[ad_1]

Skyline of Tokyo, Japan.

Jackyenjoyphotography | Second | Getty Pictures

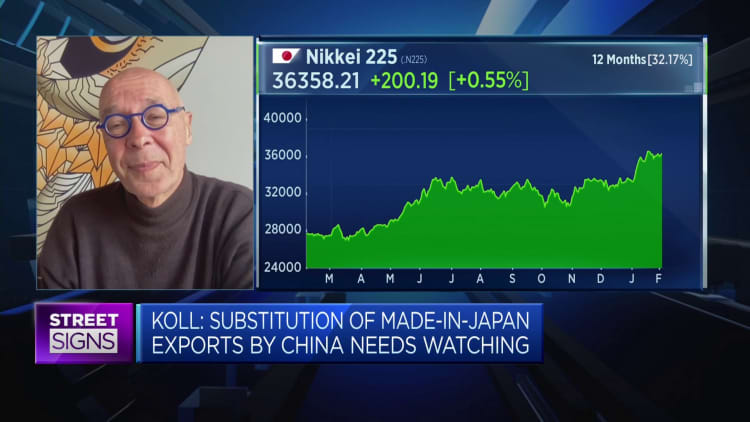

Japan’s Nikkei 225 smashed by way of the 40,000 stage on Monday, hovering previous one other milestone to a brand new document excessive — nevertheless it didn’t shock Japan professional Jesper Koll who expects one other 37% upside for the benchmark inventory index.

“In my view, it’s completely cheap to count on an increase within the Nikkei to 55,000 by end-2025. I [know I sound] extra like a bubble-era stockbroker than a gentleman, however I can not cover my pleasure,” Koll, professional director at monetary companies agency Monex Group, advised CNBC on Monday.

Koll was referring to the asset and fairness bubble Japan noticed within the late 80s, which resulted within the Nikkei hitting its 1989 highs.

However the euphoria didn’t final. In 1990, the bubble burst and Japan fell right into a interval of financial stagnation, recognized immediately as its “misplaced a long time.” In lower than a yr, the Nikkei misplaced half its worth.

Nikkei’s new highs

For the previous two weeks, Japan’s benchmark inventory index has been testing uncharted territory.

On Feb. 22, the index surpassed its earlier all-time excessive of 38,915.87, set on Dec. 29, 1989 — breaching a document that was held for 34 years.

Following that, the index climbed previous the 39,000 mark, and ultimately crossed the 40,000 stage on Monday.

In July final yr, Koll advised CNBC’s “Road Indicators Asia” he anticipated the Nikkei to hit 40,000 “over the following 12 months.”

When requested what drives his optimism, Koll advised CNBC on Monday that it was partially as a consequence of Japan’s means to be a “capital value-creating superpower.”

He mentioned his optimism doesn’t stem from the Financial institution of Japan’s financial actions, nor a lift from the so-called “new capitalism” initiative introduced by Prime Minister Fumio Kishida in June.

As an alternative, his optimism comes from Japan’s non-public sector.

“Japan’s energy comes bottom-up from the non-public sector,” Koll mentioned.

“Japan’s firms command superior earnings energy. Two a long time of relentless ‘kaizen’ restructuring have turned company Japan right into a capital value-creating superpower.”

There isn’t a query that Japanese ‘salarymen CEOs’ created extra basic financial worth than Wall Road’s celebrity CEOs.

Jesper Koll

Professional director, Monex Group

“Kaizen” refers broadly to the artwork of fixed enchancment by way of small modifications. First adopted by Japanese companies after World Warfare II, it’s a Japanese time period that seeks “steady enchancment.”

Notably, it views enchancment in productiveness as a “gradual and methodical course of,” recognizing that enchancment can come from any worker at any time.

“The times of virtually determined top-down disaster administration and macro stimulus are over,” Koll mentioned. “That was the faux rallies we received over the previous 30 years.”

Koll mentioned that between 1995 and 2022, the top-line gross sales progress for Topix firms was up by 1.1 occasions; however earnings per share rose by 11 occasions.

He in contrast it to the S&P 500 firms on Wall Road, declaring these firms reported a sale progress of three occasions, and EPS rose by 6 occasions.

“There isn’t a query that Japanese ‘salarymen CEOs’ created extra basic financial worth than Wall Road’s celebrity CEOs.”

‘Go-go Nikkei’

Koll’s optimism doesn’t finish right here. He mentioned it’s “completely cheap” to count on the Nikkei to rise to 55,000 earlier than the top of 2025.

“Go-go Nikkei,” he quipped, making a pun on the Japanese translation of 5-5 being “go-go.”

He mentioned Japanese CEOs are the “undisputed world champions of delivering on the laborious half, true financial worth creation.”

Veteran worth investor Warren Buffett elevated his stakes in 5 of Japan’s largest buying and selling homes in 2023, however promised the CEO of every firm that Berkshire Hathaway “would by no means purchase greater than 9.9% with out their consent.”

“All of them welcomed us in, and their outcomes have exceeded our expectations since we bought the group,” he advised CNBC in April final yr.

“We could not really feel higher concerning the funding [in Japan],” he added, after talking to the CEOs of these buying and selling homes, specifically Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

In line with Koll, the true query buyers should ask now could be: What’s the likelihood for Japanese earnings and EPS to rise by 37% between now and end-2025?

He mentioned that the majority international buyers he spoke to suppose an EPS progress of about 30-40% is a “completely cheap forecast.” He identified that in any case, EPS surged 11 occasions between 1995 to 2002, throughout a time when Japan was experiencing deflation.

Potential headwinds

Nonetheless, there are could also be world and home dangers that might derail that optimism.

At dwelling, Koll mentioned Kishida is aiming to spice up authorities spending, together with elevating child-care allowances and elevated spending on deep tech college analysis and protection — however the prime minister has but to current plans on the best way to pay for these initiatives.

As such, Koll is anticipating tax hikes to be on the horizon, maybe in 2025 or 2026. Traditionally, he mentioned, tax increments have all the time been a giant problem for Japanese shares.

The danger on the worldwide entrance is what the Japan professional calls a “Made-in-China foreign money conflict.” If Chinese language authorities are compelled to devalue the Chinese language yuan by about 20% to 30%, it will pose an enormous problem to Japanese competitiveness, he added.

Explaining his view, Koll mentioned China may search to weaken its foreign money so as to enhance competitiveness if the nation falls into outright deflation.

One other potential headwind might be U.S. or European tariffs imposed on Chinese language imports.

“In a world commerce conflict, Japan will get harm,” Koll identified.

[ad_2]

Source link