[ad_1]

Jean-Luc Ichard

Orange S.A. (NYSE:ORAN), a number one telecommunications firm, operates with a enterprise mannequin that integrates digital providers and networking. Their distinctive experience as each a community operator and digital providers integrator permits them to supply their clients a variety of abilities. Orange additionally designs modern, safe cell monetary providers via Orange Cash and Orange Financial institution, tailor-made to satisfy folks’s wants in every of their markets.

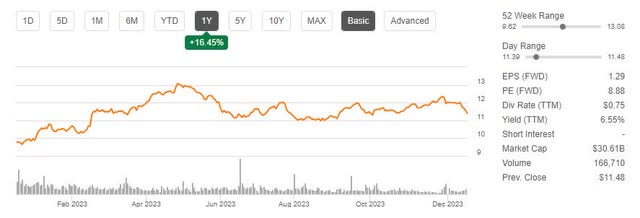

Orange is a stable participant within the telecom house with a 6%+ dividend yield and 16% worth development throughout the previous yr.

ORAN Value Development (Searching for Alpha)

I’ve little question that Orange will proceed to money movement and proceed to pay a powerful dividend and buyers who beforehand entered the inventory might be effectively rewarded. Nevertheless, I’m involved about worth appreciation for buyers coming into the inventory at present.

From a development standpoint, Orange is doing simply okay and is lagging the trade in key areas. With a big price base, the enterprise is very delicate to income development fee. My DCF-generated worth goal of $13 would not present a ample premium to enter at present, given the state of the bond market. With that in thoughts, I fee Orange a maintain pending enchancment in long-term development prospects.

Orange Is Lagging The Business In Development

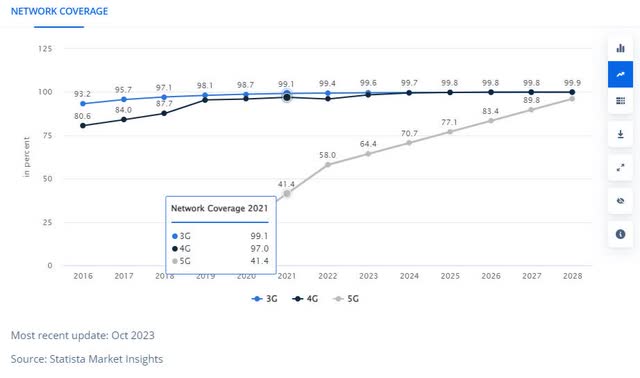

It virtually goes with out saying that telecom in Europe, very like North America, is a mature trade. In 2023, 99% of Europe has 3G, 97% has 4G and 41% has 5G. By 2028, 5G is predicted to cowl 96% of the inhabitants.

European Community Protection (Statista)

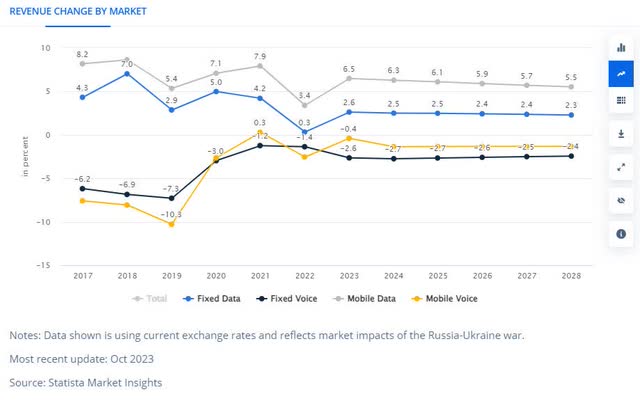

In mature areas, I search for telecoms to be at or above market development fee in key companies to make sure the enterprise is executing effectively and may proceed overlaying prices. Listed here are the anticipated total development charges based mostly on the latest European telecom evaluation from Statista:

Telecom Development Charges (Statista)

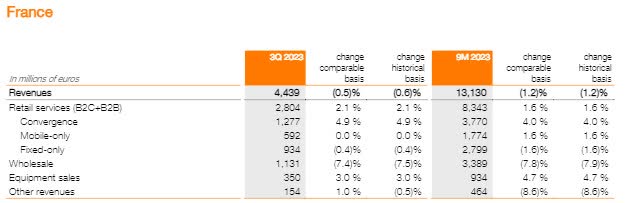

Additionally it is essential to notice, per the identical evaluation, that the general development fee from 2023 – 2028 is predicted to be 2.65%. Sadly, Orange would not stack as much as the trade. General income development was 1.8% (1.9% for year-to-date)

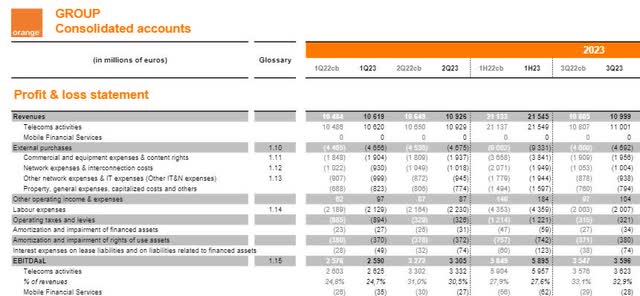

Orange Q3 Abstract (Orange Investor Relations)

Utilizing France for instance, no particular person service stored up with total development charges.

France financials (Orange Investor Relations)

Much more regarding, the high-margin Wholesale enterprise was down 6.7% in Q3 and struggled in practically each area.

A variety of telecoms, corresponding to competitor Vodafone, have been leaning closely into the enterprise house to drive development. Sadly Orange had a combined quarter in enterprise as effectively.

Enterprise financials (Orange Investor Relations)

The enterprise is under no circumstances falling off a cliff, however I’m involved that development expectations are greater than what Orange can ship.

Income Development Falling Behind Prices

As proven within the monetary abstract above, income in Q3 grew by 1.8% outpacing EBITDA development of 1.4%. Orange has a big price base to think about.

Orange P&L (Orange Investor Relations)

Listed here are the typical inflation charges impacting Orange:

Labour is up 4.5% Core Inflation is up 3.4%

Administration did go into element within the earnings launch on an effectivity plan.

Orange Technique (Orange Investor Relations)

Nevertheless, there may be solely a lot to chop when price development from inflation outpaces income development by 1-2ppt. Given the state of income development, particularly in high-margin companies like wholesale, I’m involved concerning the margin deteriorating over the subsequent few years.

Inventory Value Pretty Valued Given Development

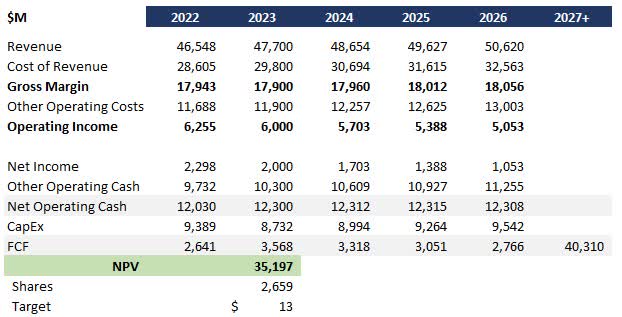

I ran a simplified discounted money movement evaluation with the next assumptions:

Administration steerage is achieved for 2023 Income development at 2% based mostly on present pattern Expense development at 3% based mostly on present pattern 9% low cost fee based mostly on low danger premium for a longtime, large-scale telecom 2% long-run development fee based mostly on present traits and market expectations

I generated a worth goal of $13 or 16% upside from at present’s pricing.

ORAN DCF (Knowledge: SA; Evaluation: Mike Dion)

Wall Road analysts get a barely greater worth goal at $14.59 and suggest a powerful purchase. Additionally price noting that the quant ranking is giving a powerful purchase as effectively.

Wall Road Ranking (Searching for Alpha)

Right here is why I’m not recommending a purchase, regardless of the concurrence of the three rankings above.

DCF evaluation on this case is very delicate to income development fee. 10 foundation factors on the expansion fee is +/- $0.50 on the inventory worth. I used a 2% development fee based mostly on the general pattern, however the Q3 development fee of 1.8% drops the value goal to $12. Development is challenged within the total European telecom market and there may be solely a lot development that may be priced in for anyone firm. Orange must stabilize declines in areas like wholesale for a couple of quarters.

Upside Potential And Draw back Danger

On the upside, Orange might exceed trade development targets via its “disciplined worth” technique along with stabilizing price development. Alternatively, Orange might drive extra worth from companies like Enterprise or monetary providers to offset core challenges.

On the draw back, prices might develop quicker than anticipated if inflation doesn’t proceed to mitigate. As well as, companies like wholesale or fastened entry might decline quicker than anticipated, or retail development might decelerate.

General, I really feel that the upside and draw back are effectively balanced, particularly given the inertia of such a big firm.

Verdict

In conclusion, whereas my DCF reveals a worth goal of $13, a possible upside of 16% from at present’s pricing, and finds sturdy purchase suggestions from each Wall Road analysts and quantitative rankings, it is essential to strategy this with warning. The corporate’s valuation is very delicate to income development fee changes – a discount of the projected development fee from 2% to 1.8% ends in a worth goal drop to $12. Moreover, the European telecom market poses development challenges, and Orange is grappling with the necessity to halt declines in sectors corresponding to wholesale.

Potential development avenues for Orange embrace exceeding trade development targets by way of its “disciplined worth” technique and deriving extra worth from sectors like Enterprise or monetary providers. Nevertheless, the dangers embrace a possible enhance in prices if inflation doesn’t persist in mitigating them or a faster-than-expected decline in companies like wholesale or fastened entry. Given these elements, I fee Orange a maintain with a well-balanced upside and draw back from the inertia of such a big firm like Orange.

[ad_2]

Source link