[ad_1]

Here is all the pieces you might want to find out about shares that will help you get essentially the most out of your portfolio.

Market capitalization, dividend yield, asset effectivity… carry out your individual search and slim down the outcomes to get the perfect outcomes.

What’s occurring out there? Why is the present volatility having such a big effect on my portfolio? How can I determine the shares that pique my curiosity and have the potential for the perfect returns proper now?

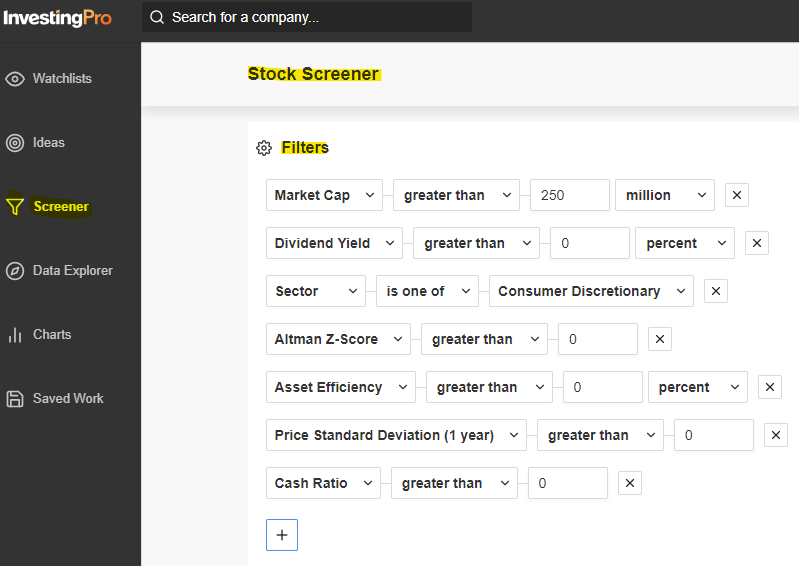

InvestingPro has the solutions to those questions. The inventory finder within the “Filters” part gives you with up-to-the-minute market information and a breakdown of the professionals and cons that may affect shares.

Supply: InvestingPro

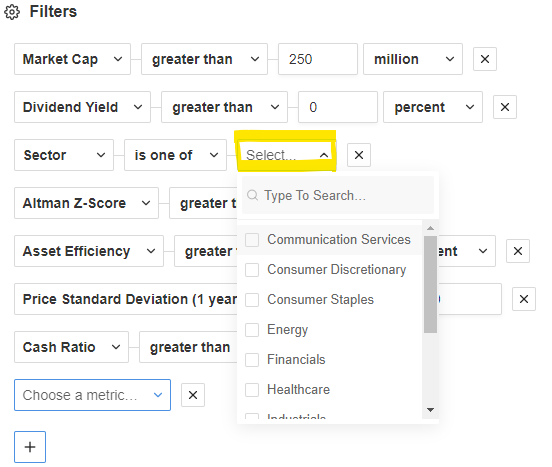

For example, InvestingPro gives a spread of useful filters, together with:

Market Cap: This metric gauges the entire fairness worth of a public firm, calculated based mostly on the latest inventory buying and selling value. For cryptocurrencies, it is computed by multiplying the final buying and selling value by the excellent provide.

Dividend Yield: It quantifies the money returned to shareholders by an organization as a share of the value paid for every share.

Sector: This filter categorizes shares based mostly on their space of enterprise exercise.

Altman Z-Rating System: A predictive method used to evaluate the probability of an organization going bankrupt inside a two-year interval.

Asset Effectivity: This ratio measures the money circulation generated by an organization in relation to its belongings.

Inventory Value Normal Deviation (1-year): This metric calculates the usual deviation of a inventory’s value over the previous 12 months.

Money Ratio: It evaluates an organization’s short-term liquidity.

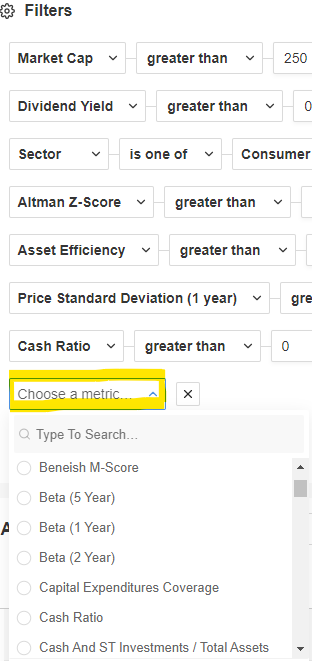

You even have the choice to introduce new filters to tailor your search additional. For instance, contemplate including filters just like the Beneish M-Rating System, Beta (1, 2, or 5 years), capital expenditure protection, solvency ratio, complete debt, and extra to your choice.

Filters – Select a metric

Supply: InvestingPro

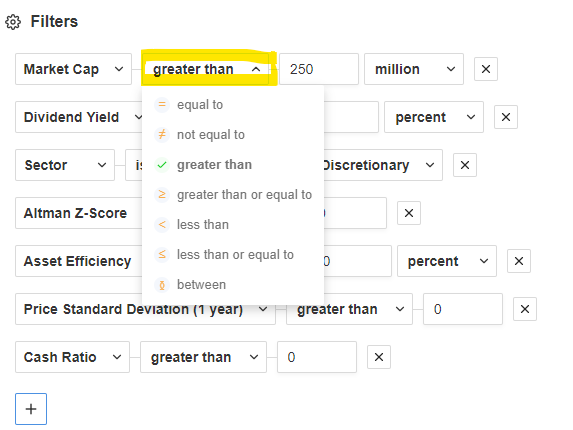

Refine Your Search

Inside every filter, the search engine gives quite a lot of choices. For example, out there cap or dividend yield class, you possibly can seek for quantities which can be “better than,” “lower than,” “between,” and extra.

Filters

Supply: InvestingPro

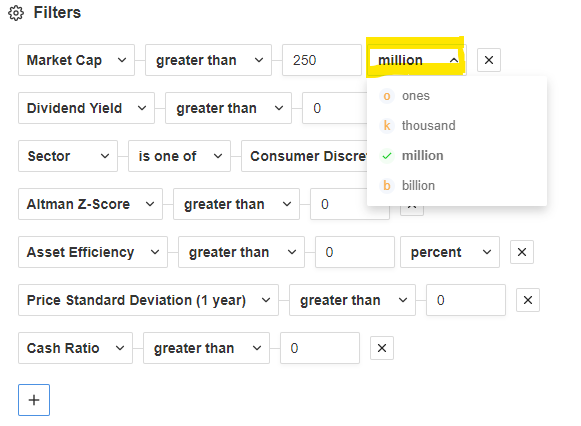

Subsequently, it permits us to manually enter the particular quantity and select the specified unit, whether or not or not it’s in 1000’s, hundreds of thousands, or billions.

Filters

Supply: InvestingPro

The sector filter permits us to go looking by business, reminiscent of communication companies, shopper discretionary, shopper staples, healthcare, vitality, industrials, data expertise, actual property, and extra.

Filters – Choose

Supply: InvestingPro

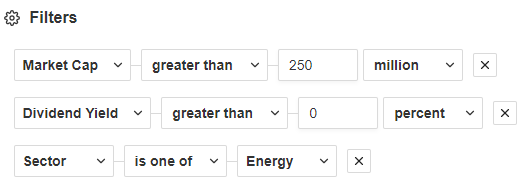

Let’s take an instance: if you wish to seek for firms with a market capitalization of greater than $250 million, with a dividend yield of greater than 0%, and belonging to the vitality sector, you must seek for the parameters as follows:

Outcomes

Supply: InvestingPro

Search Outcomes

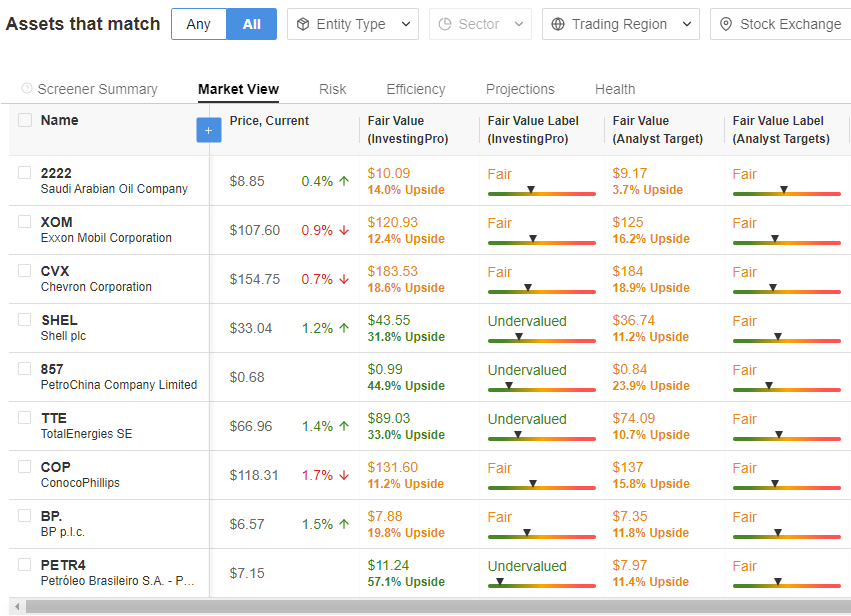

After you have made your choice, InvestingPro shows the listing of shares that match your search parameters:

Supply: InvestingPro

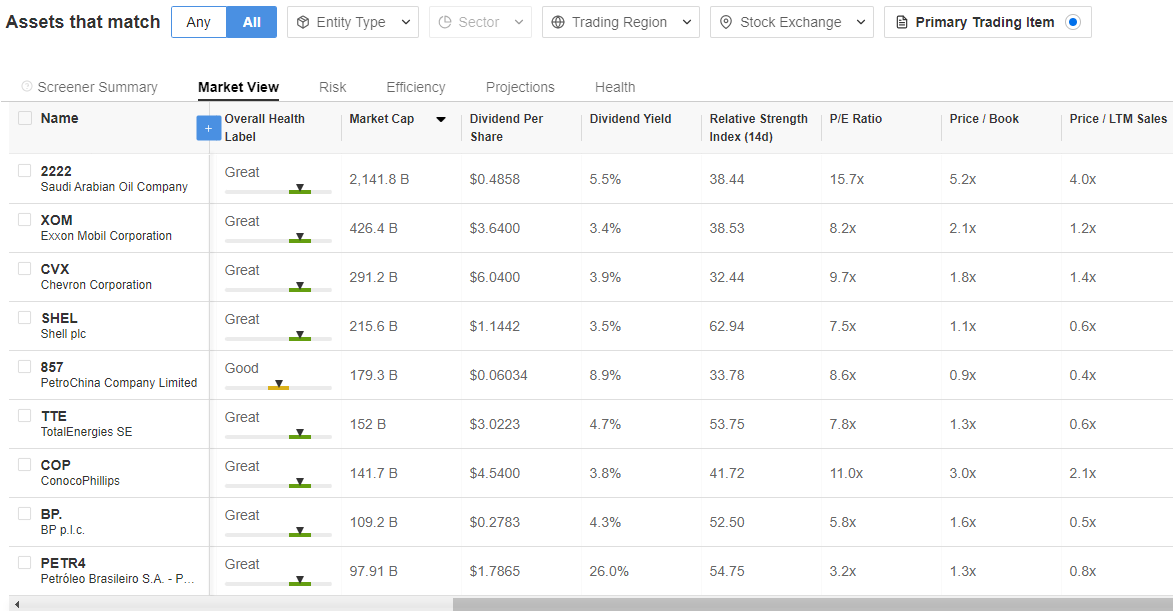

The itemizing gives market worth, truthful worth, market capitalization, dividend per share, dividend yield, Relative Power index, P/E, and so forth.

Supply: InvestingPro

You can even discover attention-grabbing information on the chance of those firms, their earnings forecasts, completely different effectivity ratios and all the pieces you might want to know concerning the shares that will help you get essentially the most out of your portfolio.

*All figures within the outcomes desk are proven in {dollars}.

Save Your Searches

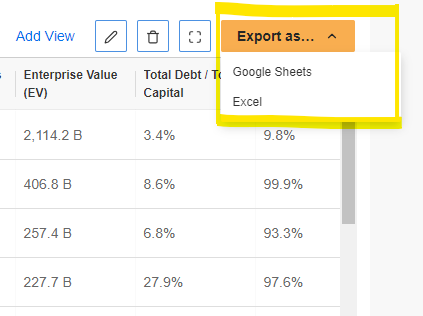

Bear in mind you could save and all the time have your search outcomes at hand. To obtain your outcomes, click on on the “Export As” drop-down menu on the prime proper of the search engine.

Export as…

Supply: InvestingPro

As we discover ourselves within the latter a part of the 12 months, amidst the company outcomes season, when traders are eager on reshaping their portfolios, seize the possibility to entry privileged data, empowering you to make well-informed funding decisions.

Do not fall behind; uncover find out how to uncover the market’s most potent shares with the added benefit of InvestingPro’s “Filters” part at this time with the hyperlink beneath.

Signal Up for a Free Week Now!

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation or suggestion to take a position as such and is under no circumstances supposed to encourage the acquisition of belongings. I wish to remind you that any asset class is evaluated from a number of factors of view and is extremely dangerous. Due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link