[ad_1]

Slimoche

Written by Ophir Gottlieb

Lede

We reiterate our bullish (however speculative) stance on Jumia however notice chapter threat. This isn’t an funding for everybody.

The CEO, Francis Dufay, has a transparent plan, however extra importantly, is executing on that plan impeccably effectively. Our religion in Jumia is a mirrored image of our religion in Francis based mostly on our a number of conversations with him.

On January third, Morgan Stanley upgraded Jumia to market carry out and raised its worth goal from $3.00 to $3.60.

We consider this may very well be the start of establishments recognizing the somewhat radical change within the firm’s trajectory.

Preface

Jumia Applied sciences (NYSE:JMIA) reported earnings on 11-15-2023 earlier than the market opened and substantial progress was made for the singular aim that we should deal with within the intermediate time period: solvency.

Whereas we do some deeper evaluation under, these are the essential takeaways.

Bettering Bills

First, 5 bullets on enhancing bills and losses:

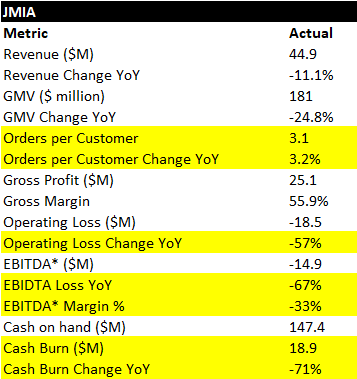

1. Quarterly money burn dropped 71% yr over yr (YoY).

2. Liquidity of $147.4 million, leaving the corporate seven quarters of “survival money runway.”

3. Internet money utilized in operations dropped 55% YoY; Adjusted EBITDA loss dropped 67% YoY.

4. Gross sales and Promoting bills dropped 74% YoY; Client incentives dropped 63% YoY.

5. Achievement expense down from 9.6% of income to six.6% of income; needs to be, at the very least partly, a everlasting operational effectivity achieve.

Bettering Progress

Second, six bullets on progress:

1. Progress technique working: improve in GMV of bodily items in 5 international locations utilizing the gross sales strategy (JForce) that CEO led in Ivory Coast (for 10 years) earlier than changing into CEO. JForce is straight away accretive to money stream.

2. Growth into secondary cities and rural areas is accelerating.

3. Jumia’s new pick-up stations, branded to the agency, now account for 44% of deliveries.

4. Variety of orders had dipped attributable to deliberate choices to deal with core classes and scale back incentives has now returned to progress with 11% QoQ progress; Q3 normally reveals a seasonal drop from Q2.

5. Increased repurchase charges from new clients; elevated common bodily order worth (+5% YoY)

6. Income on a relentless foreign money foundation rose by 19% YoY.

With little time to point out dramatic enchancment, Jumia is doing it.

The last word will need to have is money burn to dip to zero or very shut it; after which flip optimistic.

quarterly outcomes (FactSet)

Replace: 11-17-2023

We spoke with the CEO

Finish Replace

On the High

Final quarter we famous that we had interviewed two specialists and shared these conversations with CML Professional members.

Mixed with our assembly with new CEO Francis Dufay (a ten-year Jumia veteran), there have been many takeaways the place all three sources agreed.

From the agreements in these conversations, our personal conversations with Nigerian residents, and arduous knowledge from the final seven quarters of financials, it is now time to pay some consideration to Jumia as an ascension story, somewhat than only a survival story. However that is nonetheless a survival story first…

Make no mistake: That is nonetheless a survival story first…

The fly within the ointment final quarter (Q3 2023) was huge: The $38M money burn in Q2 was bigger than the prior quarter however half of it was non-operational – it was foreign money headwinds.

There’s hardship in masking JMIA: the corporate has no analysts of document. Which means no estimates.

We won’t let you know how the agency did relative to estimates as a result of there are none. However, on this one case, only for the very short-term, it is perhaps higher that there aren’t any estimates to match outcomes to as a result of we will cowl survival with no need estimates from analysts of document; we simply want a steadiness sheet and firm steerage.

What’s Occurring – The Apex of Change

Regardless of native macro-economic hardships, Jumia’s enterprise is sustaining income progress in fixed foreign money (+19%) whilst EBITDA loss has dropped by 67%.

The corporate reported its smallest EBITDA loss in its historical past in Q2 2023 at $19.3M versus estimates for a lack of $23.9M. That is on the again of two quarters in the past (Q1) which on the time was the smallest EBITDA loss in its historical past.

This quarter progress on money burn was higher as was progress on progress, with an EBITDA loss all the way down to $14.9 million.

This income progress (on fixed foreign money) comes even because the agency dropped unprofitable enterprise traces and deliberately lowered sure income streams which have confirmed to be money stream destructive. The deliberately dropped companies accounted for 45% of the decline in whole orders in Q2 2023.

(We notice that bills are far much less impacted by foreign money headwinds since income and expense are principally transacted in the identical foreign money.)

However that’s not the story; removed from it. Working money stream burn, yr over yr, dropped by 75% in Q1 2023, two-quarters into the brand new CEO’s management.

Final quarter the working loss discount was 64%.

This quarter noticed a 57% drop in working loss.

The corporate may very well be lower than twelve-months away from breakeven with its $147 million USD on the steadiness sheet (as of Sep 30, 2023), and it higher be.

We consider that if the agency can present steerage of working money stream breakeven inside a couple of quarters, the solvency threat will likely be off the desk and that leaves an enterprise to be valued on its enterprise, not its chapter threat and that enterprise is value excess of pennies on the greenback.

That leaves an enterprise priced at lower than 2x money available, rising income at 19% (fixed foreign money), working money stream loss down 55%, an immovable logistics and model moat in ten African economies, the place even UPS has submitted to its power, and a worthwhile progress trajectory that might final greater than a decade.

After all, the choice is an organization that’s defunct in a matter of lower than two years. In different phrases, this breakeven isn’t a pleasant to have – it is a will need to have.

We begin with agreements from the conversations after which to the financials, which have been radically improved in simply three quarters.

The 4 elementary agreements from the conversations we famous above had been the next:

4 elementary Agreements from Knowledgeable Checks

1. The Jumia model is stronger than even that of Amazon, with comparisons to Google and Fb as a worldwide model. The commentary to this fashion has been ubiquitous and unanimous.

Actually, the Jumia model enchantment is so robust that the agency is ready and continues to rent extra expertise at a decrease price merely for the advantage of the imprimatur of the employer.

2. Logistics exterior of main cities within the African international locations that Jumia serves is not like something in Western international locations.

There aren’t any addresses, no highway indicators, and even, in some locations, no roads in any respect, with restricted Web.

With out Jumia, that portion of the world, a whole lot of hundreds of thousands of individuals, is minimize off from the West and from provide past what their native markets carry.

Proof of the moat Jumia holds inside its logistics enterprise was uncovered in April of 2022, when UPS introduced a partnership with Jumia to develop its logistics providers in Africa.

However opposite to standard Western based mostly evaluation, the native markets that serve these huge populations usually are not a barrier to entry for options, however somewhat a conduit to these options, and this level is crucially vital and vastly misunderstood as is the populace at massive.

The Jumia logistics arm and JForce are crown jewels of the enterprise as Jumia employs locals in dozens of non-urban geographies handy ship the Web to folks’s doorsteps (JForce), after which hand ship the packages, facilitating commerce at a scale that’s nearly unattainable for an additional agency to attain.

Utilizing Jumia Pay, no money is exchanged and fee on supply reduces a lot of the friction of a (rightfully) hesitant buyer cohort. This gross sales movement (JForce) has been efficiently accomplished and proved out in varied international locations, most notably in elements of the Ivory Coast, the place the present CEO previously ran enterprise operations.

The enterprise, per our inner conversations with former Jumia senior managers, is sort of instantly accretive to money stream.

3. The whole addressable market as measured by demand for items mixed with the power of consumers to pay for these items are each underappreciated by the skin world.

Locals spend cash for items weekly; they’re merely restricted to these merchandise which are inside strolling distance. This phenomenon exists all through the 9 international locations that Jumia serves and whole to billions of unaddressed demand.

With its logistic arm and JForce, Jumia has discovered and continues to seek out excessive demand and a willingness to spend as varied populaces as soon as terribly restricted to native provide decisions are actually uncovered to selection from something that Jumia / China / The Web can ship.

When addressing this specific phenomenon, the CEO famous that he “deeply believes” that present markets are constrained by provide, not demand, and that accessing the huge pool of Chinese language suppliers is a “large benefit” the place Jumia will seize a “sizeable take fee.”

The margins are excessive on this enterprise, worthwhile practically instantly, and has been confirmed out in a number of areas already, and the demand, per our professional calls, is recurring and fairly substantial.

4. Jumia is and has deliberately moved away from unprofitable classes. It has suspended first occasion grocery providing in most international locations and “considerably lowered” promotional depth behind quite a lot of non-profitable providers. This may seem as a decrease consumer base within the near-term, nevertheless it is because of intentional strikes that will likely be accretive to long-term sustainable profitability whereas specializing in progress in worthwhile enterprises (like native promoting by JForce).

After the second quarter report and our professional channel checks, we felt that all the things we had heard about Jumia from our different analysis is true: dominant model recognition.

Now we have an professional now, extra senior than the one prior, that laid out the unimaginable points with making a enterprise work within the Sub-Saharan African international locations; simply wild obstacles from no addresses, to thuggery, theft, political corruption, and even the issue of sustaining the standard of the paper cash held in wallets since banking is not that frequent.

The chance is large however the dangers are effectively mentioned right here. Jumia is kind of dangerous – very dangerous even – simply know that.

The query is how quickly profitability might be achieved, specifically with respect to the money available.

Two quarters in the past, as in Q1 2023, Working loss was surprisingly low.

Loss from operations was just below $31 million, whereas Wall Road estimates had been at a $44 million loss.

That could be a substantial turnaround from the $66.4 million loss in the identical quarter a yr in the past.

In fixed foreign money, JMIA income grew 24%.

The core enterprise grew and bills dropped.

A couple of catch-all charts up to date for the quarter simply reported do the story’s introduction justice.

Whereas a DCF mannequin may extrapolate varied outcomes of worth for the agency, the fairness market has made the computation simpler:

If the enterprise can maintain as a going concern, then the fairness worth can be value considerably greater than merely money available.

So, the main focus for Jumia is, whereas straightforward to lose the forest for the bushes, survival.

If the agency can attain money stream breakeven, shorts can have an issue.

If the agency can not attain money stream breakeven, the fairness could also be value $0.

Whereas the info all go in the proper course for losses, they need to fall additional, and need to fall sooner.

With a $19M money burn in Q3 and $147M in money available, that reads as an organization with seven quarters of money left (up from 4 quarters in Q2 2023).

Definitely that money burn is declining considerably, however fact is fact: numbers are numbers. Jumia must sluggish its losses by one other 75% somewhat shortly.

Earnings Fast Takeaways

At the moment, JMIA is buying and selling at a few $130 million enterprise worth (EV); that is market cap – money.

Additional, we’ve got no analyst estimates to match outcomes to; there aren’t any analysts.

If JMIA is definitely a going concern in three-years, in needs to be value greater than $130 million, and analyst estimates will not matter to hit that low bar (survival).

Our prior dossiers on Jumia had been all the time fairly lengthy – together with a reiteration of its historical past.

Final quarter we lastly reached the purpose the place we may (and can) merely evaluate the quarter reported, and direct all traders to our prior dossiers on JMIA for the somewhat lengthy and concerned historical past.

Threat

There are various, many dangers for Jumia however the single most vital is the primary bullet level:

• Will Jumia exist in a two-years, or will it go bankrupt?

• Even when the thought is correct, Africa is like no different place on this planet in some ways.

• This logistics community is sensible, nevertheless it’s not straightforward and we actually do not know what occurs if it has to scale up.

• Can Jumia deal with $500 million in gross sales? $1 billion? $10 billion?

These are cheap questions, and we’ve got no apparent reply.

• Will Jumia do the arduous half and construct out a digital Africa solely to see an enormous American or (extra possible) Chinese language agency take that market as soon as it is made and crush the Jumia enterprise?

In any case, China is actually in “colonization” mode over Africa because it builds out its infrastructure (water, electrical energy, roads) with a probable boomerang quid professional quo – “we constructed it, we personal it.”

What does Jumia do in that regard? What does Africa do?

• The place are the massive traders? Why hasn’t a well-respected agency like Abdiel, Dragoneer, Whale Rock, Tiger… anybody invested even $100 million to take a 5% stake within the firm? Are we the fools on the poker desk?

• Is the platform technique working or is that this all attributable to aggressive promoting spend and can drop off after promoting dies down.

• The corporate will possible increase capital once more if it continues to spend to develop.

• There are various extra dangers for Jumia however most of these fall beneath the purview of “regular know-how firm dangers” so we are going to simply go away the final bit as a catch-all.

Conclusion

We reiterate our bullish (however speculative) stance on Jumia however notice chapter threat.

The CEO, Francis Dufay, has a transparent plan, however extra importantly, is executing on that plan impeccably effectively. Our religion in Jumia is a mirrored image of our religion in Francis.

The writer is lengthy Jumia (JMIA) on the time of this writing.

Please learn the authorized disclaimers under and as all the time, bear in mind, CML Professional doesn’t make suggestions or solicitations for the sale or buy of any safety ever. We aren’t licensed to take action, and would not do it even when we had been. We share analysis and supply you the ability to be educated to make your individual choices.

Authorized

The knowledge contained on this web site is offered for basic informational functions, as a comfort to the readers. The supplies usually are not an alternative choice to acquiring skilled recommendation from a professional particular person, agency or company. Seek the advice of the suitable skilled advisor for extra full and present info. Capital Market Laboratories (“The Firm”) doesn’t have interaction in rendering any authorized or skilled providers by inserting these basic informational supplies on this web site.

The Firm particularly disclaims any legal responsibility, whether or not based mostly in contract, tort, strict legal responsibility or in any other case, for any direct, oblique, incidental, consequential, or particular damages arising out of or in any approach linked with entry to or use of the location, even when I’ve been suggested of the potential for such damages, together with legal responsibility in reference to errors or omissions in, or delays in transmission of, info to or from the consumer, interruptions in telecommunications connections to the location or viruses.

The Firm makes no representations or warranties in regards to the accuracy or completeness of the data contained on this web site. Any hyperlinks offered to different server websites are supplied as a matter of comfort and under no circumstances are supposed to indicate that The Firm endorses, sponsors, promotes or is affiliated with the homeowners of or individuals in these websites, or endorse any info contained on these websites, except expressly acknowledged.

[ad_2]

Source link