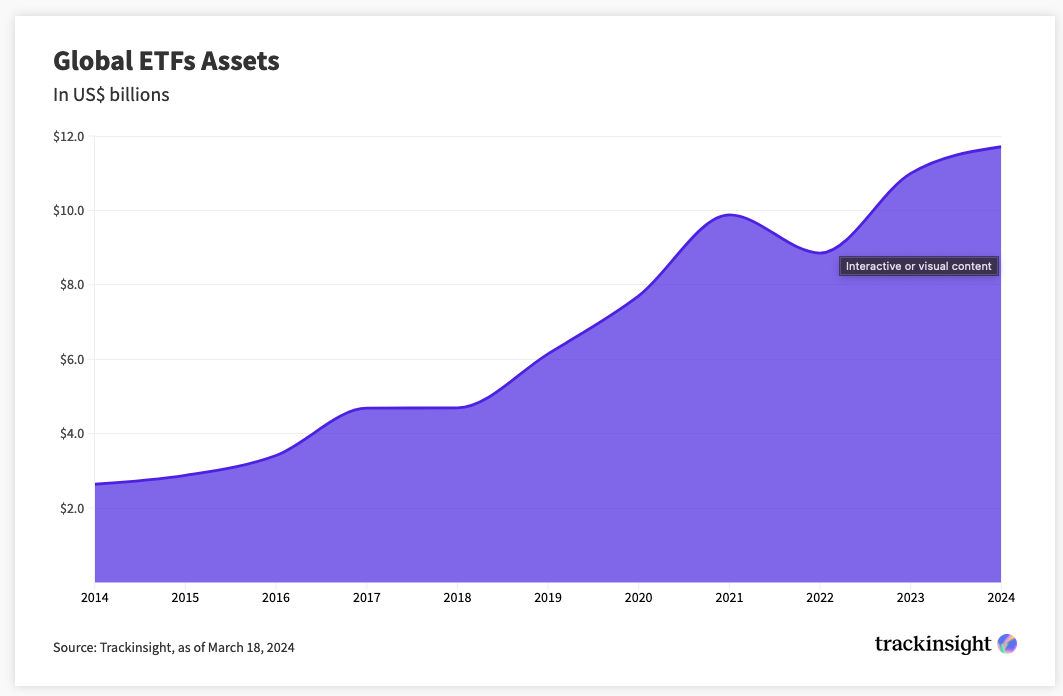

The survey and Trackinsight’s world ETF information present that ETFs have quickly change into a most popular funding automobile, celebrated for his or her advantages, together with diversification, liquidity cost-effectiveness, transparency, and suppleness.

A better take a look at the survey respondents’ portfolios reveals a strategic embrace of ETFs, with 10% to 60% of portfolios allotted to those devices. Notably, a big 20.8% of traders allocate greater than 60% of their portfolios to ETFs, underscoring the deep belief and reliance on these versatile monetary devices.

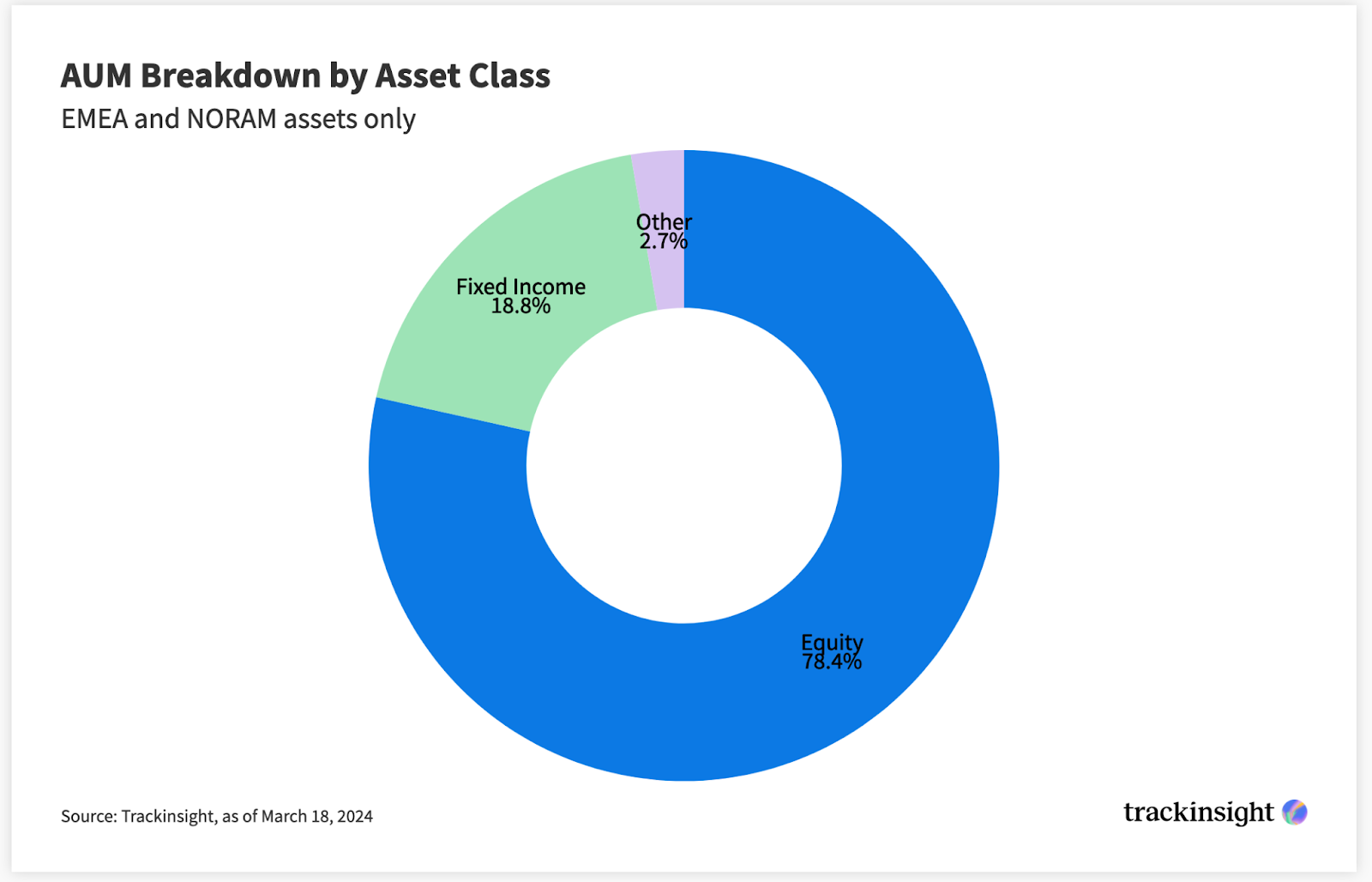

Future Allocations: Fairness and Past

Buyers should not standing nonetheless, with many planning to considerably enhance their ETF allocations over the subsequent 2-3 years. Fairness ETFs are anticipated to see the most important uptick, with 25% of traders anticipating a lift of greater than 20% of their fairness ETF holdings over the subsequent 2-3 years. This bullish sentiment extends to fastened revenue, commodities, and multi-assets, indicating a broad-based confidence in ETFs’ potential to ship throughout numerous asset lessons.

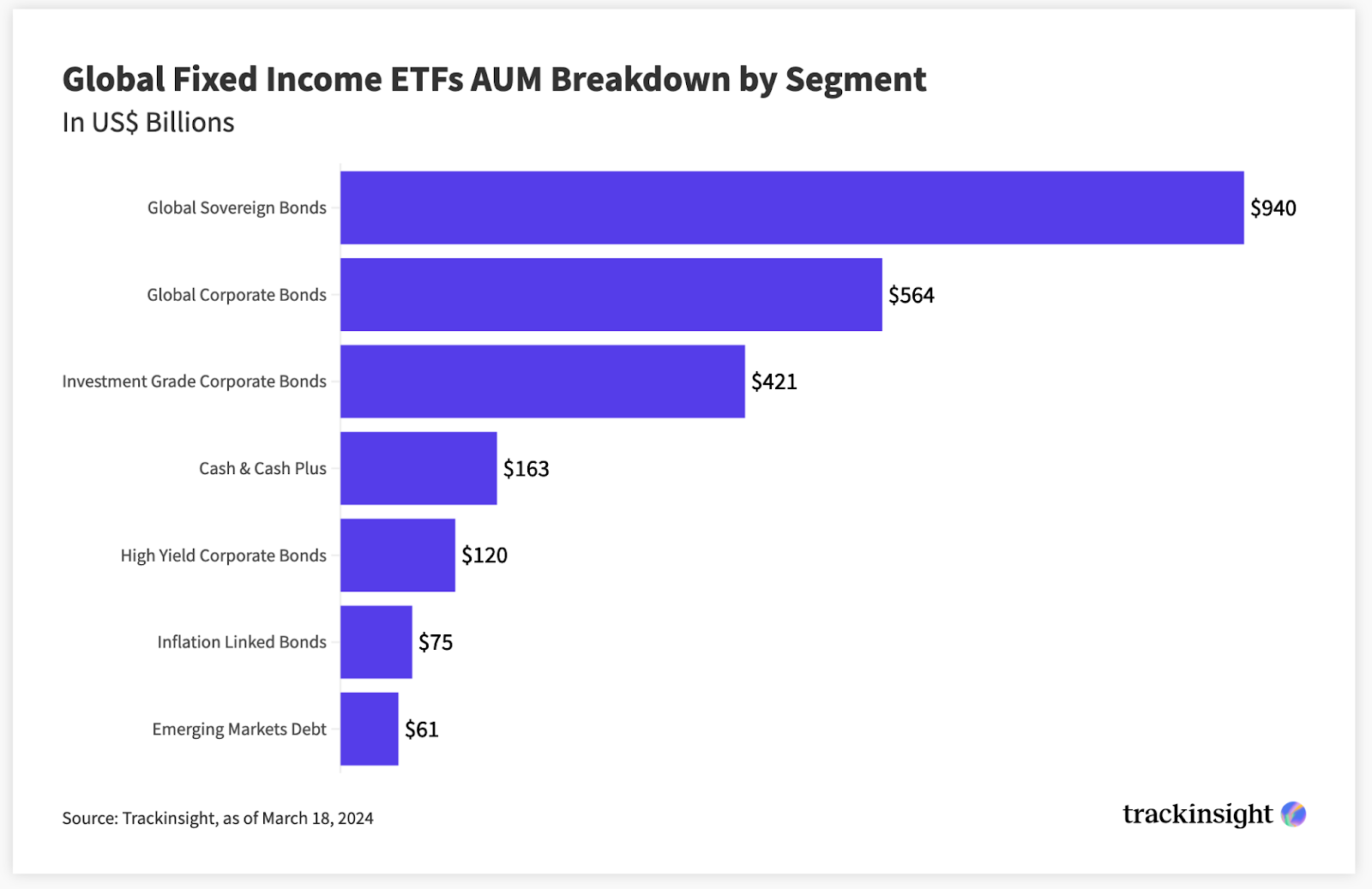

The Fastened Revenue ETF Attraction

Fastened revenue ETFs have gotten more and more well-liked, with 72.5% of the respondents both traders or exhibiting curiosity on this section. Funding methods amongst allocators differ broadly, with a near-even break up between passive and energetic approaches. Trying forward, 65.4% of traders are optimistic concerning the macro-economic setting for fastened revenue investing in 2024, with company investment-grade bonds anticipated to steer the market.

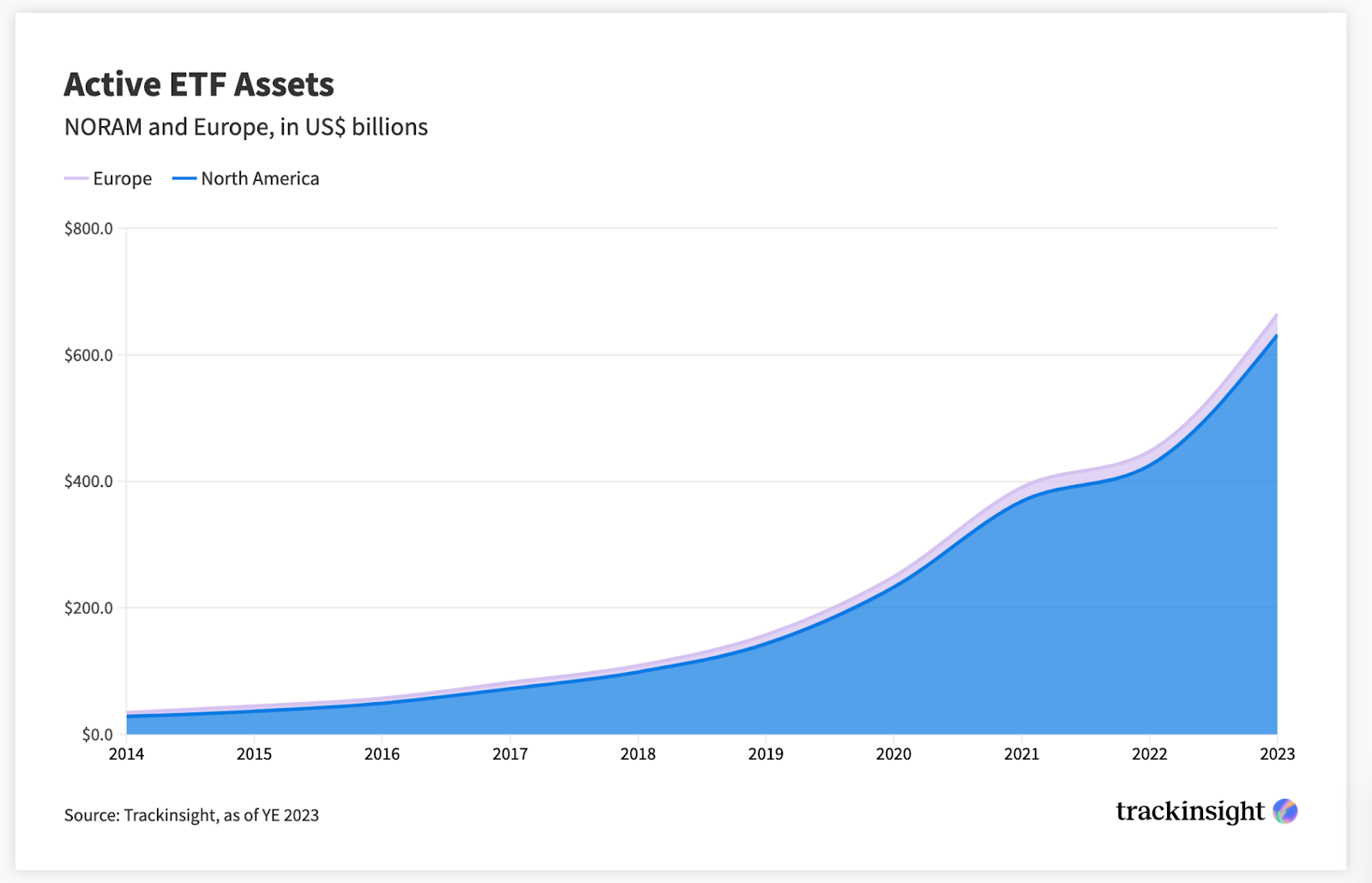

Elevated adoption of Lively ETFs

Lively ETFs are catching the attention of 73.2% of survey respondents, drawn by their potential to reinforce portfolio range and yield increased returns in comparison with passive investments. With over 71% planning to spice up their energetic ETF investments in areas like fairness, fastened revenue, and thematic investing, the rising curiosity is evident.

Furthermore, a notable 80.1% favor energetic ETFs over mutual funds for his or her flexibility and advantages. But, challenges akin to increased prices, restricted choices, non-transparency, and unproven histories pose important considerations for these contemplating energetic ETFs.

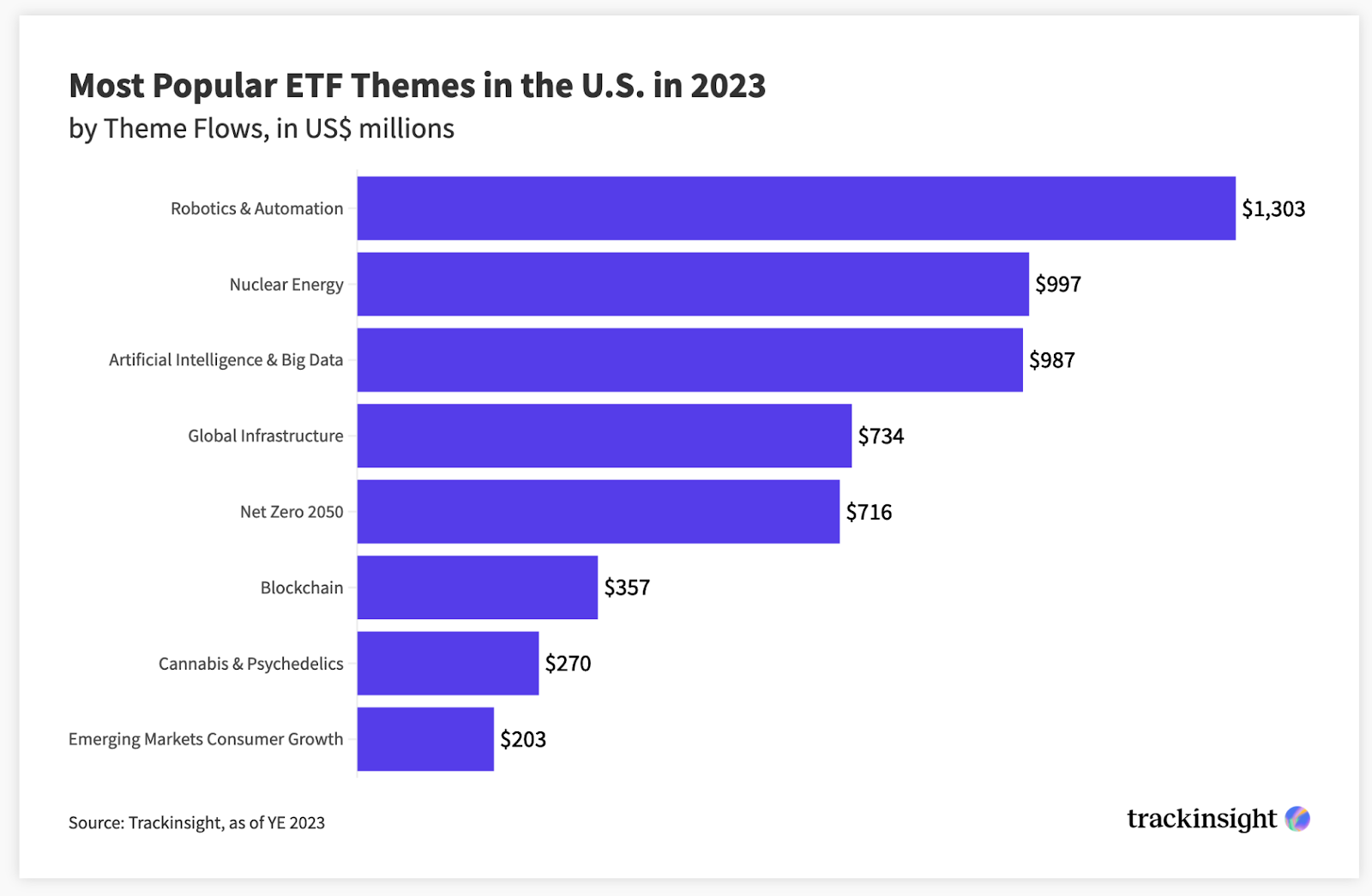

The Rise of Thematic ETFs

Thematic ETFs are notable for his or her capability to deal with particular traits or sectors. In line with the survey, 68% of traders categorical curiosity in these ETFs, viewing them as strategic long-term investments and diversification instruments.

When requested about their future thematic investing urge for food, respondents anticipate to considerably enhance allocation to thematic ETFs over the subsequent 2-3 years, with 15.2% planning to extend by greater than 20% and 51.6% aiming for a rise of 5% to twenty%.

Thematic ETFs are predominantly used as satellite tv for pc exposures in line with the survey, enhancing portfolios by concentrating on progress sectors akin to disruptive know-how and digital infrastructure.

Regulatory Tendencies Can Unlock Room for extra ETF Progress

Current regulatory developments have made it simpler to transition from mutual funds to ETFs, with a staggering 81.9% of survey respondents inclined to switch mutual fund holdings to ETF share lessons by way of tax-free exchanges. This shift displays a robust desire for the ETF construction over conventional mutual funds.

The expansion of ETFs has been outstanding, and it appears to be like set to proceed quickly as extra traders undertake them and innovation retains advancing. A standout second got here with the early 2024 launch of Spot ETFs within the U.S., attracting immense curiosity and file investments. As traders purpose to diversify their portfolios throughout numerous asset lessons and profit from regulatory adjustments that simplify transitions, the funding panorama is more and more leaning in the direction of ETFs.

Considering studying extra about World ETF traits?

Obtain Trackinsight’s 2024 World ETF Survey Report titled “Unlock 50+ Charts of Worldwide ETF Tendencies” to realize entry to beneficial insights on the worldwide ETF universe, from energetic and glued revenue methods to the most recent traits in crypto, ESG and thematic investing.

[ad_2]

Source link

Add comment