[ad_1]

Torsten Asmus

The iShares BB Rated Company Bond ETF (NYSEARCA:HYBB) covers principally BB rated fastened revenue securities within the company US debt market. The 2 key issues to deal with are credit standing and period. We predict that credit score spreads are somewhat too low within the present atmosphere contemplating the dangers to company debt that come from the unsure financial state of affairs, significantly unsure inflation situations, and the maturity partitions coming. On period, we equally assume that period is simply too excessive in HYBB contemplating like trajectory with charges and the market tendency to overestimate the potential for a smooth touchdown. HYBB isn’t the choose proper now.

HYBB Breakdown

Expense ratios of 0.25% are completely affordable contemplating that this can be a extra tailor-made portfolio with company credit score, not only a treasury portfolio.

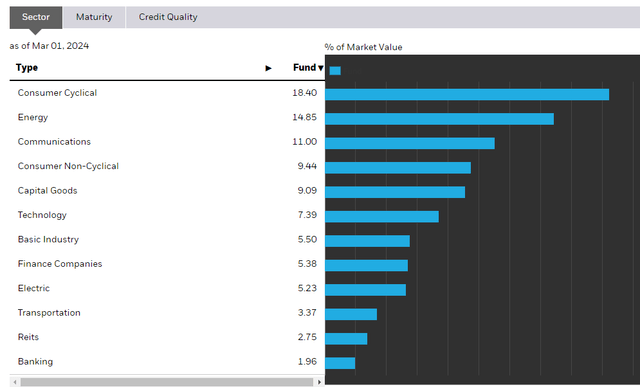

When it comes to credit score profile, greater than 92% of the portfolio is in BB rated company credit score. Sector-wise, there’s quite a lot of shopper cyclical, power, and communications publicity.

Sector (iShares.com)

The efficient period is 3.67 years.

Macro Feedback

Let’s begin with credit score danger. We wish credit score spreads to be commensurate to the chance of credit score in a given macro atmosphere. We do not assume that’s the case presently.

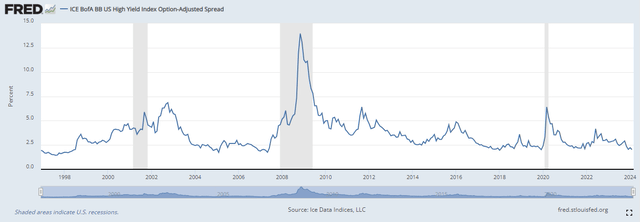

Credit score Spreads (FRED)

Credit score spreads are at traditionally low ranges, which isn’t begin as a result of we don’t assume credit score danger is at traditionally low ranges in any respect, and due to this fact premiums for that danger must be greater. Charges are greater, which in fact means extra stress on the funds of corporations. Charges are greater than twice as excessive as they have been in a decade or extra, but credit score spreads are at ranges just like occasions the place the financial system was unhurt and charges have been a lot decrease. Even with expectations that charges are going to return down, they’ll nonetheless be excessive, and 2024 and 2025 are the years through which a plurality of the company debt must be refinanced within the US. Simply in 2024, 25% of excellent debt will come due, and 2025 shall be one other main yr. A number of company America has been benefiting from fastened fee debt, these refinancings will common up curiosity being paid by corporates by a really substantial quantity, even when charges come down rather a lot, which we do not assume would be the case.

Regarding each the credit score unfold situation and period, which measures sensitivity of an instrument to adjustments in prevailing charges, is the matter of the tenor of fee declines. At the moment, charges have not been reduce, though the Fed will possible reduce them a bit in some unspecified time in the future in 2024. However by how a lot goes to be critically vital for HYBB since its period is not that low. The extent of the cuts will even have an effect on the monetary situations of company America. We don’t assume the cuts are coming that quickly. Optimism about smooth landings improves entry to capital and reverses results of the Fed coverage, making excessive charges extra possible for longer. Importantly, wage progress continues to be occurring at ranges a lot greater than inflation run-rates and the coverage fee goal, and this cements expectations that are additionally surveyed at ranges a lot greater than coverage charges. There’s little or no cause to imagine that inflation is making a forceful decline, past simply the results of extra inflated comps. Greater for longer will trounce expectations for greater period devices.

Again to credit score spreads, the maturity partitions and the impacts of upper common rates of interest in US corporates might additionally begin spilling over into the roles market with extra aggressive cost-cutting. Whereas which may assist rates of interest come down extra, you’d then as a substitute have a difficulty on the demand aspect, which might create an particularly large downside for shopper cyclical shares particularly, but additionally power. That will even be a supply of markets bidding up credit score spreads.

Backside Line

We predict that maturity partitions create dangers given the upper fee atmosphere, that can have an effect on burdens on corporates a method or one other, a few of which, starting at decrease score points, will begin to battle extra to repay debt. The upper fee atmosphere does not gel with a credit score unfold according to a a lot decrease fee atmosphere at the easiest of occasions. Furthermore, we predict that every one metrics are displaying inflation to be fairly sticky downwards, which can exacerbate the credit score unfold issues and also will have an effect on HYBB technically by means of period results. For each these causes, we would be on the sidelines of a BB rated ETF with period like HYBB.

[ad_2]

Source link