[ad_1]

American investor David Einhorn manages the Greenlight Capital hedge fund.

Over the past 5 years, the fund has gained greater than 48%.

On this piece, we’ll take a better take a look at his portfolio composition utilizing InvestingPro.

In 2024, make investments like the large funds from the consolation of your house with our AI-powered ProPicks inventory choice device. Be taught extra right here>>

David M. Einhorn, an American investor and newbie poker participant, based the hedge fund Greenlight Capital in 1996. Einhorn is thought for his outspoken nature within the finance world, usually publicly criticizing and advocating for short-selling main firms on Wall Avenue.

Over the previous 5 years, the fund has delivered a formidable almost 50% return, primarily investing in client durables and mining-related firms. The fund’s largest holding, comprising 28.9% of its portfolio, is Inexperienced Brick Companions (NYSE:), making its efficiency carefully tied to the valuation of this inventory.

David Einhorn’s Affect

David Einhorn’s affect within the monetary world is obvious from his inclusion in Time journal’s checklist of the 100 most influential individuals in 2013. With an estimated wealth of $1.5 billion in 2019, Einhorn’s speeches usually spotlight weaknesses in particular firms, resulting in ideas for brief promoting.

His notable calls embody accusing Allied Capital of fraud and elevating considerations about Lehman Brothers’ accounting practices, which later proved to be legitimate when the funding financial institution declared chapter. Einhorn additionally criticized Microsoft Company (NASDAQ:) in 2011, calling for a change in management after it misplaced market worth to Apple (NASDAQ:) and Alphabet (NASDAQ:). Nonetheless, his profession confronted a setback with an $11.2 million tremendous from the UK Monetary Providers Authority for insider buying and selling.

Greenlight Capital Fund Overview

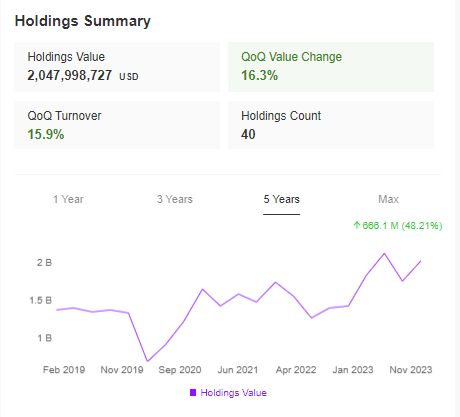

As of the top of 2023, Greenlight Capital has delivered a 48.2% return over 5 years and manages belongings exceeding $2 billion. The fund’s efficiency and funding concepts can be found within the InvestingPro platform’s concepts part.

Greenlight Capital

Supply: InvestingPro

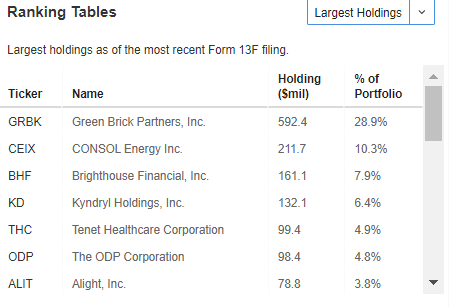

The construction of the funding portfolio, which is characterised by an elevated share of 1 or a number of firms, makes for much less diversification and an absence of danger spreading. On this case, the primary two firms on which Greenlight Capital’s efficiency largely relies upon are CONSOL Power (NYSE:) and Inexperienced Brick Companions.

Holdings

Supply: InvestingPro

Inexperienced Brick Companions Inventory Assaults Historic Highs

Inexperienced Brick Companions is a U.S.-based firm engaged in dwelling building and land improvement primarily in Texas. The corporate’s inventory is buying and selling inside a broad uptrend inside which the most certainly state of affairs can be an try and assault the historic maxima positioned within the value space of $59.

The upward state of affairs is additional supported by yesterday’s Fed assembly, which was perceived as dovish and triggered a dynamic upward momentum within the broad inventory market. Within the reverse possibility, a break of the native upward pattern line must be the start line for an extension of the correction to the realm of help at $49 per share.

***

Take your investing sport to the following stage in 2024 with ProPicks

Establishments and billionaire traders worldwide are already properly forward of the sport on the subject of AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and decrease losses.

Now, InvestingPro customers can do exactly the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking device: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% during the last decade, traders have the perfect collection of shares out there on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

For readers of this text, now with the code: INWESTUJPRO1 as a lot as 10% low cost on annual and two-year InvestingPro subscriptions.

Subscribe In the present day!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to speculate as such it isn’t meant to incentivize the acquisition of belongings in any means. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding resolution and the related danger stays with the investor.

[ad_2]

Source link