[ad_1]

The primary week of 2024 can be an enormous one, with lots of knowledge that may both justify the market rally and expectations for charge cuts or not.

Information that is available in too scorching will kill the concept of charge cuts beginning as quickly as March, and knowledge that is available in too chilly will kill the concept of a smooth touchdown. It means Goldilocks should return from her Christmas journey to Aruba and seem this week.

For December, the index is anticipated to rise to 47.1 from 46.7, whereas the service index falls to 52.5 from 52.7. is anticipated to indicate 113,000 new jobs have been created in December versus 103,000 in November.

Lastly, the official BLS job report 163,000 new jobs could have been made, down from 199,000 in November.

Total, these numbers are in keeping with their prior developments and counsel no important change in financial progress. The Atlanta Fed GDPNow mannequin signifies that the fourth quarter is rising by a 2.4% seasonally adjusted annualized charge.

Not less than, primarily based on the estimates, there doesn’t appear to be sufficient to help charge cuts any time shortly. If it is available in as anticipated, I believe that knowledge might be sufficient to show larger the current decline in charges and tighten monetary situations.

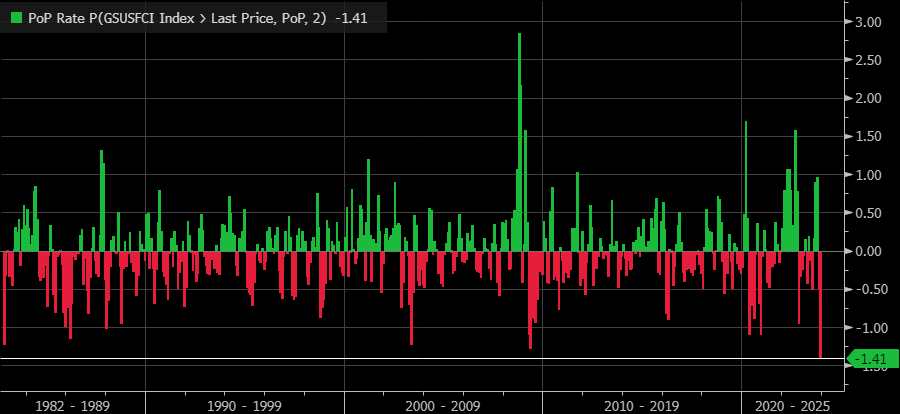

By most requirements, monetary situations have eased a lot that the easing might have already substituted for charge cuts.

In reality, over the past two months, the GS monetary situations index has diminished by its most ever. One might argue this might have a stimulative impact on the US financial system as we transfer ahead.

On prime of this, we now have began to see transport charges rising, as famous by the WCI Composite Container Freight Benchmark, which has elevated from 1381 on November 30 to 1660 on December 21.

Will probably be fascinating to see if the current improve in freight value exhibits up within the ISM manufacturing Priced Paid PMI for December.

There aren’t any estimates at the moment, however the index was 49.9 in November. If one factor is obvious, larger freight prices and easing monetary situations result in larger costs over time.

Charges Will Probably Reverse within the Lengthy-Time period

If this exhibits up, then I’d assume the current decline in long-term charges will seemingly reverse; how excessive charges on the again of the curve go from right here is unclear, however there are indicators that the also can go larger from a technical standpoint.

The RSI is beginning to consolidate and is even displaying indicators of turning larger. The large check can be when the 10-year reaches the 10-day exponential transferring common and if it might probably breathe above that transferring common.

If the 10-year does break larger, the downtrend at 4% turns into the subsequent goal, and after that, we might be speaking a couple of 10-year transferring larger to round 4.35%.

Total, I believe this can seemingly end result within the curve transferring larger, with a lot of the heavy lifting coming from the again of the curve. It definitely seems just like the curve is breaking out of a downtrend.

S&P 500: Larger Charges and Steeper Curves Would possibly Deter the Bulls

As for the , larger charges and steeper curves will current issues, particularly whether it is as a result of we start to begin seeing the consequences of easing monetary situations on this week’s knowledge factors.

The S&P 500 additionally broke under a rising wedge sample and is closing in on the 10-day exponential transferring common, which hasn’t been damaged since November 2.

That transferring common comes at 4,745 and is across the zero gamma degree.

The zero gamma degree is the road that separates constructive from unfavourable gamma; a break under the zero gamma degree would push the index again into unfavourable gamma and improve volatility. I nonetheless assume a return to 4,100 over the subsequent a number of weeks is probably going.

So, at this level, it appears rather a lot is driving on the information this week, and to maintain the market transferring larger, it’ll take the information coming in good. Something too scorching or chilly can be an enormous blow to the end-of-year rally.

Authentic Put up

[ad_2]

Source link