[ad_1]

peepo

There are a lot of the explanation why the automotive business isn’t a very enticing one. It’s capital intensive, gross sales are very delicate to the state of the financial system, which ends up in excessive cyclicality, and most members are likely to have mainly no aggressive moats. Similar to airways (JETS), the auto producer sector has seen greater than its fair proportion of bankruptcies, given the harmful mixture of excessive debt masses with cyclical income. The one two U.S. auto producers we will consider that haven’t gone bankrupt are Tesla (TSLA) and Ford (F).

The one exception we see is high-end manufacturers, the place shoppers are prepared to pay a premium for the status they provide. Just like how luxurious garments and equipment firms like Louis Vuitton (OTCPK:LVMHF), Hermès (OTCPK:HESAY), and Kering (OTCPK:PPRUY) have delivered superior monetary efficiency, luxurious automakers are additionally in a position to ship extra enticing financials to buyers. Rich shoppers are prepared to pay very excessive markups for the design, high quality, efficiency, and cachet these manufacturers supply. That is true to some extent for Tesla, BMW (OTCPK:BMWYY), and Mercedes-Benz (OTCPK:MBGYY), however rather more so for Ferrari NV (RACE) and Porsche AG (OTCPK:DRPRY). Each these firms are thought of among the many ten most useful luxurious manufacturers on the planet.

Porsche AG Investor Presentation

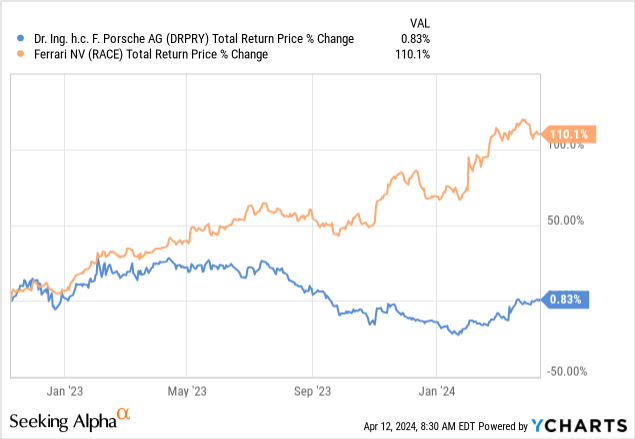

Ferrari has been buying and selling for longer, having had its IPO in 2015, and has delivered over 600% returns to buyers. Porsche AG grew to become public in 2022, and its efficiency has been lackluster. Nonetheless, issues might be completely different going ahead, despite the fact that Ferrari nonetheless has the benefit of a extra prosperous buyer base on common.

Financials

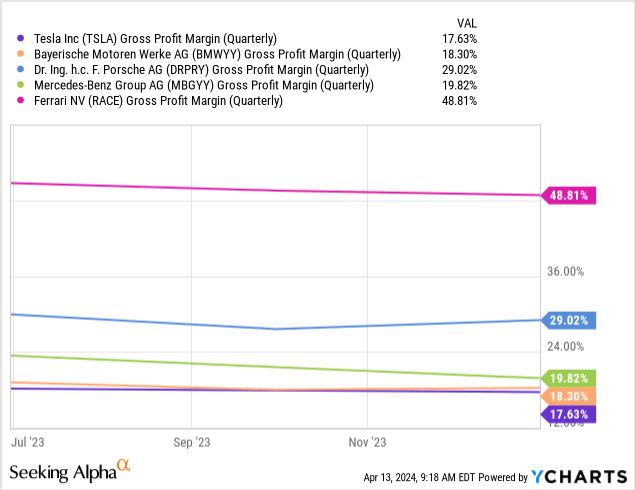

Their model worth is mirrored in vastly superior gross revenue margins, with Ferrari near 50%, and Porsche at near 30%. Tesla, BMW, and Mercedes are all presently delivering gross revenue margins beneath 20%.

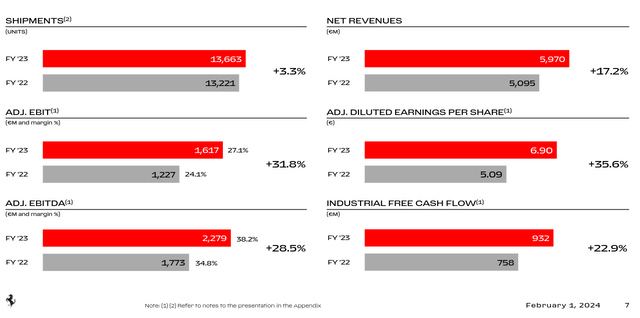

Each Ferrari and Porsche noticed vital advantages from elevated pricing and useful combine in 2023, whereas volumes had been up solely barely. For instance, as could be seen within the slide beneath, whereas Ferrari shipped solely 3.3% extra automobiles in comparison with the earlier 12 months, revenues had been up greater than 17%, and adjusted diluted EPS had been up greater than 35%.

Ferrari Investor Presentation

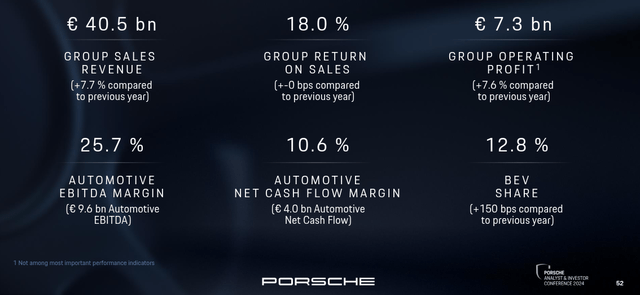

Porsche noticed a extra modest income enhance, largely on account of headwinds in China, one in all its most essential markets. Nonetheless, the corporate managed to ship some development and its revenue margins remained at enviable ranges. Porsche has additionally been efficiently growing the proportion of gross sales from battery-electric automobiles.

Porsche AG Investor Presentation

Innovation & New Launches

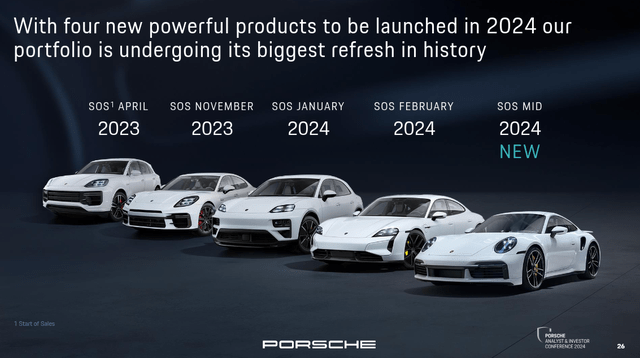

Porsche is refreshing its portfolio with a number of essential launches in 2024, embrace a brand new 911 mannequin, which might be a sporty high-performance hybrid. One space the place we see Porsche outperforming Ferrari is within the transition to electrical automobiles.

Porsche AG Investor Presentation

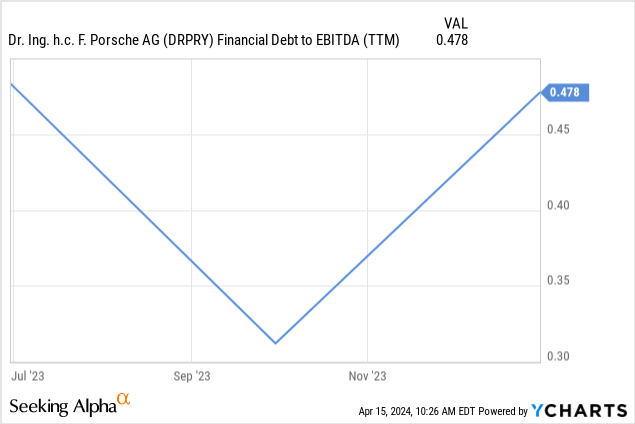

Steadiness Sheet

Porsche AG has a really strong stability sheet with comparatively low leverage. We predict it might simply survive a recession, and it might additionally afford to reinvest within the enterprise and return capital to shareholders.

Valuations

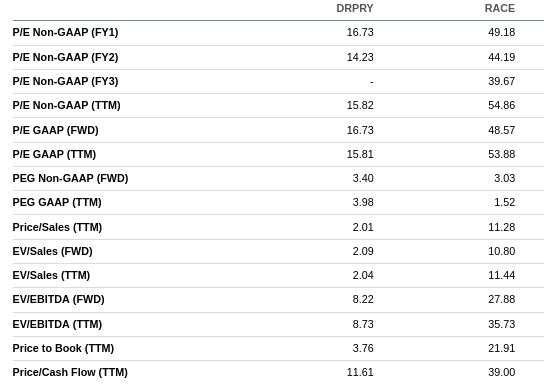

Shut competitor Ferrari gives a minuscule ahead dividend yield of ~0.6%, whereas Porsche’s ahead dividend yield is considerably extra enticing at ~2.4%. BMW and Mercedes supply larger dividends, however we consider they’re in a special class, as their gross revenue margins confirmed. We’ll due to this fact focus extra on Ferrari as essentially the most related peer.

Ferrari is buying and selling at a lot larger valuation multiples. For instance, Porsche AG is buying and selling with a roughly 17x ahead Value/Earnings a number of, whereas Ferrari is buying and selling at a valuation a number of about thrice larger. Whereas we agree with the market that Ferrari deserves to commerce at a better valuation given its larger development and margins, we consider the distinction to be extreme.

In search of Alpha

Based mostly on our earnings estimates for each firms we calculated a internet current worth of $12.27 for DRPRY and $185.50 for RACE. We due to this fact see Porsche AG as roughly 20% undervalued, whereas RACE seems to be considerably overvalued proper now.

EPS DRPRY Discounted @ 10% EPS RACE Discounted @ 10% FY 24E 0.59 0.54 8.35 7.59 FY 25E 0.69 0.57 9.29 7.68 FY 26E 0.75 0.57 10.34 7.77 FY 27E 0.82 0.56 11.48 7.84 FY 28E 0.89 0.55 12.74 7.91 FY 29E 0.97 0.55 14.14 7.98 FY 30E 1.06 0.54 15.70 8.05 FY 31E 1.16 0.54 17.42 8.13 FY 32E 1.26 0.53 19.34 8.20 FY 33E 1.37 0.53 21.47 8.28 FY 34E 1.50 0.53 23.83 8.35 Terminal Worth @ 3% terminal development 19.64 6.26 306.68 97.72 NPV $12.27 $185.50 Click on to enlarge

Dangers

With Ferrari, we see two essential dangers, one is that it seems behind opponents like Porsche within the transfer in direction of electrification, with its first absolutely electrical automobile not anticipated to be out there till the ultimate quarter of 2025. The opposite danger is the extraordinarily excessive valuation at which it presently trades.

In Porsche’s AG case we see completely different dangers, one being its buyer combine, which incorporates some higher center class prospects that are usually extra economically delicate in comparison with Ferrari’s tremendous wealthy clientele. Porsche can be extremely depending on the Chinese language market, which has been notably weak and difficult lately. The corporate is mitigating this danger by adjusting manufacturing to stability demand and provide, and avoiding having to resort to deep reductions. One other danger with Porsche AG is that the corporate is managed by its largest shareholder, Volkswagen AG (OTCPK:VWAGY), which itself is managed by Porsche Automobil Holding SE (OTCPK:POAHF). Porsche SE is itself managed by the Porsche-Piëch household. The chance is that their pursuits may not at all times be aligned with that of minority shareholders, though there’s profit in Volkswagen and Porsche engaged on joint initiatives and collaborating in R&D and different innovation efforts.

Conclusion

Whereas Ferrari has essentially the most spectacular financials of any automotive firm we’ve got ever analyzed, we discover its valuation extreme. In the meantime Porsche AG additionally gives the advantages of an ultra-premium model, leading to above common gross revenue margins, at a way more cheap valuation. There are essential dangers to contemplate with each firms, however we want Porsche AG given the margin of security its present valuation gives.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link