[ad_1]

Yuichiro Chino/Second through Getty Pictures

Introduction

It is lastly time for me to cowl Illumina Inc. (NASDAQ:ILMN), which can very nicely be some of the hated shares in healthcare.

Going again to 2010, ILMN has returned 338%, which underperforms each the S&P 500 and the Well being Care Choose Sector SPDR ETF (XLV) by a large margin.

Positive, if you happen to had purchased ILMN in 2010 (or earlier), you’ll be sitting on a pleasant acquire.

The issue is that the corporate turned from an outperformer right into a inventory that has destroyed a whole lot of wealth since 2021.

Even after rising greater than 50% from its latest lows, ILMN shares are nonetheless down greater than 70% from their all-time excessive.

It additionally doesn’t assist that these declines include a wave of destructive headlines, together with the compelled sale of cancer-test maker Grail, growing competitors from China, and common weak spot within the biotech sector.

Whereas I don’t blame anybody for disliking ILMN, I imagine there’s worth within the inventory, because it appears to be in a spot the place it might go away the worst behind and profit from what might be a brand new interval of elevated progress.

So, let’s get to it!

What’s Illumina? And What’s Up With Grail?

As that is my first article masking ILMN, I need to spend a while shedding some mild on its enterprise.

Please be happy to skip this half if you happen to’re aware of the corporate.

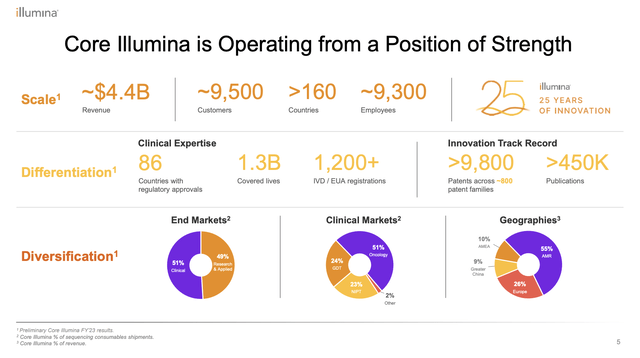

To the people who find themselves new, it is honest to say that Illumina is a world chief in genetic and genomic evaluation, which supplies sequencing- and array-based options.

Serving various markets, together with analysis, medical, and utilized settings, the corporate’s portfolio goals to simplify and speed up genetic evaluation.

Based in 1998, the corporate’s portfolio consists of built-in sequencing and microarray techniques, consumables, and evaluation instruments.

Its merchandise cater to a variety of genomic complexities, value factors, and throughput necessities that assist purposes akin to focused exome and whole-genome sequencing, genetic variation evaluation, gene expression research, and extra.

Illumina

Moreover, in response to the corporate:

A big and dynamic Illumina consumer group has revealed tons of of hundreds of customer-authored scientific papers utilizing our applied sciences. By speedy innovation, we’re altering the economics of genetic analysis, enabling initiatives that had been beforehand thought-about unimaginable, and supporting medical advances in direction of precision medication.

Most of our product gross sales include sequencing- and array-based devices and consumables, which embody reagents, movement cells, and library preparation, based mostly on our proprietary applied sciences.

Illumina

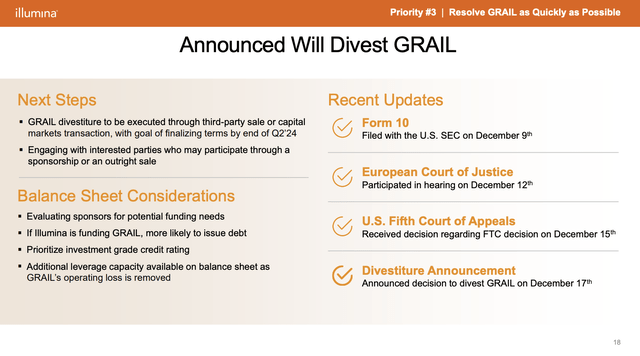

Sadly, like a few of its friends that trip the wave of secular tailwinds in healthcare, Illumina has confronted huge challenges, particularly with regard to the 2020 acquisition of Grail, which it now has to unwind.

In 4Q23, the corporate was sued by Carl Icahn, who accused the corporate of violating “fiduciary duties” by closing the Grail deal with out regulatory approval.

On December 17, the Wall Avenue Journal wrote that Illumina would divest Grail after it misplaced the authorized battle towards U.S. antitrust regulators.

The corporate’s determination to divest itself of Grail ends a long-running saga that had weighed down on the inventory and compelled the departure of the chief govt who had championed the mix. As soon as Grail departs, Illumina can give attention to its gene-sequencing enterprise.

Illumina

With that stated, earlier this month, the corporate introduced on the JPMorgan Annual Healthcare Convention.

Illumina’s Restoration

At first of the convention, the corporate’s new CEO, Jacob Thaysen, emphasised the main target is on driving genomics ahead and positioning Illumina on the heart of the worldwide transformation of genomics.

The corporate’s substantial stock, world attain, various choices, and deep partnerships with clients had been highlighted as components contributing to Illumina’s position in enhancing affected person outcomes.

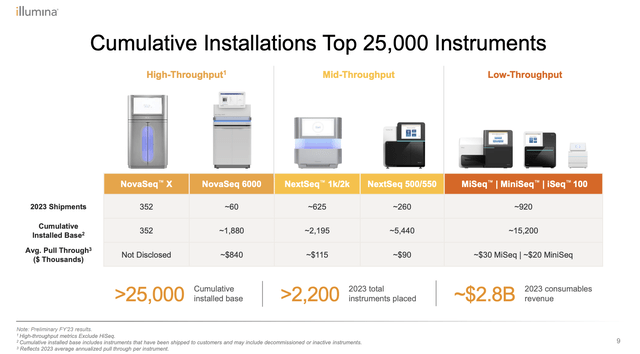

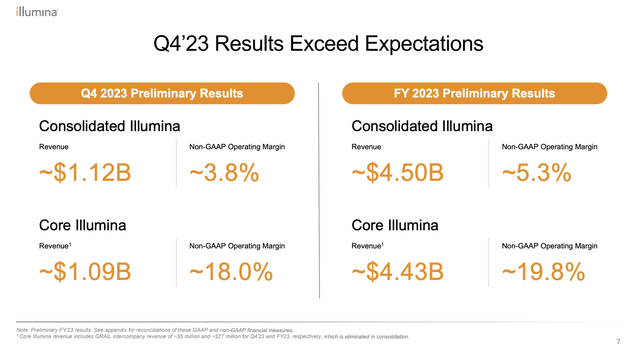

To this point, he’s proper, as preliminary This fall outcomes surpassed expectations, largely pushed by the NovaSeq X devices and consumable gross sales.

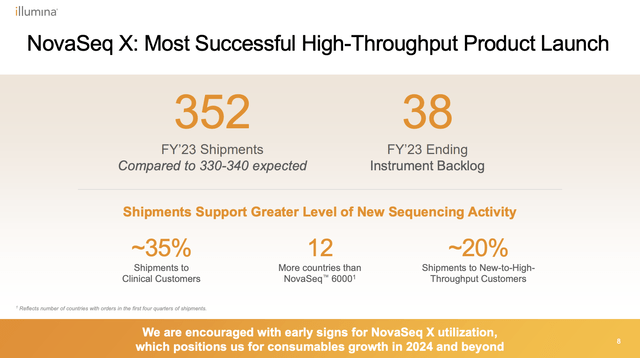

In line with the corporate, the launch of NovaSeq X was probably the most profitable launch within the firm’s historical past.

Because of this, the consolidated preliminary income for the quarter was roughly $1.12 billion, marking a 3% improve from the earlier 12 months.

Core income for This fall was round $1.09 billion, with a noteworthy non-GAAP working margin of roughly 18%.

Unsurprisingly, the corporate attributes the success to the aforementioned launch of the NovaSeq X and the next sturdy efficiency of high-throughput devices, particularly the NovaSeq X and NovaSeq 6000.

Illumina

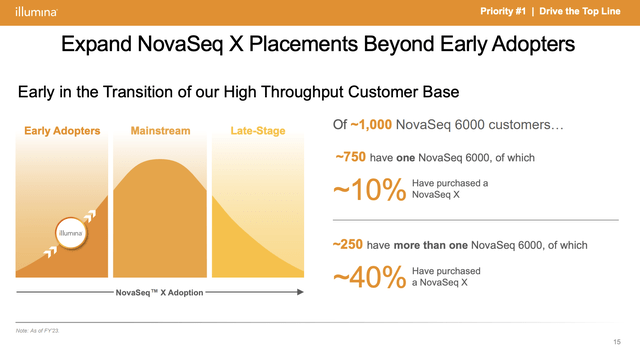

Primarily, NovaSeq X is predicted to be a significant driver of progress for a few years to come back, supported by the substantial variety of orders acquired since its launch (900) and devices shipped (352).

The backlog of 38 devices coming into 2024 additionally underscores the sustained demand for this instrument.

Illumina

Usually, the corporate believes that its ecosystem is one in every of its most precious property, with potential as a complete end-to-end resolution supplier, specializing in Pattern-to-Perception.

On prime of that, the corporate introduced various main collaborations and alliances.

For instance, Illumina collaborates with Nashville Bioscience, and three new members (BMS, GSK, and Novo Nordisk) be a part of the Alliance for Genomic Discovery.

This alliance goals to sequence over 250,000 complete genome samples, mixed with longitudinal well being knowledge, with the potential to revolutionize drug discovery and therapy plans.

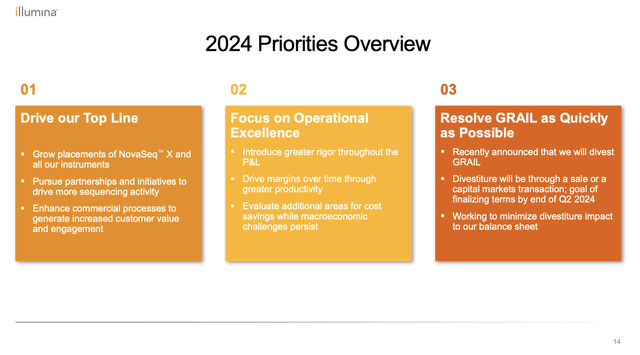

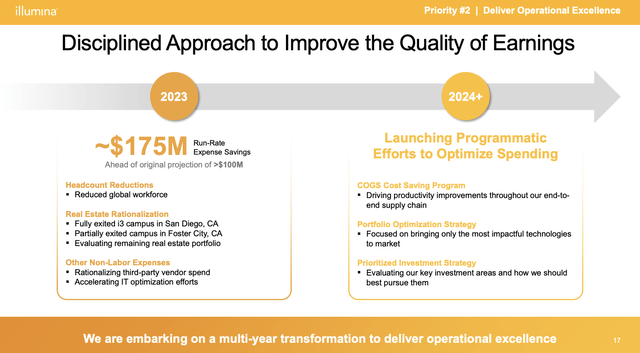

In mild of those developments, the corporate has three important priorities for 2024:

Buyer focus and industrial excellence. Operational excellence with a give attention to value discount and productiveness. Resolving the Grail state of affairs.

Illumina

The third level could also be the obvious, and Illumina expects to disclose the monetary influence by the top of the second quarter of this 12 months.

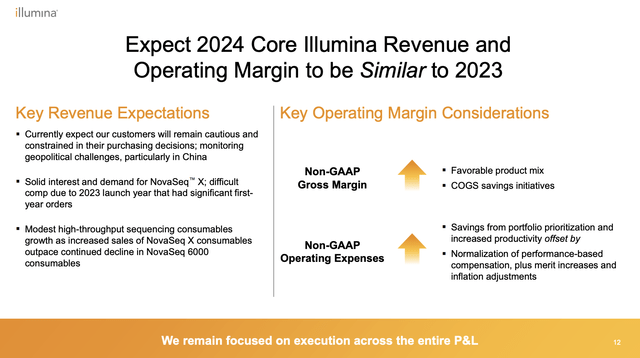

Having stated that, on a full-year foundation, the corporate expects flattish income progress.

Illumina

The corporate attributed this conservative outlook to industry-wide buyer warning and conservatism in processing choices.

Regardless of constructive macroeconomic indicators, Illumina aligns its projections with the cautious stance of its clients and refrains from distinguishing between the primary and second halves of the 12 months based mostly on historic developments that contradicted preliminary expectations.

This isn’t an unusual improvement, as many corporations within the place of ILMN face {industry} headwinds, particularly due to elevated charges that suppress investments in costly gear.

Within the case of ILMN, medical clients, particularly these getting ready to profitability, had been famous to have grow to be extra cautious about spending to expedite the adoption of purposes on new platforms.

The excellent news is that Illumina anticipates enhancements in sequencing exercise over time, which appears to be the consensus amongst analysts, however extra on that within the valuation a part of this text.

For now, what issues most to me is that Illumina believes that the {industry} continues to be within the early levels of genomic transformation.

Alternatives for progress embody varied illness purposes, such because the transition from strong tumor to liquid biopsy, detection of minimal residual illness, and early most cancers detection.

Illumina additionally stays assured within the disruptive potential of sequencing applied sciences, significantly in drug discovery, and believes that it’s early within the transition of its high-throughput buyer base.

Illumina

Because of this, the corporate anticipates vital alternatives over the following decade and past.

Sadly, Illumina didn’t present particular numbers, because it must take time to determine what future income progress may appear like – particularly in mild of ongoing challenges.

Going again to the JPMorgan convention, the corporate talked about an important subject: China.

China has became a headwind for a lot of healthcare corporations resulting from sluggish progress and better competitors. Illumina is one in every of these corporations.

Roughly 10% of Illumina’s enterprise comes from China, and the corporate expects challenges within the area to persist in 2024.

Nonetheless, regardless of financial and market challenges, the corporate perceives alternatives in China, significantly with Chinese language corporations expressing a want to collaborate with Illumina resulting from its repute for innovation and high quality.

At present, a strategic realignment is underway to handle the altering dynamics, specializing in attaining extra localized operations in China.

Usually, the corporate’s method to competitors entails a dedication to supporting clients and driving innovation to take care of its management place whereas additionally reducing prices to enhance the standard of earnings, which usually means enhancing free money movement as a share of web revenue.

Illumina

So, what does all of this imply for the chance/reward?

Valuation

The corporate, which is predicted to finish up with additional cash than gross debt in 2024, has an investment-grade credit standing of BBB.

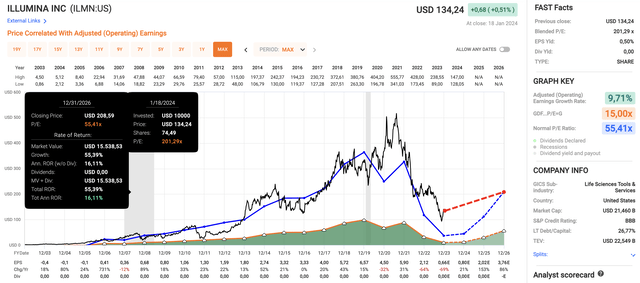

After various powerful years, EPS is predicted to extend by 21% this 12 months, adopted by 153% and 86% progress in 2025 and 2026, respectively.

Whereas these numbers are topic to alter, they might point out the primary restoration because the firm began to really feel headwinds in 2022.

FAST Graphs

Moreover, ILMN at present trades at a blended P/E ratio of 202x. That is primarily as a result of anticipated full-year 2023 EPS results of simply $0.66.

Traditionally, ILMN has traded at 55x earnings, which might nonetheless be a very good match for its anticipated restoration.

If the corporate is ready to increase EPS to roughly $3.80 by 2026, adopted by consilient double-digit progress, it may return >15% per 12 months.

Keep in mind, regardless of the latest sell-off, traders shopping for ILMN in 2003 have made greater than 24% per 12 months!

Having stated all of this, there are apparent the explanation why ILMN is buying and selling approach beneath its highs. The Grail deal was a catastrophe. Proxy wars with Icahn didn’t assist, and financial headwinds have been main points.

I get it when individuals are annoyed – I’d be, too.

Nonetheless, we’re seeing inexperienced shoots.

Demand is predicted to get well, the corporate’s core enterprise is powerful, and even its China publicity may quickly flip right into a invaluable asset once more.

Given its valuation, I fee ILMN a Robust Purchase and think about shopping for a small place for my buying and selling account.

Takeaway

I imagine Illumina presents a compelling alternative regardless of latest setbacks.

The corporate, a world chief in genetic and genomic evaluation, confronted challenges, together with the Grail acquisition and associated authorized battles.

Nonetheless, with a brand new CEO and a give attention to driving genomics ahead, Illumina’s preliminary This fall outcomes exceeded expectations.

Furthermore, the profitable launch of NovaSeq X and strategic collaborations sign constructive momentum.

Regardless of {industry} headwinds and a cautious outlook, Illumina stays assured within the early levels of genomic transformation.

With a conservative valuation and potential for restoration, ILMN emerges as a Robust Purchase, providing traders an opportunity to capitalize on its long-term progress prospects.

[ad_2]

Source link