[ad_1]

Jacob Wackerhausen/iStock through Getty Pictures

Funding Thesis

Preview

We first coated Limbach Holdings (NASDAQ:LMB) in September final 12 months in “Limbach Holdings: Unstable Money Circulate Right here To Keep”. We had been total optimistic concerning the firm’s progress however nonetheless had considerations about its risky money move in historical past, which alternated from constructive to unfavorable in a matter of 1 to 2 years. Such volatility is inherent to the character of the corporate’s workflow and industrial sample. Though its free money move and web revenue had been on a rising trajectory, chances are high downward shifts could possibly be embedded because of the risky sample. We gave it a maintain score when it was at $36 and really useful traders to see if extra structural modifications will come about. The inventory fell by about 20% within the subsequent two months since our final article, however skilled a soar after the Q3 earnings launch to as excessive as by 25%. Now it’s buying and selling at $41 or a 12% improve since final September.

Updates

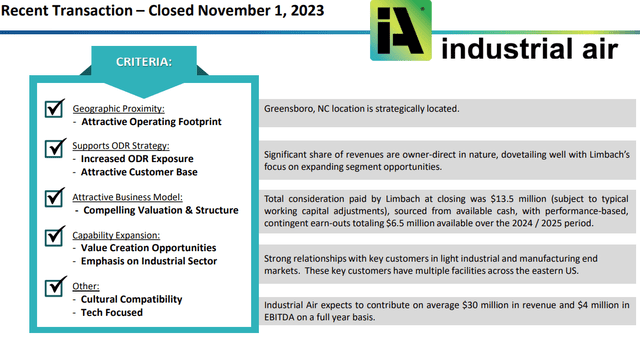

Since our final write-up, Limbach has made an acquisition of Industrial Air LLC (“IA”), which is an NC-based specialty mechanical contractor. The corporate is seeking to seamlessly combine IA’s ODR-heavy mannequin with its personal ODR (“Proprietor Direct Relationships”) section. IA is “an environmental mechanical and air filtration options and customized air dealing with gear firm” with an industrial buyer base notably specializing in the textile business. It was an all-cash acquisition of $13 million and a distinct segment buy-out. The expectation is coming in 2024, IA will generate $30 million in income, and the proprietor will keep on to handle the enterprise operation with a $6.5 million incentive package deal payout ought to the expectation be met or exceeded within the subsequent two years. That is according to the way it has all the time structured earned-out packages with its earlier acquisitions.

Limbach: IA Acquisition (Firm presentation)

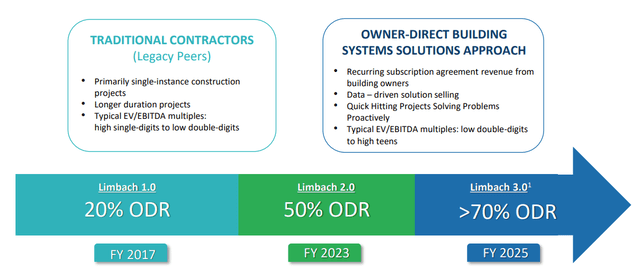

On a better strategic perspective, beforehand we identified that the balanced section mixture of contribution to income/margin has been useful in attaining higher progress. Though this isn’t a big deal, it signifies the corporate is constant this technique of balancing with a concentrate on ODR.

Limbach: ODR Section Goal (Firm presentation)

This deal additionally represents Limbach’s geographical enlargement goals. Together with the acquisition of Jake Marshal, LLC, IA helps Limbach to increase the footprint east of the Mississippi River, equivalent to within the Carolinas and the east coast. That is precisely the place it needed to concentrate on. We famous beforehand that it’s closing out and exiting its Southern California enterprise, and the updates from its presentation in November gave a a lot clearer image: it now has no focused enterprise enlargement west of Mississippi, aside from some within the south. This reveals the place its areas are worthwhile, and the place it has losses.

Limbach: Present & Goal Geographies (Firm presentation)

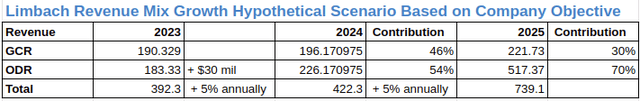

We think about the target of “50% ODR” achieved by Q3, since ODR’s income contribution was 49%. Assuming the added $30 million in income materialized, ODR’s income contribution might be about 54% by the top of FY ’24 if all different present items develop 5% yearly. For ODR to realize 70% of the income, it can ultimately should develop to about $517 million by the top of FY ’25. If subtracting the $30 million progress contribution from IA once more in FY ’25, that might be a web improve of $231 million. This seems to be vital, that’s as a result of the GCR section can be rising, so ODR will actually want so as to add as much as 20% of the overall income of FY 2025. We’re reluctant to imagine a flat income progress via FY ’25 for the reason that goal of the acquisitions ought to first get pleasure from boosting the highest line. Assuming a flat income progress will solely underestimate how a lot ODR must develop with a purpose to meet the target. If we assume the acquisition value is one-third of the extra income, it can want about $77 million in funding. In fact, the fee could possibly be increased.

Limbach: Income Combine Progress Situation (Calculated and Charted by Waterside Perception with knowledge from firm)

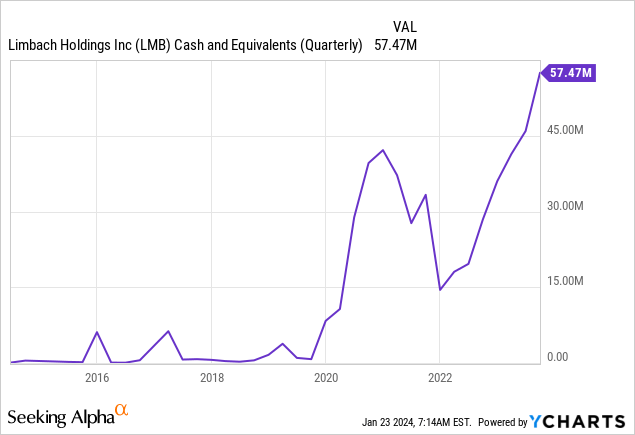

Limbach began accumulating money on the finish of 2019, rising from virtually minimal money readily available to greater than 50x extra inside 4 years. Together with IA, it has finished 3 acquisitions in these 4 years, complete of $38 million all-cash. For This autumn of FY ’23, if taken away $13 million from the all-cash bills for the IA deal, it nonetheless has north of $40 million left, remaining at its historic highs. It isn’t to say that it’s going to fund all the future acquisitions via money. With its debt-to-equity ratio at 33%, it will probably nonetheless use leverage to make the acquisitions wanted, however the money place could possibly be vastly decreased.

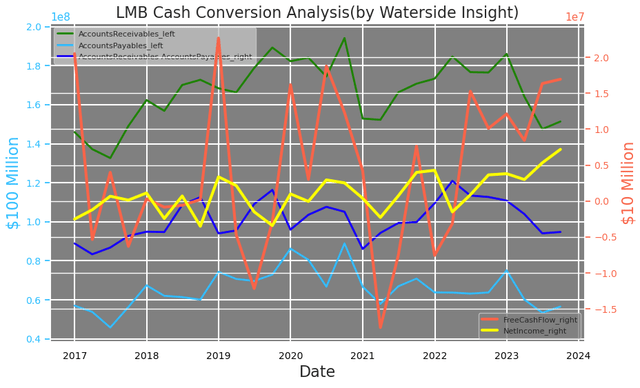

The volatility we acknowledged from the earlier write-up remains to be one in every of our considerations for the corporate. The primary 3 quarters’ working money move in FY ’23 was $20 million extra YoY. The availability to its working money move throughout this time was largely because of the improve of about $12 million increased of Internet Revenue. Nevertheless it additionally had $21 million decrease accounts receivable and $18 million extra accounts payable, which canceled out a big a part of one another and ended up with a $3 million web contribution.

Limbach: Money Conversion (Calculated and Charted by Waterside Perception with knowledge from firm)

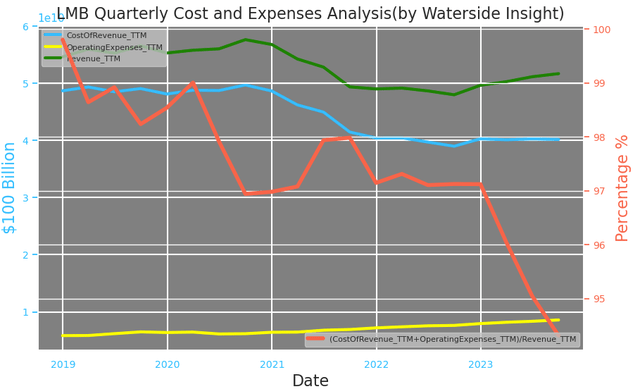

Limbach’s web revenue has additionally been well-matched with its free money move on a TTM foundation by way of volatility. Since its income has been in decline up to now 5 years and flat for the previous three years, for the volatility of its money move to be smoothed out, it might want to proceed producing sturdy web revenue. The numerous pickup of its web revenue since 2021 has to do with the discount of the price of income, which has decreased by 20% throughout this time. The most important a part of its value of income is from labor, gear, materials, and subcontract and contract prices. These prices have traditionally fluctuated, for instance, there are occasional incidents within the GCR section (“Basic Contractor Relationships”) that initiatives typically can exceed the funds, and it’ll supply to re-design the venture to carry down the prices. Labor and materials prices rely upon the final market situation. In distinction, the gear prices, that are associated to the possession prices or company-owned property, along with rental gear, can maybe give it higher management. That is instantly hinging on the ODR’s progress since many of the HVAC, plumbing, Computerized Temperature Controls, and different upkeep initiatives are more likely to be recurring and/or repeatable. The long-term buyer relationship, which is on the core of the ODR’s CRM, may assist the corporate keep away from frequent modifications of various gear on varied duties, therefore the reuse of its gear and even rental gear may carry down the prices.

Such advantages are most probably to be long-term and gradual although. Limbach has been searching for natural progress throughout the ODR items in recent times along with the acquisitions, which includes performing contractual work for the buildings that it has by no means supplied providers earlier than. New initiatives may include new variations, particularly customization to the constructing is the important thing to retaining a long-term buyer relationship. Subsequently, the preliminary value will not be low. That is maybe one of many causes the price of income has been flat as a substitute of constant its discount up to now two years. When the speedy enlargement is applied, the following two years are more likely to see related stagnation if not re-growing of the prices, leading to extra volatility to the online revenue and money move.

Limbach: Prices and Bills (Calculated and Charted by Waterside Perception with knowledge from firm)

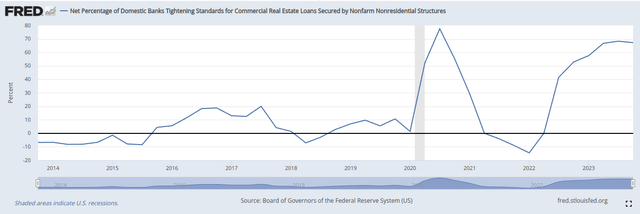

Final however not least, the industries Limbach serves mission-critical methods in. The corporate serves Healthcare, Knowledge Facilities, Industrial and light-weight manufacturing services, Greater Schooling, Cultural and leisure, and Life science industries. We talked about this final time and these industries all have one factor in widespread, all of them have their specialties in constructing utilization as a substitute of merely accommodating workplace employees. There was a tightening in lending requirements for industrial actual property markets since 2022. This wave could be seen because the continuation of the transition from metropolitan workplace constructing induced throughout the pandemic. It jumped from almost none to 70% of banks in 2020 after which such a soar occurred once more in 2022. Though Limbach’s industrial focus has a cushion within the face of the cooling of business actual property, it will not be fully shielded from it. This can be a macro danger that it’s going to should be conscious of throughout its deliberate enlargement.

lmb (lmb)

Monetary Overview & Valuation

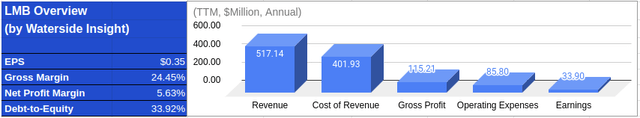

Limbach: Monetary Overview (Calculated and Charted by Waterside Perception with knowledge from firm)

We maintained our earlier evaluation that the corporate’s value is pretty valued after 5 months. The rebalance of its segments is on the suitable path in direction of increased income progress, particularly when its high line has been in decline and flattened up to now 5 years. Nevertheless, such progress does include financing prices, integration, and working prices along with the general industrial macro dangers within the present surroundings. The volatility in its web revenue and money move is more likely to proceed, though could possibly be to a lesser extent. The market’s optimism has largely priced in at this level.

Conclusion

We evaluation the current modifications and acquisitions of Limbach since our final write-up 5 months in the past and proceed to see volatility as a part of its pure tendency within the operational outcomes. To focus extra on the ODR section is on the suitable path and it has the dry powder to execute extra acquisitions to hurry up such a transition. Nevertheless, after assessing the general image, the prices behind such ambition are nonetheless key in controlling its volatility. We expect the market value in the intervening time is truthful and traders should not chase on the highs.

[ad_2]

Source link