[ad_1]

Settapongd Dee-ud/iStock through Getty Photos

Expensive readers,

Iron Mountain Integrated (NYSE:IRM) is a knowledge storage REIT targeted on revolutionary options in knowledge heart infrastructure, asset lifecycle administration, and data administration providers. The REIT primarily owns two distinct kinds of properties – paper storage services and knowledge facilities. Whereas the previous is prone to expertise a secular decline over time, the latter has boomed these days because of the rise of AI. Each section enhances one another fairly effectively as IRM typically takes in paper paperwork that it digitizes and shops in a digital kind on their servers, due to this fact offering end-to-end knowledge storage options to their clients.

I began protection on the inventory with a HOLD ranking at $63 per share again in July 2023 and was fairly skeptical in regards to the inventory’s future prospects for quite a few causes, specifically:

a heavy presence in a declining paper storage market excessive (preliminary and upkeep) CAPEX of information facilities decelerating income development, notably within the providers section and most significantly premium valuation at a time when most different REITs have been buying and selling at a reduction

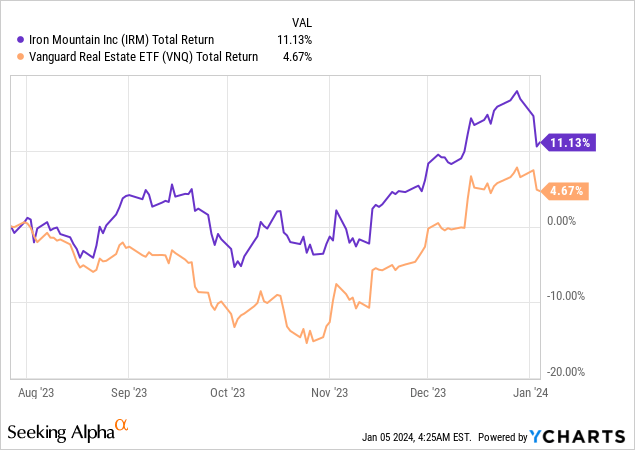

Since my article, IRM has outperformed the broader REIT index (VNQ) and has returned RoR of 11%. However the inventory stays costly relative to the remainder of the REIT sector, regardless of clear deceleration traits seen within the newest earnings.

The corporate has additionally just lately made an acquisition of Regency Applied sciences for $200 Million. The acquisition is supposed to increase IRM’s lifecycle enterprise into a brand new section of recycling IT belongings. The corporate made the next assertion concerning the advantages of the acquisition:

This strategic transaction represents a major milestone in our efforts to strengthen Iron Mountain’s presence within the Asset Lifecycle Administration sector and our sustainability choices and can propel our enterprise development ahead.

I just like the acquisition as a result of it continues to shift the portfolio additional away from conventional paper storage services, which have a questionable future.

Good efficiency, however decelerating development

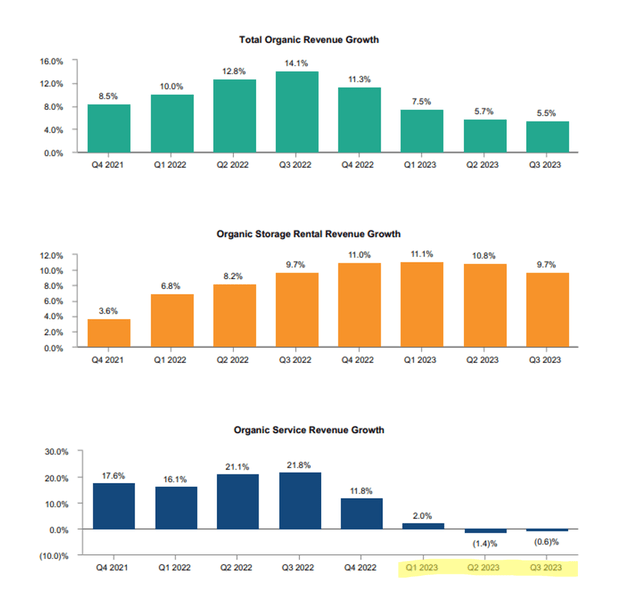

Once I wrote the unique article, IRM had reported a fantastic first quarter with year-over-year AFFO development of 9%, which not less than considerably supported the premium valuation. I warned that service income development began decelerating and that going ahead natural income development, in addition to AFFO development, would probably sluggish.

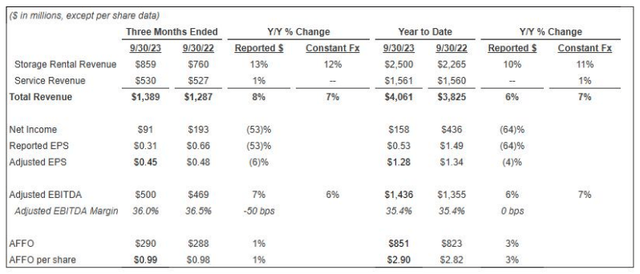

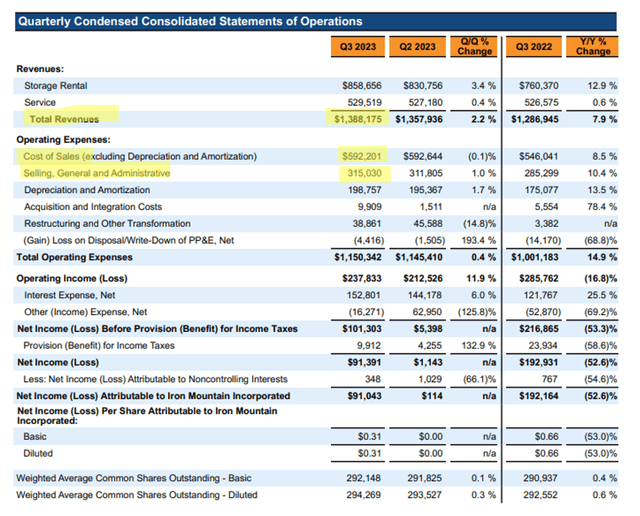

Certainly, year-to-date AFFO per share grew by simply 3% YoY, and throughout the third quarter development was minimal at simply 1% YoY as AFFO per share reached $0.99.

IRM Presentation

The deceleration in AFFO development was, largely, pushed by flat service revenues over the previous 9 months.

Yr-to-date, natural storage revenues grew properly at 10.5% YoY, however have additionally began to come back down from report ranges seen in late 2022 and early 2023. Development in natural storage revenues was pushed by 20% YoY development within the knowledge heart enterprise, pushed primarily by new knowledge heart commencements.

IRM Presentation

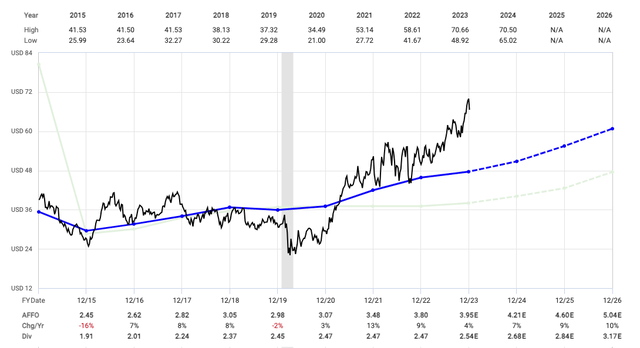

For the complete yr, administration expects AFFO to come back in at $3.91-$4.00 per share, up 4% YoY. Past that, analyst consensus requires 7% development in 2024 and 9% in 2025. Notably, these analysts have a 100% 2-year hit fee (with a 20% error margin), however I see their estimates as bold in mild of present development deceleration traits. To err on the aspect of warning, I assume income development of solely 4% per yr in my calculations which is according to the long-term development CAGR.

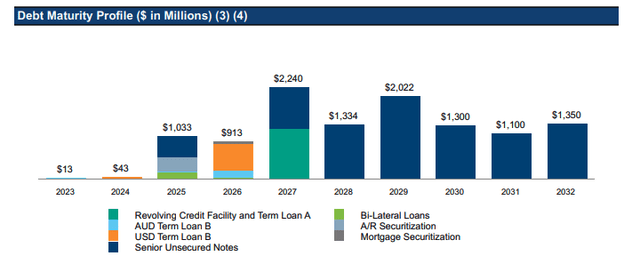

I additionally need to level out that IRM’s steadiness sheet has a comparatively poor ranking of BB-. Their leverage is comparatively cheap at 6.1x adjusted EBITDA, however they’ve 19% of floating fee debt and an already high-weighted common rate of interest of 5.6%. Amongst their costliest debt is the $1.28 Billion excellent on their revolving line of credit score which at the moment accrues curiosity at a whopping 7.2%. I discussed in my earlier article that IRM tried to refinance the credit score line with 7% notes due in 2029 however has made little progress on this entrance.

The REIT has no materials debt maturities till 2025, however given their excessive publicity to floating fee debt, the curiosity expense will probably rise in 2024, posing headwinds to an bold AFFO development forecast.

IRM Presentation

An costly price ticket relative to different REITs

IRM pays a 3.9% dividend yield and the dividend hasn’t elevated a lot through the years regardless of a wholesome 64% payout ratio. I see no imminent danger of a dividend reduce right here and absolutely anticipate the dividend to stay and develop barely within the following years.

However this is the factor. IRM trades at a excessive a number of of 16.8x AFFO, which is meaningfully above its historic common of 12x AFFO.

FAST Graphs

IRM does not report NOI, however it may be approximated by deducting the price of gross sales and SG&A from complete revenues. With web debt of $11.5 Billion and a market cap of slightly below $20 Billion, I estimate that the inventory trades at an implied cap fee of 6.2%.

IRM Presentation

To place issues into perspective, Realty Revenue (O) which is among the most secure REITs, trades at 5.5%. Lengthy-term treasury bonds commerce at 4%, which means a 220 bps danger premium for IRM. I think about such a premium relative to treasuries roughly honest given IRM’s BB- ranking.

It is also price noticing that IRM is in truth fairly inefficient in the best way it runs the enterprise and consequently has very low working and revenue margins of 17% and 6.5%, respectively. That is extraordinarily low for a REIT.

All issues thought-about, I can see why the REIT would enchantment to buyers who imagine in AI. However on the similar time, I can not ignore the truth that income development has slowed materially this yr. I do not really feel completely comfy with the consensus forecast which requires an acceleration in development, largely out of nowhere, regardless of headwinds from a better curiosity expense. Extra importantly, I’m not comfy shopping for a REIT at what I think about honest worth after I can purchase others at steep reductions. For these causes, I downgrade IRM to a SELL right here at $66.50 per share.

The one danger to my thesis is that IRM, for some cause, continues to commerce at a premium to the remainder of the REIT sector. This might occur if the AI-fueled rally continues and/or strengthens. Furthermore, a re-acceleration in income development and/or a decrease valuation which might put the risk-reward in step with the remainder of the sector would additionally make me rethink my stance.

[ad_2]

Source link