[ad_1]

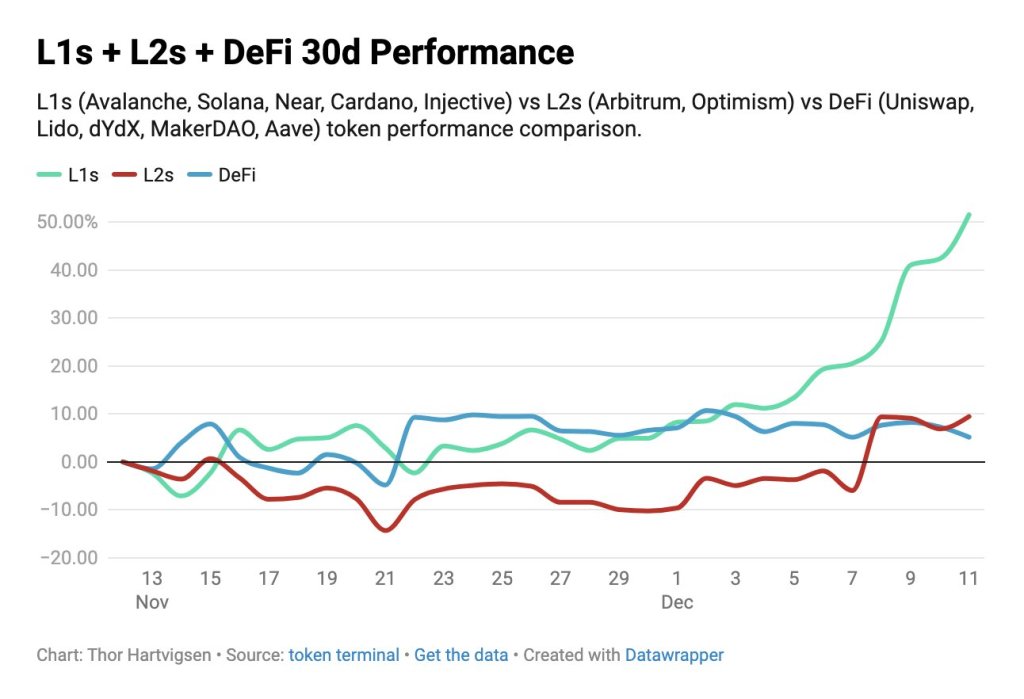

Within the present bull run, a curious pattern has emerged: layer-1 cash like Solana (SOL), Avalanche (AVAX), and Cardano (ADA) are outperforming layer-2 tokens like Arbitrum (ARB) and decentralized finance (DeFi) property like Uniswap (UNI) and MakerDAO (MKR).

Layer-1 Tokens Like Solana Leads The Efficiency Chart

Taking to X on December 13, Thor Hartvigsen, a data-driven decentralized finance (defi) researcher, famous that layer-1 cash beneath statement, like AVAX and SOL, are, on common, up 50% up to now month.

Then again, layer-2 cash like ARB and OP and DeFi tokens, like UNI and DYDX, are trailing, solely including round 10% throughout the identical interval.

Total, the broader crypto market is on an uptrend, edging increased, with some, like Solana (SOL) and Bitcoin (BTC), fully reversing post-FTX collapse losses in November 2024.

Buoying this stellar value motion is the noticeable enchancment in sentiment as a consequence of enhancing regulatory developments and, most significantly, a revival in buying and selling exercise after the sharp contraction in 2022.

Nonetheless, as highlighted above, the divergence in efficiency between layer-1, layer-2, and DeFi tokens raises questions in regards to the underlying elements driving market preferences and the strategic positioning of varied crypto asset courses.

One attainable rationalization for the Solana, Avalanche, and different layer-1 cash rally is that they’re seen as extra foundational property, laying the groundwork for creating decentralized functions (dapps) and serving because the spine of the broader blockchain ecosystem, together with the launching of layer-2 options.

Do layer-2 and DeFi Tokens Depend on How The Mainnet Performs?

In the meantime, layer-2 tokens like ARB and OP are sometimes considered as extra specialised and targeted on enhancing the scalability and throughput of layer-1 mainnets, particularly probably the most lively by market cap, Ethereum. Arbitrum, OP Mainnet, Base, and different choices are explicitly designed to handle the constraints of layer-1s.

As an instance, when on-chain exercise spikes in Ethereum, the community struggles with the deluge of transactions, forcing fuel charges increased. This could discourage exercise, permitting customers to contemplate cheaper alternate options, together with scalable layer-1s or layer-2 choices.

Then again, DeFi tokens like UNI or Dealer Joe’s JOE, as an example, can signify governance or utility. Notably, their efficiency is tied to how their underlying protocols carry out, which additionally depend on the final market sentiment and the final well being of the broader DeFi ecosystem.

Associated Studying: Shiba Inu Whales Exiting From Exchanges: Is This Bullish?

The out-performance of mainnet cash may be attributed to the rising demand for blockchain infrastructure.

The necessity for strong and scalable blockchains turns into more and more essential because the sphere matures and attracts extra customers. Contemplating their in-built utilities, these cash present the muse for layer-2 and DeFi tokens to thrive.

[ad_2]

Source link