[ad_1]

ArtistGNDphotography

Funding Thesis

Lennar Company (NYSE:LEN) is about to report FY23 ends in a few weeks. I wished to take a look at the corporate’s monetary place and provides some feedback on the outlook. The corporate appears very environment friendly and can climate the uncertainties of the financial system fairly properly in my view, nonetheless, due to these uncertainties I will likely be staying on the sidelines for now and I’m assigning a maintain ranking till we get some extra readability.

Financials

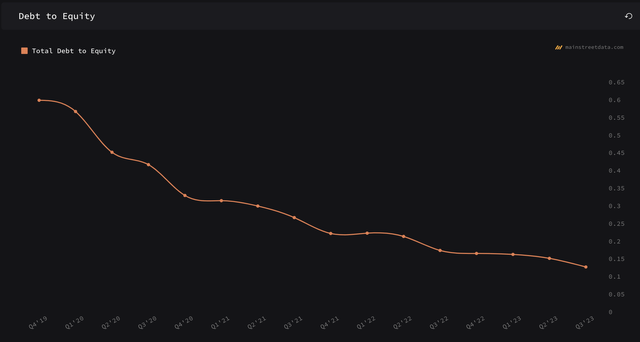

As of Q3 ’23, the corporate had round $4B in money and equivalents, in opposition to $3B in long-term debt. The attention-grabbing half is, that the corporate is not paying any curiosity expense on it, or at the least it’s not mirrored in its revenue assertion. Lennar has been paying down its excellent debt steadily over time, which is sweet administration, and on condition that it looks like the corporate’s not paying any curiosity on it, the corporate is at no threat of insolvency at this level. Its debt/fairness ratio has additionally been steadily on account of repayments, and it appears like the corporate isn’t closely leveraged anymore.

Debt to Fairness (MainStreetData)

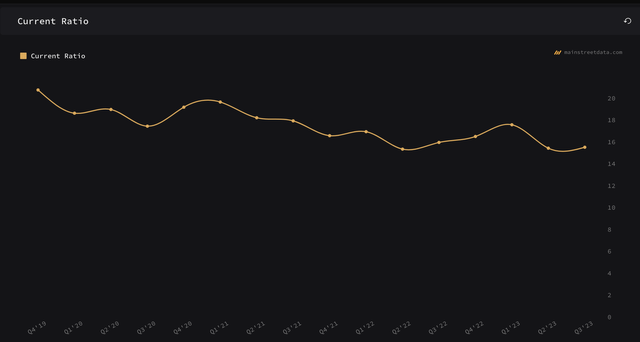

The corporate’s present ratio may be very excessive on account of stock ranges. It’s not notably unhealthy; nonetheless, I really feel it’s inefficient use of property in my view. The corporate goes to begin specializing in promoting properties which are full and closable, fairly than on properties that will likely be offered a lot additional out sooner or later. I like this initiative as it’s going to convey a rise in stock turnover sooner or later, which is able to enhance the corporate’s money stream.

Present Ratio (MainStreetData)

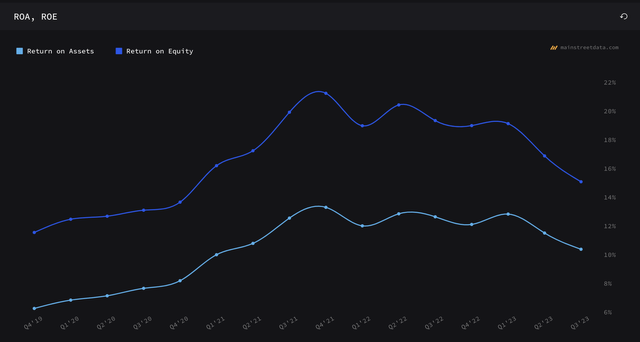

By way of effectivity and profitability, the corporate’s ROA and ROE have seen a slight decline in current quarters; nonetheless, these are nonetheless fairly wholesome. The slight lower in these metrics could be attributed to a rise in whole property coupled with decrease web revenue ranges over the previous couple of quarters in comparison with the prior 12 months, largely due to a rise in stock. However, the corporate appears to be fairly environment friendly in utilizing its property and shareholder capital.

ROA and ROE (MainStreetData)

The corporate’s historic return on invested capital has been in an uptrend for the final 5 years and it appears nice if we simply have a look at the corporate by itself. If we add on the competitors, we will see that LEN has the bottom return in comparison with the competitors chosen by Looking for Alpha by default. So, do with this data what you’ll however to me, it looks like the corporate isn’t as interesting as among the competitors under.

ROTC vs Competitors (Looking for Alpha)

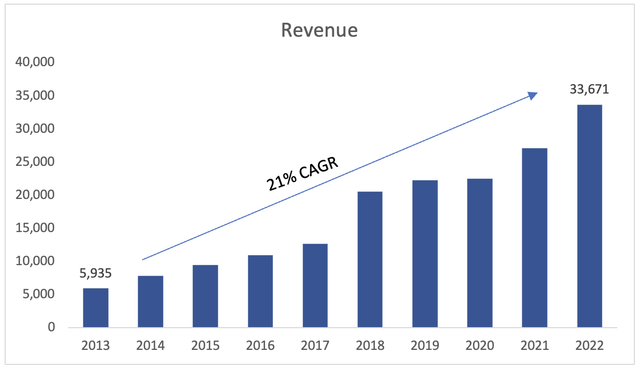

By way of revenues, the corporate grew fairly properly over the past decade, exhibiting round 21% CAGR with a large leap in gross sales from FY17 to FY18, which could be attributed to a 55% enhance in house deliveries and a ten% enhance in costs, in line with the FY18 10-Okay report. In line with analysts, the corporate will see fairly low income development for the subsequent 5 years. I might take these with a grain of salt since it’s inconceivable to foretell what’s going to occur 2 years from now. It’s simpler to know what’s going to occur on the finish of the 12 months as the corporate often provides steering. Macro situations could change, and efficiency could also be affected significantly. Will the corporate see related development going ahead, thus far it appears prefer it’ll be fairly low, so I’ll take a conservative outlook once I worth the corporate within the later part.

Income Progress (Creator)

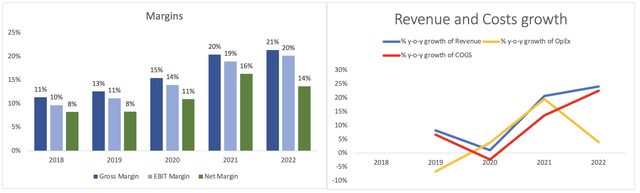

By way of margins, these have improved significantly over time, which could be attributed to the corporate’s efforts to regulate prices. Prices in some years didn’t enhance as a lot as gross sales did, which helped the corporate change into extra worthwhile just lately.

Margins and Progress of Prices and Income (Creator)

Total, it appears like the corporate has been doing decently over time, nonetheless, I might anticipate one thing to present very quickly, and I do anticipate some additional dips in profitability and effectivity when the corporate declares its FY23 ends in December.

Feedback on the Outlook

By way of financial situations, it’s not wanting good on the whole. Excessive-interest charges usually are not notably good for folks. It prices much more to take out a mortgage than it did only a 12 months in the past, which is able to put a damper on house gross sales as an increasing number of folks will likely be delaying their house purchases in hopes of rate of interest cuts someday in ’24-’25. It’s not out of the realm of risk for certain. The charges will keep elevated for longer; nonetheless, we do not understand how lengthy. The common mortgage fee rose 85% from January ’22 to September ’23. This has affected many individuals’s buying energy and many individuals began delaying their mortgage purposes. In the identical article, it mentioned that

“Mortgage purposes for house purchases in mid-October fell to their lowest ranges since 1995 and have been 21% decrease than software exercise on the identical level a 12 months in the past.

Present house gross sales have dropped in six of the final seven months, together with a 2% decline in September 2023. Over the earlier 12 months, present house gross sales exercise declined 15.4%.”

Due to these declines, common house costs additionally fell, which negatively affected and can have an effect on sooner or later in the event that they proceed to fall, the corporate’s gross sales and margins.

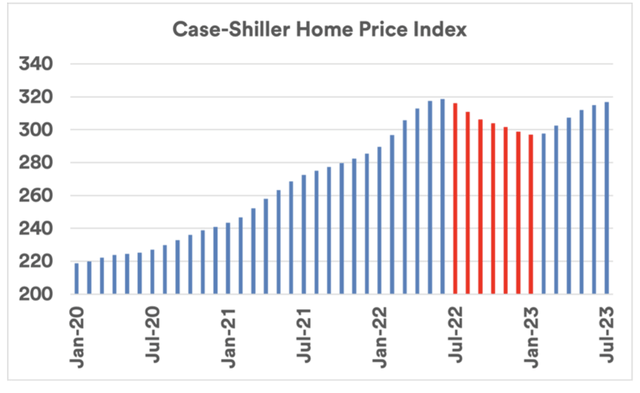

There’s a gentle on the finish of the tunnel, nonetheless. Residence costs started to select up all year long, which is sweet for LEN. It appears like individuals are beginning to get used to the thought of upper rates of interest and a few of them stopped delaying the acquisition of a home as they see it as a great funding and will refinance their mortgage within the later years as soon as the charges begin to come down considerably (if they are going to).

Value index (S&P Dow Jones Indices)

I do not suppose that is the top of the panic. The financial system continues to be very robust with very low unemployment numbers. Inflation could rear its ugly head once more. I do not like the truth that home costs are rising once more after not-so-big of a drop in a few months in ’22. As soon as the unemployment charge begins to tick meaningfully up, I would not be shocked to see some defaults on mortgages on account of funds being too excessive on this atmosphere and home costs could come again down once more.

It’s all a hypothesis on my half, however I feel the outlook isn’t on the optimistic spectrum and I might be very cautious in beginning a place in such a dangerous sector proper now.

Valuation

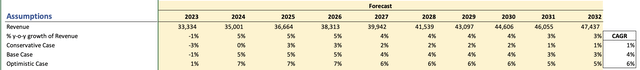

Let’s take a look at some assumptions. These will after all be my assumptions and yours could differ. For income development, I wish to be on the conservative finish for an additional margin of security. I do not suppose LEN will be capable of obtain 21% CAGR over the subsequent decade given the little or no development guided for FY23 and past (as per Looking for Alpha) and the unsure financial outlook, which has me slightly anxious. Under are my assumptions for 3 instances, the bottom, conservative, and optimistic, and their respective CAGRs.

Income Assumptions (Creator)

Is that this too conservative? Possibly, however I fairly be secure than sorry.

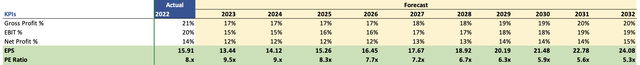

By way of margins and EPS, evidently the administration is doing an excellent job at controlling prices, so I made a decision to not decrease effectivity and profitability an excessive amount of, nonetheless, to maintain it extra conservative, and so as to add slightly further margin of security, under are the margins and EPS in comparison with FY22 numbers.

Margins and EPS assumptions (Creator)

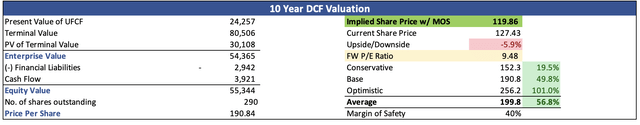

For the DCF valuation, I went with the corporate’s WACC of 10.3% as my low cost and a couple of.5% terminal development charge. On prime of those assumptions/estimates, I made a decision so as to add a 40% margin of security as a result of I feel the subsequent 12 months or so appears very uneven and the extra cushion I’ve, the higher I’ll sleep at evening. With that mentioned Lennar’s intrinsic worth and what I might be keen to pay for it to tackle these dangers is round $120 a share, which implies the corporate is buying and selling at a slight premium.

Intrinsic Worth (Creator)

Closing Feedback

Your valuation could also be completely different and that’s okay. I really feel this worth would mirror my threat/reward urge for food fairly properly. I’m curious to see what sort of outlook the administration sees for the subsequent 12 months when the corporate reviews FY23 numbers in December. I do not suppose we’ve seen the top of volatility and the subsequent half a 12 months or so could current a fair higher shopping for alternative. There are simply too many unknowns for me proper now by way of macroeconomic situations. Is the FED completed elevating charges? They gave the impression to be fairly dovish nowadays, however I do not suppose they’ve dominated out future hikes if vital. I do not suppose we are going to see cuts any time quickly. Home costs could proceed to rise, which is able to ultimately result in many individuals not having the ability to afford their properties and we are going to begin to see defaults and worth drops as soon as once more.

I wish to get extra readability earlier than committing my capital to such an unsure sector for now. Until the value will get very enticing, I do not thoughts ready out the chaos, realizing that I received a great deal on the corporate for the long term.

[ad_2]

Source link