[ad_1]

Nikada

China is a scorching mess, and a backside is on the market someplace. Every time issues turnaround, the KraneShares Bosera MSCI China A 50 Join Index ETF (NYSEARCA:KBA) could also be one to think about. There will likely be a possibility for bulls/contrarians on China to make some massive positive aspects. I simply do not suppose it is right here…but.

KBA ETF presents a singular platform for investing within the largest and most liquid Chinese language A-share corporations. KBA is a benchmarked ETF that follows the MSCI China A 50 Join Index. This index consists of fifty large-cap shares listed in Shanghai and Shenzhen, accessible via Inventory Join. One of many key options of this index is its futures contracts for Inventory Join-eligible A-shares, which makes it a compelling danger administration software. This function, coupled with KBA’s give attention to the biggest and most liquid shares, makes it a gorgeous choice for worldwide traders.

ETF Holdings

KBA’s portfolio encompasses a various vary of holdings. Here is an summary of its prime particular person positions:

1. Kweichow Moutai Co Ltd: That is China’s main baijiu (a distilled Chinese language spirit) producer and distributor, making up roughly 7.92% of KBA’s portfolio.

2. Up to date Amperex Know-how: The world’s largest provider of electrical automobile (EV) batteries, this firm represents about 6.10% of KBA’s holdings.

3. Wanhua Chemical Group: A number one chemical product provider in China, Wanhua Chemical Group makes up about 5.47% of KBA’s portfolio.

4. Zijin Mining: One in all China’s largest gold producers and the second-largest copper producer, Zijin Mining contributes roughly 4.88% to KBA’s holdings.

5. BYD: A number one participant within the EV market, BYD makes up about 3.87% of KBA’s portfolio.

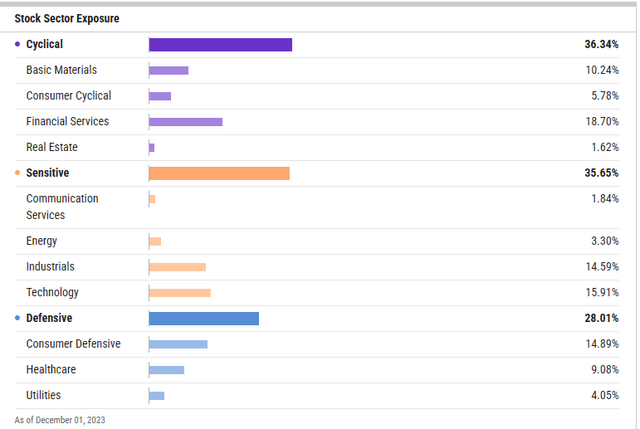

Sector Composition and Weightings

The sector allocation in KBA’s portfolio are what you’d largely anticipate, with Financials, Know-how, and Industrials main the pack. It is price nothing that China, and this ETF, are in the end world development performs, which suggests in case you anticipate a recession, this is not one thing to allocate to from a longer-term perspective.

ycharts.com

Peer Comparability

When in comparison with comparable ETFs, KBA holds its personal. Its closest comparable, the iShares MSCI China A ETF (CNYA), prices a barely larger expense ratio of 0.6%. Moreover, KBA’s portfolio is extra centered, with a decrease allocation to main banks, an vital distinguishing issue.

Execs and Cons of Investing

The theme that KBA tracks has a number of execs and cons:

Execs:

Diversification: KBA presents publicity to a various vary of sectors and corporations inside China’s A-share market.

Potential for Excessive Returns: As China’s economic system continues to develop, there’s potential for top returns. This should be balanced towards an imploding actual property sector there and excessive debt, in order the saying goes, excessive danger, excessive return potential right here.

Threat Administration: The futures contracts for Inventory Join-eligible A-shares provide a potent danger administration software.

Cons:

Geopolitical Threat: Investing in China comes with its share of geopolitical dangers, which may impression the efficiency of the ETF.

Regulatory Threat: The Chinese language authorities’s regulatory measures can have a big impression on the businesses inside KBA’s portfolio.

Conclusion

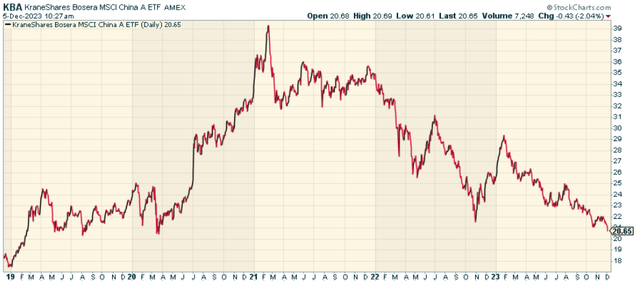

Investing within the KraneShares Bosera MSCI China A 50 Join Index ETF is an effective option to get entry to China. The issue is the timing right here. The chart, actually, appears terrible.

stockcharts.com

I would fairly watch for an actual capitulatory transfer in world equities to allocate right here. It is a good fund for what it does, and suppose it is one to commerce after a washout. We’re nearing that, however not there simply but.

[ad_2]

Source link